Are you a seasoned Claim Representative seeking a new career path? Discover our professionally built Claim Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

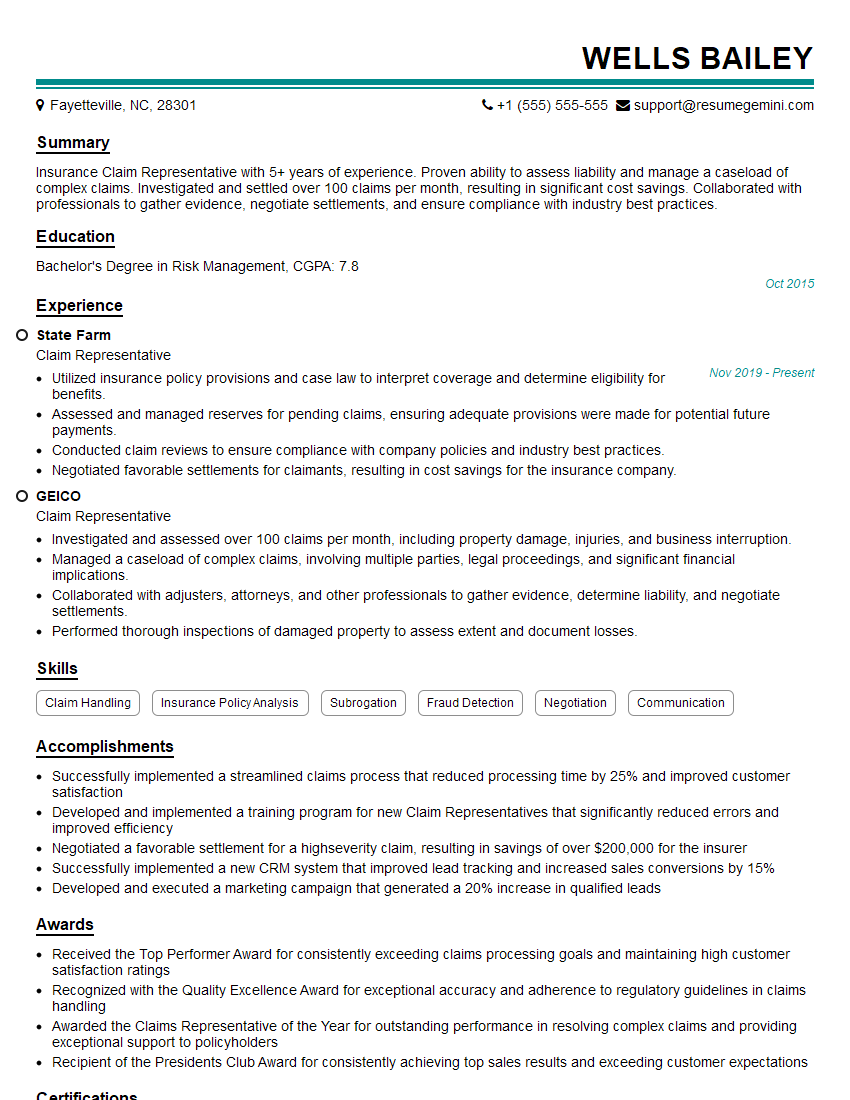

Wells Bailey

Claim Representative

Summary

Insurance Claim Representative with 5+ years of experience. Proven ability to assess liability and manage a caseload of complex claims. Investigated and settled over 100 claims per month, resulting in significant cost savings. Collaborated with professionals to gather evidence, negotiate settlements, and ensure compliance with industry best practices.

Education

Bachelor’s Degree in Risk Management

October 2015

Skills

- Claim Handling

- Insurance Policy Analysis

- Subrogation

- Fraud Detection

- Negotiation

- Communication

Work Experience

Claim Representative

- Utilized insurance policy provisions and case law to interpret coverage and determine eligibility for benefits.

- Assessed and managed reserves for pending claims, ensuring adequate provisions were made for potential future payments.

- Conducted claim reviews to ensure compliance with company policies and industry best practices.

- Negotiated favorable settlements for claimants, resulting in cost savings for the insurance company.

Claim Representative

- Investigated and assessed over 100 claims per month, including property damage, injuries, and business interruption.

- Managed a caseload of complex claims, involving multiple parties, legal proceedings, and significant financial implications.

- Collaborated with adjusters, attorneys, and other professionals to gather evidence, determine liability, and negotiate settlements.

- Performed thorough inspections of damaged property to assess extent and document losses.

Accomplishments

- Successfully implemented a streamlined claims process that reduced processing time by 25% and improved customer satisfaction

- Developed and implemented a training program for new Claim Representatives that significantly reduced errors and improved efficiency

- Negotiated a favorable settlement for a highseverity claim, resulting in savings of over $200,000 for the insurer

- Successfully implemented a new CRM system that improved lead tracking and increased sales conversions by 15%

- Developed and executed a marketing campaign that generated a 20% increase in qualified leads

Awards

- Received the Top Performer Award for consistently exceeding claims processing goals and maintaining high customer satisfaction ratings

- Recognized with the Quality Excellence Award for exceptional accuracy and adherence to regulatory guidelines in claims handling

- Awarded the Claims Representative of the Year for outstanding performance in resolving complex claims and providing exceptional support to policyholders

- Recipient of the Presidents Club Award for consistently achieving top sales results and exceeding customer expectations

Certificates

- Certified Claim Representative (CCR)

- Associate in Claims (AIC)

- Chartered Property Casualty Underwriter (CPCU)

- Certified Insurance Risk Manager (CIRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Claim Representative

- Highlight your experience and skills in claim handling, investigation, and negotiation.

- Quantify your accomplishments and provide specific examples of how you saved the company money or improved customer satisfaction.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

- Proofread your resume carefully for errors before submitting it.

Essential Experience Highlights for a Strong Claim Representative Resume

- Investigate and evaluate insurance claims

- Assess liability and determine coverage

- Negotiate settlements and oversee claim payments

- Review policies and interpret clauses

- Communicate with clients, policyholders, and other stakeholders

- Maintain and manage case files

- Stay up-to-date on industry regulations and best practices

Frequently Asked Questions (FAQ’s) For Claim Representative

What is the average salary for a Claim Representative?

The average salary for a Claim Representative in the United States is around $65,000 per year.

What are the job prospects for Claim Representatives?

The job outlook for Claim Representatives is expected to grow by about 10% over the next decade, which is faster than the average for all occupations.

What are the qualifications for becoming a Claim Representative?

Most Claim Representatives have at least a bachelor’s degree in risk management, insurance, or a related field. They also typically have experience working in the insurance industry.

What are the benefits of working as a Claim Representative?

Claim Representatives enjoy a number of benefits, including competitive salaries, comprehensive benefits packages, and opportunities for career advancement.

What are the challenges of working as a Claim Representative?

Claim Representatives can face a number of challenges, including dealing with difficult customers, managing complex claims, and working under deadlines.

What are the skills required to be a successful Claim Representative?

Successful Claim Representatives possess a strong understanding of insurance policies, excellent communication and negotiation skills, and the ability to work independently and as part of a team.

What is the career path for Claim Representatives?

Claim Representatives can advance their careers by becoming Claims Adjusters, Claims Managers, or Underwriters.