Are you gearing up for an interview for a Banking Center Manager position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Banking Center Manager and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

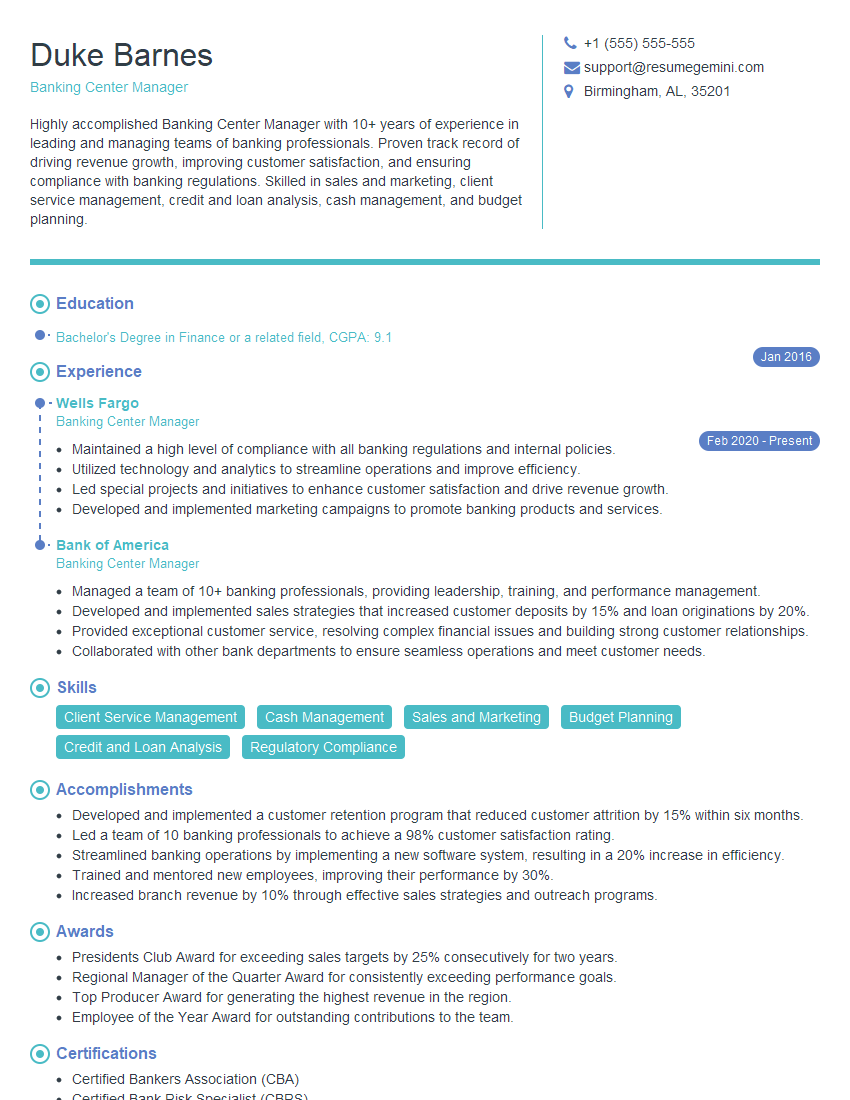

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Banking Center Manager

1. How do you ensure compliance with banking regulations and policies within your branch?

To ensure compliance, I implement the following measures:

- Conduct regular training sessions for staff on regulatory updates and industry best practices.

- Establish clear policies and procedures that align with regulatory requirements.

- Conduct internal audits and risk assessments to identify and address compliance gaps.

- Foster a culture of ethical conduct and accountability among employees.

- Work closely with legal counsel and compliance officers to stay informed on regulatory changes.

2. Describe your approach to managing risk in the context of banking operations.

Risk Identification and Assessment

- Identify potential risks through risk assessments and monitoring key performance indicators.

- Quantify risks using data analysis and industry benchmarks.

Risk Mitigation

- Develop and implement mitigation strategies to address identified risks.

- Monitor the effectiveness of mitigation measures and make adjustments as needed.

Risk Reporting and Communication

- Regularly report risk exposure to senior management and stakeholders.

- Communicate risk information to staff and customers to promote awareness.

3. How do you prioritize customer service within your branch and measure customer satisfaction?

To prioritize customer service and measure satisfaction, I employ the following strategies:

- Set clear customer service standards and expectations.

- Train staff on effective communication and conflict resolution techniques.

- Implement a customer feedback mechanism to gather insights and identify areas for improvement.

- Analyze feedback to identify trends and develop targeted improvement plans.

- Recognize and reward staff for providing exceptional customer service.

4. Describe your strategies for increasing revenue and profitability within your branch.

To increase revenue and profitability, I implement the following strategies:

- Analyze market trends and identify potential growth opportunities.

- Develop and implement marketing campaigns to promote products and services.

- Cross-sell and upsell products to existing customers.

- Optimize financial performance through expense control and efficiency measures.

- Monitor profitability metrics and make data-driven decisions to enhance performance.

5. How do you develop and manage your team to achieve branch goals?

To develop and manage my team effectively, I follow these principles:

- Establish clear goals and expectations for each team member.

- Provide ongoing coaching and mentorship to support professional growth.

- Recognize and reward individual and team accomplishments.

- Foster a positive and inclusive work environment.

- Empower staff to take ownership and contribute to decision-making.

6. What are your strategies for managing operational efficiency within your branch?

To enhance operational efficiency, I employ the following strategies:

- Streamline processes and identify opportunities for automation.

- Implement technology solutions to improve productivity and reduce manual tasks.

- Optimize staff scheduling and allocate resources effectively.

- Monitor key performance indicators and identify areas for improvement.

- Foster a culture of continuous improvement and encourage staff to suggest ideas.

7. How do you approach and resolve customer complaints or conflicts?

To resolve customer complaints and conflicts effectively, I follow these steps:

- Listen attentively to the customer’s concerns and show empathy.

- Investigate the issue thoroughly to understand the root cause.

- Present a fair and reasonable resolution that aligns with bank policies.

- Document the complaint and resolution to ensure transparency.

- Follow up with the customer to ensure satisfaction and prevent future issues.

8. What are your strategies for managing financial risks, such as credit risk and market risk?

To manage financial risks effectively, I implement the following strategies:

Credit Risk Management

- Analyze credit applications using robust criteria and industry benchmarks.

- Monitor customer creditworthiness and identify any potential risks.

- Establish appropriate loan loss provisions and manage loan portfolios prudently.

Market Risk Management

- Monitor market trends and identify potential exposures.

- Implement hedging strategies and diversification to mitigate risks.

- Stress test portfolios to assess resilience under adverse market conditions.

9. How do you stay up-to-date with the latest industry regulations and best practices?

To maintain my knowledge and industry expertise, I engage in the following activities:

- Attend industry conferences and workshops.

- Read industry publications and research materials.

- Participate in professional development programs.

- Network with industry professionals.

- Stay informed about regulatory changes through official sources and industry updates.

10. What are the key qualities and skills that have contributed to your success as a Banking Center Manager?

My success as a Banking Center Manager is attributed to the following qualities and skills:

- Strong leadership and management abilities.

- Deep understanding of banking operations and regulations.

- Excellent customer service and relationship-building skills.

- Proven ability to increase revenue and profitability.

- Commitment to ethical and compliant practices.

- Effective communication and interpersonal skills.

- Ability to work under pressure and manage multiple priorities.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Banking Center Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Banking Center Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Banking Center Manager is responsible for the overall operations of a bank branch. They are responsible for managing a team of employees, providing customer service, and ensuring that the branch meets its financial goals. The following are some of the key job responsibilities of a Banking Center Manager:

1. Manage a team of employees

The Banking Center Manager is responsible for hiring, training, and supervising a team of employees. They must ensure that their employees are properly trained and motivated to provide excellent customer service and meet the needs of the branch.

- Hire, train, and supervise a team of employees

- Create a positive and productive work environment

- Set performance goals and provide feedback to employees

2. Provide customer service

The Banking Center Manager is responsible for providing excellent customer service to both internal and external customers. They must be able to resolve customer issues quickly and efficiently, and they must be able to build strong relationships with customers.

- Greet and assist customers with their banking needs

- Open and close accounts, process transactions, and provide financial advice

- Resolve customer complaints and issues

3. Ensure that the branch meets its financial goals

The Banking Center Manager is responsible for ensuring that the branch meets its financial goals. They must be able to track the branch’s performance and make adjustments as needed to ensure that the branch is meeting its targets.

- Track the branch’s performance and make adjustments as needed

- Meet with customers to discuss their financial needs and goals

- Develop and implement marketing plans to attract new customers

4. Comply with all applicable laws and regulations

The Banking Center Manager is responsible for ensuring that the branch complies with all applicable laws and regulations. They must be familiar with all of the relevant laws and regulations, and they must be able to implement policies and procedures to ensure that the branch is in compliance.

- Stay up-to-date on all applicable laws and regulations

- Implement policies and procedures to ensure that the branch is in compliance

- Report any suspected violations to the appropriate authorities

Interview Tips

To prepare for an interview for a Banking Center Manager position, you should do the following:

1. Research the company and the position

It is important to do your research on the company and the position before you go to the interview. This will help you to understand the company’s culture and values, and it will help you to tailor your answers to the interviewer’s questions.

- Visit the company’s website

- Read articles about the company in the news

- Talk to people who work at the company

2. Practice answering common interview questions

There are a number of common interview questions that you are likely to be asked in an interview for a Banking Center Manager position. It is important to practice answering these questions so that you can give clear and concise answers.

- Tell me about your experience in banking.

- Why are you interested in this position?

- What are your strengths and weaknesses?

3. Prepare questions to ask the interviewer

Asking the interviewer questions at the end of the interview shows that you are interested in the position and that you have done your research. It also gives you an opportunity to learn more about the company and the position.

- What are the biggest challenges facing the company?

- What are the company’s plans for growth?

- What is the company’s culture like?

4. Dress professionally

It is important to dress professionally for your interview. This shows that you are taking the interview seriously and that you are making a good impression on the interviewer.

- Wear a suit or business casual attire

- Make sure your clothes are clean and pressed

- Accessorize with a tie or scarf

5. Be yourself

It is important to be yourself in your interview. This will help you to relax and give your best performance. Don’t try to be someone you’re not, because the interviewer will be able to tell.

- Be honest and genuine

- Show your personality

- Be confident in your abilities

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Banking Center Manager interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.