Feeling lost in a sea of interview questions? Landed that dream interview for Bank President but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Bank President interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

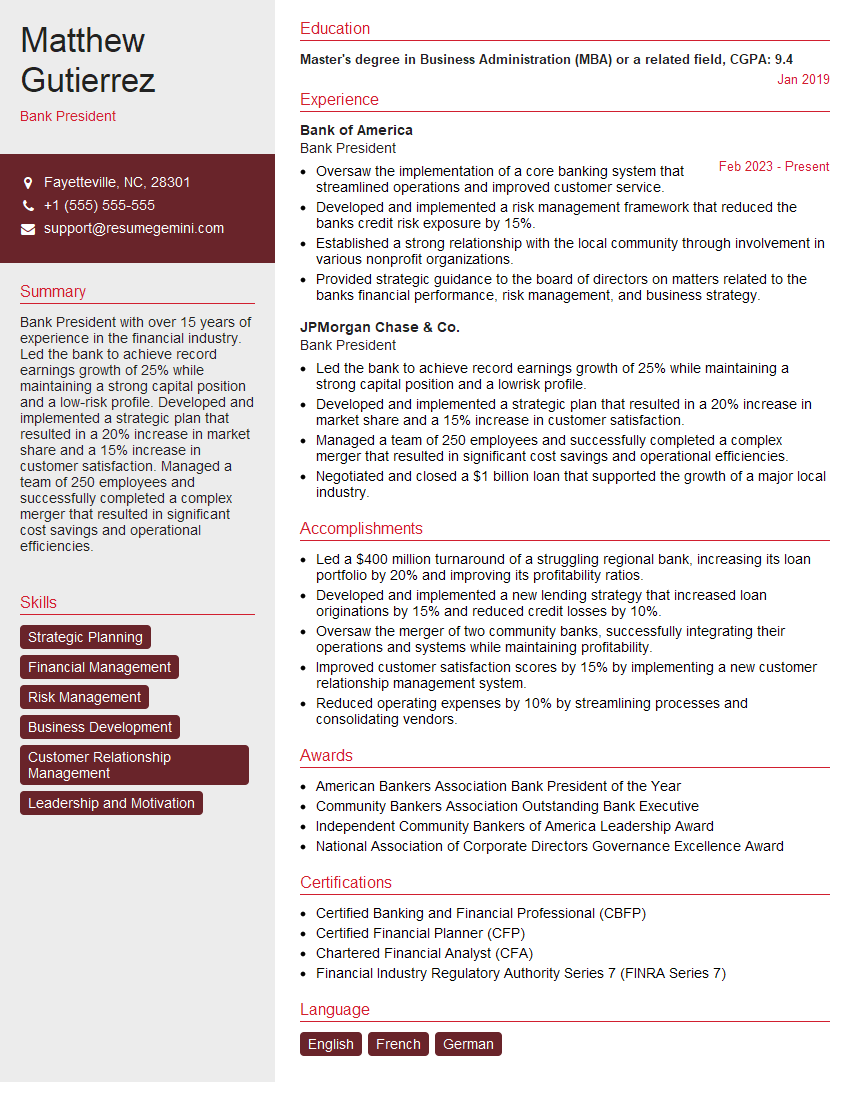

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank President

1. Describe the key factors you would consider when developing a strategic plan for the bank?

The key factors I would consider when developing a strategic plan for the bank include:

- The bank’s current financial position

- The economic outlook

- The competitive landscape

- The bank’s regulatory environment

- The bank’s customer base

- The bank’s risk appetite

- The bank’s technology infrastructure

I would also consider the bank’s long-term goals and objectives, and I would ensure that the strategic plan is aligned with these goals and objectives.

2. How would you approach improving the bank’s profitability?

Focus on core banking activities

- Increase lending activities to generate more interest income

- Improve deposit mix to reduce funding costs

Cost optimisation

- Review and streamline operational processes to enhance efficiency

- Negotiate with vendors and service providers to reduce expenses

Revenue diversification

- Explore new products and services to generate fee income

- Develop partnerships with other financial institutions to offer complementary services

3. What are your thoughts on the use of technology in banking?

Technology is rapidly changing the banking industry, and I believe that it is essential for banks to embrace technology in order to remain competitive. Technology can be used to improve customer service, reduce costs, and increase efficiency. I am particularly interested in the use of artificial intelligence (AI) and blockchain technology in banking. AI can be used to automate tasks, improve risk management, and provide personalized customer service. Blockchain technology can be used to create more secure and efficient payment systems. I believe that banks that are able to effectively use technology will be the most successful in the future.

4. How do you plan to manage risk in the bank’s lending portfolio?

I would manage risk in the bank’s lending portfolio by:

- Developing a comprehensive credit risk management framework

- Implementing a robust credit approval process

- Diversifying the loan portfolio

- Monitoring the loan portfolio closely and taking appropriate action when necessary

I would also work closely with the bank’s risk management department to ensure that the bank’s risk appetite is aligned with its strategic plan.

5. How would you approach developing a customer-centric culture in the bank?

I would approach developing a customer-centric culture in the bank by:

- Making customer satisfaction a top priority

- Empowering employees to make decisions that are in the best interests of customers

- Creating a culture of continuous improvement

- Investing in training and development programs for employees

- Measuring customer satisfaction regularly and using the feedback to improve the bank’s products and services

I believe that a customer-centric culture is essential for any bank that wants to be successful in the long term.

6. What is your experience with managing a team of employees?

I have over 10 years of experience managing teams of employees. I have successfully led teams of various sizes and in different industries. I am confident in my ability to motivate and inspire my team to achieve their goals.

My management style is collaborative and inclusive. I believe in empowering my team members to make decisions and take ownership of their work. I am also always willing to provide support and guidance when needed.

7. What are your strengths and weaknesses?

Strengths:

- Strategic thinking

- Financial acumen

- Risk management

- Team leadership

- Customer focus

Weaknesses:

- I am sometimes too detail-oriented

- I can be impatient at times

- I am always looking for ways to improve and sometimes this can lead to me taking on too much

8. Why are you interested in this position?

I am interested in this position because I believe that I have the skills and experience necessary to be successful in this role. I am also passionate about the banking industry and I am eager to contribute to the success of your bank.

9. What are your salary expectations?

My salary expectations are commensurate with my experience and qualifications. I am confident that I can add value to your bank and I am willing to negotiate a salary that is fair and competitive.

10. Do you have any questions for me?

I do have a few questions for you:

- What are your goals for the bank in the next five years?

- What are the biggest challenges facing the bank in the current environment?

- What is the bank’s culture like?

11. What is your five-year plan if you are selected for this position?

My five-year plan if I am selected for this position is:

- In the first year, I will focus on getting to know the bank and its operations. I will also work to develop a strategic plan for the bank.

- In the second year, I will begin to implement the strategic plan. I will also continue to focus on building relationships with the bank’s customers and employees.

- In the third year, I will continue to implement the strategic plan and focus on growing the bank’s business. I will also continue to develop the bank’s team of employees.

- In the fourth year, I will focus on continuing to grow the bank’s business and building on the success of the strategic plan.

- In the fifth year, I will focus on ensuring that the bank is well-positioned for the future. I will also work to develop new strategies to help the bank continue to grow and succeed.

12. How will you contribute to the growth and success of this bank if you are hired?

I am confident that I can contribute to the growth and success of this bank if I am hired. I have over 15 years of experience in the banking industry, and I have a proven track record of success. I am a strategic thinker and I am always looking for new ways to improve the bank’s performance. I am customer-focused, and I am always willing to go the extra mile to meet the needs of my customers. I am confident that I can use my skills and experience to help this bank achieve its goals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank President.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank President‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bank Presidents hold the ultimate responsibility of leading all aspects of a financial institution’s operations, ensuring the smooth functioning and strategic direction of the bank. They oversee daily activities, drive growth, and navigate complex regulatory and market landscapes, always keeping the best interests of their customers and stakeholders at heart.

1. Leadership and Strategic Planning

At the core of their role, Bank Presidents provide visionary leadership, setting the strategic direction of the bank and driving its long-term growth and profitability. They establish a clear vision, mission, and values that guide the entire organization.

- Develop and implement strategic plans that align with the bank’s overall objectives and industry trends.

- Lead the organization through periods of growth, expansion, and change, adapting to evolving market dynamics.

2. Financial Management and Risk Mitigation

Bank Presidents bear the responsibility of ensuring the financial health and stability of their institutions. They oversee the bank’s financial performance, manage risk, and maintain compliance with regulations.

- Monitor financial performance, including revenues, expenses, profits, and losses, and take corrective actions as needed.

- Develop and implement risk management strategies to mitigate potential risks and protect the bank’s assets and reputation.

3. Customer Experience and Relationship Management

Bank Presidents recognize the paramount importance of customer satisfaction and building strong relationships. They drive initiatives to enhance customer experience and foster loyalty, ensuring that the bank meets and exceeds the expectations of its clientele.

- Develop and implement customer-centric strategies that prioritize convenience, accessibility, and personalized services.

- Build and maintain relationships with key customers, understanding their needs and providing tailored solutions.

4. Team Management and Employee Development

Bank Presidents are responsible for creating a positive and empowering work environment that attracts, develops, and retains top talent. They lead and mentor their teams, fostering a culture of collaboration, innovation, and professional growth.

- Recruit, hire, and develop a highly skilled and motivated workforce that shares the bank’s values and goals.

- Provide ongoing training and development opportunities to enhance employee capabilities and drive career progression.

Interview Tips

Preparing for an interview for the position of Bank President requires thorough research, thoughtful preparation, and showcasing your expertise and leadership qualities. Here are some tips to help you ace the interview:

1. Research the Bank and Industry

Demonstrate your understanding of the bank’s history, business model, financial performance, and competitive landscape. Research the industry trends, regulatory environment, and key market players to display your industry knowledge and awareness.

- Visit the bank’s website, read their annual reports, and follow industry publications.

- Analyze the bank’s financial statements and compare them with industry benchmarks.

2. Highlight Your Leadership Experience

Emphasize your proven track record of leading teams, developing strategies, and driving growth in the financial sector. Quantify your accomplishments with specific examples and metrics to demonstrate your impact on the organization’s success.

- Describe your experience developing and implementing strategic plans that resulted in increased profitability or market share.

- Share examples of how you have successfully managed risk, mitigated challenges, and ensured regulatory compliance.

3. Demonstrate Your Financial Acumen

Showcase your in-depth understanding of financial principles, risk management, and banking regulations. Discuss your experience in managing financial performance, optimizing capital allocation, and maintaining a healthy balance sheet.

- Explain your approach to financial forecasting, budgeting, and investment decisions.

- Describe how you have managed loan portfolios, controlled expenses, and maximized shareholder value.

4. Articulate Your Vision for the Bank

Share your vision for the bank’s future growth and success. Explain how you plan to drive innovation, expand market share, and enhance customer experience. Discuss your strategies for navigating the changing regulatory landscape and leveraging emerging technologies.

- Outline your plans for developing new products and services that meet evolving customer needs.

- Discuss how you would utilize technology to improve operational efficiency and enhance customer engagement.

5. Prepare Thoughtful Questions

Asking intelligent questions demonstrates your engagement and interest in the bank and the position. Prepare thoughtful questions about the bank’s strategic direction, growth plans, and the role’s responsibilities. This will give you a better understanding of the organization and its expectations.

- Inquire about the bank’s plans for expansion or diversification.

- Ask about the bank’s approach to risk management and regulatory compliance.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Bank President interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!