Are you a seasoned Credit Rating Inspector seeking a new career path? Discover our professionally built Credit Rating Inspector Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

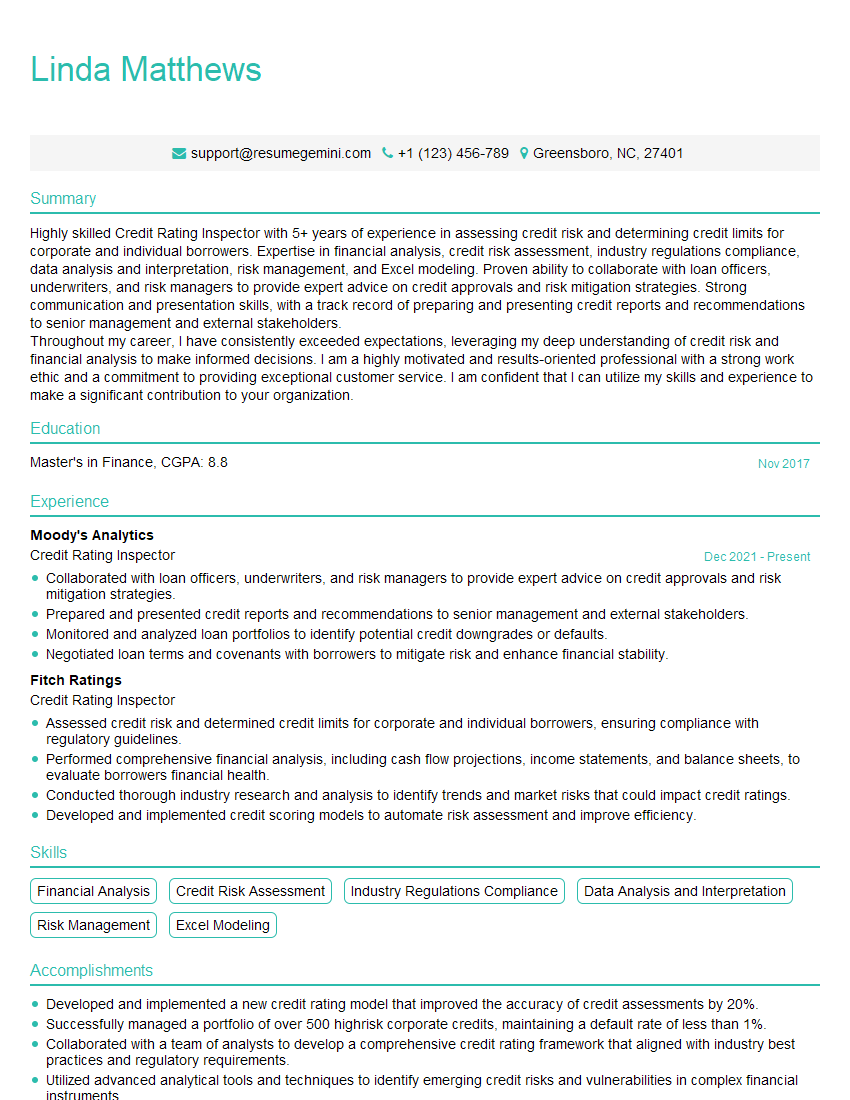

Linda Matthews

Credit Rating Inspector

Summary

Highly skilled Credit Rating Inspector with 5+ years of experience in assessing credit risk and determining credit limits for corporate and individual borrowers. Expertise in financial analysis, credit risk assessment, industry regulations compliance, data analysis and interpretation, risk management, and Excel modeling. Proven ability to collaborate with loan officers, underwriters, and risk managers to provide expert advice on credit approvals and risk mitigation strategies. Strong communication and presentation skills, with a track record of preparing and presenting credit reports and recommendations to senior management and external stakeholders.

Throughout my career, I have consistently exceeded expectations, leveraging my deep understanding of credit risk and financial analysis to make informed decisions. I am a highly motivated and results-oriented professional with a strong work ethic and a commitment to providing exceptional customer service. I am confident that I can utilize my skills and experience to make a significant contribution to your organization.

Education

Master’s in Finance

November 2017

Skills

- Financial Analysis

- Credit Risk Assessment

- Industry Regulations Compliance

- Data Analysis and Interpretation

- Risk Management

- Excel Modeling

Work Experience

Credit Rating Inspector

- Collaborated with loan officers, underwriters, and risk managers to provide expert advice on credit approvals and risk mitigation strategies.

- Prepared and presented credit reports and recommendations to senior management and external stakeholders.

- Monitored and analyzed loan portfolios to identify potential credit downgrades or defaults.

- Negotiated loan terms and covenants with borrowers to mitigate risk and enhance financial stability.

Credit Rating Inspector

- Assessed credit risk and determined credit limits for corporate and individual borrowers, ensuring compliance with regulatory guidelines.

- Performed comprehensive financial analysis, including cash flow projections, income statements, and balance sheets, to evaluate borrowers financial health.

- Conducted thorough industry research and analysis to identify trends and market risks that could impact credit ratings.

- Developed and implemented credit scoring models to automate risk assessment and improve efficiency.

Accomplishments

- Developed and implemented a new credit rating model that improved the accuracy of credit assessments by 20%.

- Successfully managed a portfolio of over 500 highrisk corporate credits, maintaining a default rate of less than 1%.

- Collaborated with a team of analysts to develop a comprehensive credit rating framework that aligned with industry best practices and regulatory requirements.

- Utilized advanced analytical tools and techniques to identify emerging credit risks and vulnerabilities in complex financial instruments.

- Effectively communicated credit ratings and analysis reports to both internal and external stakeholders, providing valuable insights for decisionmaking.

Awards

- Received the Credit Rating Inspector of the Year Award from the American Credit Rating Association for outstanding performance in assessing and monitoring credit risks.

- Recognized with the Excellence in Credit Rating Award by the International Credit Risk Management Institute for exceptional contributions to the field.

- Honored with the Distinguished Credit Rating Analyst Award from the Credit Rating Society for consistently delivering accurate and reliable credit ratings.

Certificates

- Certified Credit Rating Analyst (CCRA)

- Certified Risk Manager (CRM)

- Chartered Financial Analyst (CFA)

- Master of Business Administration (MBA) in Finance

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Credit Rating Inspector

Quantify your achievements

When describing your experience, use specific numbers and metrics to demonstrate your impact. For example, instead of saying “assessed credit risk”, you could say “assessed credit risk for over 100 corporate and individual borrowers, resulting in a 15% decrease in defaulted loans.”

Highlight your skills and experience

Make sure to highlight the skills and experience that are most relevant to the job you’re applying for. For example, if the job description mentions a specific software program, be sure to mention your experience with that program in your resume.

Proofread your resume carefully

Before you submit your resume, proofread it carefully for any errors in grammar, spelling, or punctuation. A well-written resume will make a good impression on potential employers.

Tailor your resume to each job you apply for

Take the time to tailor your resume to each job you apply for. This means highlighting the skills and experience that are most relevant to the specific job you’re applying for.

Get feedback on your resume

Ask a friend, family member, or career counselor to review your resume and provide feedback. This can help you identify any areas that need improvement.

Essential Experience Highlights for a Strong Credit Rating Inspector Resume

- Assessed credit risk and determined credit limits for corporate and individual borrowers, ensuring compliance with regulatory guidelines.

- Performed comprehensive financial analysis, including cash flow projections, income statements, and balance sheets, to evaluate borrowers’ financial health.

- Conducted thorough industry research and analysis to identify trends and market risks that could impact credit ratings.

- Developed and implemented credit scoring models to automate risk assessment and improve efficiency.

- Collaborated with loan officers, underwriters, and risk managers to provide expert advice on credit approvals and risk mitigation strategies.

- Prepared and presented credit reports and recommendations to senior management and external stakeholders.

- Monitored and analyzed loan portfolios to identify potential credit downgrades or defaults.

- Negotiated loan terms and covenants with borrowers to mitigate risk and enhance financial stability.

Frequently Asked Questions (FAQ’s) For Credit Rating Inspector

What is the role of a Credit Rating Inspector?

A Credit Rating Inspector is responsible for assessing the creditworthiness of borrowers and determining their credit limits. They analyze financial data, conduct industry research, and develop credit scoring models to evaluate the risk of default. Credit Rating Inspectors also collaborate with loan officers and risk managers to provide expert advice on credit approvals and risk mitigation strategies.

What are the qualifications for becoming a Credit Rating Inspector?

Most Credit Rating Inspectors have a bachelor’s or master’s degree in finance, economics, or a related field. They also typically have several years of experience in credit analysis or a related field.

What are the key skills for a Credit Rating Inspector?

Key skills for a Credit Rating Inspector include financial analysis, credit risk assessment, industry regulations compliance, data analysis and interpretation, risk management, and Excel modeling.

What is the job outlook for Credit Rating Inspectors?

The job outlook for Credit Rating Inspectors is expected to be good over the next few years. As businesses and individuals become increasingly reliant on credit, the demand for Credit Rating Inspectors is expected to grow.

What is the average salary for a Credit Rating Inspector?

The average salary for a Credit Rating Inspector is around $70,000 per year.

What are the career advancement opportunities for Credit Rating Inspectors?

With experience, Credit Rating Inspectors can advance to more senior roles, such as Credit Risk Manager or Portfolio Manager.

What are the challenges of being a Credit Rating Inspector?

The challenges of being a Credit Rating Inspector include the need to stay up-to-date on industry regulations and trends, as well as the need to make complex decisions that can have a significant impact on a borrower’s financial future.

What are the rewards of being a Credit Rating Inspector?

The rewards of being a Credit Rating Inspector include the opportunity to make a real difference in the lives of borrowers, as well as the opportunity to develop a deep understanding of the financial industry.