Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Adviser Sales interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Adviser Sales so you can tailor your answers to impress potential employers.

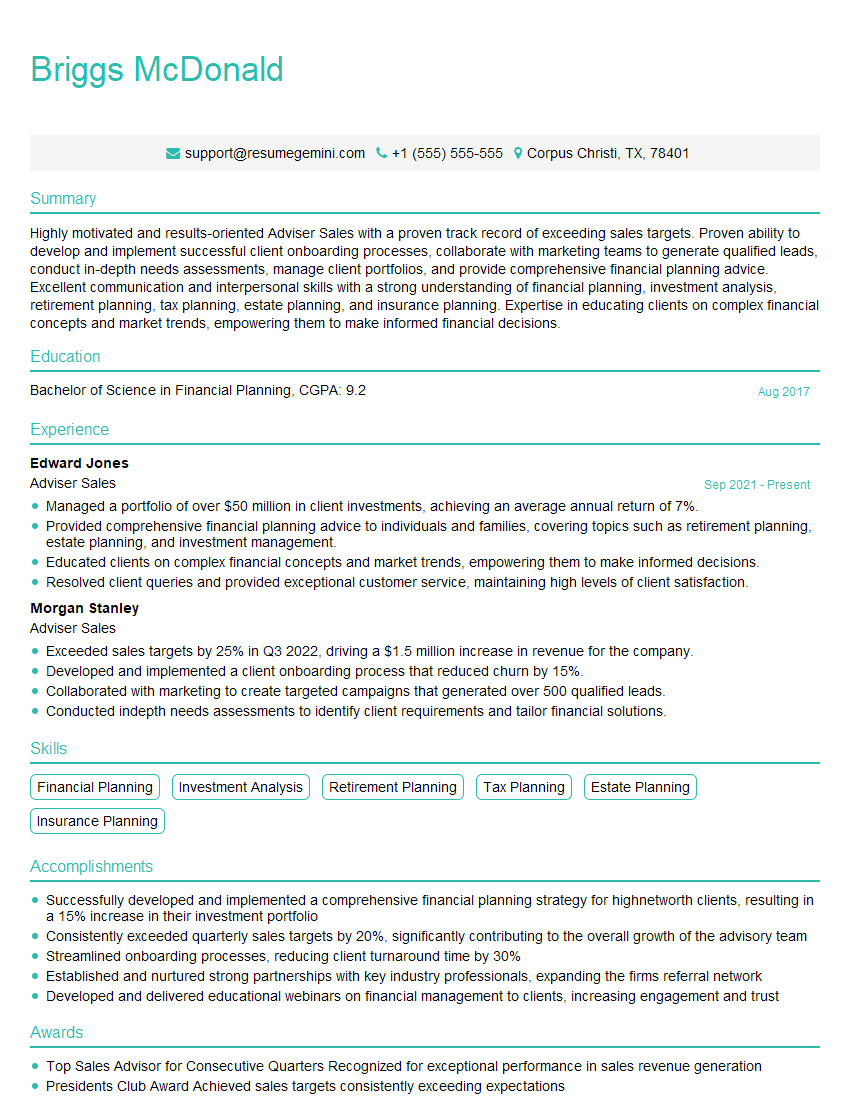

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Adviser Sales

1. Discuss your experience in identifying and qualifying sales leads.

In my previous role, I used a multi-step process to identify and qualify leads. Firstly, I used LinkedIn Sales Navigator and other online tools to generate a list of potential leads based on specific criteria such as industry, company size, and job title. I also attended industry events and conferences to network with potential customers. Once I had a list of leads, I would qualify them by conducting phone interviews to assess their needs and determine if they were a good fit for our products or services. I used a lead scoring system to prioritize the most promising leads and focus my efforts on them.

2. How do you build rapport with clients and build relationships?

Active Listening

- Pay undivided attention to clients.

- Ask clarifying questions and summarize key points.

Personalized Approach

- Research clients’ backgrounds and industries.

- Tailor communication and solutions to specific needs.

Empathy and Understanding

- Put yourself in clients’ shoes and understand their perspectives.

- Show genuine concern for their challenges and goals.

Regular Communication

- Maintain consistent contact through phone, email, and meetings.

- Provide value and updates without being intrusive.

3. Describe your approach to managing a sales pipeline.

I follow a structured sales pipeline that includes the following stages: Prospecting, Qualification, Needs Assessment, Proposal, Negotiation, and Closing. I use a CRM system to track the progress of each lead and opportunity, and I regularly review my pipeline to identify any bottlenecks or potential issues. I also use data analysis to identify trends and patterns in my sales pipeline, and I make adjustments to my approach as needed to improve my results.

4. How do you negotiate effectively with clients?

- Preparation: Research market data, competitor prices, and client’s needs.

- Understanding Client’s Objectives: Identify their priorities, constraints, and decision-making process.

- Active Listening: Communicate clearly, ask questions, and show empathy to build trust.

- Value Proposition: Emphasize the unique benefits and value of your solution.

- Concessions and Alternatives: Be prepared to offer creative solutions and compromises to meet both parties’ needs.

- Documenting Agreements: Clearly document all agreed-upon terms and conditions to avoid misunderstandings.

5. How do you stay up-to-date on industry trends and best practices?

- Industry Publications and Events: Attend industry conferences, webinars, and read trade magazines.

- Online Research: Utilize search engines, industry blogs, and social media to gather information.

- Networking and Collaboration: Connect with other professionals in the field and exchange knowledge.

- Training and Development Programs: Participate in workshops, seminars, or online courses to enhance skills and stay current.

- Continuous Improvement: Regularly review and assess personal performance and seek ways to improve.

6. What are some of the challenges you have faced as an Adviser Sales?

- Competitive Market: Navigating a highly competitive industry and differentiating products.

- Economic Fluctuations: Adapting to changes in economic conditions and adjusting sales strategies accordingly.

- Client Objections: Handling objections effectively and finding solutions that address client concerns.

- Time Management and Prioritization: Managing a large client base and optimizing time to maximize productivity.

- Staying Motivated: Maintaining a positive attitude and staying focused despite setbacks.

7. What are your sales targets and how do you measure your success?

My sales targets are typically set by my manager and based on the company’s overall revenue goals. I measure my success by tracking my progress towards these targets and by assessing the following metrics: number of new clients acquired, revenue generated, customer satisfaction, and market share gained. I also regularly review my sales pipeline to identify opportunities for growth and improve my performance.

8. Describe a time when you had to go above and beyond to close a deal.

In my previous role, I was working on a major sales deal with a Fortune 500 company. The deal was complex and required extensive negotiation and collaboration with multiple stakeholders. I spent several months building a strong relationship with the client and understanding their needs. I also worked closely with my team to develop a customized solution that met their specific requirements. After several rounds of negotiations, we were able to close the deal, which exceeded my sales target for the quarter.

9. How do you handle rejection and setbacks in sales?

- Acknowledge the Situation: Accept that rejection is a normal part of sales and focus on learning from it.

- Analyze the Reasons: Identify areas for improvement and adjust strategies accordingly.

- Maintain a Positive Attitude: Stay motivated and avoid dwelling on setbacks.

- Seek Support: Talk to colleagues or mentors for encouragement and advice.

- Move Forward: Learn from the experience and apply insights to future interactions.

10. How do you stay organized and manage your workload?

- Effective Time Management: Prioritize tasks, set deadlines, and allocate time wisely.

- CRM Utilization: Use a CRM system to track client interactions, manage appointments, and monitor progress.

- Delegation and Collaboration: Delegate tasks when necessary and collaborate with colleagues to maximize productivity.

- Automation: Utilize technology and automation tools to streamline processes and save time.

- Regular Reviews: Regularly assess workload and make adjustments to improve efficiency.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Adviser Sales.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Adviser Sales‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Adviser Sales is responsible for providing financial advice and guidance to clients, helping them make informed decisions about their investments and financial planning. Their responsibilities encompass a wide range of tasks, including:

1. Client Relationship Management

Establishing and maintaining strong relationships with clients through regular communication, understanding their financial needs and goals, and providing personalized advice.

- Conducting thorough client interviews to gather information about their financial situation, risk tolerance, and investment objectives.

- Developing and presenting comprehensive financial plans that align with clients’ goals and aspirations.

2. Investment Management

Conducting in-depth research and analysis of financial markets and investment products to make informed recommendations to clients.

- Creating and managing diversified investment portfolios tailored to clients’ individual needs and risk profiles.

- Monitoring and adjusting portfolios regularly to meet changing market conditions and client circumstances.

3. Retirement Planning

Advising clients on strategies to prepare for retirement, including maximizing retirement savings and generating income.

- Recommending and implementing appropriate retirement plans, such as IRAs, 401(k)s, and annuities.

- Providing guidance on Social Security benefits and other retirement-related considerations.

4. Estate Planning

Assisting clients with estate planning strategies to ensure the smooth transfer of their assets according to their wishes.

- Creating and reviewing wills, trusts, and other estate planning documents.

- Advising clients on strategies to minimize estate taxes and protect their assets.

Interview Tips

Preparing thoroughly for an interview is crucial to making a positive impression on the hiring manager and increasing your chances of success. Here are some tips to help you ace your Adviser Sales interview:

1. Research the Company and the Role

Take the time to research the company you’re applying to, including its history, culture, and financial performance. Understand the specific role you’re applying for and how your skills and experience align with the job requirements.

- Visit the company website and social media pages.

- Read industry news and articles to stay up-to-date on the latest trends and developments.

2. Practice Common Interview Questions

Familiarize yourself with common interview questions and prepare thoughtful answers. Some frequently asked questions include:

- Tell me about yourself and your experience in financial advisory.

- Why are you interested in this role and our company?

- How do you stay up-to-date on the latest financial market trends?

- What is your investment philosophy and how do you apply it to client portfolios?

3. Prepare Questions for the Interviewer

Asking well-thought-out questions during the interview demonstrates your interest in the role and the company. This is also an opportunity to clarify any uncertainties and gain valuable insights.

- What are the company’s growth plans and how does this role contribute to them?

- What are the biggest challenges facing the industry and how is the company addressing them?

- What opportunities are there for professional development and career advancement within the company?

4. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally and arrive for the interview on time. A neat and polished appearance conveys respect for the interviewer and the company.

- Choose business attire that is clean, pressed, and appropriate for the office environment.

- Plan your route and leave ample time for travel to avoid any delays.

5. Follow Up After the Interview

After the interview, send a thank-you note to the interviewer within 24 hours. Express your appreciation for their time and reiterate your interest in the role. This shows your professionalism and follow-through.

- Keep your thank-you note brief and to the point.

- Proofread your message carefully for any errors.

Next Step:

Now that you’re armed with the knowledge of Adviser Sales interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Adviser Sales positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini