Are you gearing up for a career in Card Checker? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Card Checker and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

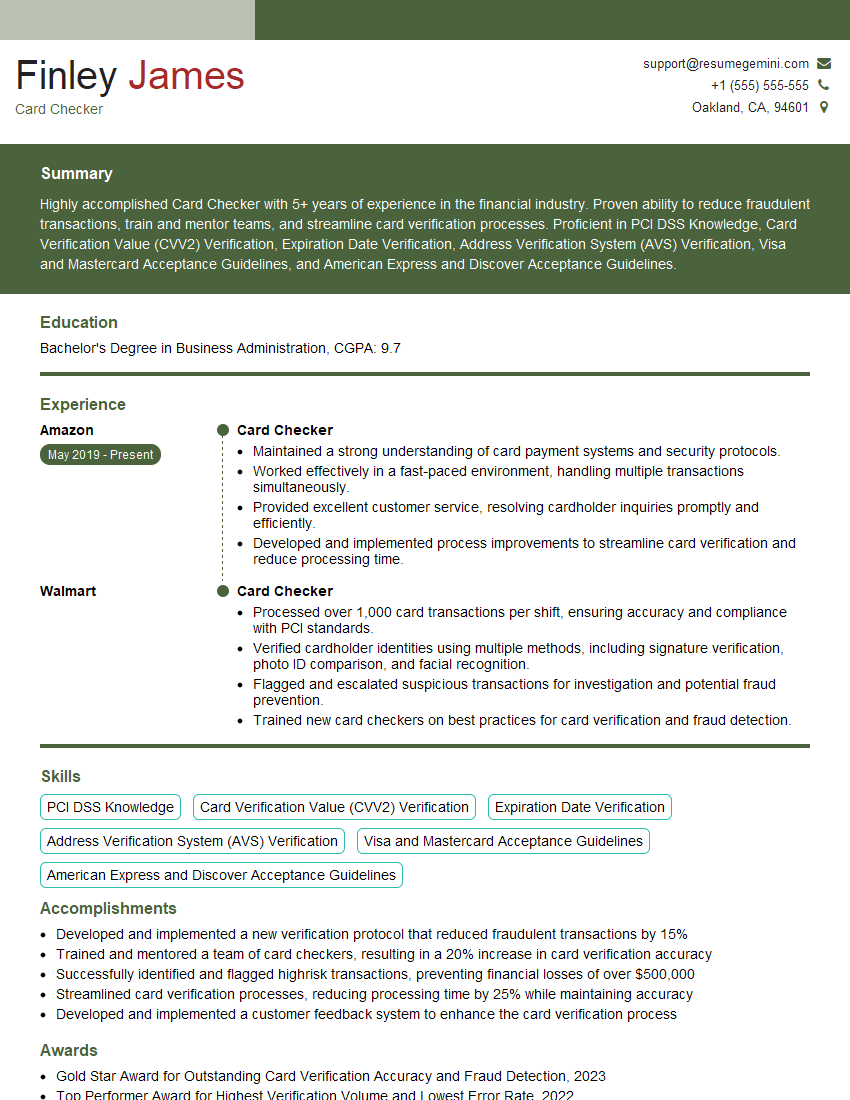

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Card Checker

1. What are the key elements of a credit card that you check for validity?

- Card number (16 digits for Visa and MasterCard, 15 digits for American Express)

- Cardholder name

- Expiration date

- CVV code (3 or 4 digits on the back of the card)

- Signature panel (for manual verification)

2. How do you handle a situation where a customer presents you with a card that has been altered or tampered with?

Reporting the incident

- Notify the merchant

- Contact the issuer and report the incident

Protecting the customer

- Do not accept the card

- Explain the situation to the customer and offer alternative payment options

3. What are the different types of fraud that you are trained to detect?

- Counterfeit cards

- Stolen cards

- Lost cards

- Phishing scams

- Card-not-present fraud

4. How do you update your knowledge and stay current with the latest fraud trends?

- Attending industry conferences and workshops

- Reading industry publications and blogs

- Participating in online forums and discussion groups

- Receiving training from the merchant and issuer

5. What are some of the common mistakes that you have seen customers make when using credit cards?

- Using debit cards as credit cards

- Not signing the back of the card

- Giving out their PIN number

- Carrying multiple cards in their wallet

- Not keeping their cards in a safe place

6. How do you handle a situation where a customer is unable to provide a photo ID?

- Ask for an alternative form of identification, such as a passport or driver’s license

- If the customer is unable to provide any form of identification, contact the issuer for guidance

- In some cases, the merchant may accept the card without a photo ID, but additional verification may be required

7. What are the most important qualities of a successful Card Checker?

- Attention to detail

- Strong communication skills

- Ability to work independently

- Knowledge of credit card fraud

- Strong customer service skills

8. What is your favorite part of being a Card Checker?

I enjoy the challenge of verifying credit cards and protecting customers from fraud. I also appreciate the opportunity to provide excellent customer service and make a difference in the safety of my community.

9. What is your biggest pet peeve when dealing with customers?

My biggest pet peeve is when customers are rude or impatient. I understand that people can be frustrated when their card is declined, but it is important to remember that I am only doing my job to protect them from fraud.

10. What is your career goal?

My career goal is to become a Fraud Analyst. I am passionate about fighting fraud and protecting consumers from financial loss. I believe that my skills and experience as a Card Checker would be a valuable asset to any fraud prevention team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Card Checker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Card Checker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Card Checkers verify the identification of guests, track patron information, and ensure gaming compliance. They work in casinos and other gaming establishments and are responsible for providing a safe and secure environment for guests.

1. Verifying Guests’ Identification

This is the most important responsibility of a Card Checker. They are responsible for checking the identification of all guests who enter the gaming area. This is done to ensure that guests are of legal age to gamble and that they are not on any self-exclusion lists.

- Check guests’ identification cards to verify their age and identity.

- Compare guests’ photos to their identification cards to ensure that they are the same person.

- Check guests’ names against self-exclusion lists to ensure that they are not banned from gambling.

2. Tracking Patron Information

Card Checkers also track patron information. This information is used to generate reports that are used to monitor gambling activity and identify potential problems.

- Track guests’ winnings and losses.

- Monitor guests’ time spent gambling.

- Identify guests who are at risk for problem gambling.

3. Ensuring Gaming Compliance

Card Checkers are responsible for ensuring that all gaming activities are conducted in accordance with the law. This includes checking that all games are fair and that all guests are treated fairly.

- Monitor gaming activities to ensure that they are conducted in a fair and legal manner.

- Report any suspicious activity to the Gaming Control Board.

4. Providing Customer Service

Card Checkers also provide customer service to guests. They answer questions, provide directions, and help guests resolve any issues they may have.

- Answer guests’ questions about gaming rules and procedures.

- Provide directions to guests.

- Help guests resolve any issues they may have.

Interview Tips

Preparing for a Card Checker interview can be daunting, but with the right preparation, you can increase your chances of success. Here are a few tips to help you ace your interview:

1. Research the Company and the Position

Before you go to your interview, take some time to research the company and the position you are applying for. This will help you understand the company’s culture, values, and goals. It will also help you answer questions about your qualifications and why you are interested in the position.

- Visit the company’s website to learn about their history, mission, and values.

- Read articles and reviews about the company to get an understanding of their reputation.

- Check out the company’s social media pages to see what they are posting about.

- Talk to people who work for the company to get their insights.

2. Practice Answering Common Interview Questions

There are some common interview questions that you can expect to be asked in a Card Checker interview. These questions may include:

- Tell me about your experience in the gaming industry.

- What are your strengths and weaknesses as a Card Checker?

- Why are you interested in working for this company?

- What are your salary expectations?

Take some time to practice answering these questions so that you can feel confident and prepared during your interview.

3. Dress Professionally and Arrive on Time

Your appearance and punctuality will make a big impression on the interviewer. Dress professionally and arrive on time for your interview. This shows that you are organized, respectful, and reliable.

4. Be Yourself and Be Enthusiastic

The most important thing is to be yourself and be enthusiastic about the position. The interviewer wants to see that you are a good fit for the company and that you are passionate about the job. Let your personality shine through and show the interviewer why you are the best person for the job.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Card Checker interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!