Feeling lost in a sea of interview questions? Landed that dream interview for Claims Clerk but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Claims Clerk interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

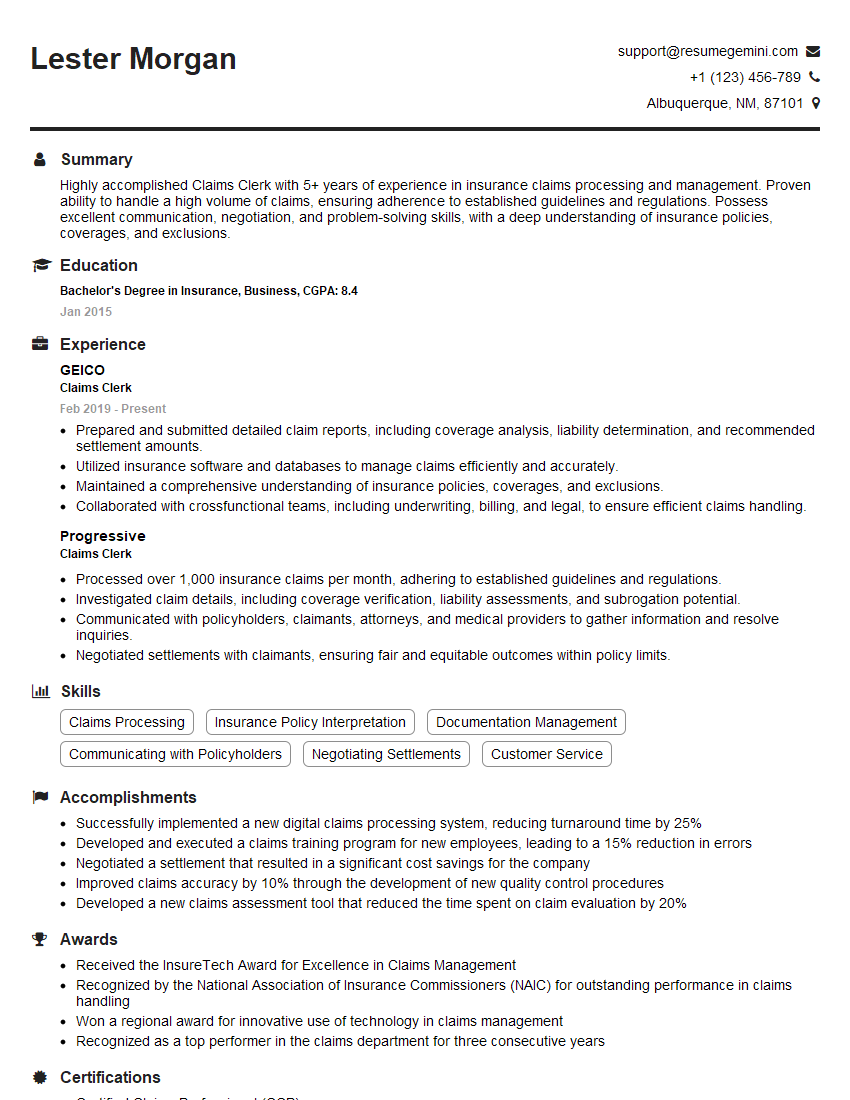

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Claims Clerk

1. Explain the key responsibilities of a Claims Clerk?

- Processing and evaluating insurance claims

- Investigating claims to determine coverage and liability

- Communicating with policyholders and claimants to gather information

- Calculating and issuing claim payments

- Maintaining records and documentation related to claims

2. Describe the types of insurance claims you have handled in the past?

- Auto insurance claims

- Homeowners insurance claims

- Health insurance claims

- Commercial insurance claims

- Life insurance claims

3. How do you determine the coverage and liability of a claim?

By reviewing the policy, investigating the facts of the claim, and applying the law

4. What are the most common reasons for claim denials?

- The claim is not covered by the policy

- The claim is fraudulent

- The policyholder has not paid their premiums

- The claimant has not provided enough information

- The claim is not timely filed

5. What are the key qualities of a successful Claims Clerk?

- Strong attention to detail

- Excellent communication skills

- Problem-solving skills

- Knowledge of insurance policies and procedures

- Ability to work independently and as part of a team

6. What is your experience with using insurance software?

- I have experience using a variety of insurance software, including claims processing systems, policy management systems, and underwriting systems

- I am proficient in using these systems to process claims, manage policies, and underwrite risks

7. How do you stay up-to-date on changes in the insurance industry?

- I read industry publications and attend conferences

- I take continuing education courses

- I network with other professionals in the insurance industry

8. What is your favorite part of working as a Claims Clerk?

- I enjoy helping people through difficult times

- I like the challenge of solving complex problems

- I appreciate the opportunity to make a difference in people’s lives

9. What are your career goals?

- I would like to continue to develop my skills and knowledge in the insurance industry

- I would like to eventually move into a management position

- I would like to make a positive contribution to the insurance industry

10. Do you have any questions for me?

This is an opportunity for you to ask the interviewer questions about the position, the company, or the industry

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Claims Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Claims Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Claims Clerks are responsible for handling incoming claims, such as medical bills, insurance forms, and other documents. They must be able to process claims accurately and efficiently, as well as communicate effectively with both customers and insurance companies.

1. Data Entry

Claims Clerks will need to be able to enter data accurately and quickly. They may need to use a variety of software programs, including claims processing systems and spreadsheets.

- Verify the accuracy of data entered into the computer systems

- Scan and upload relevant documents to the claims system

2. Customer Service

Claims Clerks will need to be able to communicate effectively with customers. They may need to answer questions about claims, explain the claims process, and resolve disputes.

- Answer phone calls and emails from customers

- Provide customers with information about their claims

- Resolve customer complaints

3. Problem Solving

Claims Clerks will need to be able to solve problems independently. They may encounter errors in claims, or they may need to find ways to resolve disputes with customers or insurance companies.

- Identify and resolve errors in claims

- Research policies and procedures to find solutions to problems

- Negotiate with customers and insurance companies to resolve disputes

4. Documentation

Claims Clerks will need to be able to document their work accurately and clearly. They may need to prepare reports, summaries, and other documents.

- Document all interactions with customers and insurance companies

- Prepare reports on claims activity

- Summarize findings and recommendations

Interview Tips

Here are some tips for acing your interview for a Claims Clerk position:

1. Research the company and the position

Before your interview, take some time to research the company and the position you are applying for. This will help you understand the company culture and the specific requirements of the job. You can usually find this information on the company website.

2. Practice answering common interview questions

There are a number of common interview questions that you are likely to be asked. It is a good idea to practice answering these questions in advance so that you can feel confident and prepared during your interview. Some common interview questions include:

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- How do you handle stress?

- What are your salary expectations?

3. Be professional and enthusiastic

First impressions matter, so it is important to be professional and enthusiastic during your interview. Dress appropriately, arrive on time, and be polite to everyone you meet. Show the interviewer that you are interested in the position and that you are eager to learn more about the company.

4. Follow up after the interview

After your interview, take some time to follow up with the interviewer. This could involve sending a thank-you note or email, or calling to check on the status of your application. This shows that you are interested in the position and that you are willing to go the extra mile.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Claims Clerk interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.