Are you gearing up for an interview for a Computer Bookkeeper position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Computer Bookkeeper and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

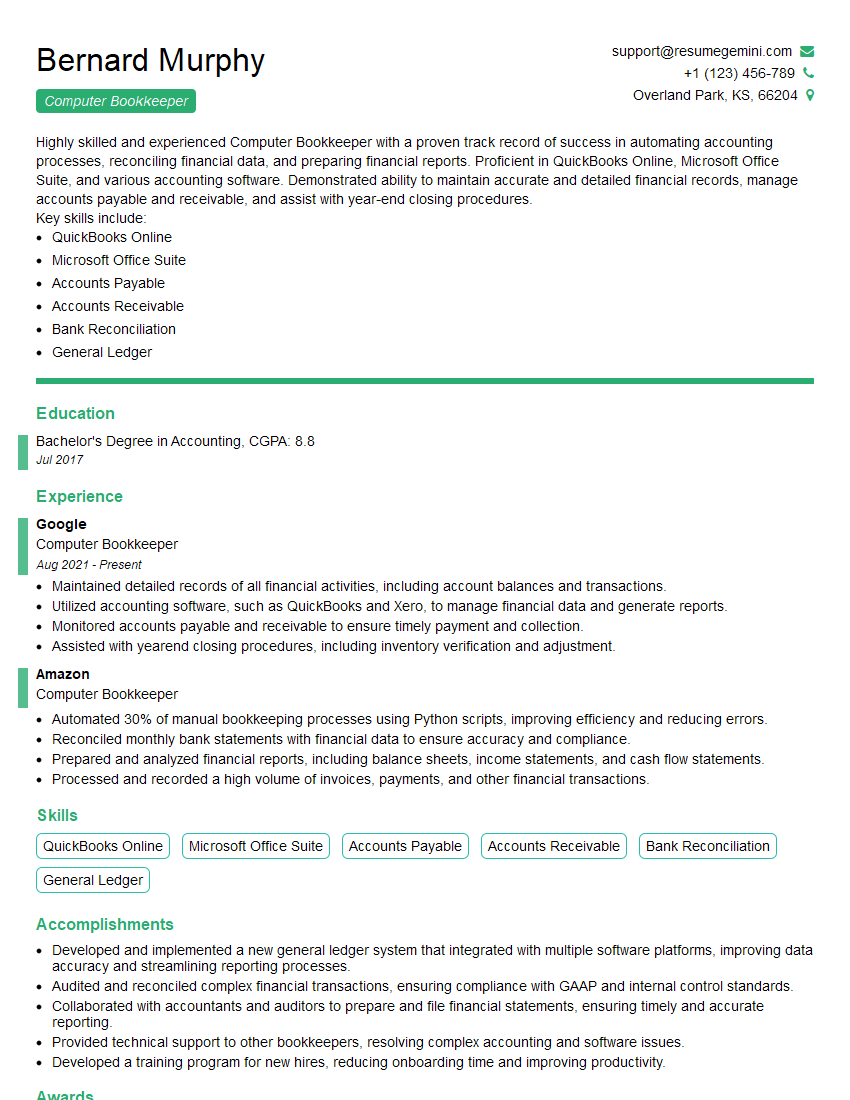

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Computer Bookkeeper

1. Describe your experience with using accounting software, such as QuickBooks or Xero?

I have extensive experience using both QuickBooks and Xero. I have used QuickBooks for over 10 years and Xero for the past 5 years. I am proficient in all aspects of both software, including setting up accounts, recording transactions, generating reports, and managing invoices and payments.

2. What are some of the key differences between QuickBooks and Xero?

Advantages of QuickBooks

- More established and widely used software

- Has a larger library of add-ons and integrations

- Offers more robust reporting capabilities

Advantages of Xero

- More user-friendly and intuitive interface

- More cloud-based and accessible from anywhere

- Offers a wider range of features, including project management and inventory management

3. What are your experiences with data entry and processing?

I have over 5 years of experience with data entry and processing. I have worked in a variety of industries, including accounting, finance, and healthcare. I am proficient in using a variety of data entry software, including Microsoft Excel, Access, and SQL. I am also experienced in using OCR software to convert paper documents into digital format.

4. What are your experiences with reconciling bank statements?

I have over 5 years of experience with reconciling bank statements. I have reconciled bank statements for businesses of all sizes, from small businesses to large corporations. I am familiar with the different types of bank statements and the different methods of reconciliation. I am also experienced in using reconciliation software to automate the reconciliation process.

5. What types of financial reports are you familiar with?

- Balance sheet

- Income statement

- Cash flow statement

- Statement of changes in equity

- Trial balance

I am familiar with the different types of financial reports and their uses. I am able to prepare and analyze these reports to provide insights into a company’s financial performance.

6. What are your communication and interpersonal skills like?

I have excellent communication and interpersonal skills. I am able to communicate effectively with people of all levels, both verbally and in writing. I am also able to build and maintain strong relationships with clients and colleagues.

7. How would you handle a situation where you had to deal with a difficult client?

- Stay calm and professional.

- Listen to the client’s concerns.

- Try to understand the client’s perspective.

- Work with the client to find a mutually acceptable solution.

I have been in situations where I had to deal with difficult clients. I have always been able to resolve the situation by following the steps above.

8. What are your career goals?

My career goal is to become a Certified Public Accountant (CPA). I am currently working towards my CPA license and I am confident that I will be able to achieve my goal within the next few years.

9. Why are you interested in this position?

I am interested in this position because it is a great opportunity for me to use my skills and experience to make a meaningful contribution to your company. I am confident that I can be a valuable asset to your team and I am eager to learn more about this opportunity.

10. Why should we hire you?

- I have the skills and experience that you are looking for.

- I am a hard worker and I am always willing to go the extra mile.

- I am a team player and I am always willing to help out my colleagues.

- I am confident that I can be a valuable asset to your team.

I am confident that I am the best candidate for this position. I have the skills, experience, and motivation that you are looking for. I am eager to learn more about this opportunity and I am confident that I can be a valuable asset to your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Computer Bookkeeper.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Computer Bookkeeper‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Computer Bookkeepers are responsible for maintaining accurate and complete financial records for their organizations. Their duties include recording and organizing financial data, preparing and analyzing financial reports, assisting with audits, and ensuring compliance with tax regulations.

1. Recording Financial Data

Computer Bookkeepers keep a detailed record of all financial transactions, including sales, purchases, receipts, and payments.

- Enter data into accounting software using a computer.

- Verify the accuracy and completeness of financial transactions.

2. Preparing Financial Reports

Bookkeepers prepare a variety of financial reports, including balance sheets, income statements, and cash flow statements.

- Create and maintain financial reports using accounting software.

- Analyze financial reports to identify trends and patterns.

3. Assisting with Audits

Bookkeepers assist with internal and external audits by providing auditors with access to financial records and documentation.

- Gather and organize financial records for audits.

- Answer auditors’ questions and provide explanations of financial transactions.

4. Ensuring Compliance with Tax Regulations

Bookkeepers stay up-to-date on tax regulations to ensure that their organizations are in compliance.

- Calculate and file taxes, including sales tax, payroll tax, and income tax.

- Maintain documentation to support tax filings.

Interview Tips

To ace an interview for a Computer Bookkeeper position, it is important to be well-prepared and able to demonstrate your skills and experience. Here are some tips to help you succeed:

1. Research the Company and Position

Before you go on an interview, be sure to do your research on the company and the position you are applying for. This will show the interviewer that you are serious about the opportunity and that you have taken the time to learn about the organization.

- Visit the company’s website to learn about their history, mission, and values.

- Read the job description carefully and make a list of the key skills and experience required for the position.

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is helpful to practice your answers to these questions in advance so that you can deliver them confidently and concisely.

- Focus on your skills and experience that are most relevant to the position.

- Use the STAR method to answer questions about your experience. STAR stands for Situation, Task, Action, Result.

3. Highlight Your Computer Skills

Computer Bookkeepers must be proficient in a variety of computer software programs, including accounting software, spreadsheet programs, and word processing programs.

- In your interview, be sure to highlight your proficiency in these programs and provide specific examples of how you have used them in your previous roles.

- If you have any experience with specialized accounting software, be sure to mention that as well.

4. Be Prepared to Talk About Your Experience

The interviewer will want to know about your experience as a Computer Bookkeeper. Be prepared to discuss your responsibilities in previous roles and provide specific examples of your accomplishments.

- Quantify your accomplishments whenever possible. For example, instead of saying “I prepared financial reports,” say “I prepared financial reports that resulted in a 5% increase in profits.”

- Be prepared to talk about your experience with difficult clients or situations.

5. Ask Questions

At the end of the interview, be sure to ask the interviewer questions about the position and the company. This shows that you are interested in the opportunity and that you are taking the interview seriously.

- Ask questions about the company’s culture, growth plans, and financial stability.

- Ask questions about the position, such as the responsibilities, reporting structure, and opportunities for advancement.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Computer Bookkeeper interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!