Feeling lost in a sea of interview questions? Landed that dream interview for Assistant Collector but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Assistant Collector interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

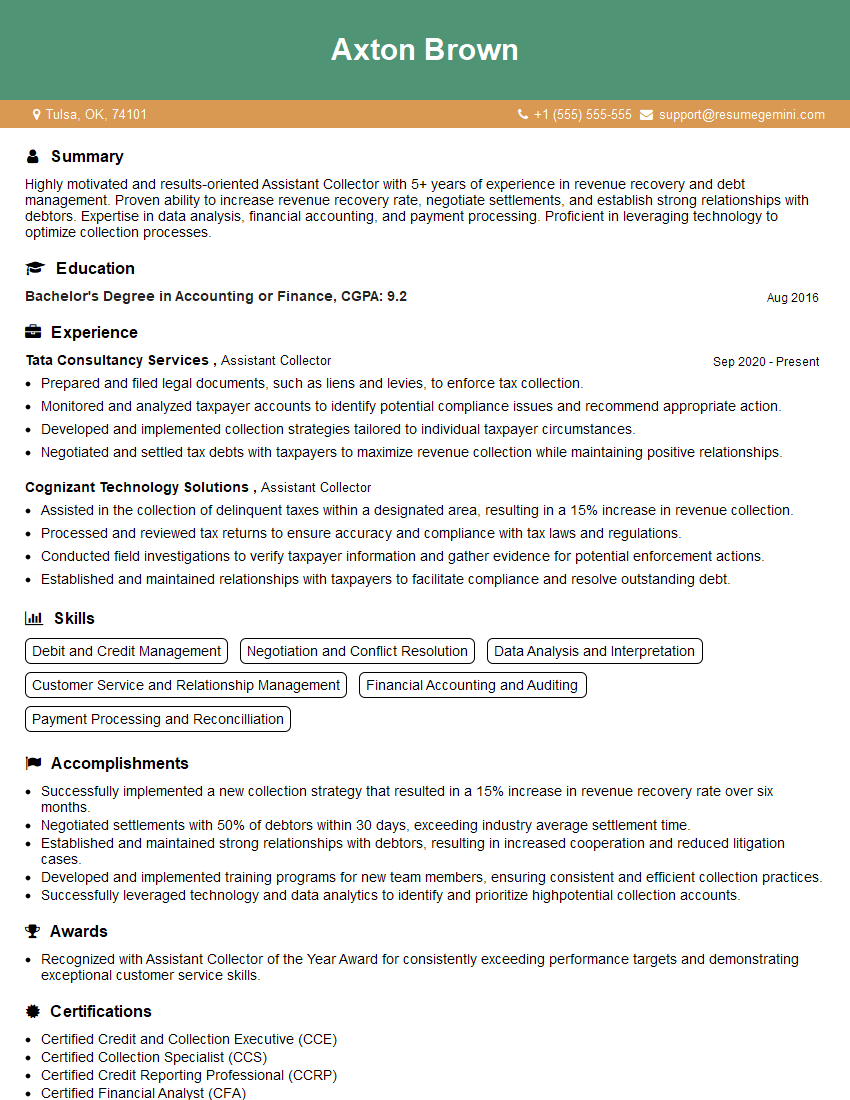

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Assistant Collector

1. What are the key responsibilities of an Assistant Collector?

- Revenue collection and administration

- Maintenance of land records

- Disaster management

- Law and order maintenance

- Social welfare and development

2. What is the role of an Assistant Collector in revenue collection?

Revenue Collection Process

- Identification of taxpayers

- Assessment of taxes

- Collection of taxes

- Enforcement of revenue laws

Role of Assistant Collector

- Supervision of revenue collection process

- Monitoring of tax arrears

- Initiation of recovery proceedings

- Conduct of tax audits

3. What are the different types of land records maintained by an Assistant Collector?

- Cadastral maps

- Record of Rights

- Mutation registers

- Settlement records

- Tenancy records

4. What is the procedure for land acquisition by the government?

- Notification of intention to acquire

- Survey and demarcation

- Assessment of compensation

- Payment of compensation

- Taking possession of land

5. What are the key features of the Disaster Management Act, 2005?

- Establishment of National Disaster Management Authority (NDMA)

- Preparation of disaster management plans

- Establishment of State Disaster Management Authorities (SDMAs)

- Capacity building and training

- Response and relief measures

6. What is the role of an Assistant Collector in law and order maintenance?

- Supervision of police force

- Maintenance of communal harmony

- Prevention and detection of crime

- Enforcement of law and order

- Coordination with other agencies

7. What are the different social welfare schemes implemented by the government?

- Public Distribution System (PDS)

- Integrated Child Development Services (ICDS)

- National Rural Employment Guarantee Scheme (NREGS)

- Pradhan Mantri Awas Yojana (PMAY)

- National Health Mission (NHM)

8. What is the role of an Assistant Collector in social development?

- Implementation of social welfare schemes

- Empowerment of women and children

- Promotion of education and healthcare

- Community development initiatives

- Protection of vulnerable groups

9. What are the key challenges faced by Assistant Collectors in the current scenario?

- Revenue shortfalls

- Land disputes

- Natural disasters

- Law and order issues

- Resource constraints

10. How do you see the role of Assistant Collectors evolving in the future?

- Increased use of technology

- Focus on public service delivery

- Capacity building and training

- Collaboration with other agencies

- Emphasis on sustainable development

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Assistant Collector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Assistant Collector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Assistant Collectors are responsible for various tasks related to tax collection and revenue management for their respective regions. Their key job responsibilities include:

1. Tax Assessment and Collection

Assessing and collecting taxes from individuals and businesses within their jurisdiction, ensuring accuracy and compliance with tax laws.

- Determining tax liabilities based on financial statements, records, and field investigations.

- Issuing tax bills and collecting payments, including managing tax payments and accounts receivable.

2. Revenue Management

Monitoring and managing the collection of various revenue streams, including property taxes, sales taxes, and other local levies.

- Analyzing and interpreting revenue data to identify trends and potential areas for improvement.

- Developing and implementing strategies to maximize revenue collection while ensuring equity and fairness.

3. Taxpayer Assistance and Education

Providing guidance and assistance to taxpayers regarding tax laws, regulations, and procedures.

- Answering inquiries, resolving tax issues, and offering educational programs to enhance taxpayer understanding.

- Conducting outreach initiatives to inform the public about tax obligations and services.

4. Audit and Enforcement

Conducting audits to verify the accuracy of tax returns and ensuring compliance with tax laws.

- Investigating cases of potential tax fraud or evasion.

- Imposing penalties and taking legal action when necessary to enforce tax laws.

Interview Tips

To ace the interview for an Assistant Collector position, consider the following tips:

1. Research the Role and Organization

Familiarize yourself with the specific responsibilities of an Assistant Collector and the mission and values of the organization. This will enable you to tailor your answers and demonstrate your understanding of the role.

- Review the job description and gather information from the organization’s website and industry publications.

- Connect with professionals in the field on LinkedIn or attend networking events to gain insights.

2. Highlight Your Relevant Skills and Experience

Emphasize your skills in tax assessment, revenue management, taxpayer assistance, and auditing. Provide specific examples of your accomplishments and how you have contributed to achieving revenue targets.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide concrete details.

- Quantify your results whenever possible, such as the percentage increase in revenue collected or the number of cases successfully audited.

3. Demonstrate Your Knowledge of Tax Laws and Regulations

Assistant Collectors are expected to have a thorough understanding of tax laws and regulations. Be prepared to discuss your knowledge of relevant tax codes and how you have applied them in your previous roles.

- Stay up-to-date on the latest tax updates and amendments.

- Consider obtaining a certification in tax law or a related field to enhance your credibility.

4. Emphasize Your Communication and Interpersonal Skills

Assistant Collectors interact with taxpayers, colleagues, and other stakeholders on a regular basis. Strong communication and interpersonal skills are essential to building relationships and resolving conflicts.

- Provide examples of how you have effectively communicated complex tax information to individuals with varying levels of understanding.

- Highlight your ability to handle difficult conversations and negotiate with taxpayers to reach mutually acceptable outcomes.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Assistant Collector interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.