Feeling lost in a sea of interview questions? Landed that dream interview for Banking Officer but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Banking Officer interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

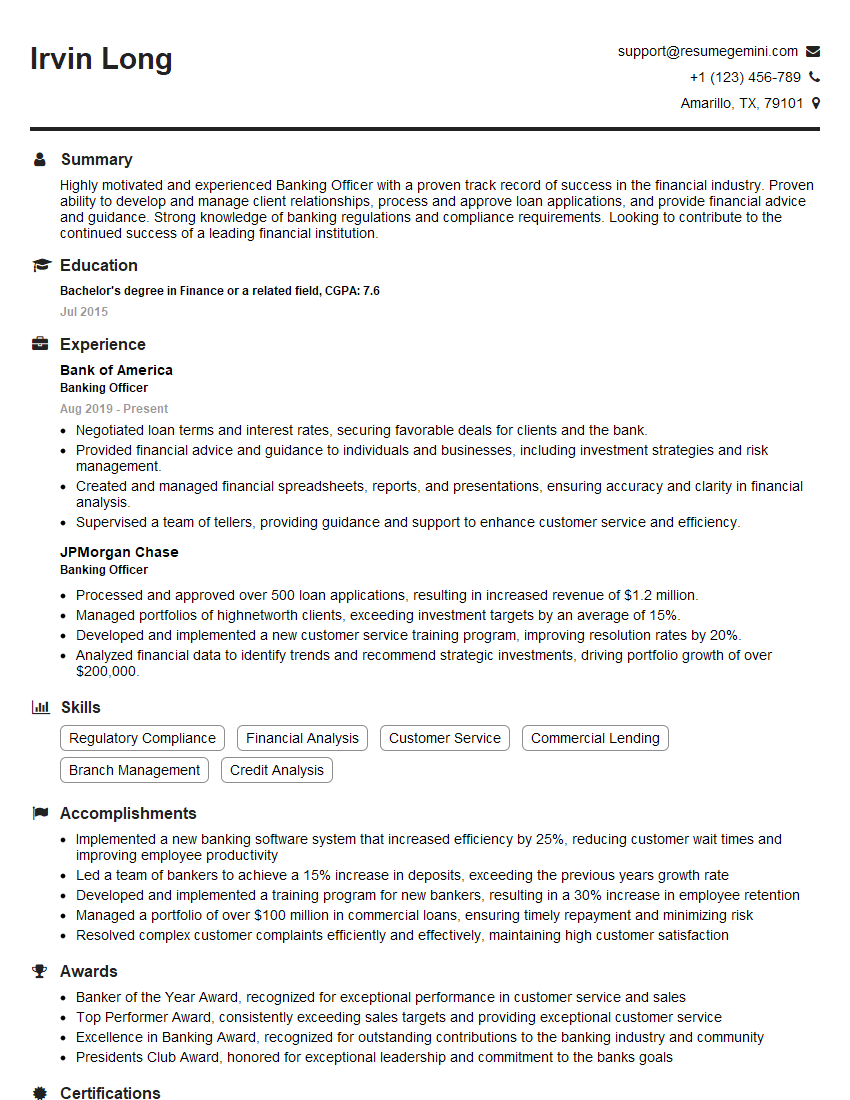

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Banking Officer

1. Explain the different types of bank accounts and their key features?

Answer

- Savings Accounts: Offer low interest rates, but withdrawals are limited. Ideal for emergency funds or short-term savings goals.

- Checking Accounts: Allow unlimited withdrawals and deposits, but typically offer no interest. Suitable for everyday transactions and bills.

- Money Market Accounts (MMAs): Hybrid accounts that combine the features of savings and checking accounts, offering higher interest rates than savings accounts and check-writing capabilities.

- Certificates of Deposit (CDs): Time deposits with fixed terms and interest rates, offering higher returns than savings accounts but with restrictions on withdrawals.

- Individual Retirement Accounts (IRAs): Tax-advantaged accounts designed for retirement savings, offering various investment options.

2. Describe the key principles of sound lending practices?

Answer

- Five Cs of Credit: Character, Capacity, Capital, Collateral, and Conditions.

- Risk Assessment: Thorough evaluation of borrower’s creditworthiness, debt-to-income ratio, and other financial factors.

- Loan Structuring: Tailoring loan terms to match borrower’s repayment ability and financial goals.

- Collateralization: Securing loans with collateral to mitigate risk in case of default.

- Loan Monitoring: Regular review of borrower’s financial performance and loan status to identify potential issues.

3. Explain the regulatory environment governing banking operations?

Answer

- Bank Secrecy Act (BSA): Anti-money laundering and terrorist financing regulations.

- Federal Deposit Insurance Corporation (FDIC): Insures customer deposits up to $250,000.

- Truth in Lending Act (TILA): Discloses loan terms and costs to borrowers.

- Dodd-Frank Wall Street Reform and Consumer Protection Act: Comprehensive banking reform legislation.

- Basel Accords: International standards for risk management and capital adequacy.

4. Describe the process of handling customer complaints and disputes?

Answer

- Active Listening and Understanding: Empathize with the customer’s perspective and understand the complaint’s root cause.

- Investigation and Resolution: Thoroughly investigate the issue and work with the customer to find a mutually acceptable solution.

- Documentation and Follow-Up: Document the complaint, resolution, and follow up with the customer to ensure satisfaction.

- Escalation: If the complaint cannot be resolved internally, it may need to be escalated to management or regulatory authorities.

- Continuous Improvement: Use customer complaints to identify areas for improvement in processes and procedures.

5. Explain the role of technology in modern banking?

Answer

- Digital Banking: Mobile banking, online banking, and digital wallets.

- Automated Teller Machines (ATMs): Self-service banking devices.

- Blockchain and Distributed Ledger Technology: Secure and transparent record-keeping.

- Artificial Intelligence (AI): Chatbots, fraud detection, and personalized financial advice.

- RegTech: Software solutions for regulatory compliance and risk management.

6. Describe the key elements of a bank’s balance sheet?

Answer

- Assets: Cash, loans, securities, and other investments.

- Liabilities: Deposits, borrowings, and other obligations.

- Shareholder Equity: The bank’s capital and retained earnings.

- Income Statement: Revenue, expenses, and net income.

- Statement of Cash Flows: Movement of money in and out of the bank.

7. Explain the role of a bank in the financial system?

Answer

- Financial Intermediation: Facilitating the flow of funds between savers and borrowers.

- Payment System: Processing and clearing financial transactions.

- Risk Management: Managing credit risk, market risk, and operational risk.

- Economic Stability: Providing stability to the financial system by absorbing shocks and maintaining confidence.

- Government Role: Acting as fiscal agents for governments, managing public debt, and implementing monetary policy.

8. Describe the key concepts of financial planning?

Answer

- Goal Setting: Identifying financial goals and prioritizing them.

- Budgeting and Cash Flow Management: Creating a spending plan and tracking income and expenses.

- Saving and Investing: Allocating funds to grow wealth and meet long-term goals.

- Risk Management: Protecting against financial losses through insurance, diversification, and contingency planning.

- Retirement Planning: Ensuring financial security during retirement.

9. Explain the difference between a debit card and a credit card?

Answer

- Debit Card: Linked directly to the user’s checking account, deducting funds immediately upon purchase.

- Credit Card: A loan product that allows users to borrow money and repay it over time with interest.

10. Describe the role of the Federal Reserve in the banking system?

Answer

- Monetary Policy: Setting interest rates and controlling the money supply.

- Bank Supervision: Regulating and overseeing the banking industry.

- Lender of Last Resort: Providing liquidity to banks during financial crises.

- Clearing and Settlement: Facilitating the transfer of funds between banks.

- Economic Data and Research: Collecting and disseminating economic data and conducting research.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Banking Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Banking Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Banking Officers play a crucial role in the financial industry, handling diverse responsibilities that contribute to the smooth functioning of banking operations:

1. Customer Service

Banking Officers serve as the primary point of contact for customers, providing a wide range of services including:

- Opening and managing accounts

- Processing transactions, such as deposits, withdrawals, and loan applications

- Providing financial advice and assistance

2. Sales and Marketing

In addition to customer service, Banking Officers often have sales and marketing responsibilities such as:

- Promoting banking products and services

- Cross-selling financial products to existing customers

- Identifying and attracting new customers

3. Operations

Banking Officers play a vital role in maintaining the day-to-day operations of a bank. Some of their operational responsibilities include:

- Processing checks and other financial documents

- Reconciling accounts and maintaining financial records

- Ensuring compliance with banking regulations and policies

4. Risk Management

Banking Officers also have responsibilities in risk management, including:

- Identifying and assessing financial risks

- Implementing controls to mitigate risks

- Monitoring financial performance and reporting on risk exposure

Interview Tips

To ace the interview for a Banking Officer position, follow these preparation tips:

1. Research the Bank

Familiarize yourself with the bank’s history, mission, and financial performance. This will demonstrate your interest in the organization and show that you’ve taken the time to learn about their business.

- Visit the bank’s website and social media pages.

- Read news articles and industry reports about the bank.

- Talk to people who work at the bank or who have experience with the organization.

2. Prepare for Common Interview Questions

Practice answering common interview questions, such as:

- Tell Me About Yourself

- Why Are You Interested in Banking?

- What Are Your Strengths and Weaknesses?

- Why Should We Hire You?

- What Is Your Experience with Customer Service?

3. Dress Professionally

First impressions matter, so dress professionally for your interview. This means wearing a suit or business casual attire. You should also make sure your clothes are clean, pressed, and fit well.

4. Be Confident and Enthusiastic

Project confidence and enthusiasm throughout your interview. This will show the interviewer that you are genuinely interested in the position and that you believe in your abilities.

5. Ask Questions

Asking thoughtful questions at the end of the interview shows that you are engaged and interested in the position. It also gives you the opportunity to learn more about the bank and the role.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Banking Officer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!