Are you a seasoned Insurance and Accounts Receiveable Coordinator seeking a new career path? Discover our professionally built Insurance and Accounts Receiveable Coordinator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

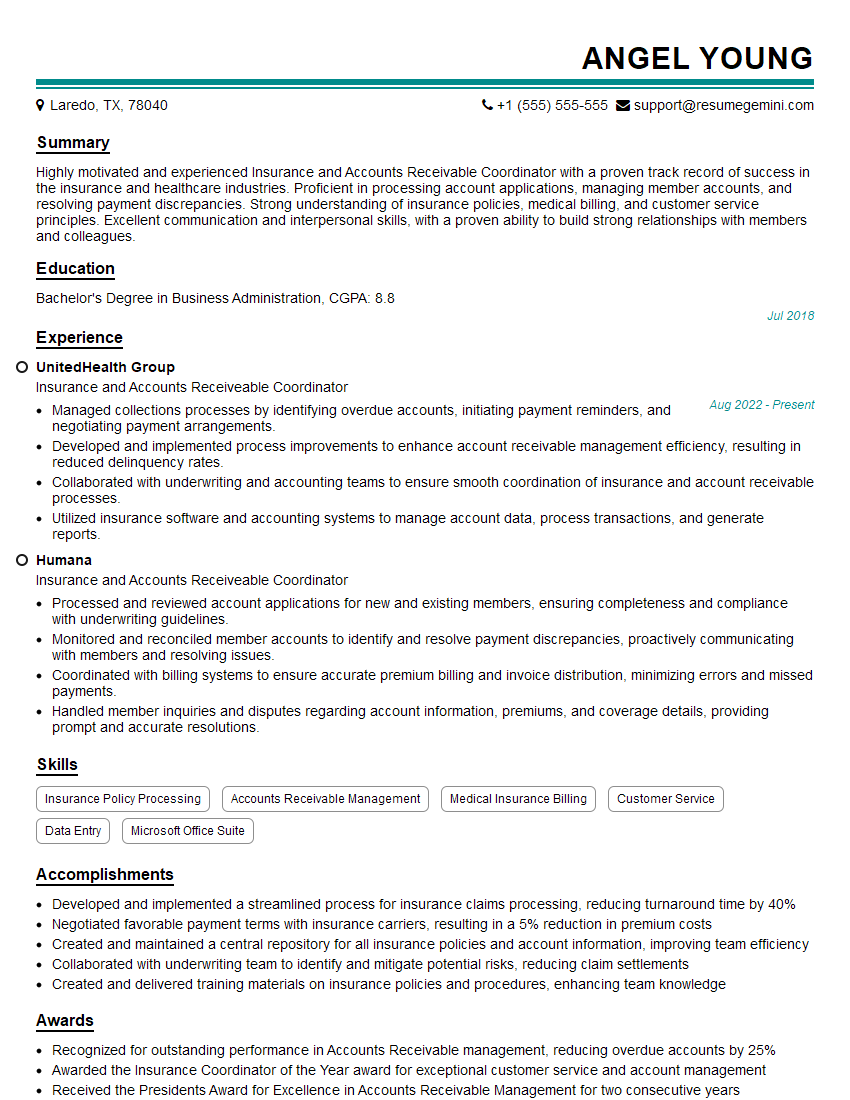

Angel Young

Insurance and Accounts Receiveable Coordinator

Summary

Highly motivated and experienced Insurance and Accounts Receivable Coordinator with a proven track record of success in the insurance and healthcare industries. Proficient in processing account applications, managing member accounts, and resolving payment discrepancies. Strong understanding of insurance policies, medical billing, and customer service principles. Excellent communication and interpersonal skills, with a proven ability to build strong relationships with members and colleagues.

Education

Bachelor’s Degree in Business Administration

July 2018

Skills

- Insurance Policy Processing

- Accounts Receivable Management

- Medical Insurance Billing

- Customer Service

- Data Entry

- Microsoft Office Suite

Work Experience

Insurance and Accounts Receiveable Coordinator

- Managed collections processes by identifying overdue accounts, initiating payment reminders, and negotiating payment arrangements.

- Developed and implemented process improvements to enhance account receivable management efficiency, resulting in reduced delinquency rates.

- Collaborated with underwriting and accounting teams to ensure smooth coordination of insurance and account receivable processes.

- Utilized insurance software and accounting systems to manage account data, process transactions, and generate reports.

Insurance and Accounts Receiveable Coordinator

- Processed and reviewed account applications for new and existing members, ensuring completeness and compliance with underwriting guidelines.

- Monitored and reconciled member accounts to identify and resolve payment discrepancies, proactively communicating with members and resolving issues.

- Coordinated with billing systems to ensure accurate premium billing and invoice distribution, minimizing errors and missed payments.

- Handled member inquiries and disputes regarding account information, premiums, and coverage details, providing prompt and accurate resolutions.

Accomplishments

- Developed and implemented a streamlined process for insurance claims processing, reducing turnaround time by 40%

- Negotiated favorable payment terms with insurance carriers, resulting in a 5% reduction in premium costs

- Created and maintained a central repository for all insurance policies and account information, improving team efficiency

- Collaborated with underwriting team to identify and mitigate potential risks, reducing claim settlements

- Created and delivered training materials on insurance policies and procedures, enhancing team knowledge

Awards

- Recognized for outstanding performance in Accounts Receivable management, reducing overdue accounts by 25%

- Awarded the Insurance Coordinator of the Year award for exceptional customer service and account management

- Received the Presidents Award for Excellence in Accounts Receivable Management for two consecutive years

- Recognized for consistently exceeding performance targets and receiving positive customer feedback

Certificates

- Certified Insurance Service Representative (CISR)

- Certified Professional Insurance Agent (CPIA)

- Certified Insurance Counselor (CIC)

- Certified Risk Manager (CRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Insurance and Accounts Receiveable Coordinator

- Highlight your experience in insurance policy processing, accounts receivable management, and medical insurance billing.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Showcase your customer service skills and ability to resolve issues and disputes.

- Emphasize your proficiency in insurance software and accounting systems.

Essential Experience Highlights for a Strong Insurance and Accounts Receiveable Coordinator Resume

- Process and review account applications for new and existing members, ensuring completeness and compliance with underwriting guidelines.

- Monitor and reconcile member accounts to identify and resolve payment discrepancies, proactively communicating with members and resolving issues.

- Coordinate with billing systems to ensure accurate premium billing and invoice distribution, minimizing errors and missed payments.

- Handle member inquiries and disputes regarding account information, premiums, and coverage details, providing prompt and accurate resolutions.

- Manage collections processes by identifying overdue accounts, initiating payment reminders, and negotiating payment arrangements.

- Develop and implement process improvements to enhance account receivable management efficiency, resulting in reduced delinquency rates.

- Collaborate with underwriting and accounting teams to ensure smooth coordination of insurance and account receivable processes.

Frequently Asked Questions (FAQ’s) For Insurance and Accounts Receiveable Coordinator

What are the key skills required for an Insurance and Accounts Receivable Coordinator?

Key skills include insurance policy processing, accounts receivable management, medical insurance billing, customer service, data entry, and proficiency in Microsoft Office Suite.

What are the primary responsibilities of an Insurance and Accounts Receivable Coordinator?

Primary responsibilities include processing account applications, managing member accounts, resolving payment discrepancies, handling member inquiries, managing collections processes, and collaborating with other teams.

What are the educational requirements for an Insurance and Accounts Receivable Coordinator?

A bachelor’s degree in business administration or a related field is typically required.

What industries hire Insurance and Accounts Receivable Coordinators?

Insurance and Accounts Receivable Coordinators are employed in various industries, including insurance, healthcare, and financial services.

What is the career outlook for Insurance and Accounts Receivable Coordinators?

The career outlook for Insurance and Accounts Receivable Coordinators is expected to grow in the coming years due to the increasing demand for healthcare and insurance services.

How much do Insurance and Accounts Receivable Coordinators earn?

The salary for Insurance and Accounts Receivable Coordinators varies depending on experience, location, and company size.