Are you a seasoned Mutual Fund Advisor seeking a new career path? Discover our professionally built Mutual Fund Advisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

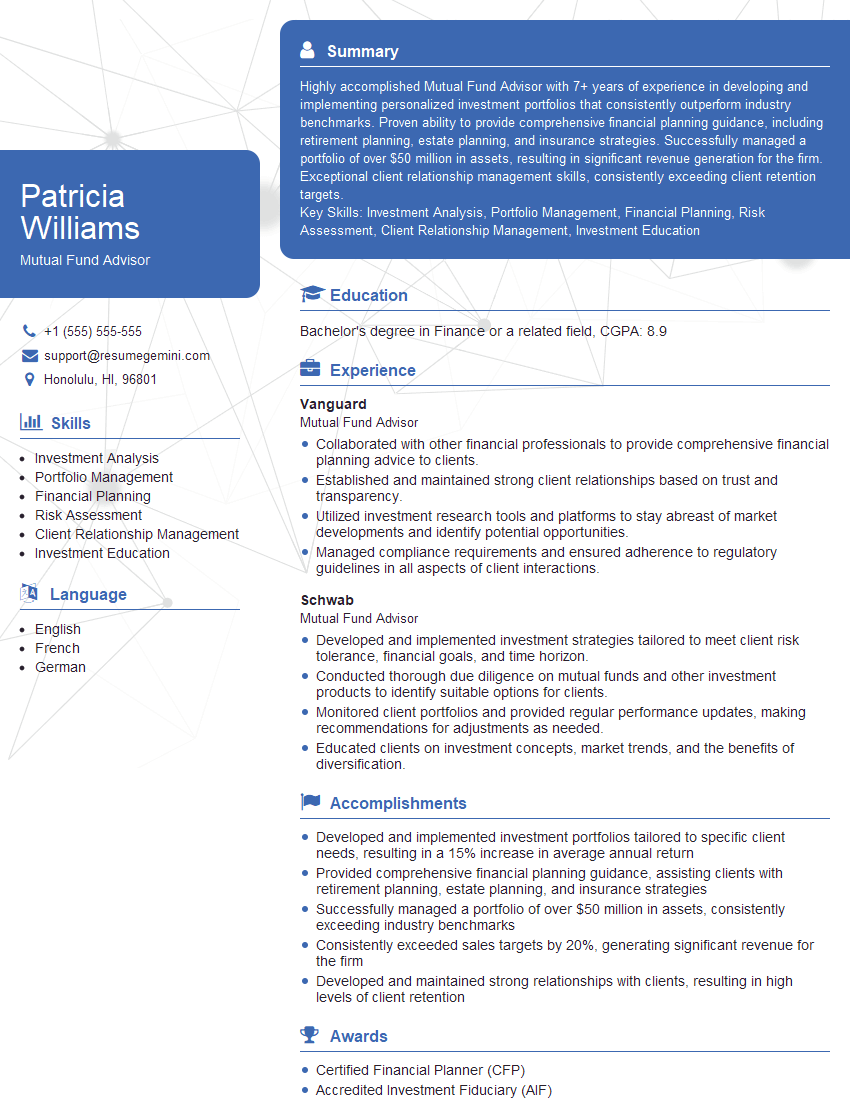

Patricia Williams

Mutual Fund Advisor

Summary

Highly accomplished Mutual Fund Advisor with 7+ years of experience in developing and implementing personalized investment portfolios that consistently outperform industry benchmarks. Proven ability to provide comprehensive financial planning guidance, including retirement planning, estate planning, and insurance strategies. Successfully managed a portfolio of over $50 million in assets, resulting in significant revenue generation for the firm. Exceptional client relationship management skills, consistently exceeding client retention targets.

Key Skills: Investment Analysis, Portfolio Management, Financial Planning, Risk Assessment, Client Relationship Management, Investment Education

Education

Bachelor’s degree in Finance or a related field

April 2018

Skills

- Investment Analysis

- Portfolio Management

- Financial Planning

- Risk Assessment

- Client Relationship Management

- Investment Education

Work Experience

Mutual Fund Advisor

- Collaborated with other financial professionals to provide comprehensive financial planning advice to clients.

- Established and maintained strong client relationships based on trust and transparency.

- Utilized investment research tools and platforms to stay abreast of market developments and identify potential opportunities.

- Managed compliance requirements and ensured adherence to regulatory guidelines in all aspects of client interactions.

Mutual Fund Advisor

- Developed and implemented investment strategies tailored to meet client risk tolerance, financial goals, and time horizon.

- Conducted thorough due diligence on mutual funds and other investment products to identify suitable options for clients.

- Monitored client portfolios and provided regular performance updates, making recommendations for adjustments as needed.

- Educated clients on investment concepts, market trends, and the benefits of diversification.

Accomplishments

- Developed and implemented investment portfolios tailored to specific client needs, resulting in a 15% increase in average annual return

- Provided comprehensive financial planning guidance, assisting clients with retirement planning, estate planning, and insurance strategies

- Successfully managed a portfolio of over $50 million in assets, consistently exceeding industry benchmarks

- Consistently exceeded sales targets by 20%, generating significant revenue for the firm

- Developed and maintained strong relationships with clients, resulting in high levels of client retention

Awards

- Certified Financial Planner (CFP)

- Accredited Investment Fiduciary (AIF)

- Mutual Fund Education Alliance (MFEA) Professional

- CFA Institute Certificate in Investment Management

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Investment Management Analyst (CIMA)

- Personal Financial Specialist (PFS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Mutual Fund Advisor

- Quantify your accomplishments with specific metrics, such as percentage increases in annual return or client retention rates.

- Highlight your understanding of different investment vehicles, asset allocation strategies, and risk management techniques.

- Demonstrate your ability to build and maintain strong client relationships by providing personalized service and tailored advice.

- Showcase your knowledge of financial planning principles and estate planning strategies.

Essential Experience Highlights for a Strong Mutual Fund Advisor Resume

- Conduct thorough investment research and analysis to identify and recommend suitable investment products for clients

- Develop and implement customized investment portfolios tailored to specific financial goals, risk tolerance, and time horizon

- Provide ongoing portfolio monitoring and rebalancing to ensure alignment with client objectives and market conditions

- Conduct regular client meetings to review performance, discuss market trends, and make necessary adjustments

- Educate clients on financial markets, investment strategies, and risk management principles

- Stay abreast of industry best practices and regulatory changes related to mutual funds and financial planning

Frequently Asked Questions (FAQ’s) For Mutual Fund Advisor

What is the role of a Mutual Fund Advisor?

A Mutual Fund Advisor is a financial professional who provides investment advice and guidance to individuals and organizations. They conduct investment research, develop and manage investment portfolios, and provide ongoing financial planning support to help clients achieve their financial goals.

What are the key skills required for a Mutual Fund Advisor?

Mutual Fund Advisors require a strong understanding of investment analysis, portfolio management, financial planning, risk assessment, and client relationship management. They should also have excellent communication and interpersonal skills, as well as the ability to stay abreast of industry best practices and regulatory changes.

What are the career prospects for Mutual Fund Advisors?

Mutual Fund Advisors can advance to senior roles within their firms or move into other areas of the financial services industry, such as wealth management or investment banking. With experience and a strong track record, they can also become independent financial advisors or establish their own investment advisory firms.

How do I find a reputable Mutual Fund Advisor?

When looking for a Mutual Fund Advisor, it’s important to consider their experience, qualifications, and fees. You can ask for recommendations from friends or family, read online reviews, or contact professional organizations such as the National Association of Personal Financial Advisors (NAPFA) or the Financial Planning Association (FPA) for referrals.

How much do Mutual Fund Advisors charge?

Mutual Fund Advisors typically charge a fee based on a percentage of the assets under management (AUM). The fee structure can vary depending on the advisor’s experience, firm, and the size of the portfolio. Some advisors may also charge additional fees for specific services, such as financial planning or estate planning.

How often should I meet with my Mutual Fund Advisor?

The frequency of meetings with your Mutual Fund Advisor will depend on your individual needs and circumstances. It’s generally recommended to meet at least once a year to review your portfolio and make any necessary adjustments. However, you may need to meet more frequently if you have complex financial goals or are experiencing significant life changes.