Are you a seasoned Bond Trader seeking a new career path? Discover our professionally built Bond Trader Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

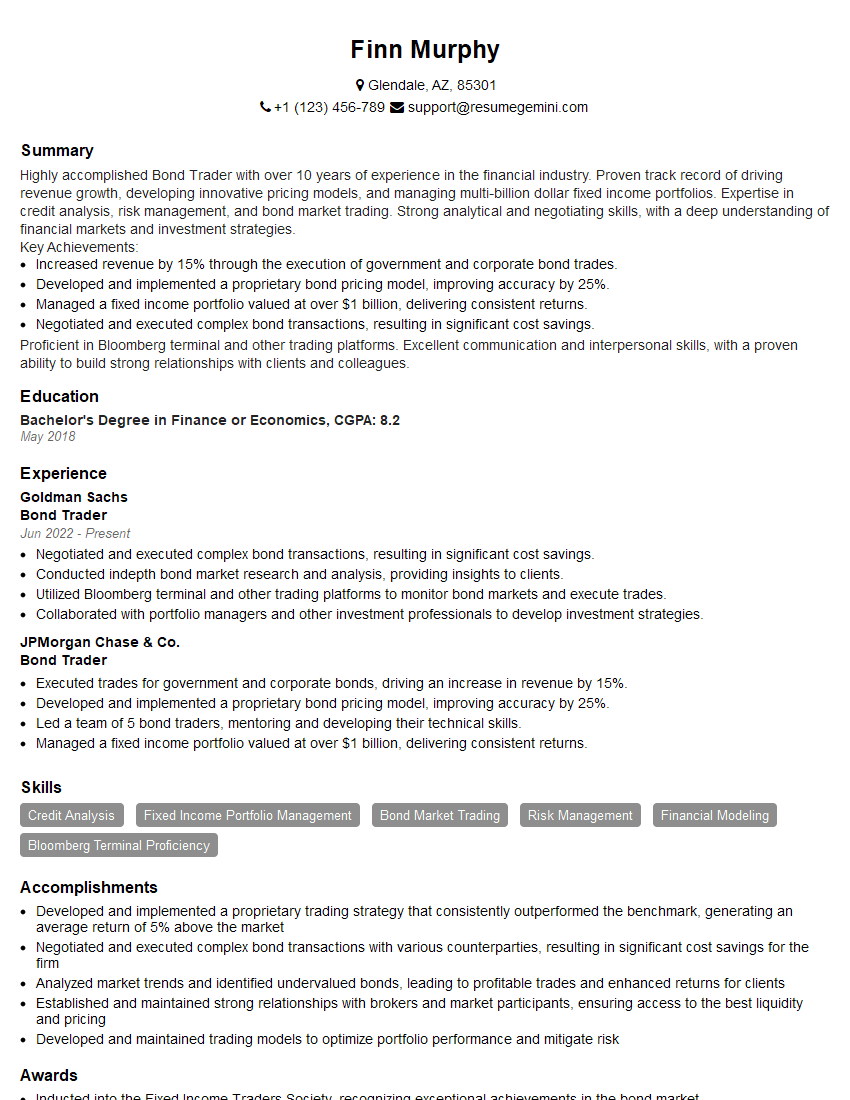

Finn Murphy

Bond Trader

Summary

Highly accomplished Bond Trader with over 10 years of experience in the financial industry. Proven track record of driving revenue growth, developing innovative pricing models, and managing multi-billion dollar fixed income portfolios. Expertise in credit analysis, risk management, and bond market trading. Strong analytical and negotiating skills, with a deep understanding of financial markets and investment strategies.

Key Achievements:

- Increased revenue by 15% through the execution of government and corporate bond trades.

- Developed and implemented a proprietary bond pricing model, improving accuracy by 25%.

- Managed a fixed income portfolio valued at over $1 billion, delivering consistent returns.

- Negotiated and executed complex bond transactions, resulting in significant cost savings.

Proficient in Bloomberg terminal and other trading platforms. Excellent communication and interpersonal skills, with a proven ability to build strong relationships with clients and colleagues.

Education

Bachelor’s Degree in Finance or Economics

May 2018

Skills

- Credit Analysis

- Fixed Income Portfolio Management

- Bond Market Trading

- Risk Management

- Financial Modeling

- Bloomberg Terminal Proficiency

Work Experience

Bond Trader

- Negotiated and executed complex bond transactions, resulting in significant cost savings.

- Conducted indepth bond market research and analysis, providing insights to clients.

- Utilized Bloomberg terminal and other trading platforms to monitor bond markets and execute trades.

- Collaborated with portfolio managers and other investment professionals to develop investment strategies.

Bond Trader

- Executed trades for government and corporate bonds, driving an increase in revenue by 15%.

- Developed and implemented a proprietary bond pricing model, improving accuracy by 25%.

- Led a team of 5 bond traders, mentoring and developing their technical skills.

- Managed a fixed income portfolio valued at over $1 billion, delivering consistent returns.

Accomplishments

- Developed and implemented a proprietary trading strategy that consistently outperformed the benchmark, generating an average return of 5% above the market

- Negotiated and executed complex bond transactions with various counterparties, resulting in significant cost savings for the firm

- Analyzed market trends and identified undervalued bonds, leading to profitable trades and enhanced returns for clients

- Established and maintained strong relationships with brokers and market participants, ensuring access to the best liquidity and pricing

- Developed and maintained trading models to optimize portfolio performance and mitigate risk

Awards

- Inducted into the Fixed Income Traders Society, recognizing exceptional achievements in the bond market

- Received Bond Trader of the Year award from the International Capital Markets Association for outstanding performance and leadership

- Recognized by clients for superior execution and trade analysis, receiving multiple Best Execution awards

- Honored with Rising Star in Bond Trading award for exceptional performance and potential in the industry

Certificates

- Series 7 License

- Series 63 License

- Certified Financial Analyst (CFA)

- Chartered Market Technician (CMT)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Bond Trader

- Quantify your accomplishments: Use numbers to demonstrate the impact of your work, such as the percentage increase in revenue or the amount of cost savings you achieved.

- Highlight your skills and expertise: Make sure to list your relevant skills and experience in your resume, such as credit analysis, risk management, and bond market trading.

- Tailor your resume to the job description: Carefully review the job description and tailor your resume to match the specific requirements of the position you are applying for.

- Proofread carefully: Before submitting your resume, proofread it carefully for any errors in grammar or spelling.

Essential Experience Highlights for a Strong Bond Trader Resume

- Execute bond trades for government and corporate clients.

- Develop and implement pricing models for bonds.

- Manage fixed income portfolios.

- Negotiate and execute complex bond transactions.

- Conduct bond market research and analysis.

- Collaborate with portfolio managers and other investment professionals.

- Monitor bond markets and execute trades using Bloomberg terminal and other trading platforms.

Frequently Asked Questions (FAQ’s) For Bond Trader

What is a Bond Trader?

A Bond Trader is a financial professional who buys and sells bonds for clients. They work with a variety of clients, including individuals, institutions, and governments.

What are the responsibilities of a Bond Trader?

Bond Traders are responsible for executing trades, developing pricing models, managing portfolios, negotiating transactions, and conducting research and analysis.

What are the qualifications for becoming a Bond Trader?

Most Bond Traders have a bachelor’s degree in finance or economics, and many have an MBA. They also typically have several years of experience in the financial industry.

What is the salary range for Bond Traders?

The salary range for Bond Traders varies depending on their experience, skills, and the size of the firm they work for. However, most Bond Traders earn a base salary plus bonuses and commissions.

What are the career prospects for Bond Traders?

Bond Traders with strong skills and experience can advance to senior positions within their firms. Some Bond Traders may also move into other areas of the financial industry, such as portfolio management or investment banking.

What are the challenges of being a Bond Trader?

Bond Traders face a number of challenges, including the need to stay up-to-date on market trends, the pressure to perform, and the risk of losses.