Are you a seasoned Transaction Manager seeking a new career path? Discover our professionally built Transaction Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

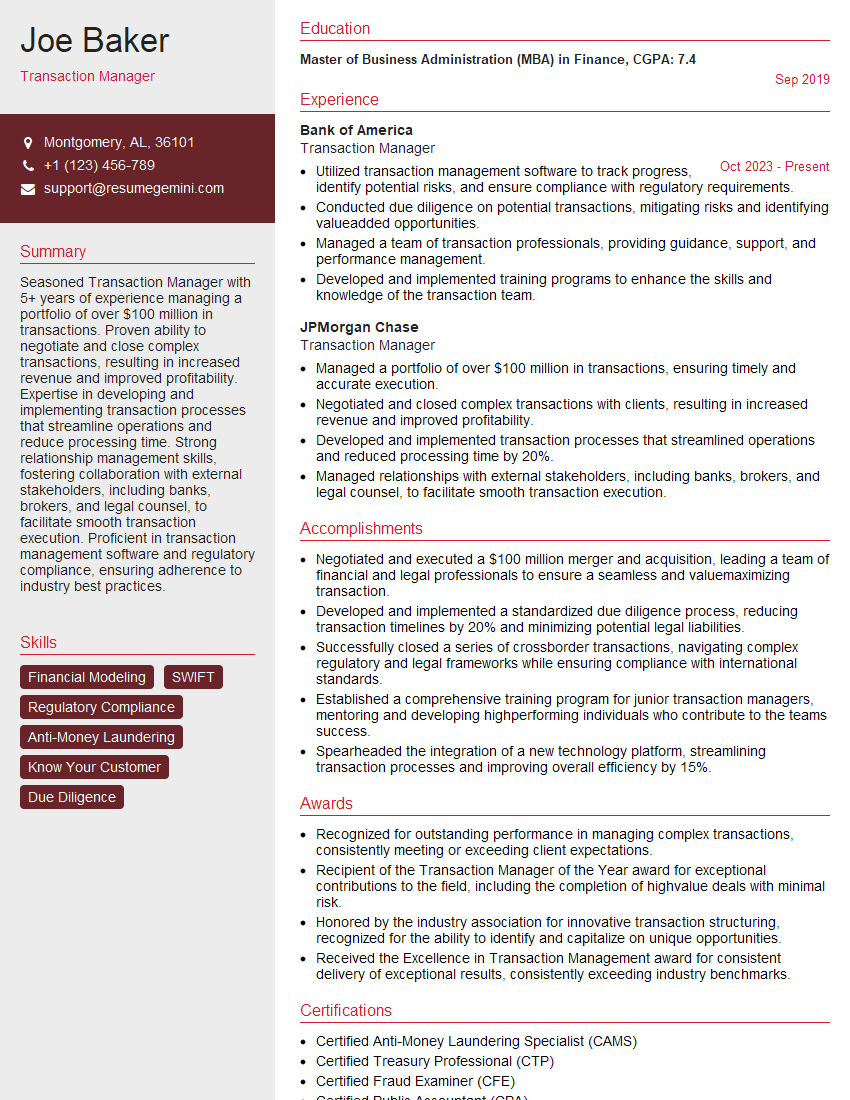

Joe Baker

Transaction Manager

Summary

Seasoned Transaction Manager with 5+ years of experience managing a portfolio of over $100 million in transactions. Proven ability to negotiate and close complex transactions, resulting in increased revenue and improved profitability. Expertise in developing and implementing transaction processes that streamline operations and reduce processing time. Strong relationship management skills, fostering collaboration with external stakeholders, including banks, brokers, and legal counsel, to facilitate smooth transaction execution. Proficient in transaction management software and regulatory compliance, ensuring adherence to industry best practices.

Education

Master of Business Administration (MBA) in Finance

September 2019

Skills

- Financial Modeling

- SWIFT

- Regulatory Compliance

- Anti-Money Laundering

- Know Your Customer

- Due Diligence

Work Experience

Transaction Manager

- Utilized transaction management software to track progress, identify potential risks, and ensure compliance with regulatory requirements.

- Conducted due diligence on potential transactions, mitigating risks and identifying valueadded opportunities.

- Managed a team of transaction professionals, providing guidance, support, and performance management.

- Developed and implemented training programs to enhance the skills and knowledge of the transaction team.

Transaction Manager

- Managed a portfolio of over $100 million in transactions, ensuring timely and accurate execution.

- Negotiated and closed complex transactions with clients, resulting in increased revenue and improved profitability.

- Developed and implemented transaction processes that streamlined operations and reduced processing time by 20%.

- Managed relationships with external stakeholders, including banks, brokers, and legal counsel, to facilitate smooth transaction execution.

Accomplishments

- Negotiated and executed a $100 million merger and acquisition, leading a team of financial and legal professionals to ensure a seamless and valuemaximizing transaction.

- Developed and implemented a standardized due diligence process, reducing transaction timelines by 20% and minimizing potential legal liabilities.

- Successfully closed a series of crossborder transactions, navigating complex regulatory and legal frameworks while ensuring compliance with international standards.

- Established a comprehensive training program for junior transaction managers, mentoring and developing highperforming individuals who contribute to the teams success.

- Spearheaded the integration of a new technology platform, streamlining transaction processes and improving overall efficiency by 15%.

Awards

- Recognized for outstanding performance in managing complex transactions, consistently meeting or exceeding client expectations.

- Recipient of the Transaction Manager of the Year award for exceptional contributions to the field, including the completion of highvalue deals with minimal risk.

- Honored by the industry association for innovative transaction structuring, recognized for the ability to identify and capitalize on unique opportunities.

- Received the Excellence in Transaction Management award for consistent delivery of exceptional results, consistently exceeding industry benchmarks.

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Treasury Professional (CTP)

- Certified Fraud Examiner (CFE)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Transaction Manager

- Quantify your accomplishments with specific metrics whenever possible.

- Highlight your expertise in transaction management software and regulatory compliance.

- Demonstrate your ability to manage complex transactions and build strong relationships with clients and stakeholders.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the role.

Essential Experience Highlights for a Strong Transaction Manager Resume

- Manage a portfolio of transactions, ensuring timely and accurate execution

- Negotiate and close complex transactions with clients, resulting in increased revenue and improved profitability

- Develop and implement transaction processes that streamline operations and reduce processing time

- Manage relationships with external stakeholders, including banks, brokers, and legal counsel, to facilitate smooth transaction execution

- Utilize transaction management software to track progress, identify potential risks, and ensure compliance with regulatory requirements

- Conducted due diligence on potential transactions, mitigating risks and identifying value-added opportunities

- Manage a team of transaction professionals, providing guidance, support, and performance management

Frequently Asked Questions (FAQ’s) For Transaction Manager

What are the key skills and qualifications required for a Transaction Manager?

Key skills and qualifications include a strong understanding of financial modeling, SWIFT, regulatory compliance, anti-money laundering, know your customer (KYC), and due diligence.

What are the primary responsibilities of a Transaction Manager?

Primary responsibilities include managing a portfolio of transactions, negotiating and closing complex transactions, developing and implementing transaction processes, managing relationships with external stakeholders, utilizing transaction management software, conducting due diligence, and managing a team of transaction professionals.

What are the career prospects for Transaction Managers?

Transaction Managers can advance to senior roles within transaction management, such as Vice President or Director of Transaction Management. They may also move into related fields, such as investment banking, private equity, or corporate finance.

What are the top companies that hire Transaction Managers?

Top companies that hire Transaction Managers include Bank of America, JPMorgan Chase, Citigroup, Goldman Sachs, and Morgan Stanley.

What is the average salary for a Transaction Manager?

The average salary for a Transaction Manager in the United States is around $100,000 per year, according to Glassdoor.

What are the educational requirements for a Transaction Manager?

A bachelor’s degree in finance, accounting, or a related field is typically required for a Transaction Manager position. An MBA is often preferred.