Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bank Consultant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

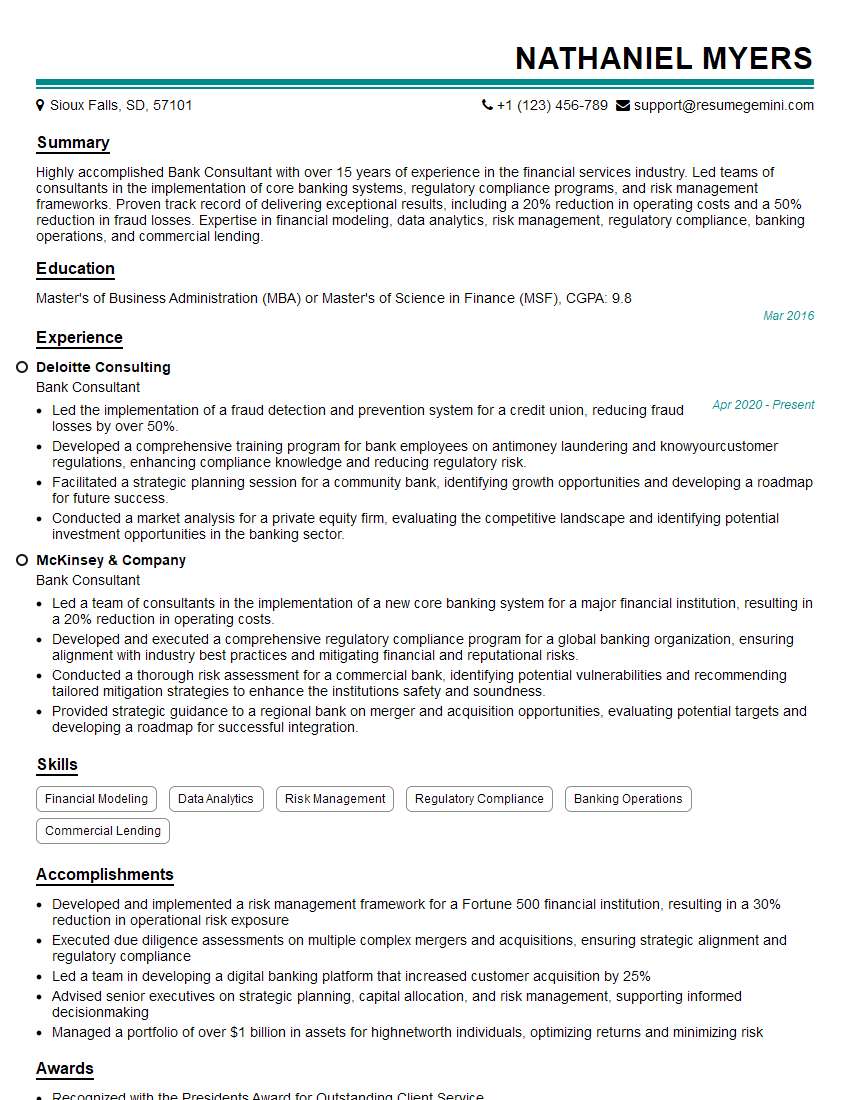

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank Consultant

1. What are the key challenges facing the banking industry today?

The banking industry is facing a number of key challenges today, including:

- Regulatory changes: The banking industry is heavily regulated, and changes to regulations can have a significant impact on banks’ operations. Banks must be able to adapt quickly and efficiently to new regulations.

- Competition from non-traditional players: Banks are facing increasing competition from non-traditional players, such as fintech companies. These companies are often able to offer lower costs and more innovative products than traditional banks.

- Changing customer expectations: Customers are increasingly expecting banks to provide a more personalized and convenient experience. Banks must be able to meet these expectations in order to retain customers.

2. What are the key trends that are shaping the future of the banking industry?

Technology

- The use of technology is transforming the banking industry. Banks are using technology to automate tasks, improve customer service, and develop new products and services.

- Banks are also using technology to partner with fintech companies and other non-traditional players.

Regulation

- Regulation is another key trend that is shaping the future of the banking industry. Banks are facing increasing regulation in areas such as data privacy, cybersecurity, and lending.

- Banks must be able to comply with these regulations in order to remain in business.

Customer expectations

- Customer expectations are also changing the banking industry. Customers are increasingly expecting banks to provide a more personalized and convenient experience.

- Banks must be able to meet these expectations in order to retain customers.

3. What are the key skills and qualities that a successful bank consultant needs?

A successful bank consultant needs a number of key skills and qualities, including:

- Strong technical skills: Bank consultants need to have a strong understanding of the banking industry, including regulations, accounting, and finance.

- Excellent communication skills: Bank consultants need to be able to communicate effectively with clients, colleagues, and other stakeholders.

- Problem-solving skills: Bank consultants need to be able to identify and solve problems quickly and efficiently.

- Teamwork skills: Bank consultants often work on teams, so they need to be able to work effectively with others.

- Business acumen: Bank consultants need to have a good understanding of the business world and be able to apply their knowledge to help clients achieve their goals.

4. What are the key challenges that bank consultants face?

Bank consultants face a number of key challenges, including:

- Keeping up with the latest trends: The banking industry is constantly changing, so bank consultants need to be able to keep up with the latest trends.

- Meeting client expectations: Bank consultants need to be able to meet the expectations of their clients, who are often demanding and have high expectations.

- Managing multiple projects: Bank consultants often work on multiple projects at the same time, so they need to be able to manage their time and resources effectively.

5. What is your favorite part of being a bank consultant?

My favorite part of being a bank consultant is the opportunity to work with a variety of clients on a variety of projects. I enjoy the challenge of helping clients solve their problems and achieve their goals.

6. What is your least favorite part of being a bank consultant?

My least favorite part of being a bank consultant is the long hours and travel required. I often work long hours, and I am often required to travel to client sites.

7. What are your career goals?

My career goals are to become a partner in a consulting firm and to eventually start my own consulting firm.

8. How do you stay up-to-date on the latest trends in the banking industry?

I stay up-to-date on the latest trends in the banking industry by reading industry publications, attending conferences, and networking with other professionals.

9. What is your favorite banking product or service?

My favorite banking product or service is mobile banking. I love the convenience of being able to bank anywhere, anytime.

10. What is your advice for someone who wants to become a bank consultant?

My advice for someone who wants to become a bank consultant is to get a strong education in banking and finance. I also recommend getting involved in extracurricular activities and networking with other professionals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Bank Consultant, your primary responsibilities will revolve around offering financial and strategic advice to banks and other financial institutions. This multifaceted role requires a deep understanding of banking operations, market trends, and regulatory frameworks.

1. Strategic Planning and Business Analysis

You will work closely with bank executives to develop and implement strategic plans aimed at enhancing growth, profitability, and operational efficiency. This involves analyzing the bank’s current performance, identifying areas for improvement, and formulating action plans to address challenges.

- Conducting thorough market research to stay abreast of industry trends and competitive landscapes

- Assessing bank operations, financial performance, and risk management practices

2. Risk Management and Compliance

You will play a crucial role in advising banks on developing and implementing effective risk management frameworks. This entails assessing the bank’s exposure to various risks, designing policies to mitigate these risks, and ensuring compliance with regulatory requirements.

- Evaluating risk profiles of banking products and services

- Designing and implementing policies and procedures to manage market, credit, and operational risks

3. Process Improvement and Optimization

You will collaborate with bank staff to identify opportunities for process improvement and optimization. This involves streamlining operations, implementing technology solutions, and enhancing customer service.

- Identifying bottlenecks and inefficiencies in banking processes

- Developing and implementing solutions to enhance operational efficiency and customer experience

4. Corporate Finance and Capital Advisory

You may also be involved in providing advice on corporate finance matters, such as mergers and acquisitions, capital raising, and financial restructuring. This requires a strong understanding of financial markets and structuring techniques.

- Evaluating financial options for banks, including debt and equity financing

- Providing guidance on mergers and acquisitions to achieve strategic goals

Interview Tips

Preparing for the interview is crucial to making a strong impression. Here are some tips to help you succeed:

1. Research the Bank and the Role

Familiarize yourself with the bank’s history, services, and key challenges. Understand the specific requirements of the Bank Consultant role and align your skills and experience with the job description.

2. Practice Your Answers to Common Interview Questions

Prepare for questions related to your experience in banking consulting, financial analysis, risk management, and process improvement. Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples of your accomplishments.

Example Outline:

- Situation: Describe a challenging situation you faced in a previous role.

- Task: Explain the task you were responsible for and the specific actions you took.

- Action: Highlight the specific actions you took to address the problem.

- Result: Quantify the positive results of your actions, if possible.

3. Be Prepared to Discuss Your Skills and Industry Knowledge

Emphasize your expertise in financial modeling, risk assessment, process optimization, and industry best practices. Be ready to discuss your understanding of regulatory frameworks and emerging trends in banking.

4. Show Enthusiasm and Passion

Convince the interviewer that you are genuinely interested in the banking industry and passionate about making a positive impact. Highlight your willingness to go the extra mile and your commitment to providing exceptional client service.

5. Prepare Questions for the Interviewer

Asking thoughtful questions demonstrates your interest in the role and the company. Prepare questions about the bank’s strategic plans, challenges, or specific projects that you could potentially contribute to.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Bank Consultant, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Bank Consultant positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.