Are you a seasoned Credit Risk Officer seeking a new career path? Discover our professionally built Credit Risk Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

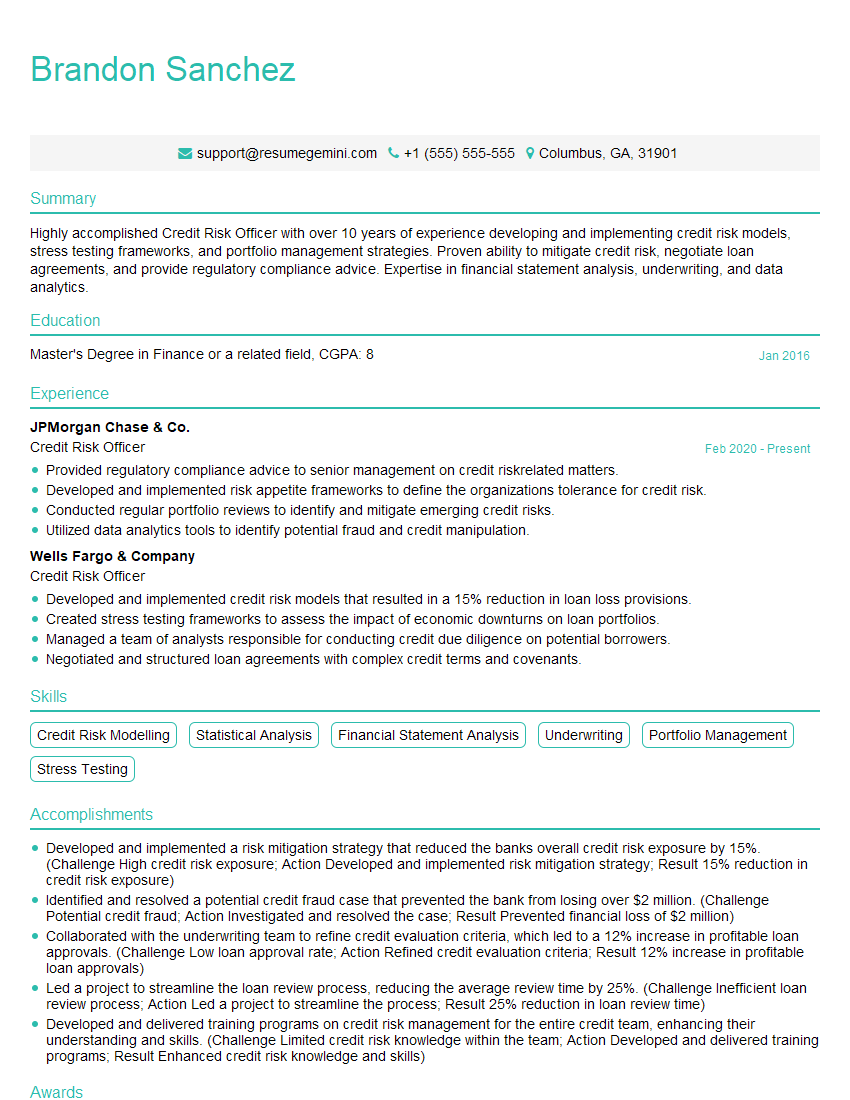

Brandon Sanchez

Credit Risk Officer

Summary

Highly accomplished Credit Risk Officer with over 10 years of experience developing and implementing credit risk models, stress testing frameworks, and portfolio management strategies. Proven ability to mitigate credit risk, negotiate loan agreements, and provide regulatory compliance advice. Expertise in financial statement analysis, underwriting, and data analytics.

Education

Master’s Degree in Finance or a related field

January 2016

Skills

- Credit Risk Modelling

- Statistical Analysis

- Financial Statement Analysis

- Underwriting

- Portfolio Management

- Stress Testing

Work Experience

Credit Risk Officer

- Provided regulatory compliance advice to senior management on credit riskrelated matters.

- Developed and implemented risk appetite frameworks to define the organizations tolerance for credit risk.

- Conducted regular portfolio reviews to identify and mitigate emerging credit risks.

- Utilized data analytics tools to identify potential fraud and credit manipulation.

Credit Risk Officer

- Developed and implemented credit risk models that resulted in a 15% reduction in loan loss provisions.

- Created stress testing frameworks to assess the impact of economic downturns on loan portfolios.

- Managed a team of analysts responsible for conducting credit due diligence on potential borrowers.

- Negotiated and structured loan agreements with complex credit terms and covenants.

Accomplishments

- Developed and implemented a risk mitigation strategy that reduced the banks overall credit risk exposure by 15%. (Challenge High credit risk exposure; Action Developed and implemented risk mitigation strategy; Result 15% reduction in credit risk exposure)

- Identified and resolved a potential credit fraud case that prevented the bank from losing over $2 million. (Challenge Potential credit fraud; Action Investigated and resolved the case; Result Prevented financial loss of $2 million)

- Collaborated with the underwriting team to refine credit evaluation criteria, which led to a 12% increase in profitable loan approvals. (Challenge Low loan approval rate; Action Refined credit evaluation criteria; Result 12% increase in profitable loan approvals)

- Led a project to streamline the loan review process, reducing the average review time by 25%. (Challenge Inefficient loan review process; Action Led a project to streamline the process; Result 25% reduction in loan review time)

- Developed and delivered training programs on credit risk management for the entire credit team, enhancing their understanding and skills. (Challenge Limited credit risk knowledge within the team; Action Developed and delivered training programs; Result Enhanced credit risk knowledge and skills)

Awards

- Received the Credit Risk Officer of the Year award for exceptional performance in managing credit risk and minimizing financial losses.

- Recognized for outstanding contribution to the implementation of a new credit scoring system that enhanced the accuracy and efficiency of credit risk assessments.

- Honored with the Best Credit Risk Management Practice award for implementing innovative techniques that improved risk identification and mitigation.

- Received the Credit Risk Excellence Award for consistently exceeding performance targets and demonstrating exceptional analytical skills in assessing and mitigating credit risks.

Certificates

- FRM

- CRM

- CISI

- PWC

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Risk Officer

- Quantify your accomplishments with specific metrics whenever possible.

- Highlight your experience in developing and implementing credit risk models.

- Emphasize your skills in financial statement analysis and underwriting.

- Demonstrate your knowledge of regulatory compliance requirements.

- Showcase your ability to communicate complex financial concepts clearly and effectively.

Essential Experience Highlights for a Strong Credit Risk Officer Resume

- Developed and implemented credit risk models that resulted in a 15% reduction in loan loss provisions.

- Created stress testing frameworks to assess the impact of economic downturns on loan portfolios.

- Managed a team of analysts responsible for conducting credit due diligence on potential borrowers.

- Negotiated and structured loan agreements with complex credit terms and covenants.

- Provided regulatory compliance advice to senior management on credit risk-related matters.

- Developed and implemented risk appetite frameworks to define the organization’s tolerance for credit risk.

Frequently Asked Questions (FAQ’s) For Credit Risk Officer

What are the primary responsibilities of a Credit Risk Officer?

Credit Risk Officers are responsible for evaluating and mitigating the risk of financial loss due to borrower default. They develop and implement credit risk models, conduct stress testing, and manage loan portfolios. They also negotiate loan agreements and provide regulatory compliance advice.

What skills are necessary to be successful as a Credit Risk Officer?

Credit Risk Officers must have a strong understanding of credit risk management principles, financial statement analysis, and underwriting. They must also be proficient in data analytics and have excellent communication and negotiation skills.

What are the career prospects for Credit Risk Officers?

Credit Risk Officers can advance to senior positions within financial institutions, such as Chief Risk Officer or Head of Credit Risk. They may also move into other areas of finance, such as portfolio management or investment banking.

What is the job outlook for Credit Risk Officers?

The job outlook for Credit Risk Officers is expected to be positive in the coming years. As financial institutions continue to face increasing regulatory scrutiny and the risk of financial loss, the demand for qualified Credit Risk Officers will remain high.

What are the typical salary expectations for Credit Risk Officers?

The salary expectations for Credit Risk Officers vary depending on experience, qualifications, and location. According to Glassdoor, the average salary for Credit Risk Officers in the United States is around $100,000 per year.

What are the top companies that hire Credit Risk Officers?

Some of the top companies that hire Credit Risk Officers include JPMorgan Chase & Co., Wells Fargo & Company, Bank of America, Citigroup, and Goldman Sachs.

What is the best way to prepare for a career as a Credit Risk Officer?

The best way to prepare for a career as a Credit Risk Officer is to obtain a degree in finance or a related field. Additionally, it is helpful to gain experience in credit risk management, financial statement analysis, or underwriting through internships or entry-level positions.