Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Chief Financial Officer (CFO) position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

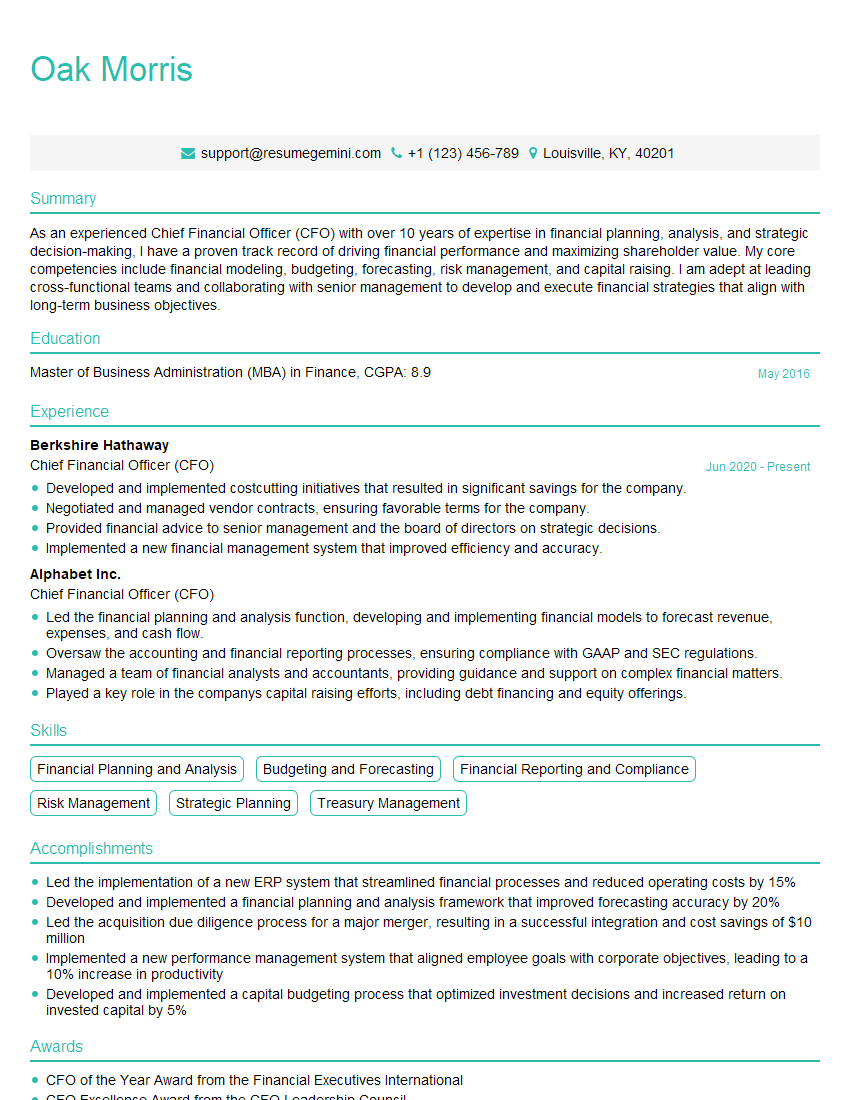

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Chief Financial Officer (CFO)

1. Describe your understanding of the role and responsibilities of a Chief Financial Officer (CFO)?

As a CFO, I am responsible for overseeing all aspects of an organization’s financial operations. My core responsibilities encompass: – Financial Planning & Analysis: I lead the development and execution of financial plans and budgets, ensuring alignment with the organization’s strategic goals. – Financial Reporting & Compliance: I ensure the accuracy and timely reporting of financial information in adherence to GAAP and regulatory standards. – Capital Management: I manage the organization’s capital structure and make strategic decisions to optimize financial resources. – Risk Management: I identify and assess financial risks, implement mitigation strategies, and monitor their effectiveness. – Investor Relations: I represent the organization to investors, analysts, and other stakeholders, providing financial insights and maintaining strong relationships.

2. Explain the key financial metrics that you monitor and how you use them to assess the financial health of a company?

Financial Performance Metrics

- Revenue and Profitability: I track revenue growth, gross margin, operating margin, and net income to evaluate the company’s overall financial performance.

- Liquidity and Solvency: I monitor current ratio, quick ratio, and debt-to-equity ratio to assess the company’s ability to meet short-term and long-term financial obligations.

Operational Efficiency Metrics

- Inventory Turnover: I analyze inventory turnover ratio to assess the efficiency of inventory management and identify potential areas for improvement.

- Days Sales Outstanding (DSO): I track DSO to evaluate the effectiveness of credit and collections processes.

3. How do you approach financial forecasting and what techniques do you use to develop accurate financial projections?

I approach financial forecasting with a structured and data-driven approach. I employ the following techniques: – Historical Data Analysis: I leverage historical financial data to identify trends and patterns that can inform future projections. – Scenario Planning: I develop multiple financial scenarios based on different assumptions to assess potential outcomes and risks. – Sensitivity Analysis: I perform sensitivity analysis to determine how changes in key variables impact financial projections. – Monte Carlo Simulation: I use Monte Carlo simulation to generate a range of possible outcomes and assess the probability of different scenarios.

4. Describe your experience in managing financial risk and how you have implemented strategies to mitigate potential risks?

- Identify and Assess Risks: I conduct thorough risk assessments to identify potential financial risks, including market risk, credit risk, and operational risk.

- Develop Mitigation Strategies: I develop and implement risk mitigation strategies such as hedging, insurance, and diversification to reduce the impact of potential risks.

- Monitor and Control Risks: I establish risk monitoring systems to track and control financial risks and ensure timely responses to emerging threats.

5. How do you stay up-to-date on the latest financial regulations and accounting standards and how do you ensure compliance within your organization?

To stay up-to-date on the latest financial regulations and accounting standards, I: – Attend industry conferences and webinars – Read professional publications and journals – Engage in continuous professional development courses – Seek advice from external auditors and legal counsel To ensure compliance within my organization, I: – Establish clear financial policies and procedures – Implement internal controls to prevent and detect financial irregularities – Conduct regular audits and reviews to monitor compliance

6. How do you approach the management of working capital and what strategies have you employed to optimize working capital efficiency?

I approach working capital management with a focus on optimizing cash flow and minimizing financial risk. I employ the following strategies: – Inventory Management: I analyze inventory levels and turnover to identify opportunities for reducing excess inventory and optimizing cash flow. – Accounts Receivable Management: I implement strategies to accelerate collections and reduce DSO, improving cash flow and reducing bad debt expenses. – Accounts Payable Management: I negotiate favorable payment terms with suppliers and explore early payment discounts to optimize cash flow.

7. Describe your experience in capital budgeting and how you evaluate the financial viability of capital projects?

I have extensive experience in capital budgeting and use a rigorous approach to evaluate the financial viability of capital projects. I employ the following steps: – Project Identification and Screening: I identify potential capital projects and screen them based on strategic alignment and financial potential. – Capital Budgeting Techniques: I use capital budgeting techniques such as Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period to assess the financial viability of each project. – Risk Analysis: I conduct sensitivity analysis and scenario planning to assess the potential risks associated with each project and develop mitigation strategies.

8. How do you approach the management of financial relationships with external stakeholders, such as banks, investors, and regulatory bodies?

I prioritize building and maintaining strong relationships with external stakeholders to ensure financial stability and support. I: – Manage relationships with banks and other lenders to secure favorable financing terms and maintain access to capital. – Communicate effectively with investors to provide financial updates, address concerns, and build trust. – Comply with regulatory requirements and maintain open communication with regulatory bodies to ensure compliance and avoid penalties.

9. How do you leverage technology to enhance financial operations and decision-making?

- Financial Management Software: I utilize financial management software to streamline accounting processes, automate reporting, and improve data accuracy.

- Data Analytics: I employ data analytics tools to analyze financial data, identify trends, and make data-driven decisions.

- Cloud Computing: I leverage cloud computing for secure data storage, remote access, and scalability.

10. Describe your leadership style and how you motivate and develop your team?

I adopt a collaborative and empowering leadership style. I: – Provide clear direction and set high expectations for my team. – Foster a culture of trust and open communication. – Recognize and reward individual and team accomplishments. – Offer ongoing training and development opportunities to enhance team skills and knowledge.

11. How do you stay informed about emerging financial trends and best practices and how do you incorporate them into your financial strategies?

- Industry Research: I conduct ongoing research to identify emerging trends and best practices in financial management.

- Professional Networking: I attend industry events and engage with other CFOs to exchange ideas and learn from their experiences.

- Continuing Education: I pursue professional development courses and certifications to stay abreast of the latest financial developments.

12. Describe a challenging financial situation you faced and how you successfully navigated it?

During the recent economic downturn, I led my team in developing and implementing a comprehensive financial recovery plan. We: – Reduced operating costs through strategic restructuring. – Negotiated favorable terms with creditors and investors. – Secured additional financing to maintain liquidity. – Implemented performance improvement initiatives to enhance revenue and profitability. Through these measures, we successfully navigated the financial challenges and positioned the company for long-term growth.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Chief Financial Officer (CFO).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Chief Financial Officer (CFO)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Chief Financial Officer (CFO) plays a pivotal role in the financial and strategic direction of an organization. Key job responsibilities include:

1. Financial Planning and Analysis

CFOs are responsible for developing and implementing financial plans and strategies that align with the organization’s overall goals. This involves:

- Creating and managing budgets

- Forecasting revenue and expenses

- Performing financial analysis and reporting

2. Financial Management

CFOs oversee all aspects of financial management, including:

- Managing cash flow

- Securing financing

- Investing surplus funds

3. Accounting and Reporting

CFOs are responsible for ensuring the accuracy and reliability of the organization’s financial statements. This involves:

- Preparing financial statements

- Compiling and analyzing financial data

- Filing regulatory reports

4. Risk Management

CFOs play a key role in identifying and managing financial risks. This involves:

- Developing and implementing risk management policies

- Conducting risk assessments

- Monitoring and reporting on financial risks

Interview Tips

Preparing thoroughly for a CFO interview is crucial. Here are some tips to help you ace the interview:

1. Research the Organization

Before the interview, conduct thorough research on the organization, its industry, and its financial situation. This will help you understand the organization’s strategic goals and financial challenges.

2. Practice Answering Common Interview Questions

Practice answering common interview questions related to financial planning, analysis, management, accounting, and risk management. Use the STAR method (Situation, Task, Action, Result) to provide clear and concise answers.

3. Highlight Your Relevant Experience

Emphasize your relevant experience in financial planning, analysis, management, accounting, and risk management. Quantify your accomplishments and provide specific examples of your contributions to the organization.

4. Be Prepared to Discuss the Industry

Be prepared to discuss the financial outlook for the industry in which the organization operates. Demonstrate your understanding of the key trends and challenges in the industry.

5. Ask Thoughtful Questions

Asking thoughtful questions at the end of the interview shows your interest in the position and the organization. Prepare questions about the organization’s financial goals, risk appetite, and growth strategies.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Chief Financial Officer (CFO) interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!