Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Chief Operating Officer (COO) position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

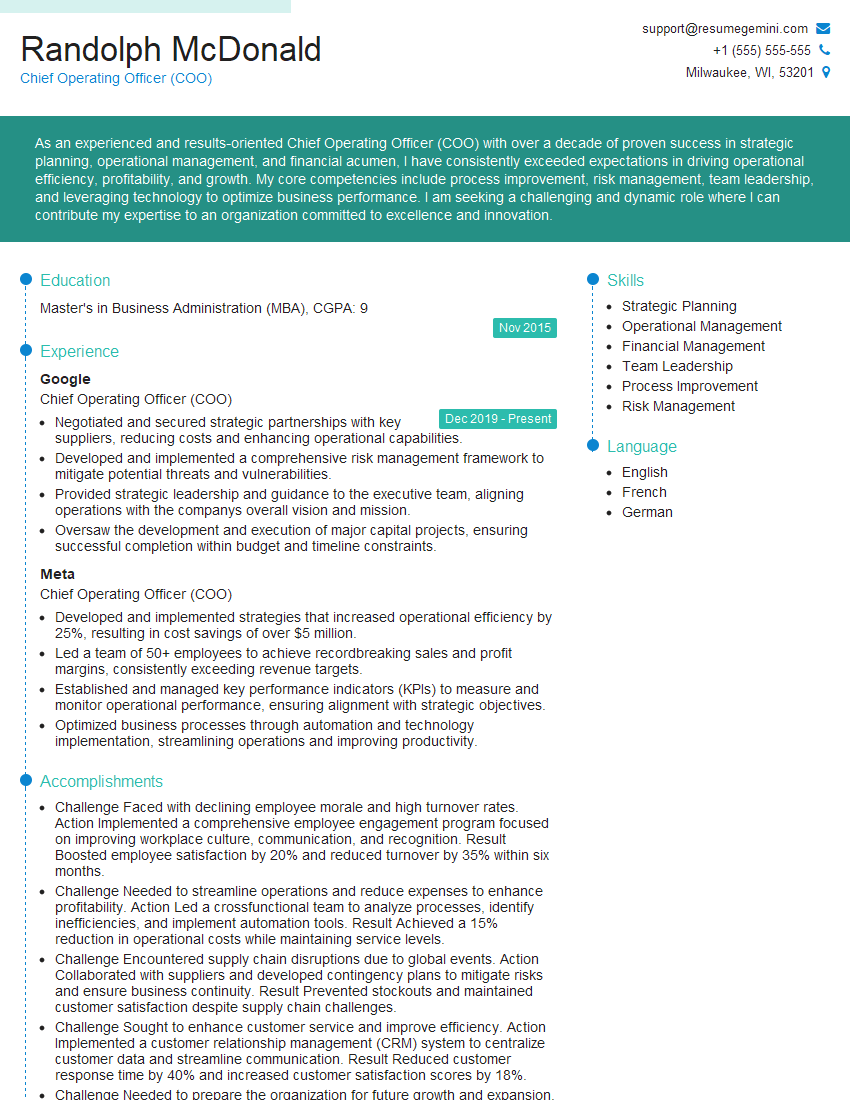

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Chief Operating Officer (COO)

1. How do you prioritize and manage multiple projects simultaneously while ensuring that each project meets its objectives and deadlines?

- Explain a structured approach to project prioritization, using criteria such as business impact, urgency, and dependencies.

- Describe how you allocate resources and set project timelines to optimize team performance.

- Discuss techniques for tracking project progress, identifying potential risks, and taking corrective actions.

2. What strategies would you implement to improve operational efficiency and reduce costs within the organization?

Cost Reduction

- Analyze current processes to identify areas of waste and inefficiency.

- Implement technology solutions to automate tasks and streamline operations.

- Negotiate favorable terms with vendors and suppliers.

Operational Efficiency

- Introduce process improvements to enhance workflow and reduce bottlenecks.

- Empower employees with training and support to optimize their productivity.

- Monitor key performance indicators and make data-driven decisions.

3. Can you describe your experience in developing and implementing strategic plans that align with the organization’s long-term goals?

- Explain your approach to conducting market research and staying up-to-date on industry trends.

- Discuss the methodologies you use to set strategic objectives, develop action plans, and monitor progress.

- Share examples of successful strategic initiatives you have led that contributed to organizational growth and success.

4. How do you manage relationships with key stakeholders, including senior management, employees, and external partners?

- Highlight your communication skills and ability to build strong relationships.

- Describe your approach to managing stakeholder expectations, addressing concerns, and fostering collaboration.

- Share examples of how you have successfully resolved conflicts and negotiated favorable outcomes.

5. What would be your approach to developing and maintaining a high-performing and motivated team?

- Discuss your leadership style and how it promotes employee engagement and productivity.

- Explain how you set clear expectations, provide constructive feedback, and recognize employee achievements.

- Share examples of initiatives you have implemented to foster a positive and supportive work environment.

6. How would you assess the organization’s current financial health and recommend strategies for improving profitability?

- Demonstrate your understanding of financial analysis techniques and key financial metrics.

- Discuss your ability to identify areas of financial risk and opportunity.

- Share examples of how you have successfully implemented financial improvement strategies in previous roles.

7. How do you stay up-to-date with industry best practices and technological advancements?

- Explain your approach to continuous learning and professional development.

- Discuss your involvement in industry organizations and conferences.

- Share examples of how you have applied innovative ideas and technologies to improve operational performance.

8. What is your experience in managing risk and ensuring regulatory compliance within a complex organization?

- Demonstrate your understanding of risk management frameworks and regulatory requirements.

- Discuss your approach to conducting risk assessments and developing mitigation plans.

- Share examples of successful risk management initiatives you have implemented.

9. How would you approach a situation where you disagree with the CEO’s decision?

- Explain your approach to respectful and professional conflict resolution.

- Discuss the importance of providing data and evidence to support your opinions.

- Share examples of how you have successfully navigated disagreements with senior management.

10. Can you describe your experience in managing crisis situations and ensuring business continuity?

- Discuss your understanding of crisis management protocols and emergency response plans.

- Explain how you would lead a team through a crisis and minimize its impact on the organization.

- Share examples of how you have successfully managed crisis situations in the past.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Chief Operating Officer (COO).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Chief Operating Officer (COO)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Chief Operating Officer (COO) is a senior executive who is responsible for the day-to-day operations of a company. The COO reports directly to the CEO and is responsible for a wide range of functions, including:

1. Financial Management

COOs are responsible for the financial management of their companies. This includes developing and implementing budgets, overseeing financial transactions, and preparing financial reports.

- Develop and implement financial plans and budgets.

- Oversee financial transactions and accounting practices.

- Prepare and present financial reports to the CEO and other stakeholders.

2. Operational Management

COOs are also responsible for the operational management of their companies. This includes developing and implementing policies and procedures, managing staff, and overseeing day-to-day operations.

- Develop and implement company policies and procedures.

- Manage staff, including hiring, training, and performance evaluation.

- Oversee day-to-day operations, including production, distribution, and customer service.

3. Strategic Planning

In addition to financial and operational management, COOs also play a role in strategic planning. This includes developing and implementing long-term goals and objectives for the company.

- Develop and implement long-term strategic plans.

- Identify and assess opportunities for growth and expansion.

- Manage relationships with key stakeholders, including shareholders, customers, and suppliers.

4. Risk Management

COOs are also responsible for risk management. This includes identifying and assessing risks to the company and developing and implementing plans to mitigate those risks.

- Identify and assess risks to the company.

- Develop and implement risk management plans.

- Monitor and evaluate risk management activities.

Interview Tips

Preparing for an interview for a COO position can be daunting, but these tips will help you put your best foot forward. Let’s explore some interview tips and tricks for acing the interview:

1. Research the Company

Before you go to your interview, take some time to research the company. This will help you understand the company’s culture, values, and strategic goals. You should also be familiar with the company’s products or services and its financial performance.

- Visit the company’s website.

- Read articles about the company in the news.

- Talk to people who work or have worked for the company.

2. Practice Your Answers

Once you’ve done your research, it’s time to practice your answers to common interview questions. This will help you feel more confident and prepared during the interview.

- Think about your strengths and weaknesses.

- Prepare answers to questions about your experience and qualifications.

- Practice answering questions about your leadership style and your vision for the company.

3. Dress Professionally

First impressions matter, so make sure you dress professionally for your interview. This means wearing a suit or business dress, and making sure your clothes are clean and pressed.

- Wear a suit or business dress.

- Make sure your clothes are clean and pressed.

- Polish your shoes.

4. Be on Time

Punctuality is important for any interview, but it’s even more important for a COO interview. Make sure you arrive at the interview on time, or even a few minutes early.

- Plan your route ahead of time.

- Leave early to give yourself plenty of time.

- If you’re running late, call the interviewer to let them know.

5. Be Yourself

It’s important to be yourself during the interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Be honest and genuine, and let your personality shine through.

- Be yourself.

- Be honest and genuine.

- Let your personality shine through.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Chief Operating Officer (COO) interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.