Are you a seasoned Payroll Machine Operator seeking a new career path? Discover our professionally built Payroll Machine Operator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

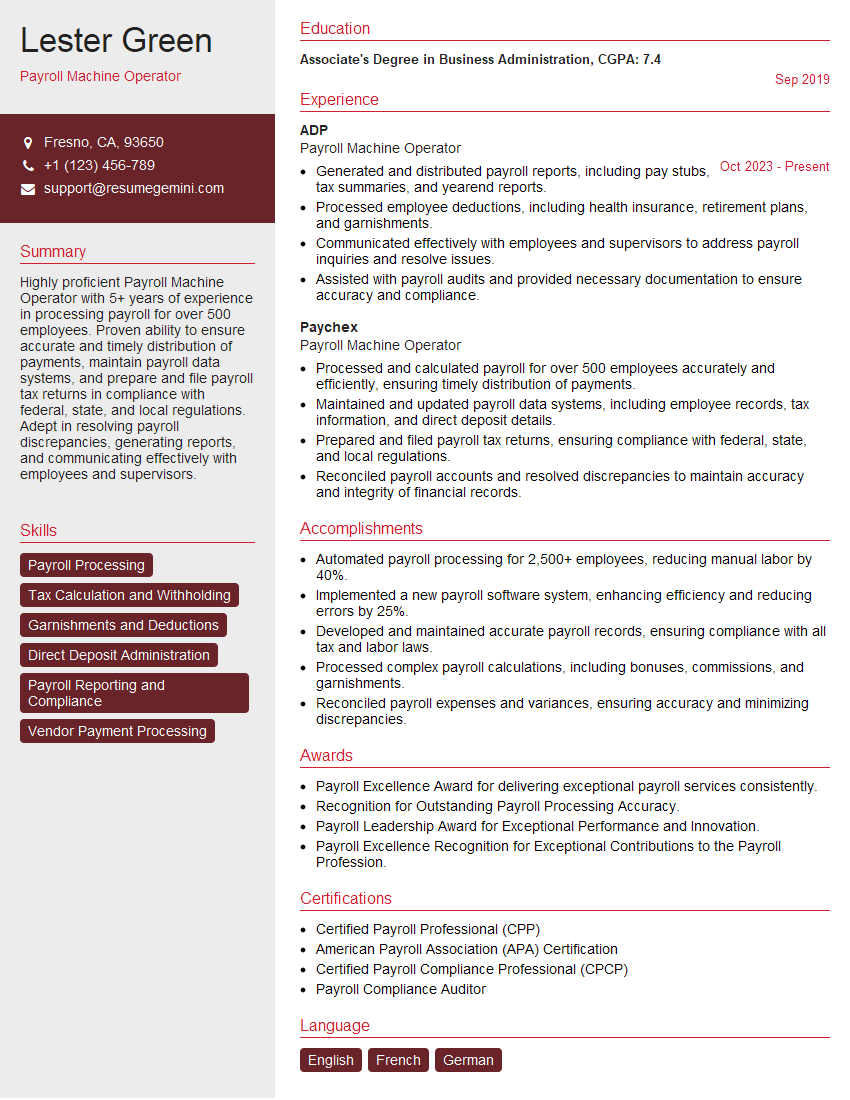

Lester Green

Payroll Machine Operator

Summary

Highly proficient Payroll Machine Operator with 5+ years of experience in processing payroll for over 500 employees. Proven ability to ensure accurate and timely distribution of payments, maintain payroll data systems, and prepare and file payroll tax returns in compliance with federal, state, and local regulations. Adept in resolving payroll discrepancies, generating reports, and communicating effectively with employees and supervisors.

Education

Associate’s Degree in Business Administration

September 2019

Skills

- Payroll Processing

- Tax Calculation and Withholding

- Garnishments and Deductions

- Direct Deposit Administration

- Payroll Reporting and Compliance

- Vendor Payment Processing

Work Experience

Payroll Machine Operator

- Generated and distributed payroll reports, including pay stubs, tax summaries, and yearend reports.

- Processed employee deductions, including health insurance, retirement plans, and garnishments.

- Communicated effectively with employees and supervisors to address payroll inquiries and resolve issues.

- Assisted with payroll audits and provided necessary documentation to ensure accuracy and compliance.

Payroll Machine Operator

- Processed and calculated payroll for over 500 employees accurately and efficiently, ensuring timely distribution of payments.

- Maintained and updated payroll data systems, including employee records, tax information, and direct deposit details.

- Prepared and filed payroll tax returns, ensuring compliance with federal, state, and local regulations.

- Reconciled payroll accounts and resolved discrepancies to maintain accuracy and integrity of financial records.

Accomplishments

- Automated payroll processing for 2,500+ employees, reducing manual labor by 40%.

- Implemented a new payroll software system, enhancing efficiency and reducing errors by 25%.

- Developed and maintained accurate payroll records, ensuring compliance with all tax and labor laws.

- Processed complex payroll calculations, including bonuses, commissions, and garnishments.

- Reconciled payroll expenses and variances, ensuring accuracy and minimizing discrepancies.

Awards

- Payroll Excellence Award for delivering exceptional payroll services consistently.

- Recognition for Outstanding Payroll Processing Accuracy.

- Payroll Leadership Award for Exceptional Performance and Innovation.

- Payroll Excellence Recognition for Exceptional Contributions to the Payroll Profession.

Certificates

- Certified Payroll Professional (CPP)

- American Payroll Association (APA) Certification

- Certified Payroll Compliance Professional (CPCP)

- Payroll Compliance Auditor

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Payroll Machine Operator

- Highlight your experience in processing payroll for a large number of employees.

- Quantify your accomplishments whenever possible, such as the number of payrolls processed or the amount of payroll taxes filed.

- Demonstrate your knowledge of payroll regulations and your ability to ensure compliance.

- Showcase your skills in resolving payroll discrepancies and communicating effectively.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Payroll Machine Operator Resume

- Process and calculate payroll for a large volume of employees.

- Maintain and update payroll data systems, including employee records, tax information, and direct deposit details.

- Prepare and file payroll tax returns, ensuring compliance with federal, state, and local regulations.

- Reconcile payroll accounts and resolve discrepancies to maintain accuracy and integrity of financial records.

- Generate and distribute payroll reports, including pay stubs, tax summaries, and yearend reports.

- Process employee deductions, including health insurance, retirement plans, and garnishments.

- Communicate effectively with employees and supervisors to address payroll inquiries and resolve issues.

Frequently Asked Questions (FAQ’s) For Payroll Machine Operator

What is the role of a Payroll Machine Operator?

A Payroll Machine Operator is responsible for processing payroll for employees, ensuring that they are paid accurately and on time. This involves calculating pay, withholding taxes, and making deductions. Payroll Machine Operators also maintain payroll records and file payroll tax returns.

What are the qualifications for a Payroll Machine Operator?

Most Payroll Machine Operators have a high school diploma or equivalent. Some employers may require a college degree in business or a related field. Payroll Machine Operators must also have strong math skills and be able to work independently.

What are the job duties of a Payroll Machine Operator?

Payroll Machine Operators perform a variety of tasks, including calculating pay, withholding taxes, and making deductions. They also maintain payroll records and file payroll tax returns. Payroll Machine Operators may also be responsible for other tasks, such as preparing reports and answering employee questions.

What is the work environment of a Payroll Machine Operator?

Payroll Machine Operators typically work in an office environment. They may work independently or as part of a team. Payroll Machine Operators typically have regular hours, but they may need to work overtime during peak periods.

What is the salary of a Payroll Machine Operator?

The salary of a Payroll Machine Operator varies depending on their experience and location. According to the U.S. Bureau of Labor Statistics, the median annual salary for Payroll Machine Operators was \$40,590 in May 2021.