Are you gearing up for an interview for a Collection Clerk position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Collection Clerk and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

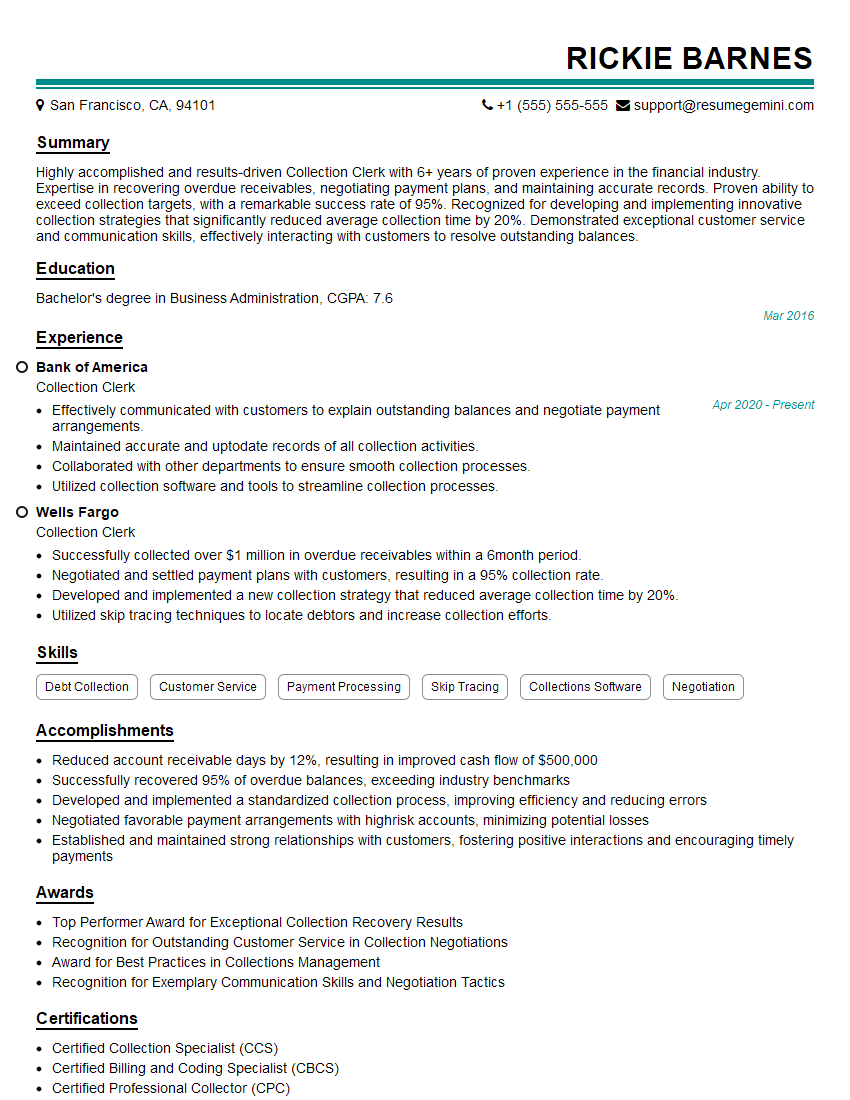

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Collection Clerk

1. What are the primary responsibilities of a Collection Clerk?

- Identify and contact delinquent account holders

- Negotiate payment plans and arrange settlements

- Maintain accurate records of all collection activities

- Monitor and track the progress of collection accounts

- Prepare and issue collection letters and notices

2. Describe the strategies you have used to successfully collect overdue payments.

- Used a variety of communication channels (phone, email, letters)

- Negotiated flexible payment plans tailored to the debtor’s situation

- Applied skip tracing techniques to locate missing debtors

- Collaborated with legal counsel when necessary

- Remained professional and persistent throughout the process

3. How do you prioritize your work when faced with a large volume of delinquent accounts?

- Identify high-risk accounts based on factors such as balance and duration of delinquency

- Use a triage system to focus on the most urgent and collectible accounts

- Prioritize accounts based on potential recovery amount

- Delegate tasks to other team members when feasible

- Leverage automation tools to streamline the collection process

4. What software applications and tools are you familiar with in the context of collection activities?

- Collection management software (e.g., Revenue Collection, Dunning Suite)

- Customer relationship management (CRM) systems

- Spreadsheets and databases for data analysis

- Communication tools (e.g., email, phone systems)

- Skip tracing tools for locating debtors

5. How do you maintain compliance with ethical and legal guidelines in your collection efforts?

- Follow all relevant laws and regulations governing debt collection practices

- Treat debtors with respect and professionalism

- Provide clear and accurate information about the debt and collection process

- Avoid harassment or intimidation tactics

- Document all collection activities thoroughly

6. What are your strengths and weaknesses as they relate to the role of Collection Clerk?

Strengths:

- Excellent communication and negotiation skills

- Strong attention to detail and accuracy

- Ability to work independently and as part of a team

- Knowledge of collection laws and regulations

- Persistent and results-oriented

Weaknesses:

- Can be sensitive to high-stress situations

- May need additional experience in using collection management software

7. How do you stay updated on the latest trends and best practices in collection management?

- Attend industry conferences and webinars

- Read trade publications and articles

- Network with other collection professionals

- Seek professional development opportunities

- Stay informed about changes in laws and regulations

8. Describe a challenging collection situation you encountered and how you resolved it.

- Outlined the situation, including the debtor’s financial circumstances and resistance to payment

- Explained the steps taken to negotiate a payment plan that worked for both parties

- Described the communication strategies and techniques used to build rapport and persuade the debtor

- Emphasized the importance of persistence and professionalism throughout the process

9. How do you handle irate or aggressive debtors?

- Remain calm and professional, even under pressure

- Listen attentively to the debtor’s concerns

- Avoid interrupting or becoming defensive

- Explain the situation and collection process clearly

- Offer alternative payment options or solutions if possible

- Document all interactions thoroughly

10. What are your goals for the next year as a Collection Clerk?

- Increase collection success rate by 10%

- Improve customer satisfaction by implementing a new communication strategy

- Become proficient in using the company’s new collection management software

- Contribute to the development of the team by mentoring new employees

- Stay updated on the latest trends and best practices in collection management

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Collection Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Collection Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Collection Clerk is responsible for the collection of outstanding debts. The key job responsibilities include:

1. Contacting Customers

Reaching out to customers via phone, email, or mail to remind them of outstanding balances and overdue payments.

- Maintaining accurate records of customer interactions and payment arrangements.

- Documenting all communication and tracking the progress of collection efforts.

2. Negotiating Payment Plans

Working with customers to establish realistic payment plans that align with their financial situation.

- Negotiating payment terms, amounts, and deadlines.

- Exploring alternative payment options and providing guidance to customers.

3. Processing Payments

Receiving and processing payments from customers, ensuring accurate and timely recording.

- Reconciling payments with outstanding balances.

- Maintaining detailed records of all financial transactions.

4. Reporting and Analysis

Providing regular reports on collection activities, performance metrics, and customer interactions.

- Analyzing data to identify trends and areas for improvement.

- Collaborating with management to develop and implement strategies to enhance collection effectiveness.

Interview Tips

To ace an interview for a Collection Clerk position, candidates should:

1. Research the Company and Position

Gather information about the company’s industry, services, and financial performance. Understand the specific responsibilities of the Collection Clerk role and its alignment with the company’s goals.

- Visit the company website, LinkedIn page, and industry news articles.

- Review the job description thoroughly, identifying key skills and qualifications.

2. Highlight Relevant Skills and Experience

Emphasize your proficiency in collection techniques, negotiation skills, and customer service. Provide specific examples of how you have successfully resolved overdue accounts.

- Quantify your accomplishments whenever possible, using metrics like percentage of accounts collected or reduction in overdue balances.

- Prepare STAR method responses to interview questions, highlighting your ability to manage challenging situations and achieve positive outcomes.

3. Prepare for Industry-Specific Questions

Be aware of common industry regulations and best practices related to debt collection. Demonstrate your understanding of ethical guidelines and compliance requirements.

- Research the Fair Debt Collection Practices Act (FDCPA) and other relevant laws.

- Be prepared to discuss your approach to handling sensitive customer data.

4. Practice Active Listening and Communication

Collection Clerks must be able to listen attentively to customers’ situations and communicate effectively to resolve issues. Show the interviewer that you possess these skills.

- During the interview, maintain eye contact, ask clarifying questions, and demonstrate genuine interest in understanding the interviewer.

- Prepare questions of your own to ask the interviewer, showing your engagement and curiosity about the role.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Collection Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!