Are you gearing up for an interview for a Bank Advisor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Bank Advisor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

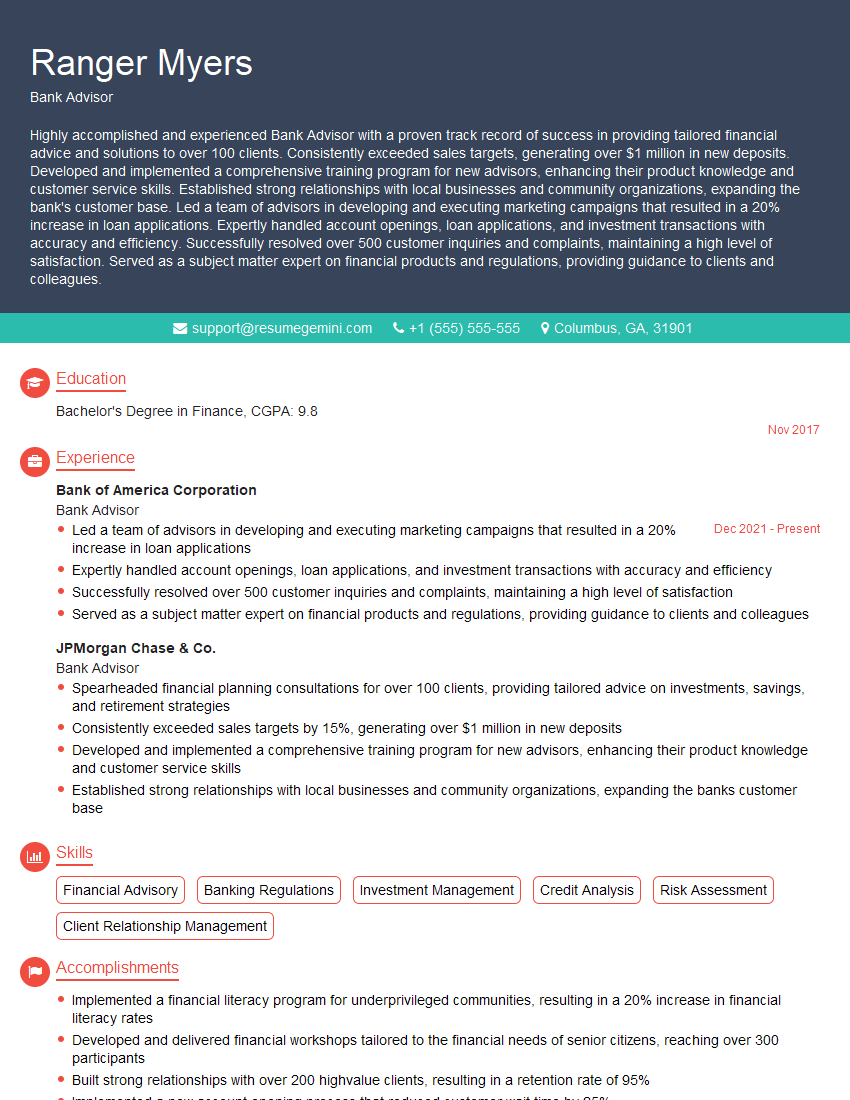

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank Advisor

1. What is your understanding of the role of a Bank Advisor?

A Bank Advisor is a financial professional who provides personalized financial advice and guidance to customers. They help customers understand their financial goals, assess their risk tolerance, and develop and implement financial plans that align with their needs and objectives. Bank Advisors may also recommend and sell financial products and services, such as savings accounts, checking accounts, loans, and investments.

2. What are the key skills and qualities that you believe are essential for success in this role?

Technical Skills

- Strong understanding of financial products and services

- Excellent communication and interpersonal skills

- Ability to build and maintain relationships

- Problem-solving skills

- Sales and marketing skills

Qualities

- Professionalism

- Ethics

- Motivation

- Empathy

- Teamwork

3. What are your strengths and weaknesses as they relate to this role?

Strengths:

- Strong understanding of financial products and services

- Excellent communication and interpersonal skills

- Ability to build and maintain relationships

- Problem-solving skills

- Sales and marketing skills

Weaknesses:

- Limited experience in the banking industry

- Lack of experience in managing a large portfolio of clients

4. How do you stay up-to-date on the latest financial trends and products?

- Read industry publications

- Attend conferences and workshops

- Take online courses

- Network with other professionals

- Stay informed about current events

5. What is your approach to providing financial advice to clients?

- Get to know the client and understand their financial goals

- Assess the client’s risk tolerance

- Develop a financial plan that aligns with the client’s needs and objectives

- Recommend and sell financial products and services that are suitable for the client

- Monitor the client’s progress and make adjustments to the financial plan as needed

6. How do you handle clients who are hesitant to take your advice?

- Listen to the client’s concerns

- Understand the client’s reasons for being hesitant

- Provide the client with additional information and resources

- Explain the benefits of following the advice

- Be patient and persistent

7. What is your sales strategy?

- Identify potential clients

- Build relationships with potential clients

- Qualify potential clients

- Present financial products and services

- Close the sale

- Follow up with clients

8. How do you measure your success as a Bank Advisor?

- Client satisfaction

- Sales volume

- Portfolio growth

- Customer referrals

- Awards and recognition

9. What are your career goals for the next 5 years?

- Become a top-producing Bank Advisor

- Manage a team of Bank Advisors

- Become a financial advisor

- Start my own financial planning firm

- Teach financial literacy

10. What is your ideal work environment?

- Collaborative

- Fast-paced

- Client-focused

- Professional

- Supportive

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank Advisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank Advisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Bank Advisor, your primary objective is to assist customers with their financial needs and provide personalized advice. Your key responsibilities include:

1. Customer Service and Relationship Management

Establish and maintain strong relationships with clients, understanding their financial goals and objectives.

- Provide comprehensive financial advice, including savings and investment planning, mortgage and loan options, and other banking products and services.

- Effectively communicate complex financial products and concepts in a clear and concise manner.

- Build and develop long-term relationships with clients, fostering trust and loyalty.

2. Sales and Business Development

Identify and develop new business opportunities, generating revenue for the bank.

- Proactively reach out to potential clients, promoting the bank’s services and products.

- Meet or exceed sales targets by effectively closing deals and building a strong clientele.

- Identify and cross-sell complementary financial products and services to existing clients.

3. Financial Analysis and Risk Management

Conduct thorough financial analysis and assess client risk profiles to ensure responsible and ethical decision-making.

- Review financial statements and analyze creditworthiness to determine eligibility for loans and other financial products.

- Assess client risk tolerance and investment objectives, providing appropriate financial solutions.

- Comply with all relevant banking regulations and ethical standards.

4. Administrative and Operational Support

Provide general support and assistance to ensure smooth operations and customer satisfaction.

- Process financial transactions, such as opening accounts, issuing loans, and executing investments.

- Resolve customer inquiries and complaints promptly and efficiently.

- Maintain detailed and accurate records of customer interactions and financial transactions.

Interview Tips

Preparing for a Bank Advisor interview requires thorough research and a thoughtful approach. To ace your interview, consider the following tips:

1. Research the Bank and Industry

Familiarize yourself with the bank’s history, mission, and financial performance. Research the industry’s trends and regulations to demonstrate your knowledge and interest.

- Visit the bank’s website and read its annual reports.

- Follow industry news and analysis to stay informed about current events.

2. Understand the Job Role and Responsibilities

Thoroughly review the job description and key responsibilities to ensure you have a clear understanding of the role’s expectations. Consider how your skills and experience align with the requirements.

- Identify specific examples from your previous work that demonstrate your abilities in customer service, sales, and financial analysis.

- Prepare questions to ask the interviewer about the specific responsibilities and the bank’s goals.

3. Practice Your Communication Skills

As a Bank Advisor, effective communication is crucial. Practice articulating financial concepts clearly and engagingly, using both verbal and nonverbal cues.

- Prepare a brief presentation or role-play to demonstrate your ability to explain complex financial topics.

- Dress professionally and maintain a positive and approachable demeanor during the interview.

4. Be Prepared to Answer Common Interview Questions

Research common interview questions for Bank Advisor positions, such as:

- Tell me about your experience in financial advisory or sales.

- How do you build and maintain strong customer relationships?

- What is your approach to financial analysis and risk management?

- Why are you interested in this role at our bank?

- What are your strengths and weaknesses as a Bank Advisor?

5. Prepare Questions for the Interviewer

Asking thoughtful questions shows your interest and engagement in the role. Prepare questions that demonstrate your curiosity and desire to learn more about the bank and the position.

- What is the bank’s growth strategy, and how does this role contribute to it?

- What are the current challenges and opportunities facing the industry?

- What are the training and development opportunities available to Bank Advisors at your bank?

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Bank Advisor role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.