Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Credit and Collection Manager interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Credit and Collection Manager so you can tailor your answers to impress potential employers.

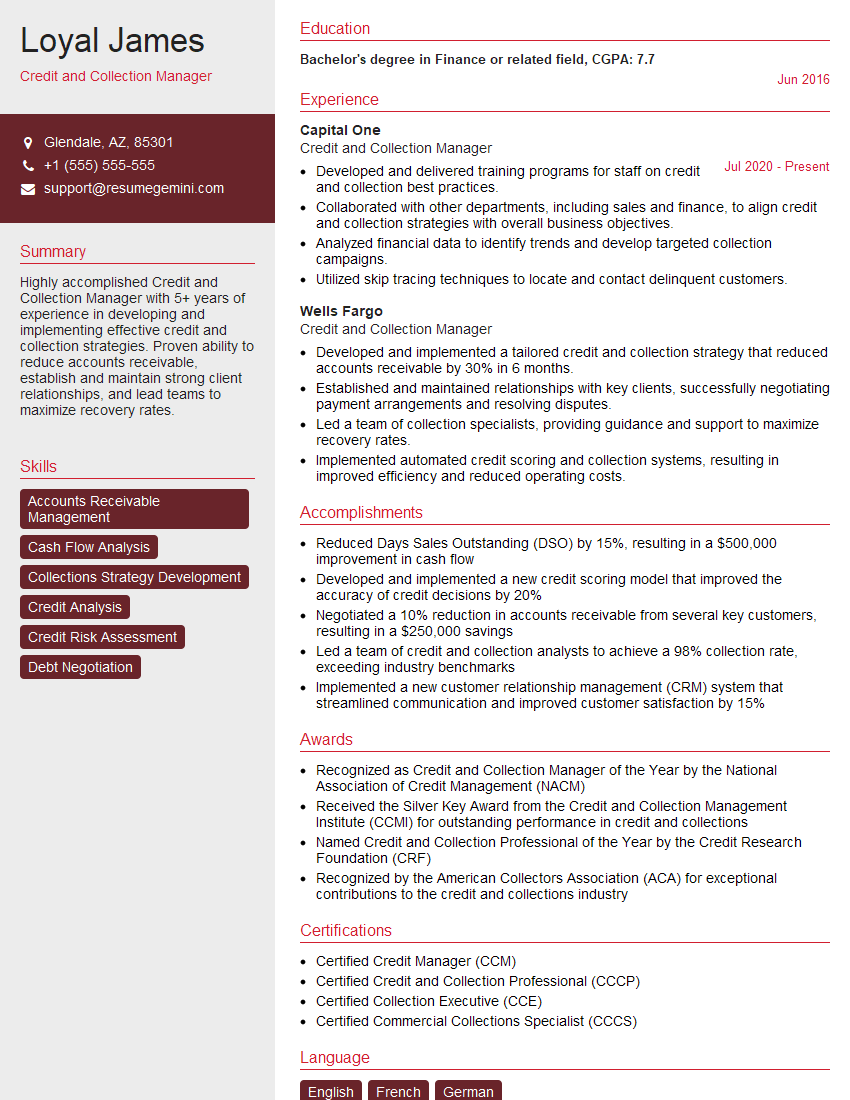

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit and Collection Manager

1. Describe your understanding of the role of a Credit and Collection Manager?

- Responsible for managing the credit and collection functions of an organization.

- Develop and implement credit policies and procedures.

- Analyze financial statements and credit reports to assess the creditworthiness of customers.

- Negotiate payment arrangements with customers.

- Collection of past due accounts.

- Monitor and manage cash flow.

2. What are the key metrics you would use to measure the effectiveness of a credit and collection department?

Collection rate:

- Percentage of receivables collected within a specified period.

Days Sales Outstanding (DSO):

- Average number of days it takes to collect receivables.

Bad debt ratio:

- Percentage of receivables that are uncollectible and written off.

Customer satisfaction scores:

- Feedback from customers on the efficiency and effectiveness of the credit and collection process.

3. Describe your experience in developing and implementing credit policies and procedures?

In my previous role, I led the development and implementation of a new credit policy that resulted in a 5% reduction in bad debt losses. I also worked with the sales team to develop a new procedure for onboarding new customers, which reduced the time it took to establish credit from 30 days to 7 days.

4. How do you assess the creditworthiness of a customer?

I use a combination of financial analysis and industry knowledge to assess the creditworthiness of a customer. I typically review the customer’s financial statements, credit reports, and payment history. I also consider the customer’s industry, size, and management team.

5. What are some of the challenges you have faced in the past when collecting past due accounts? How did you overcome them?

One of the biggest challenges I have faced in the past is collecting past due accounts from customers who are experiencing financial difficulties. In these cases, I typically try to work with the customer to develop a payment plan that they can afford. I also try to offer discounts or other incentives to encourage the customer to pay their debt.

6. What are your thoughts on using technology to improve the efficiency of the credit and collection process?

I believe that technology can be a powerful tool for improving the efficiency of the credit and collection process. I have experience using a variety of software programs, including credit scoring models, collection management systems, and customer relationship management (CRM) systems. I have found that these programs can help to automate many of the tasks that are associated with the credit and collection process, freeing up time for me to focus on more strategic initiatives.

7. What are your strengths and weaknesses as a Credit and Collection Manager?

Strengths:

- Excellent communication and negotiation skills.

- Strong analytical and problem-solving skills.

- Proven track record of success in managing credit and collection departments.

Weaknesses:

- I can be a bit too detail-oriented at times.

- I am not always the most patient person.

8. What are your salary expectations for this role?

My salary expectations are in the range of $70,000 to $90,000 per year. I am open to negotiating a salary that is commensurate with my experience and qualifications.

9. Why are you interested in working for our company?

I am interested in working for your company because I am impressed with your company’s commitment to customer service and its track record of success. I believe that my skills and experience would be a valuable asset to your team.

10. Do you have any questions for me?

Yes, I do have a few questions. Can you tell me more about the company’s credit and collection policies? What is the average DSO for the company? What is the company’s bad debt ratio?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit and Collection Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit and Collection Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Credit and Collection Manager, you will be responsible for managing the organization’s credit and collection functions. This will include developing and implementing credit policies and procedures, evaluating and approving credit applications, managing delinquent accounts, and collecting outstanding debts. You will also be responsible for monitoring the organization’s financial performance and providing financial advice to senior management.

1. Credit Policy and Procedures

You will develop and implement credit policies and procedures to ensure that the organization’s credit risk is managed effectively. This will include establishing credit limits, setting payment terms, and determining the criteria for approving credit applications.

- Analysing the company’s financial performance and industry trends to assess credit risk.

- Developing and implementing strategies to mitigate credit risk.

2. Credit Application Evaluation

You will evaluate and approve credit applications from potential customers. This will involve assessing the customer’s financial history, creditworthiness, and ability to repay the debt. You will also make recommendations on the amount of credit to be extended.

- Reviewing financial statements, credit reports, and other relevant documents.

- Conducting background checks on potential customers.

3. Delinquent Account Management

You will manage delinquent accounts and collect outstanding debts. This will involve contacting customers, negotiating payment arrangements, and taking legal action if necessary. You will also work with other departments to identify and resolve the underlying causes of delinquency.

- Developing and implementing strategies to reduce delinquency rates.

- Negotiating payment plans with delinquent customers.

4. Financial Reporting and Analysis

You will monitor the organization’s financial performance and provide financial advice to senior management. This will include preparing financial reports, analyzing financial data, and making recommendations on financial strategies.

- Preparing financial statements and reports.

- Analysing financial data to identify trends and patterns.

Interview Tips

To ace your interview for a Credit and Collection Manager position, follow these tips:

1. Research the Company and the Position

Before the interview, take the time to research the company and the position you are applying for. This will help you to understand the company’s culture, goals, and needs. You will also be able to better tailor your answers to the interviewer’s questions.

- Visit the company’s website and read their financial statements.

- Read industry news and articles to stay up-to-date on the latest trends.

2. Highlight Your Skills and Experience

During the interview, be sure to highlight your skills and experience. Focus on your ability to manage credit risk, evaluate credit applications, collect outstanding debts, and provide financial advice. You should also mention any relevant certifications or training that you have.

- Quantify your accomplishments whenever possible.

- Be prepared to discuss how your skills and experience can benefit the company.

3. Be Prepared to Answer Behavioral Questions

Behavioral questions are designed to assess your past performance and how you might behave in similar situations in the future. Be prepared to answer questions about your experience in managing credit risk, collecting outstanding debts, and providing financial advice. You should also be prepared to discuss how you have handled difficult customers or resolved conflicts.

- Use the STAR method to answer behavioral questions.

- Be honest and authentic in your answers.

4. Ask Questions

At the end of the interview, be sure to ask the interviewer questions about the position and the company. This shows that you are interested in the position and that you are taking the interview seriously. It also gives you an opportunity to learn more about the company and the position.

- Ask about the company’s culture and goals.

- Ask about the specific responsibilities of the position.

- Ask about the company’s plans for the future.

Next Step:

Now that you’re armed with the knowledge of Credit and Collection Manager interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Credit and Collection Manager positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini