Are you gearing up for a career in Collateral and Safekeeping Clerk? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Collateral and Safekeeping Clerk and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

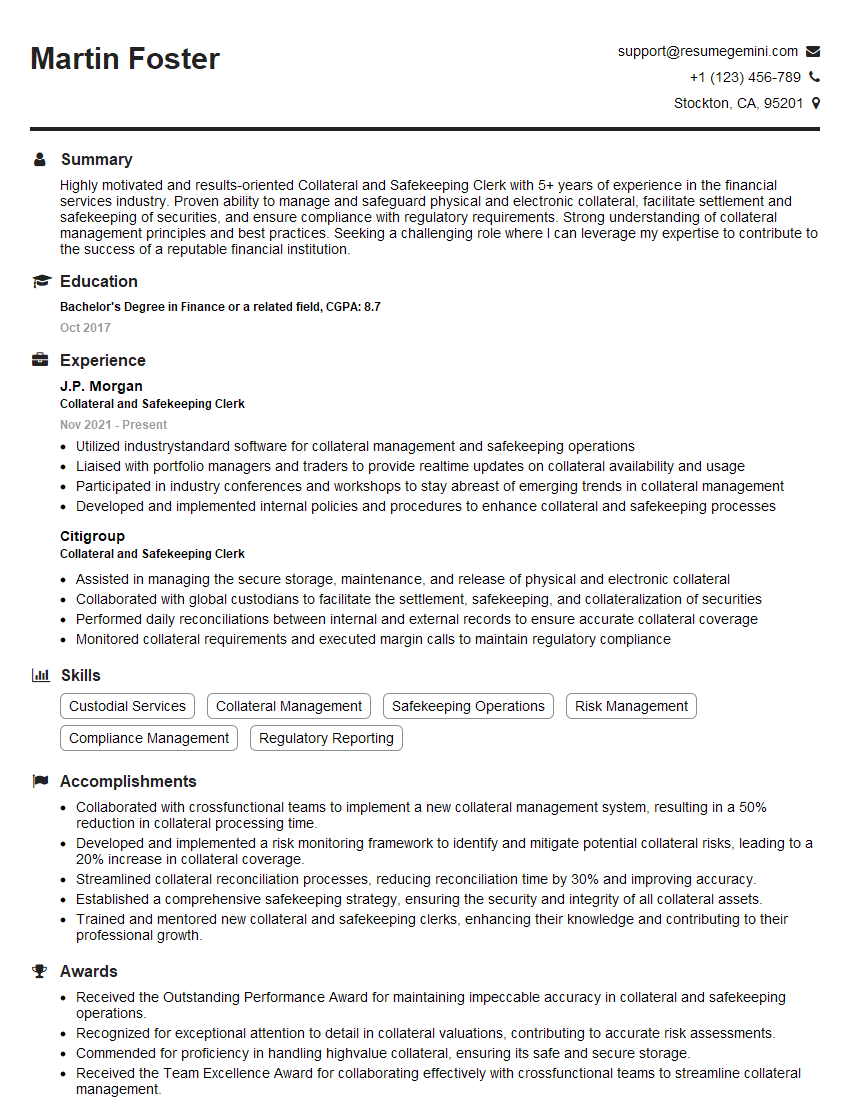

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Collateral and Safekeeping Clerk

1. Explain the process of collateral management in detail.

- The process of collateral management involves the following steps:

- Pledge: The borrower pledges collateral to the lender as security for a loan.

- Valuation: The collateral is valued to determine its worth.

- Monitoring: The lender monitors the collateral’s value and the borrower’s financial condition.

- Enforcement: If the borrower defaults on the loan, the lender can enforce the collateral to recover the outstanding debt.

- Collateral management is a critical risk management tool for lenders. It helps to ensure that the lender is adequately protected in the event of a borrower default.

2. What are the different types of collateral?

- There are many different types of collateral, including:

- Real estate: Land, buildings, and other real property can be used as collateral.

- Securities: Stocks, bonds, and other securities can be used as collateral.

- Cash: Cash can be used as collateral.

- Accounts receivable: Accounts receivable can be used as collateral.

- Inventory: Inventory can be used as collateral.

- The type of collateral that is used will depend on the specific loan agreement and the creditworthiness of the borrower.

3. What are the risks associated with collateral management?

- There are a number of risks associated with collateral management, including:

- Collateral value decline: The value of the collateral can decline over time, which can reduce the lender’s protection in the event of a borrower default.

- Borrower fraud: The borrower may fraudulently misrepresent the value or ownership of the collateral.

- Legal challenges: The borrower may challenge the lender’s right to enforce the collateral.

- Collateral management is a complex process that requires careful attention to detail. Lenders must be aware of the risks involved and take steps to mitigate these risks.

4. What are the best practices for collateral management?

- There are a number of best practices for collateral management, including:

- Proper documentation: All collateral transactions should be properly documented.

- Regular monitoring: The lender should regularly monitor the collateral’s value and the borrower’s financial condition.

- Strict enforcement: The lender should strictly enforce the collateral agreement in the event of a borrower default.

- By following these best practices, lenders can help to reduce the risks associated with collateral management.

5. What are the emerging trends in collateral management?

- There are a number of emerging trends in collateral management, including:

- Increased use of technology: Lenders are increasingly using technology to automate the collateral management process.

- Greater focus on risk management: Lenders are placing a greater focus on risk management in order to reduce the risks associated with collateral management.

- Increased use of alternative collateral: Lenders are increasingly using alternative collateral, such as intellectual property and social media data, to secure loans.

- These trends are likely to continue to shape the future of collateral management.

6. What are the challenges involved in safekeeping collateral?

- There are a number of challenges involved in safekeeping collateral, including:

- Physical security: The collateral must be stored in a secure location to prevent theft or damage.

- Insurance: The collateral must be insured against loss or damage.

- Monitoring: The collateral must be regularly monitored to ensure that it is still in good condition.

- Collateral safekeeping is a complex process that requires careful attention to detail. Safekeepers must be aware of the challenges involved and take steps to mitigate these challenges.

7. What are the best practices for safekeeping collateral?

- There are a number of best practices for safekeeping collateral, including:

- Proper storage: The collateral should be stored in a secure location that is protected from theft, fire, and other hazards.

- Regular inspection: The collateral should be regularly inspected to ensure that it is still in good condition.

- Insurance: The collateral should be insured against loss or damage.

- By following these best practices, safekeepers can help to reduce the risks associated with collateral safekeeping.

8. What are the emerging trends in safekeeping collateral?

- There are a number of emerging trends in safekeeping collateral, including:

- Increased use of technology: Safekeepers are increasingly using technology to automate the collateral safekeeping process.

- Greater focus on risk management: Safekeepers are placing a greater focus on risk management in order to reduce the risks associated with collateral safekeeping.

- Increased use of alternative safekeeping methods: Safekeepers are increasingly using alternative safekeeping methods, such as digital asset custody and blockchain technology, to store collateral.

- These trends are likely to continue to shape the future of collateral safekeeping.

9. What are the key differences between collateral management and safekeeping collateral?

- Collateral management and safekeeping collateral are two distinct processes with different objectives.

- Collateral management is the process of managing the collateral that secures a loan. This includes valuing the collateral, monitoring the collateral’s value, and enforcing the collateral agreement in the event of a borrower default.

- Safekeeping collateral is the process of storing and protecting the collateral that secures a loan. This includes storing the collateral in a secure location, insuring the collateral against loss or damage, and monitoring the collateral’s condition.

10. What are the career opportunities for Collateral and Safekeeping Clerks?

- There are a number of career opportunities for Collateral and Safekeeping Clerks, including:

- Collateral Analyst: Collateral Analysts are responsible for valuing collateral and monitoring its value.

- Safekeeping Officer: Safekeeping Officers are responsible for storing and protecting collateral.

- Collateral Manager: Collateral Managers are responsible for overseeing the entire collateral management process.

- With experience and training, Collateral and Safekeeping Clerks can advance to senior positions in the financial services industry.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Collateral and Safekeeping Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Collateral and Safekeeping Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Collateral and Safekeeping Clerk is a crucial role within financial institutions and asset management firms. Key responsibilities include managing and safeguarding valuable assets, ensuring regulatory compliance, and providing exceptional customer service.

1. Collateral Management

Manage the receipt, storage, and release of collateral, including physical assets like securities and commodities, as well as financial instruments.

- Verify and document the receipt and delivery of collateral

- Maintain accurate records of all collateral holdings

2. Safekeeping Services

Safeguard physical assets and valuable documents in secure facilities, ensuring their protection and integrity.

- Operate and maintain a secure vault or storage facility

- Monitor and control access to the vault and its contents

3. Regulatory Compliance

Ensure compliance with all applicable regulations, including those governing collateral management and safekeeping practices.

- Stay abreast of industry regulations and guidelines

- Implement and maintain compliance procedures

4. Customer Service

Provide exceptional customer service to clients, answering inquiries and ensuring the efficient handling of collateral and safekeeping requests.

- Communicate effectively with clients and stakeholders

- Resolve client inquiries and address concerns promptly

Interview Tips

Preparing thoroughly for an interview can significantly increase your chances of success. Here are some tips to help you ace your Collateral and Safekeeping Clerk interview:

1. Research the Company and Position

Take the time to research the financial institution or asset management firm you’re applying to, as well as the specific role of Collateral and Safekeeping Clerk. This will demonstrate your interest in the company and show that you’ve taken the time to understand the position’s requirements.

- Visit the company website and social media pages

- Read industry news and articles about the company

2. Practice Answering Common Interview Questions

Anticipate common interview questions related to collateral management, safekeeping practices, regulatory compliance, and customer service. Prepare thoughtful responses that highlight your skills and experience.

- Describe your experience managing collateral and ensuring its safekeeping.

- Explain how you stay up-to-date with regulatory requirements and ensure compliance.

3. Highlight Your Skills and Experience

Emphasize your strengths and how they align with the responsibilities of the Collateral and Safekeeping Clerk role. Quantify your accomplishments whenever possible to demonstrate your impact.

- Mention any experience in handling and safeguarding valuable assets.

- Share examples of how you maintained compliance with industry regulations.

4. Be Professional and Enthusiastic

Dress professionally, arrive on time, and maintain a positive and enthusiastic demeanor throughout the interview. Remember that your attitude and behavior can leave a lasting impression on the interviewer.

- Be confident and assertive, but also respectful and courteous.

- Ask thoughtful questions to demonstrate your interest and engagement.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Collateral and Safekeeping Clerk interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.