Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Commercial Credit Officer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

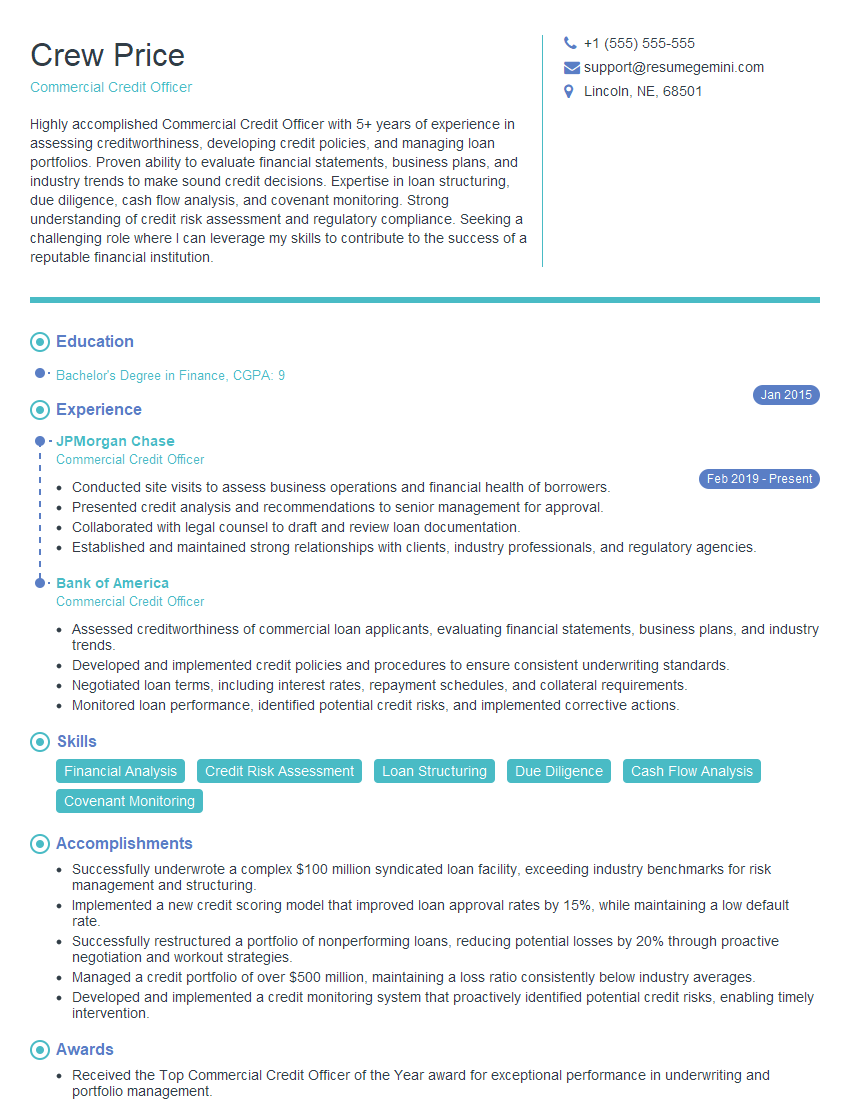

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commercial Credit Officer

1. What are the key financial ratios that you typically analyze to assess a company’s creditworthiness?

- Liquidity ratios, such as the current ratio and quick ratio

- Solvency ratios, such as the debt-to-equity ratio and times interest earned ratio

- Profitability ratios, such as the gross profit margin and net profit margin

- Efficiency ratios, such as the inventory turnover ratio and accounts receivable turnover ratio

- Other ratios, such as the Altman Z-Score and the Piotroski F-Score

2. How do you evaluate a company’s cash flow statement?

subheading of the answer

- Operating cash flow: This section shows the company’s cash flow from its core operations, such as sales, expenses, and depreciation.

- Investing cash flow: This section shows the company’s cash flow from its investments, such as capital expenditures and acquisitions.

- Financing cash flow: This section shows the company’s cash flow from its financing activities, such as borrowing and issuing stock.

subheading of the answer

- Overall, the cash flow statement provides valuable insights into a company’s financial health and its ability to generate cash.

3. How do you assess a company’s management team?

- Experience and track record: I look at the management team’s experience in the industry and their track record of success.

- Industry knowledge: I assess the management team’s knowledge of the industry and their understanding of the company’s competitive landscape.

- Leadership and communication skills: I evaluate the management team’s leadership and communication skills, as well as their ability to motivate and inspire employees.

- Teamwork and collaboration: I assess the management team’s ability to work together as a team and collaborate with each other.

4. What are the different types of credit facilities that you typically work with?

- Term loans: These are loans with a fixed repayment schedule and a fixed interest rate.

- Revolving credit facilities: These are lines of credit that allow borrowers to draw down and repay funds as needed.

- Letters of credit: These are guarantees issued by a bank that the buyer of goods or services will pay the seller.

- Export credit: These are loans or guarantees that support the export of goods or services.

- Project finance: These are loans that are used to finance the development of a specific project.

5. How do you structure a credit facility?

- The amount of the loan

- The interest rate

- The repayment schedule

- The collateral

- The covenants

6. What are the different types of collateral that you typically accept?

- Real estate

- Equipment

- Inventory

- Accounts receivable

- Personal guarantees

7. How do you manage a loan portfolio?

- Monitoring the performance of the loans

- Identifying and mitigating risks

- Restructuring loans when necessary

- Collecting on defaulted loans

8. What are the different types of credit scoring models?

- Experian

- Equifax

- TransUnion

- FICO

- VantageScore

9. How do you use credit scoring models in your work?

- To assess the creditworthiness of potential borrowers

- To price loans

- To manage loan portfolios

10. What are the latest trends in commercial lending?

- The use of alternative data in credit scoring

- The growth of online lending

- The increasing use of artificial intelligence in commercial lending

- The development of new credit products

- The increasing focus on sustainability in commercial lending

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commercial Credit Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commercial Credit Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Commercial Credit Officers play a pivotal role in assessing and managing the creditworthiness of commercial borrowers.

1. Credit Analysis and Assessment

Thoroughly analyze financial statements, credit history, and industry trends to determine a borrower’s capacity and willingness to repay.

- Evaluate income, assets, liabilities, and cash flow to assess financial strength.

- Review credit reports, liens, and other public records to identify potential risks.

2. Loan Structuring and Approval

Negotiate loan terms, covenants, and collateral requirements to mitigate risk and ensure repayment.

- Recommend loan amounts, interest rates, and repayment schedules based on risk assessment.

- Secure collateral and establish appropriate credit limits to protect the lender’s interests.

3. Relationship Management

Maintain strong relationships with borrowers and other stakeholders to monitor loan performance and identify potential issues early on.

- Conduct regular meetings and site visits to assess progress and address any concerns.

- Provide guidance and support to borrowers to help them succeed and mitigate financial risks.

4. Risk Management and Monitoring

Continuously monitor loan portfolios to identify potential problems and implement appropriate action plans.

- Track key financial ratios, industry trends, and regulatory changes to assess credit risk.

- Develop and implement risk mitigation strategies to minimize losses and protect the institution’s financial health.

Interview Tips

To ace an interview for a Commercial Credit Officer position, it’s essential to prepare thoroughly and showcase your skills and qualifications.

1. Research the Industry

Stay up-to-date with current financial trends, regulations, and industry best practices.

- Read industry publications, attend webinars, and participate in relevant online forums.

- Familiarize yourself with industry-specific risks and mitigation techniques.

2. Practice Case Studies

Review real-world credit analysis scenarios and practice presenting your recommendations.

- Analyze financial statements, calculate ratios, and assess credit risk using industry-standard methodologies.

- Develop well-reasoned loan approval or rejection recommendations and present them clearly and persuasively.

3. Highlight Your Analytical Skills

Emphasize your ability to interpret financial data, identify trends, and make informed decisions based on quantitative analysis.

- Provide specific examples of how you have used analytical techniques to assess creditworthiness and manage risk.

- Demonstrate your proficiency in using credit analysis software and other analytical tools.

4. Prepare Behavioral Questions

Be ready to answer behavioral questions that assess your professional conduct and problem-solving abilities.

- Use the STAR method (Situation, Task, Action, Result) to describe specific examples of how you handled challenging situations.

- Highlight your teamwork skills, attention to detail, and ability to work independently and under pressure.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Commercial Credit Officer role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.