Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Commercial Credit Head position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

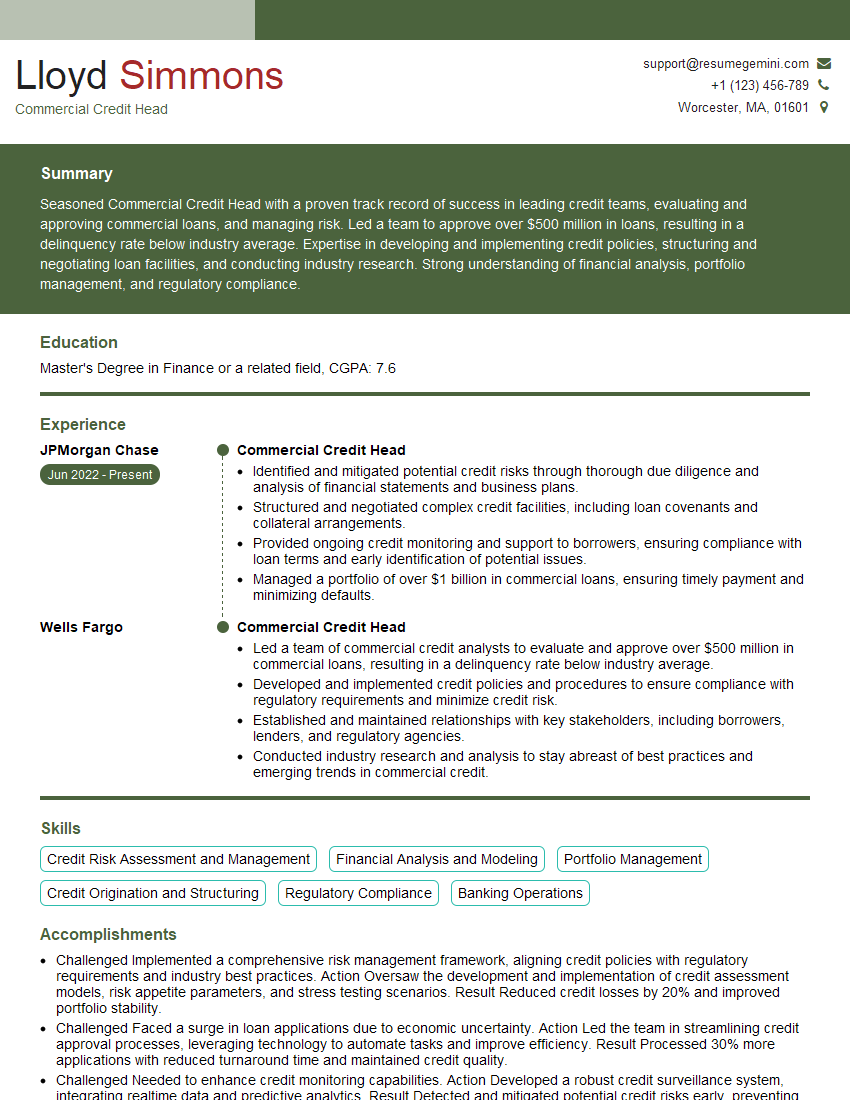

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commercial Credit Head

1. What is the key credit risk mitigation strategy your team employed during the recent economic downturn?

- Implemented stricter underwriting standards to reduce exposure to high-risk borrowers.

- Increased monitoring of existing borrowers to identify potential issues early.

- Enhanced risk modelling capabilities to better assess borrower creditworthiness.

2. Describe your approach to managing large credit exposures in a diversified portfolio.

Monitoring and Control

- Established comprehensive monitoring systems to track key credit metrics.

- Implemented early warning indicators to detect potential deterioration in credit quality.

- Regularly reviewed and updated credit limits for individual borrowers.

Stress Testing and Scenario Analysis

- Conducted thorough stress testing to assess portfolio resilience under adverse economic conditions.

- Developed contingency plans to address potential credit losses.

3. How do you integrate your credit analysis into the overall decision-making process for commercial lending?

- Collaborated closely with loan officers to provide credit risk insights and support lending decisions.

- Developed clear credit approval guidelines to ensure consistent and objective decision-making.

- Participated in credit committee meetings to present analysis and make recommendations on complex cases.

4. Discuss your experience in leveraging technology to enhance credit risk management.

- Implemented credit scoring models to automate and improve the efficiency of credit analysis.

- Utilized data analytics tools to identify trends and patterns in credit data.

- Developed dashboards and reporting systems to visualize and communicate credit risk information.

5. How do you manage regulatory compliance within your commercial credit department?

- Established a comprehensive compliance framework to ensure adherence to all relevant regulations.

- Regularly updated on regulatory changes and implemented appropriate measures to comply.

- Conducted internal audits to assess compliance and identify areas for improvement.

6. What are the key trends in commercial credit risk management that you are monitoring?

- The rise of non-traditional lending models.

- The impact of technology on credit analysis and underwriting.

- The evolving regulatory landscape.

7. How do you approach credit risk management in a post-pandemic world?

- Re-evaluated credit risk models and assumptions in light of the economic changes.

- Increased focus on monitoring borrowers in vulnerable sectors.

- Developed tailored credit solutions to support businesses impacted by the pandemic.

8. Describe your experience in working with external credit rating agencies.

- Prepared and presented information to credit rating agencies during rating reviews.

- Negotiated credit ratings and developed strategies to improve the bank’s credit profile.

- Monitored market perceptions and incorporated feedback from credit rating agencies into the credit risk management process.

9. How do you stay updated on the latest developments in the commercial credit market?

- Attend industry conferences and seminars.

- Read industry publications and reports.

- Network with other credit professionals.

10. What is your vision for the future of commercial credit risk management?

- Increased use of technology to automate and enhance credit analysis.

- Greater collaboration between lenders and regulators.

- Development of innovative credit products and strategies to meet evolving customer needs.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commercial Credit Head.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commercial Credit Head‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities:

1. Credit Risk Management

Oversee the development and implementation of credit risk policies, procedures, and practices.

- Establish credit limits for clients and monitor their exposure to minimize potential losses.

- Conduct credit analyses to assess the financial health and risk profile of potential and existing clients.

2. Loan Origination and Approval

Lead the commercial lending team in originating and approving loans for businesses.

- Evaluate loan applications, review financial statements, and conduct site visits to assess the creditworthiness of borrowers.

- Negotiate loan terms, including interest rates, repayment schedules, and collateral requirements.

3. Portfolio Management

Manage the bank’s commercial loan portfolio and ensure its quality and profitability.

- Monitor loan performance, identify and mitigate potential risks, and work with borrowers to address any issues.

- Develop and implement strategies to improve loan yields and reduce portfolio volatility.

4. Reporting and Compliance

Report on the performance of the commercial lending department to senior management and regulatory authorities.

- Ensure compliance with all applicable laws, regulations, and accounting standards related to commercial lending.

- Provide timely and accurate information to stakeholders, including external auditors and examiners.

5. Business Development

Develop and implement strategies to grow the bank’s commercial lending business.

- Identify potential clients and develop relationships with key decision-makers in the business community.

- Promote the bank’s loan products and services through presentations, networking events, and other marketing channels.

Interview Preparation Tips:

1. Research the Company and Position

- Visit the bank’s website to learn about their history, financial performance, and current initiatives.

- Review the job description thoroughly to understand the specific responsibilities and qualifications required.

2. Practice Answering Common Interview Questions

- Prepare for questions related to your experience in commercial lending, risk management, and loan origination.

- Practice answering behavioural questions using the STAR method (Situation, Task, Action, Result).

3. Highlight Your Skills and Experience

- Emphasize your technical skills, including credit analysis, loan underwriting, and portfolio management.

- Showcase your leadership and management abilities, as well as your ability to work effectively in a team environment.

4. Be Enthusiastic and Professional

- Convey your passion for commercial lending and your belief in the bank’s mission and values.

- Dress professionally, arrive on time, and maintain a positive and respectful demeanor throughout the interview.

5. Ask Thoughtful Questions

- Prepare a few questions to ask the interviewer, such as about the bank’s growth plans, their approach to risk management, or their current loan portfolio.

- Asking thoughtful questions shows that you are engaged and interested in the position.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Commercial Credit Head role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.