Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Budget Clerk interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Budget Clerk so you can tailor your answers to impress potential employers.

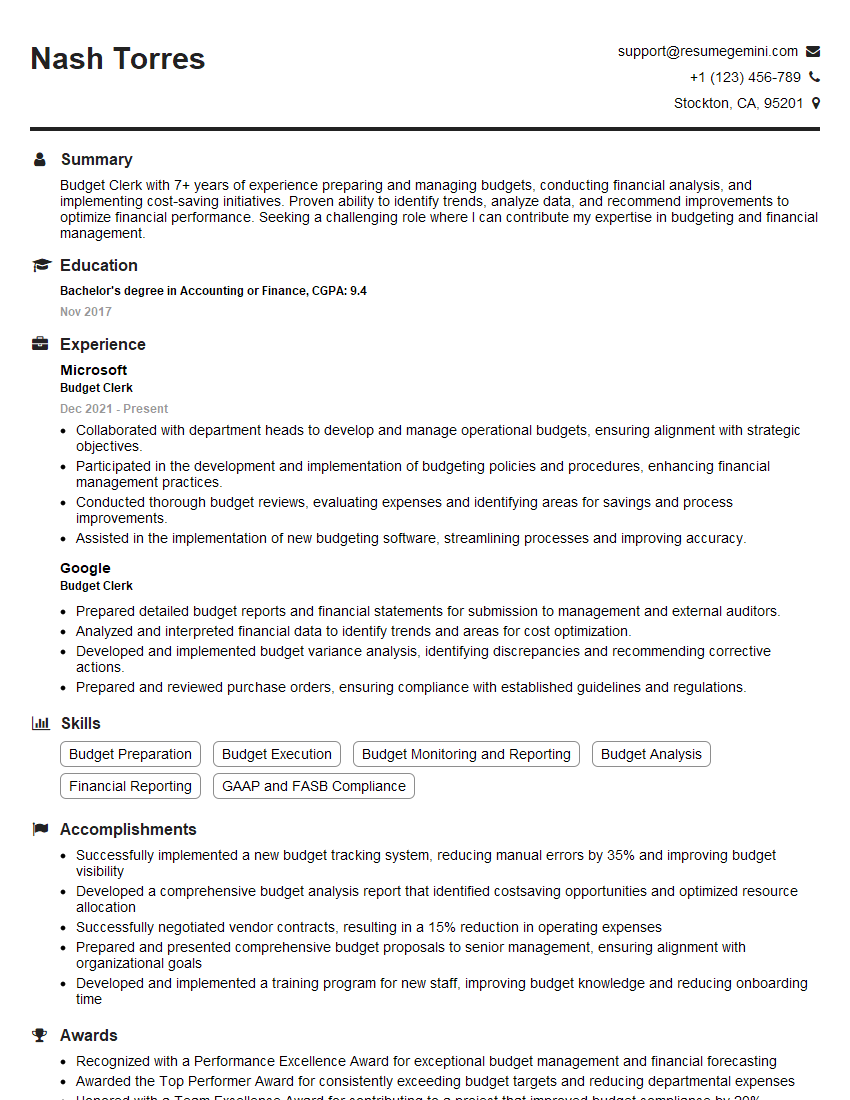

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Budget Clerk

1. What is the role of a Budget Clerk?

As a Budget Clerk, I would be responsible for a range of tasks that support the effective budgeting process within an organisation. These include:

- Preparing and maintaining financial plans and budgets in line with company goals

- Monitoring actual expenditure against budgeted amounts and identifying any variances

- Preparing reports and analysis to inform decision-making and ensure budget compliance

- Collaborating with other departments to ensure alignment with financial objectives

- Providing support and guidance on budgeting matters to colleagues

2. What is the difference between a budget and a forecast?

Budget

- A budget is a detailed financial plan for a specific period, typically one year.

- It outlines the expected income and expenses for that period.

- Budgets are used to allocate resources, set financial goals, and control spending.

Forecast

- A forecast is a prediction of future financial performance.

- It is based on historical data and assumptions about future economic conditions.

- Forecasts are used to make informed decisions about future investments and resource allocation.

3. What is variance analysis?

Variance analysis is the process of comparing actual financial results to budgeted amounts and identifying the reasons for any differences. It helps organisations to identify areas where they can improve their budgeting accuracy and control their spending. Variance analysis can be performed on both income and expense items

4. What are the key principles of sound budgeting?

- Transparency: Budgets should be clear and easy to understand.

- Accuracy: Budgets should be based on realistic assumptions and data.

- Flexibility: Budgets should be adaptable to changing circumstances.

- Alignment: Budgets should be aligned with the strategic goals of the organisation.

- Accountability: Budgets should establish clear lines of responsibility for financial performance.

5. What are some of the challenges that Budget Clerks face?

- Dealing with uncertainty: Budgets are often based on assumptions about future events, which can be difficult to predict.

- Managing conflicting priorities: Different departments may have different priorities, which can make it difficult to allocate resources fairly.

- Keeping up with changes: The economic landscape is constantly changing, which can require Budget Clerks to adapt their plans quickly.

- Communicating financial information: Budget Clerks need to be able to communicate complex financial information to non-financial audiences.

6. What are some of the software tools that Budget Clerks use?

- Excel: Excel is a powerful spreadsheet program that is widely used for budgeting.

- Budgeting software: There are a number of software programs that are specifically designed for budgeting, such as Adaptive Planning and Oracle Hyperion Planning.

- Accounting software: Accounting software can be used to track actual financial results and compare them to budgets.

7. What is your experience with budgeting?

In my previous role as a Budget Analyst at [Previous Company], I was responsible for developing and managing the company’s annual budget. I worked closely with senior management to identify financial goals and develop a budget that aligned with those goals. I also monitored actual expenditure against budgeted amounts and prepared variance analysis reports. This experience has given me a strong foundation in the principles and practices of budgeting.

8. What are your strengths and weaknesses as a Budget Clerk?

Strengths

- Strong analytical skills

- Excellent attention to detail

- Good communication and interpersonal skills

- Ability to work independently and as part of a team

Weaknesses

- Limited experience with budgeting software

- Still learning about the specific budgeting processes and procedures of this organisation

9. What are your salary expectations?

My salary expectations are in line with the market rate for Budget Clerks with my experience and qualifications. I am open to discussing a salary range that is commensurate with the responsibilities of this role and the value that I can bring to your organisation.

10. Why are you interested in this role?

I am interested in this role because it offers the opportunity to use my budgeting skills to make a meaningful contribution to your organisation. I am also attracted to the company’s commitment to financial discipline and its focus on achieving long-term success.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Budget Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Budget Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Budget Clerks are responsible for a wide range of tasks related to the preparation, execution, and monitoring of budgets within an organization. Their duties may vary depending on the size and complexity of the organization, but some of the core responsibilities typically include:

1. Budget Preparation

Budget Clerks assist in the development and preparation of operating and capital budgets. They gather data, conduct research, and analyze trends to forecast future financial needs. They also work with department heads and other stakeholders to develop budget proposals that align with the organization’s strategic goals.

- Developing and maintaining budget spreadsheets and databases

- Tracking and reconciling budget variances

2. Budget Execution

Budget Clerks monitor and control the execution of approved budgets. They track actual expenditures against budgeted amounts and identify any potential overruns or shortfalls. They also work with department heads to implement cost-saving measures and ensure that the organization’s financial resources are being used efficiently.

- Processing purchase orders and invoices

- Maintaining vendor relationships

3. Budget Reporting

Budget Clerks provide regular reports on budget performance to management. These reports may include comparisons of actual expenditures to budgeted amounts, analysis of trends, and projections of future financial needs. Budget Clerks also assist in the preparation of financial statements and other reports as required.

- Preparing budget presentations for management

- Responding to inquiries and requests for budget information

4. Compliance and Controls

Budget Clerks ensure that the organization is in compliance with all applicable laws and regulations. They also implement and maintain internal controls to prevent fraud and misuse of funds.

- Reviewing and approving expense reports

- Monitoring compliance with spending policies

Interview Tips

Preparing for a Budget Clerk interview can be daunting, but with the right approach, you can increase your chances of success. Here are a few tips to help you ace the interview:

1. Research the Organization

Before the interview, take some time to research the organization you are applying to. This will help you understand their mission, values, and financial situation. It will also show the interviewer that you are genuinely interested in the position and the organization.

- Visit the organization’s website

- Read the organization’s annual report

2. Practice Your Answers

Take some time to practice answering common interview questions. This will help you organize your thoughts and present yourself confidently during the interview.

- Why are you interested in this position?

- What are your strengths and weaknesses?

3. Highlight Your Skills

During the interview, be sure to highlight your skills and experience that are relevant to the position. For example, if you have experience in budget preparation, financial analysis, or accounting, be sure to mention that.

- Use specific examples to demonstrate your skills

- Quantify your accomplishments whenever possible

4. Ask Questions

At the end of the interview, be sure to ask the interviewer questions about the position and the organization. This shows that you are interested in the opportunity and that you are taking the interview seriously.

- What are the biggest challenges facing the organization?

- What is the company culture like?

Next Step:

Now that you’re armed with the knowledge of Budget Clerk interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Budget Clerk positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini