Are you gearing up for a career in Credit Assistant? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Credit Assistant and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

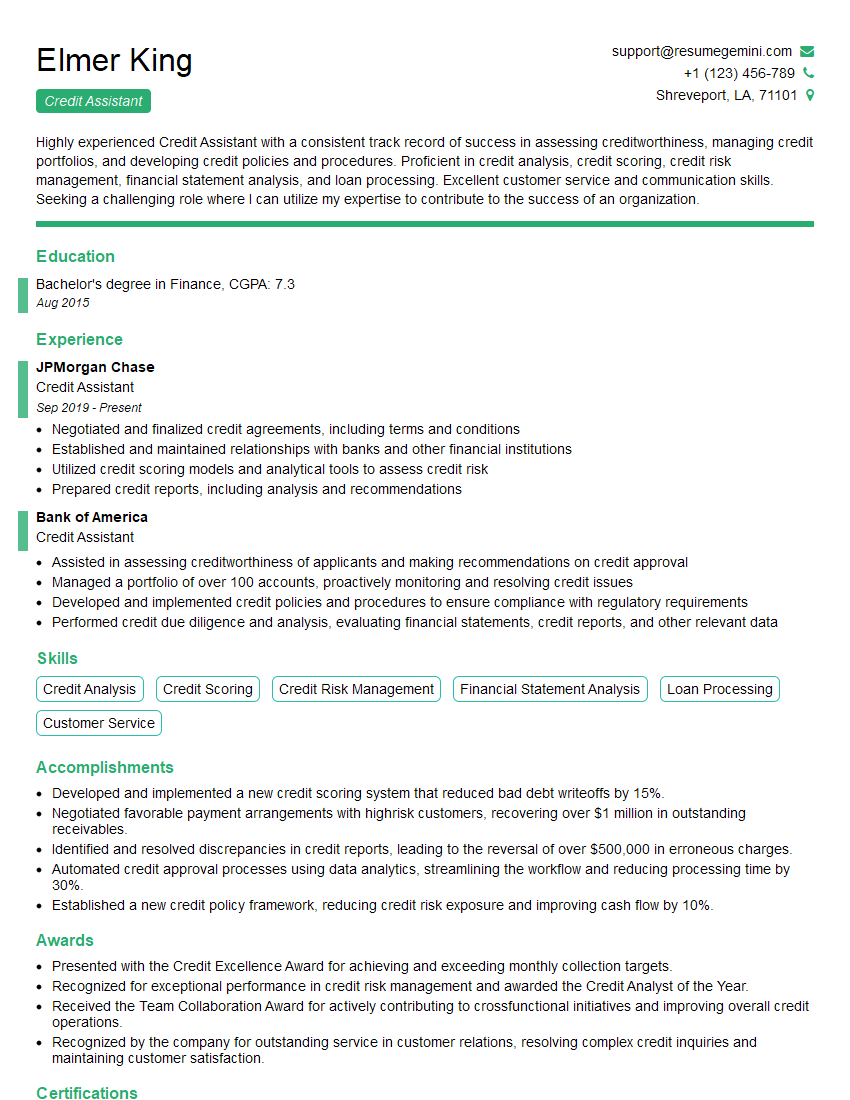

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Assistant

1. Tell me about your experience in credit analysis, and how you would approach a credit analysis project?

I have worked as a Credit Analyst for the past 3 years, and I have experience in all aspects of credit analysis, including financial statement analysis, industry analysis, and risk assessment. My approach to a credit analysis project is to first understand the client’s business and industry, then to assess the client’s financial performance and risk profile. I use a variety of analytical tools and techniques to develop my conclusions, and I always strive to provide clear and concise recommendations to my clients.

2. What are the key financial ratios that you use to assess a company’s creditworthiness?

Liquidity ratios

- Current ratio

- Quick ratio

- Cash ratio

Solvency ratios

- Debt-to-equity ratio

- Debt-to-asset ratio

- Times interest earned ratio

Profitability ratios

- Gross profit margin

- Operating profit margin

- Net profit margin

Efficiency ratios

- Inventory turnover ratio

- Days sales outstanding

- Accounts payable turnover ratio

3. How do you assess the risk of a potential customer?

I assess the risk of a potential customer by considering a variety of factors, including the customer’s financial condition, industry, and payment history. I also consider the customer’s relationship with my company and the size of the order. I use a variety of tools and techniques to assess risk, including financial statement analysis, credit scoring, and risk modeling.

4. What are the most common red flags that you look for when reviewing a credit application?

The most common red flags that I look for when reviewing a credit application include:

- Inconsistent or incomplete information

- Negative credit history

- High levels of debt

- Unstable income

- Recent job loss or change

5. What is your experience with using credit scoring models?

I have experience using a variety of credit scoring models, including FICO, VantageScore, and proprietary models. I understand the strengths and weaknesses of each model, and I use them to assess the creditworthiness of potential customers. I also have experience in developing and implementing credit scoring models.

6. How do you stay up-to-date on the latest trends in credit analysis?

I stay up-to-date on the latest trends in credit analysis by reading industry publications, attending conferences, and taking online courses. I also network with other credit professionals and keep abreast of new developments in the field.

7. What are the biggest challenges you face in your role as a Credit Assistant?

The biggest challenges I face in my role as a Credit Assistant are:

- Keeping up with the volume of work

- Making decisions quickly and accurately

- Staying up-to-date on the latest trends in credit analysis

- Managing multiple projects simultaneously

8. What are your strengths and weaknesses as a Credit Assistant?

My strengths as a Credit Assistant include:

- Strong analytical skills

- Excellent communication skills

- Attention to detail

- Ability to work independently and as part of a team

My weaknesses as a Credit Assistant include:

- Limited experience in some areas of credit analysis

- Can be slow to make decisions at times

9. What are your career goals?

My career goal is to become a Credit Analyst. I am confident that my skills and experience will allow me to be successful in this role.

10. What are your salary expectations?

My salary expectations are in line with the market rate for Credit Assistants with my experience and qualifications.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Assistant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Assistant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Credit Assistant plays a crucial role in the financial department by supporting the credit team with various important tasks. These responsibilities encompass the following key areas:

1. Credit Management

Assisting Credit Analysts in evaluating and analyzing the creditworthiness of potential customers and clients. This includes assessing financial statements, industry reports, and other relevant data to determine the risk level associated with granting credit.

- Analyzing financial ratios, cash flow statements, and balance sheets to assess the financial health and stability of applicants.

- Evaluating business plans, market research, and other qualitative factors to understand the potential customer’s industry, competitive landscape, and growth prospects.

2. Credit Approval and Monitoring

Processing credit applications, reviewing credit reports, and verifying references to ensure compliance with established credit policies.

- Obtaining and reviewing credit references from banks, trade suppliers, and other sources to verify the applicant’s credit history and payment behaviour.

- Monitoring customer accounts, tracking payments, and identifying any potential credit risks or concerns.

3. Customer Communication and Support

Responding to customer inquiries, resolving credit-related issues, and providing support to both internal and external stakeholders.

- Communicating with customers regarding credit limits, payment arrangements, and any changes to their credit terms.

- Providing clear and concise explanations of credit policies and procedures to customers and other stakeholders, such as sales teams and suppliers.

4. Administrative and Data Management

Maintaining and organizing credit files, updating customer information, and generating reports for management review.

- Scanning and digitizing credit applications and supporting documentation to create electronic records for easy retrieval.

- Preparing and presenting credit-related reports and analysis to management, providing insights into credit trends and risk exposure.

Interview Tips

To ace an interview for a Credit Assistant position, it is essential to highlight your skills and experience in credit analysis, customer service, and data management. Here are some tips to help you prepare:

1. Research the Company and Position

Familiarize yourself with the company’s financial profile, credit policies, and industry standing. Understand the specific role and responsibilities of the Credit Assistant position and how your skills and experience align with them.

- Visit the company’s website and study their financial statements, annual reports, and industry news.

- Reach out to current or former employees on LinkedIn to gain insights into the company culture and the position’s expectations.

2. Showcase Your Analytical Skills

Quantify your experience in credit analysis by highlighting specific examples of your work. Demonstrate your ability to interpret financial statements, assess risk factors, and make sound credit decisions.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide concrete examples of your analytical capabilities.

- Be prepared to discuss your understanding of different credit scoring models and your experience in using them to evaluate creditworthiness.

3. Emphasize Your Customer Service Skills

Highlight your ability to communicate effectively with customers, resolve issues professionally, and maintain positive relationships. Demonstrate your understanding of credit policies and your commitment to providing excellent customer support.

- Share examples of situations where you successfully resolved customer inquiries or complaints related to credit matters.

- Explain how you prioritize customer satisfaction and go the extra mile to ensure a smooth and positive experience for all parties.

4. Highlight Your Data Management Skills

Demonstrate your proficiency in organizing, maintaining, and analyzing data. Emphasize your experience in using credit management software or other relevant tools to manage customer accounts and track credit-related information.

- Describe your experience in implementing data management systems or processes to improve efficiency and accuracy.

- Discuss your understanding of data security best practices and your commitment to maintaining the confidentiality and integrity of sensitive customer information.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Credit Assistant interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!