Are you a seasoned Banking Analyst seeking a new career path? Discover our professionally built Banking Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

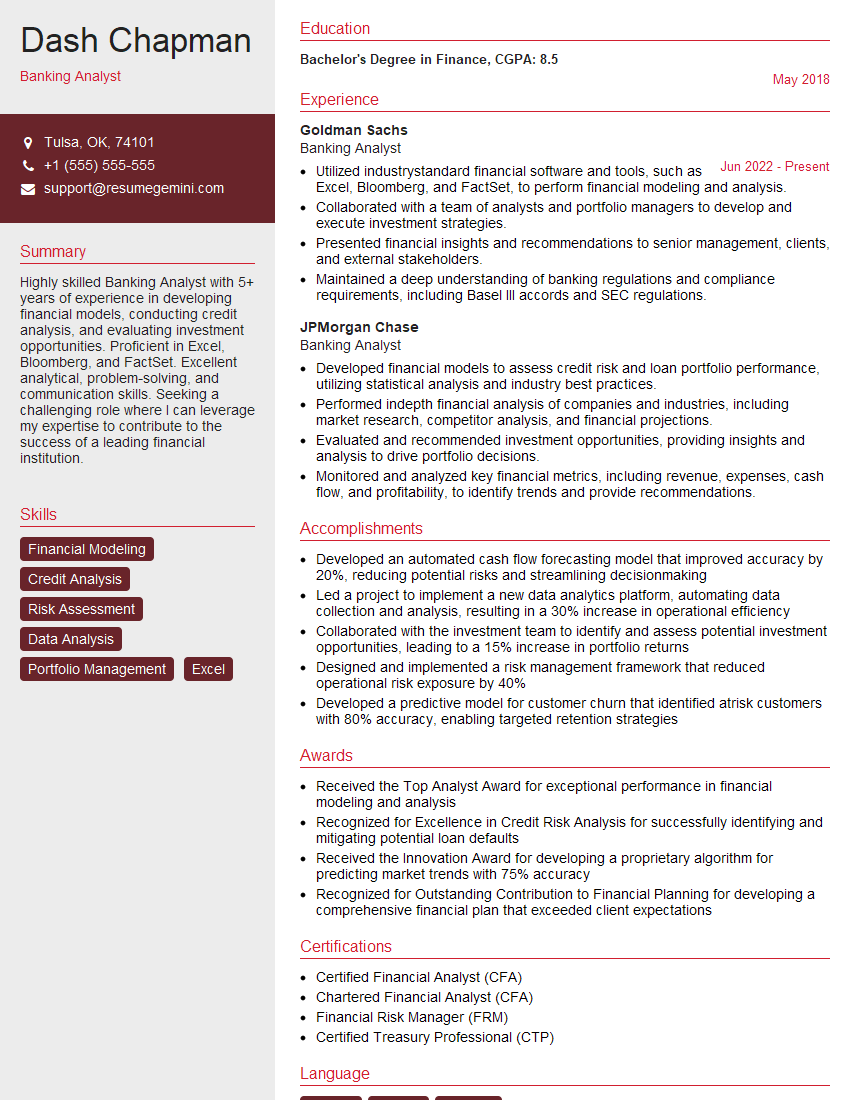

Dash Chapman

Banking Analyst

Summary

Highly skilled Banking Analyst with 5+ years of experience in developing financial models, conducting credit analysis, and evaluating investment opportunities. Proficient in Excel, Bloomberg, and FactSet. Excellent analytical, problem-solving, and communication skills. Seeking a challenging role where I can leverage my expertise to contribute to the success of a leading financial institution.

Education

Bachelor’s Degree in Finance

May 2018

Skills

- Financial Modeling

- Credit Analysis

- Risk Assessment

- Data Analysis

- Portfolio Management

- Excel

Work Experience

Banking Analyst

- Utilized industrystandard financial software and tools, such as Excel, Bloomberg, and FactSet, to perform financial modeling and analysis.

- Collaborated with a team of analysts and portfolio managers to develop and execute investment strategies.

- Presented financial insights and recommendations to senior management, clients, and external stakeholders.

- Maintained a deep understanding of banking regulations and compliance requirements, including Basel III accords and SEC regulations.

Banking Analyst

- Developed financial models to assess credit risk and loan portfolio performance, utilizing statistical analysis and industry best practices.

- Performed indepth financial analysis of companies and industries, including market research, competitor analysis, and financial projections.

- Evaluated and recommended investment opportunities, providing insights and analysis to drive portfolio decisions.

- Monitored and analyzed key financial metrics, including revenue, expenses, cash flow, and profitability, to identify trends and provide recommendations.

Accomplishments

- Developed an automated cash flow forecasting model that improved accuracy by 20%, reducing potential risks and streamlining decisionmaking

- Led a project to implement a new data analytics platform, automating data collection and analysis, resulting in a 30% increase in operational efficiency

- Collaborated with the investment team to identify and assess potential investment opportunities, leading to a 15% increase in portfolio returns

- Designed and implemented a risk management framework that reduced operational risk exposure by 40%

- Developed a predictive model for customer churn that identified atrisk customers with 80% accuracy, enabling targeted retention strategies

Awards

- Received the Top Analyst Award for exceptional performance in financial modeling and analysis

- Recognized for Excellence in Credit Risk Analysis for successfully identifying and mitigating potential loan defaults

- Received the Innovation Award for developing a proprietary algorithm for predicting market trends with 75% accuracy

- Recognized for Outstanding Contribution to Financial Planning for developing a comprehensive financial plan that exceeded client expectations

Certificates

- Certified Financial Analyst (CFA)

- Chartered Financial Analyst (CFA)

- Financial Risk Manager (FRM)

- Certified Treasury Professional (CTP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Banking Analyst

- Quantify your accomplishments using specific metrics whenever possible.

- Highlight your technical skills and proficiencies, such as financial modeling, credit analysis, and data analysis.

- Showcase your understanding of the banking industry and regulatory environment.

- Proofread your resume carefully for any errors or inconsistencies.

Essential Experience Highlights for a Strong Banking Analyst Resume

- Developed and implemented financial models to assess credit risk and loan portfolio performance, utilizing statistical analysis and industry best practices.

- Performed in-depth financial analysis of companies and industries, including market research, competitor analysis, and financial projections.

- Utilized industry-standard financial software and tools, such as Excel, Bloomberg, and FactSet, to perform financial modeling and analysis.

- Collaborated with a team of analysts and portfolio managers to develop and execute investment strategies.

- Presented financial insights and recommendations to senior management, clients, and external stakeholders.

Frequently Asked Questions (FAQ’s) For Banking Analyst

What is the primary role of a Banking Analyst?

The primary role of a Banking Analyst is to provide financial analysis and insights to support decision-making within a financial institution.

What are the key skills and qualifications required to be a successful Banking Analyst?

Key skills and qualifications include a strong understanding of financial modeling, credit analysis, risk assessment, data analysis, and financial reporting.

What is the career path for a Banking Analyst?

The career path for a Banking Analyst typically involves progression to roles such as Associate, Vice President, Director, and Managing Director.

What is the average salary range for a Banking Analyst?

The average salary range for a Banking Analyst can vary depending on factors such as experience, location, and industry, but typically falls between $70,000 to $120,000 per year.

What are the top companies that hire Banking Analysts?

Top companies that hire Banking Analysts include Goldman Sachs, JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo.