Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Adviser interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Adviser so you can tailor your answers to impress potential employers.

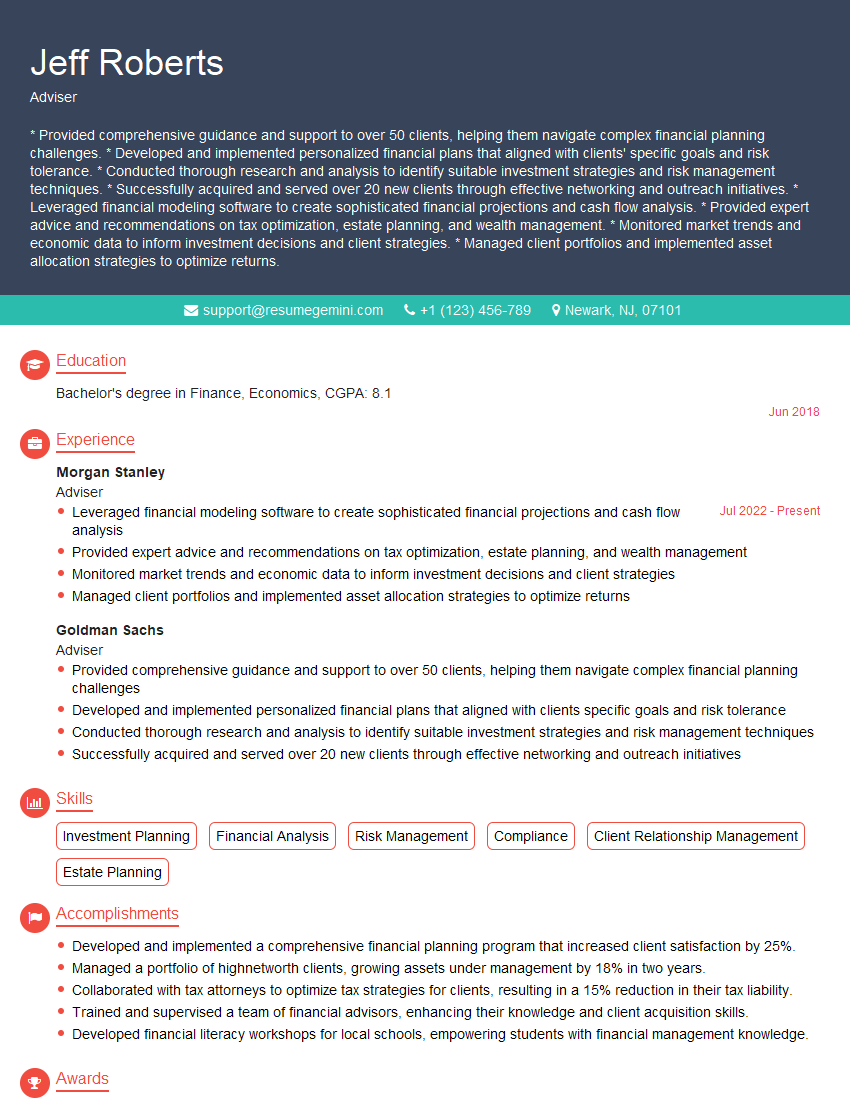

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Adviser

1. What is your understanding of the role of an Adviser?

- Understands the client’s needs and goals

- Develops and implements financial plans

- Provides ongoing advice and support

- Builds and maintains relationships with clients

- Keeps up-to-date on financial products and markets

2. What are the different types of financial products that you are familiar with?

Investment products

- Stocks

- Bonds

- Mutual funds

- Exchange-traded funds (ETFs)

Insurance products

- Life insurance

- Disability insurance

- Health insurance

- Long-term care insurance

Retirement products

- 401(k) plans

- IRAs

- Annuities

3. What is your investment philosophy?

My investment philosophy is to develop a personalized portfolio that aligns with my client’s risk tolerance, time horizon, and financial goals. I believe in a diversified approach that includes a mix of asset classes, such as stocks, bonds, and real estate. I also believe in the importance of rebalancing portfolios regularly to ensure that they remain aligned with the client’s goals.

4. What is your experience with financial planning?

I have over 10 years of experience in financial planning. I have worked with individuals, families, and businesses to develop and implement financial plans that meet their specific needs and goals. I have experience in a variety of financial planning areas, including retirement planning, investment planning, estate planning, and tax planning.

5. What is your approach to working with clients?

My approach to working with clients is to build a strong relationship based on trust and open communication. I take the time to get to know my clients and their unique circumstances. I then develop a personalized financial plan that is designed to meet their specific needs and goals. I am committed to providing ongoing support and advice to my clients as they work towards achieving their financial goals.

6. What are your strengths as an Adviser?

- Strong understanding of financial products and markets

- Ability to develop and implement personalized financial plans

- Excellent communication and interpersonal skills

- Commitment to providing ongoing support and advice to clients

- Ability to build and maintain strong relationships with clients

7. What are your weaknesses as an Adviser?

I am always looking for ways to improve my skills and knowledge. One area where I would like to continue to develop is my expertise in alternative investments, such as private equity and hedge funds.

8. Why are you interested in working for our company?

I am interested in working for your company because I am impressed by your commitment to providing comprehensive financial planning services to your clients. I believe that my skills and experience would be a valuable asset to your team, and I am confident that I can make a significant contribution to your company’s success.

9. What are your salary expectations?

My salary expectations are commensurate with my experience and qualifications. I am open to negotiating a salary package that is fair and competitive.

10. When are you available to start work?

I am available to start work immediately.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Adviser.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Adviser‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Advisers are responsible for providing guidance and support to individuals, organizations, or businesses in a variety of areas. They may specialize in a particular field, such as finance, education, or career development, or they may provide general advice on a wide range of topics.

1. Assess Client Needs

To provide effective guidance, advisers must first assess the needs of their clients. This may involve conducting interviews, administering assessments, or reviewing relevant documents.

- Conducting thorough interviews to gather information about the client’s background, goals, and current situation.

- Administering psychometric assessments to evaluate the client’s strengths, weaknesses, and personality.

2. Develop and Implement Plans

Once the client’s needs have been assessed, the adviser will develop and implement a plan to help them achieve their goals. This may involve setting specific objectives, providing resources, or offering ongoing support.

- Developing comprehensive plans that outline the client’s goals, objectives, and strategies.

- Recommending and arranging for appropriate resources and services to support the client’s progress.

3. Provide Ongoing Support

Advisers provide ongoing support to their clients throughout the planning and implementation process. This may involve answering questions, providing encouragement, or making adjustments to the plan as needed.

- Monitoring the client’s progress and providing feedback and support on a regular basis.

- Making adjustments to the plan as necessary to ensure that the client is making progress toward their goals.

4. Maintain Confidentiality

Advisers must maintain confidentiality at all times. This means that they must not share any information about their clients with anyone else without their consent.

- Ensuring that all client information is kept confidential and secure, both during and after the advisory relationship.

- Respecting the client’s right to privacy and autonomy, even if the adviser does not agree with their decisions.

Interview Tips

Preparing for an interview for an adviser position can be daunting, but with the right preparation, you can increase your chances of success.

1. Research the Company and the Position

Before you go on an interview, it is important to research the company and the position you are applying for. This will help you to understand the company’s culture, values, and goals, and to tailor your answers to the specific requirements of the position.

- Visit the company’s website and read the company’s mission statement, values, and recent news releases.

- Review the job description and make note of the specific requirements of the position.

2. Practice Your Answers

Once you have done your research, it is important to practice your answers to common interview questions. This will help you to feel more confident and prepared during the interview.

- Think about your strengths and weaknesses, and how they relate to the requirements of the position.

- Practice answering questions about your experience, education, and skills.

3. Dress Professionally

It is important to dress professionally for an interview, even if the company has a casual dress code. This will show the interviewer that you are serious about the position and that you respect the company.

- Wear a suit or other business attire, and make sure your clothes are clean and pressed.

- Pay attention to your grooming, and make sure your hair is neat and your nails are clean.

4. Be Punctual

Being punctual for an interview shows the interviewer that you are respectful of their time. It is important to arrive at the interview location a few minutes early, so that you have time to check in and get settled.

- Plan your route ahead of time, and allow yourself plenty of time to get to the interview location.

- If you are running late, call or email the interviewer to let them know.

5. Be Yourself

It is important to be yourself during an interview. The interviewer wants to get to know the real you, so do not try to be someone you are not. Be honest about your strengths and weaknesses, and be enthusiastic about the position.

- Be genuine and authentic in your interactions with the interviewer.

- Highlight your unique skills and experiences that make you a suitable candidate for the position.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Adviser interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!