Feeling lost in a sea of interview questions? Landed that dream interview for Charge Account Clerk but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Charge Account Clerk interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

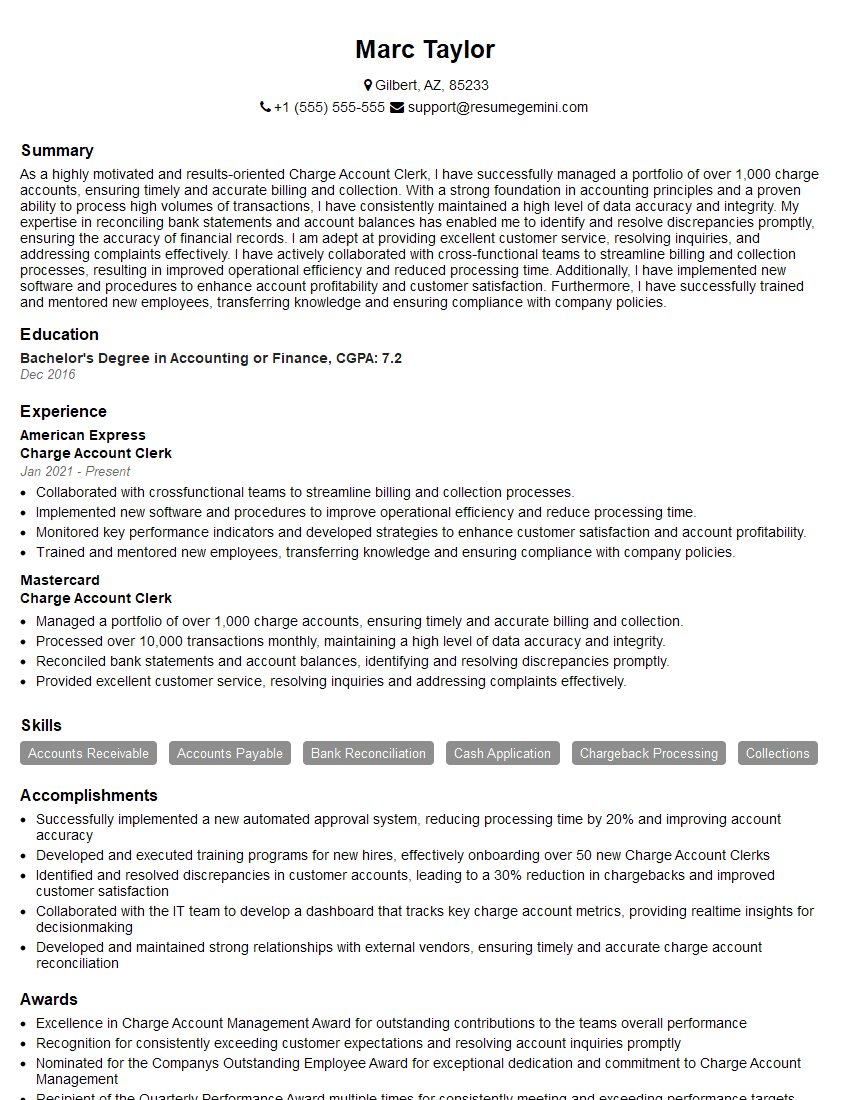

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Charge Account Clerk

1. Explain the key responsibilities of a Charge Account Clerk?

As a Charge Account Clerk, I would be responsible for processing charge account transactions, maintaining customer accounts, and providing excellent customer service. My key responsibilities would include:

- Processing charge account applications

- Maintaining customer accounts, including updating balances and applying payments

- Resolving customer inquiries and complaints

- Preparing and sending out invoices and statements

- Reconciling accounts and ensuring accuracy

2. Describe the process you would follow to open a new charge account for a customer?

Document Verification

- Verify the customer’s identity and address

- Obtain proof of income and employment

Credit Check

- Run a credit check to assess the customer’s creditworthiness

- Review the customer’s credit history and score

Account Creation

- Create a new charge account for the customer

- Set up the customer’s credit limit

- Issue a welcome letter and account information to the customer

3. How would you handle a situation where a customer disputes a charge on their account?

I would first listen to the customer’s concerns and try to understand their perspective. I would then investigate the dispute by reviewing the transaction details and any relevant documentation. If the dispute is valid, I would process a chargeback or credit to the customer’s account. If the dispute is not valid, I would explain the situation to the customer and provide them with documentation to support my findings.

4. Describe how you would ensure that customer information is kept confidential and secure?

I understand the importance of protecting customer information and would take the following steps to ensure confidentiality and security:

- Store customer information in a secure location

- Limit access to customer information to authorized personnel only

- Use strong passwords and encryption to protect customer data

- Follow all company policies and procedures regarding data security

5. What are some of the challenges you have faced in previous charge account clerk roles, and how did you overcome them?

One challenge I faced in a previous role was dealing with a high volume of customer inquiries. I overcame this by developing a system for prioritizing and responding to inquiries promptly. I also worked with my team to develop a knowledge base that could be used to answer common questions. This helped to reduce the time it took to resolve inquiries and improve customer satisfaction.

6. What are your strengths and weaknesses as a Charge Account Clerk?

My strengths include my attention to detail, accuracy, and ability to work independently. I am also a quick learner and I am always willing to take on new challenges. My weakness is that I can sometimes be too detail-oriented, which can slow me down when I am working on a project.

7. What are your career goals, and how does this position fit into them?

My career goal is to become a Credit Manager. This position would be a great opportunity for me to learn more about the credit industry and develop the skills necessary to succeed in this field.

8. What is your understanding of the role of a Charge Account Clerk in the context of the overall financial operations of a company?

The Charge Account Clerk plays a vital role in the financial operations of a company by ensuring that charge account transactions are processed accurately and efficiently. The accuracy of the Clerk’s work is critical to the company’s ability to track its financial performance and make sound business decisions.

9. What are some of the key challenges facing Charge Account Clerks in today’s business environment?

Some of the key challenges facing Charge Account Clerks in today’s business environment include:

- The increasing use of electronic payments

- The need to comply with complex regulations

- The growing threat of fraud

10. How do you stay up-to-date on the latest industry trends and best practices?

I stay up-to-date on the latest industry trends and best practices by reading industry publications, attending conferences and webinars, and networking with other professionals in the field.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Charge Account Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Charge Account Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Charge Account Clerk is responsible for various tasks related to the processing and maintenance of customer charge accounts. Here’s a breakdown of their key job responsibilities:

1. Charge Account Processing

Charge Account Clerks are primarily responsible for processing customer charge account transactions. They review and record charges made by customers, ensuring accuracy and completeness of the information entered.

2. Invoice Generation and Management

They generate and distribute invoices to customers based on processed charges. They also handle invoice inquiries and resolve any discrepancies or disputes.

3. Payment Processing and Reconciliation

Charge Account Clerks process customer payments, record them in the system, and reconcile payments against outstanding invoices. They work to ensure timely and accurate collection of payments.

4. Maintaining Customer Accounts

They maintain customer charge account records, including tracking balances, payment histories, and any special arrangements. They update account information and communicate changes to customers as needed.

5. Handling Disputes and Inquiries

Charge Account Clerks handle customer inquiries and disputes related to charge accounts. They investigate issues, provide explanations, and work to resolve any discrepancies promptly and efficiently.

Interview Tips

Preparing for an interview for a Charge Account Clerk position can increase your chances of success. Here are a few tips to help you ace the interview:

1. Research the Company and the Role

Familiarize yourself with the specific responsibilities of the Charge Account Clerk role within the company you’re applying to. Research their company history, culture, and any relevant industry trends.

2. Highlight Your Relevant Skills and Experience

Emphasize your experience in processing financial transactions, handling customer inquiries, and maintaining accurate records. Convey your proficiency in using relevant software or systems.

3. Prepare Examples of Your Work

If possible, prepare examples of your previous work that demonstrate your skills. This could include examples of charge account processing, invoice generation, or customer service interactions.

4. Practice Answering Common Interview Questions

Research common interview questions for Charge Account Clerks and practice answering them concisely and effectively. Highlight your strengths and how they align with the job requirements.

5. Be Professional and Enthusiastic

Dress professionally and arrive on time for the interview. Maintain a positive and enthusiastic attitude and show genuine interest in the role and the company.

6. Ask Informed Questions

Towards the end of the interview, ask thoughtful questions that demonstrate your interest in the position and the company. This shows that you’re engaged and eager to learn more.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Charge Account Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!