Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bookkeeper and Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

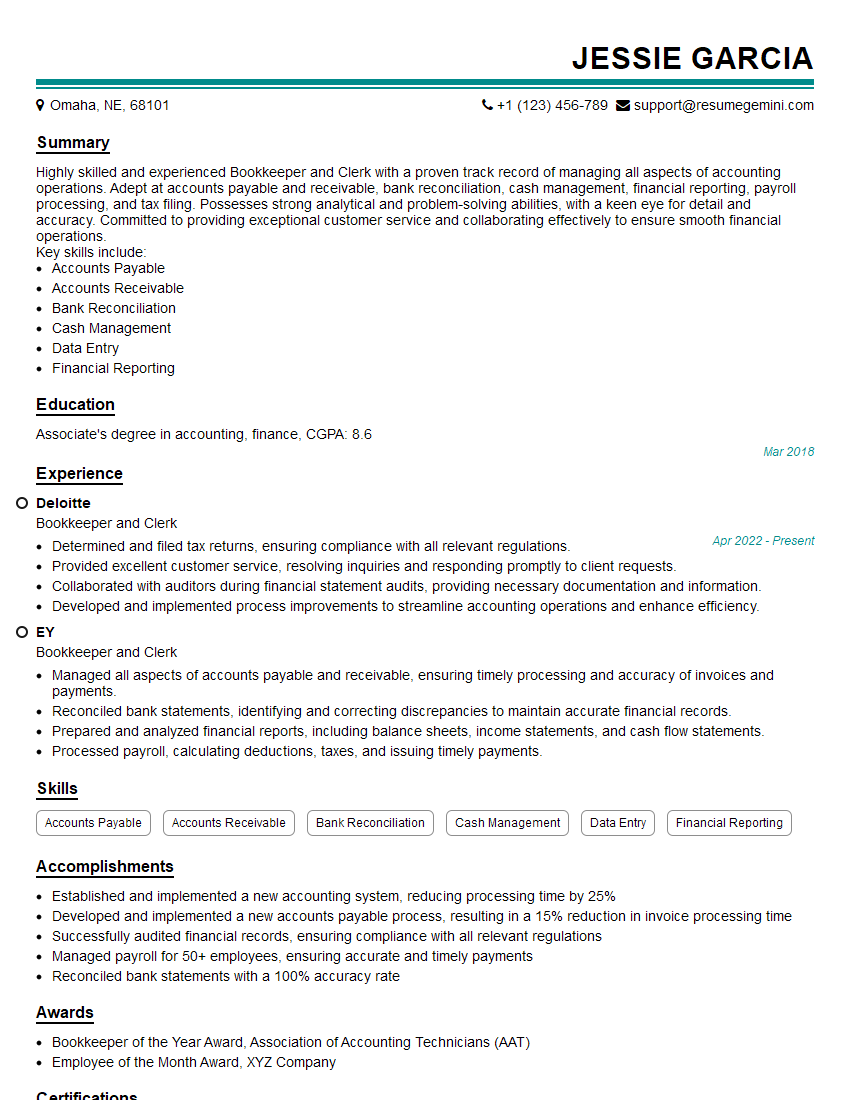

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bookkeeper and Clerk

1. How do you ensure the accuracy of financial records?

To ensure the accuracy of financial records, I follow these key steps:

- Regularly reconcile accounts: I reconcile bank statements, credit card statements, and other financial accounts to identify and correct any discrepancies.

- Double-check entries: I verify all data entries by manually checking or using automated tools to minimize errors.

- Review reports: I routinely review financial reports, such as balance sheets and income statements, to identify any unusual trends or inconsistencies.

- Implement internal controls: I establish clear processes and internal controls to prevent and detect errors, such as segregating duties and requiring multiple approvals for certain transactions.

- Seek feedback: I regularly communicate with other departments and stakeholders to ensure that the financial records align with their expectations.

2. Describe the accounting software you are familiar with.

Experience with Accounting Software

- QuickBooks: Proficient in all aspects, including accounts receivable, accounts payable, inventory management, and financial reporting.

- NetSuite: Familiar with its core accounting modules, including general ledger, accounts receivable, and accounts payable.

Knowledge of Accounting Principles

- GAAP and IFRS: Strong understanding of Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

- Financial Statement Analysis: Ability to analyze financial statements and identify key financial indicators.

3. How do you handle sensitive financial information?

I understand the importance of confidentiality and data security when dealing with sensitive financial information. Here are the measures I take:

- Secure Storage: I store all financial data in secure locations, both physically and electronically.

- Access Control: I restrict access to financial records only to authorized personnel and implement password protection and encryption measures.

- Regular Backups: I regularly create backups of financial data to protect against data loss in the event of a hardware failure or security breach.

- Compliance with Regulations: I adhere to all applicable data protection regulations and industry best practices.

- Ethical Conduct: I maintain the highest ethical standards and never disclose or misuse confidential financial information.

4. Explain the process of reconciling accounts payable.

The process of reconciling accounts payable involves matching the company’s records with those of its suppliers to identify and rectify any discrepancies:

- Gather Documents: Collect invoices, purchase orders, and supplier statements.

- Compare Records: Match the amounts recorded in the company’s accounts payable ledger with the corresponding supplier invoices.

- Identify Discrepancies: Investigate any differences between the two sets of records, such as missing invoices or incorrect quantities.

- Resolve Discrepancies: Communicate with suppliers to resolve any discrepancies and make necessary adjustments.

- Update Records: Update the accounts payable ledger and supplier records to reflect the reconciled amounts.

5. How do you prioritize your workload when faced with multiple tasks?

When faced with multiple tasks, I prioritize my workload based on the following criteria:

- Urgency: I identify the tasks that require immediate attention and prioritize them accordingly.

- Importance: I assess the significance of each task and its impact on the overall goals of the department.

- Dependencies: I consider the dependencies between tasks and ensure that I complete tasks in the correct order.

- Timeliness: I set realistic deadlines for each task and monitor my progress to ensure timely completion.

- делегирование: I delegate tasks to other team members when appropriate to optimize workflow and improve efficiency.

6. Describe your experience with payroll processing.

My experience with payroll processing includes the following responsibilities:

- Calculating Pay: I accurately calculate employee pay based on hours worked, overtime, and other factors.

- Deductions and Withholdings: I process payroll deductions for taxes, insurance, and other benefits.

- Payroll Tax Reporting: I prepare and file payroll tax returns, including federal, state, and local taxes.

- Issuing Paychecks: I issue paychecks or direct deposits to employees in a timely manner.

- Record Keeping: I maintain accurate payroll records for auditing and compliance purposes.

7. How do you stay up-to-date with changes in accounting regulations?

To stay up-to-date with changes in accounting regulations, I take the following steps:

- Attend Conferences and Webinars: I participate in industry conferences and webinars to learn about the latest accounting developments.

- Subscribe to Publications: I subscribe to professional accounting publications and newsletters to stay informed about regulatory updates.

- Utilize Online Resources: I regularly access online resources, such as the websites of the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB), to obtain the latest information.

- Network with Professionals: I connect with other accounting professionals and participate in online forums to stay abreast of industry best practices and regulatory changes.

8. What are the key differences between a balance sheet and an income statement?

The key differences between a balance sheet and an income statement are as follows:

Balance Sheet

- Purpose: Provides a snapshot of the company’s financial health at a specific point in time.

- Components: Consists of assets, liabilities, and equity.

- Equation: Assets = Liabilities + Equity.

- Focus: Shows the company’s financial position.

Income Statement

- Purpose: Summarizes the company’s revenues, expenses, and profits over a period of time.

- Components: Includes revenue, expenses, and net income or loss.

- Equation: Revenue – Expenses = Net Income.

- Focus: Shows the company’s financial performance.

9. Explain the concept of double-entry accounting.

Double-entry accounting is a system of recording financial transactions that ensures that every debit entry is matched with an equal credit entry. This allows for the preparation of accurate financial statements and ensures the integrity of the accounting records.

- Debits and Credits: Each transaction involves a debit to one account and a credit to another account.

- Balancing Equation: Total debits must always equal total credits.

- Transaction Analysis: Transactions are analyzed to determine their effects on the various accounts in the accounting system.

10. What are the different types of financial audits?

There are several different types of financial audits, each with its own purpose and scope:

- Financial Statement Audit: An independent examination of a company’s financial statements to express an opinion on their fairness and accuracy.

- Internal Audit: An evaluation of a company’s internal controls and processes to identify areas for improvement.

- Operation Audit: An assessment of a company’s operations to evaluate their efficiency and effectiveness.

- Compliance Audit: An examination to ensure that a company complies with specific laws and regulations.

- Forensic Audit: An investigation into financial fraud or other illegal activities.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bookkeeper and Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bookkeeper and Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

1. Accounting and Bookkeeping

Maintain accurate and up-to-date financial records, including journals, ledgers, and balance sheets.

Process and record financial transactions, such as payments, receipts, and invoices.

Prepare financial reports, including profit and loss statements and cash flow statements.

2. Clerk Duties

Provide administrative and clerical support to the office, such as answering phones, greeting visitors, and managing mail.

Maintain office supplies and equipment.

Assist with special projects and initiatives as needed.

3. Data Entry and Processing

Enter data accurately and efficiently into computer systems.

Process and verify data for accuracy.

Prepare and distribute reports based on data analysis.

4. Customer Service

Answer customer inquiries and resolve issues promptly.

Provide excellent customer service through phone, email, and in-person interactions.

Maintain a positive and professional demeanor.

Interview Tips

1. Research the Company and Position

Thoroughly research the company’s website, industry, and financial performance.

Review the job description carefully to identify the key skills and responsibilities.

Prepare questions that demonstrate your understanding of the company and position.

2. Highlight Your Skills and Experience

Emphasize your accounting and bookkeeping knowledge, as well as your proficiency in data entry and processing.

Provide specific examples of your accomplishments in a clear and concise manner.

Quantify your results whenever possible to demonstrate the impact of your work.

3. Practice Common Interview Questions

Prepare for questions such as “Tell me about yourself,” “Why are you interested in this position?” and “What are your strengths and weaknesses?”

Develop concise and compelling answers that highlight your qualifications and enthusiasm for the role.

Practice your answers out loud to enhance your confidence and delivery.

4. Ask Thoughtful Questions

Prepare a list of questions to ask the interviewer, such as about the company’s culture, growth prospects, and future plans.

This shows your interest in the role and the company.

Avoid asking questions that are easily answered on the company’s website or in the job description.

5. Professionalism and Appearance

Dress professionally and arrive on time for your interview.

Maintain a positive and enthusiastic demeanor throughout the interview.

Be respectful and attentive to the interviewer, even if you don’t get offered the position.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Bookkeeper and Clerk, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Bookkeeper and Clerk positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.