Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Cash Manager interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Cash Manager so you can tailor your answers to impress potential employers.

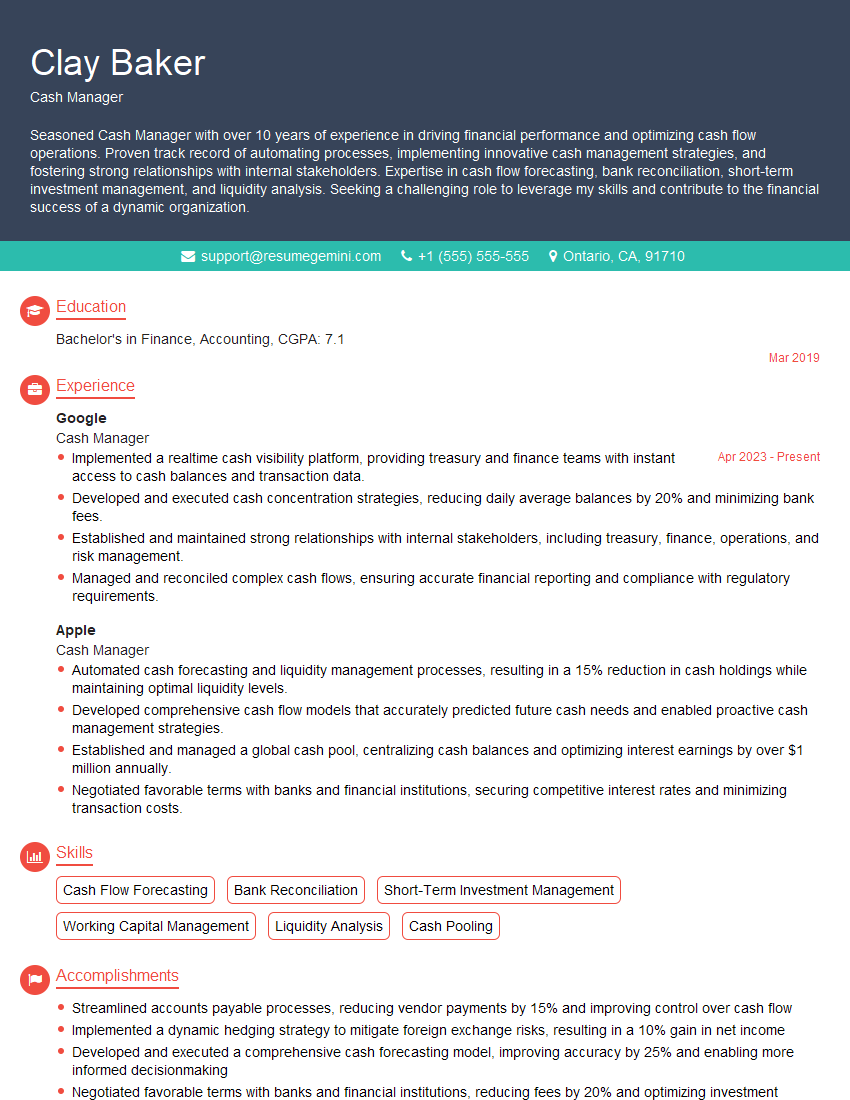

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Cash Manager

1. What are the key responsibilities of a Cash Manager?

As a Cash Manager, my responsibilities encompass a wide range of tasks that are critical to the efficient management of an organization’s cash flow. Some of my key responsibilities include:

- Forecasting cash flow and developing strategies to optimize liquidity

- Managing bank relationships, negotiating favorable terms, and minimizing borrowing costs

- Investing surplus cash to maximize returns while ensuring the safety of funds

- Implementing cash management systems and processes to streamline operations and enhance controls

- Monitoring cash flow trends, analyzing financial data, and reporting on cash management performance

2. How do you approach cash flow forecasting?

Cash flow forecasting is a crucial aspect of cash management that enables us to anticipate future cash needs and make informed decisions. My approach to cash flow forecasting involves:

a) Gathering data and assumptions:

- Collecting historical data on cash flows, revenue, expenses, and other relevant factors

- Making reasonable assumptions about future economic conditions, industry trends, and company growth

b) Using forecasting techniques:

- Employing various forecasting methods such as trend analysis, seasonal adjustment, and regression analysis

- Considering multiple scenarios to assess potential variations in cash flow

c) Sensitivity analysis and stress testing:

- Conducting sensitivity analysis to determine the impact of changes in key variables on cash flow

- Performing stress testing to assess the resilience of cash flow under adverse economic conditions

3. What is your experience in managing bank relationships?

Managing bank relationships is essential for securing favorable lending terms, minimizing fees, and optimizing cash flow. My experience in this area includes:

- Negotiating interest rates, loan covenants, and other terms with multiple banks

- Maintaining strong relationships with bankers and understanding their credit policies

- Exploring alternative financing options such as asset-based lending and factoring

- Monitoring bank performance and evaluating the quality of services provided

4. Describe your understanding of cash pooling and its benefits.

Cash pooling is a financial strategy that enables organizations with multiple subsidiaries or business units to centralize their cash balances. My understanding of cash pooling includes:

- The concept of sweeping funds from multiple accounts into a single master account

- The benefits of cash pooling, such as improved liquidity, reduced borrowing costs, and enhanced control

- The different types of cash pooling arrangements, including physical pooling and virtual pooling

- The challenges and risks associated with cash pooling, such as operational complexity and legal implications

5. How do you ensure compliance with regulatory requirements related to cash management?

Compliance with regulatory requirements is paramount in cash management. I take the following steps to ensure compliance:

- Staying up-to-date with relevant laws and regulations, including those related to anti-money laundering, know-your-customer, and financial reporting

- Implementing internal controls and audit procedures to prevent and detect fraud, errors, and other irregularities

- Collaborating with external auditors and legal counsel to ensure compliance with all applicable regulations

- Regularly reviewing and updating cash management policies and procedures to align with regulatory changes

6. What are the emerging trends in cash management that you are aware of?

The cash management landscape is constantly evolving. I keep myself updated with emerging trends, including:

- The rise of fintech solutions for cash management, such as automated clearinghouses and electronic payment systems

- The adoption of cloud-based cash management platforms for improved efficiency and real-time data access

- The increasing use of artificial intelligence and machine learning to enhance cash flow forecasting and fraud detection

- The growing emphasis on sustainable cash management practices, such as reducing paper usage and promoting electronic payments

7. How do you prioritize cash management initiatives and allocate resources effectively?

Prioritizing cash management initiatives and allocating resources effectively is crucial. I follow a structured approach that involves:

- Identifying and assessing the potential benefits and risks of various cash management initiatives

- Analyzing the financial implications and resource requirements of each initiative

- Prioritizing initiatives based on their alignment with strategic goals, potential impact, and feasibility

- Allocating resources strategically to maximize the return on investment and achieve desired outcomes

8. Describe a challenging situation you faced in cash management and how you resolved it.

During my tenure as a Cash Manager at ABC Company, we faced a significant challenge when the company experienced a sudden cash flow shortage. To resolve the situation, I took the following steps:

a) Assessing the situation:

- Analyzed cash flow projections and identified the reasons for the shortage

- Contacted customers to expedite collections and negotiate payment terms

b) Developing a plan:

- Explored short-term borrowing options and negotiated favorable interest rates

- Identified non-essential expenditures that could be temporarily reduced

c) Implementing the plan:

- Secured a short-term loan to bridge the cash flow gap

- Implemented cost-saving measures to reduce expenses

- Monitored cash flow closely and made adjustments as needed

d) Outcome:

- Successfully resolved the cash flow shortage without affecting the company’s operations

- Learned valuable lessons about cash flow management and contingency planning

9. How do you measure the success of your cash management efforts?

Measuring the success of cash management efforts is essential for continuous improvement. I use the following metrics:

- Cash flow adequacy: Ensuring that the organization has sufficient cash to meet its obligations

- Cash turnover ratio: Analyzing the efficiency of cash utilization

- Cost of borrowing: Monitoring interest expenses and negotiating favorable terms with banks

- Return on investment: Evaluating the returns generated from cash management strategies

- Customer satisfaction: Measuring the quality of service provided to customers in terms of timely payments and efficient cash management

10. What are your career goals and aspirations?

My career goal is to continue growing as a Cash Manager and make a significant contribution to the financial success of organizations. I am particularly interested in:

- Developing innovative cash management strategies that optimize liquidity and minimize risk

- Leading teams of cash management professionals and fostering a culture of excellence

- Collaborating with senior management to drive financial decision-making and support strategic initiatives

- Staying abreast of industry best practices and emerging technologies to enhance cash management capabilities

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Cash Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Cash Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Cash Managers are responsible for managing the day-to-day cash flow of a company, ensuring that it has enough cash on hand to meet its obligations and that any surplus cash is invested wisely.

1. Cash Forecasting

Cash Managers forecast the company’s cash flow using various techniques such as trend analysis, budget analysis, and scenario planning.

- Prepare cash flow statements and projections

- Identify and manage potential cash flow risks

2. Cash Management

Cash Managers manage the company’s cash on a daily basis, ensuring that it has enough cash on hand to meet its obligations.

- Manage bank relationships and negotiate favorable terms

- Monitor cash balances and invest surplus funds

3. Liquidity Management

Cash Managers manage the company’s liquidity, ensuring that it has enough cash on hand to meet its short-term obligations.

- Maintain optimal cash levels to meet current and future obligations

- Develop and implement strategies to improve liquidity

4. Risk Management

Cash Managers assess and manage the risks associated with cash management, such as the risk of a currency devaluation or the risk of a bank failure.

- Identify and assess potential cash flow risks and develop mitigation strategies

- Comply with relevant regulations and accounting standards

Interview Tips

To ace an interview for a Cash Manager position, candidates should prepare thoroughly and research the company in advance.

1. Research the Company

Candidates should research the company’s website, financial statements, and news articles to learn about its business model, financial position, and growth prospects.

- Review the company’s website to understand its products or services, target market, and financial performance.

- Read recent news articles and industry reports to gain insights into the company’s competitive landscape and industry trends.

2. Practice Common Interview Questions

Candidates should practice answering common interview questions, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”

- Prepare answers to questions about your experience in cash management, financial analysis, and risk management.

- Research the industry and be ready to discuss current trends and best practices in cash management.

3. Be Prepared to Talk About Your Experience

Candidates should be able to talk about their experience in cash management, financial analysis, and risk management.

- Highlight your accomplishments and quantify your results whenever possible.

- Use specific examples to demonstrate your skills and knowledge.

4. Be Confident and Enthusiastic

Candidates should be confident and enthusiastic about their skills and abilities.

- Make eye contact with the interviewer and speak clearly and confidently.

- Be prepared to ask questions about the company and the position.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Cash Manager role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.