Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Credit Manager interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Credit Manager so you can tailor your answers to impress potential employers.

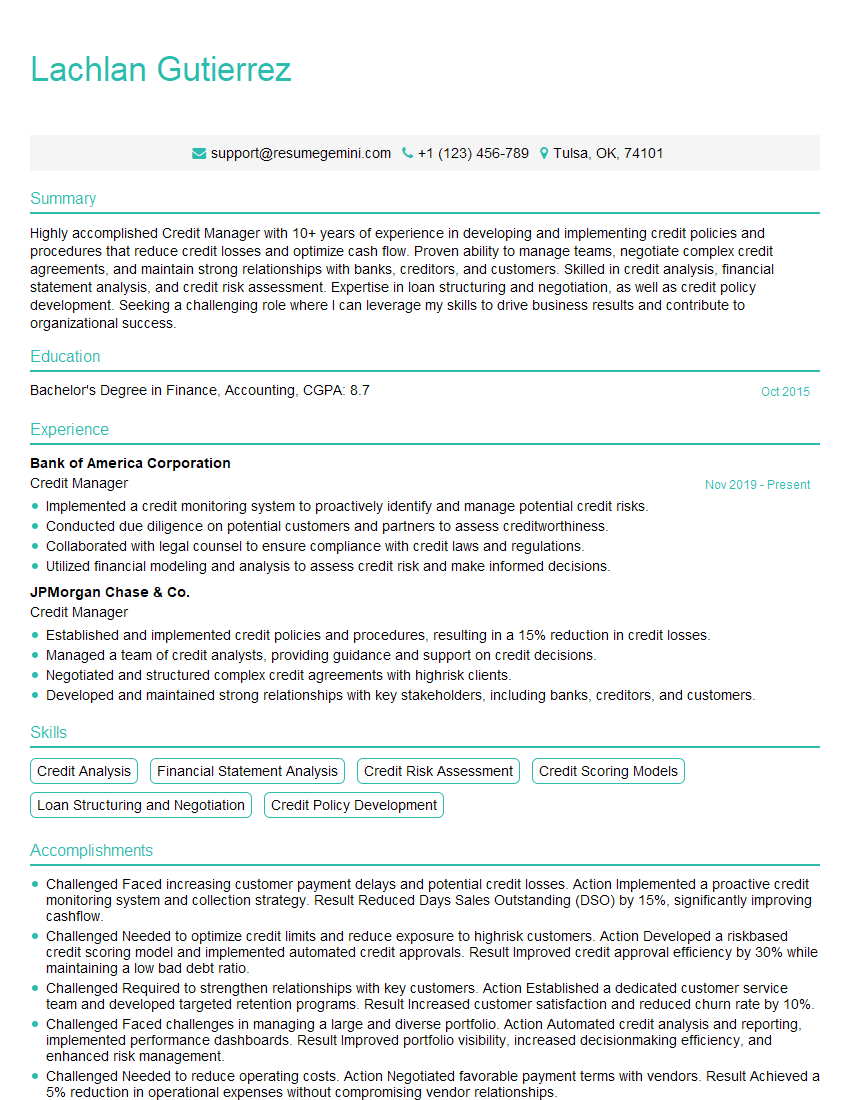

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Manager

1. Can you give me an overview of the key responsibilities of a Credit Manager?

As a Credit Manager, my responsibilities encompass:

- Developing and implementing credit policies and procedures.

- Assessing the creditworthiness of potential customers and determining credit limits.

- Monitoring customer accounts and ensuring timely payment.

- Negotiating payment terms and resolving disputes with customers.

- Managing a team of credit analysts and ensuring compliance with regulations.

2. What techniques do you employ to evaluate a customer’s creditworthiness?

Financial Analysis:

- Reviewing financial statements (balance sheets, income statements, cash flow statements)

- Calculating financial ratios (liquidity, profitability, solvency)

- Assessing cash flow projections and forecasting

Credit History:

- Obtaining credit reports from credit bureaus

- Examining payment history, outstanding balances, and derogatory marks

Industry Analysis:

- Researching industry trends, market dynamics, and competitive landscapes

- Understanding the risks and opportunities associated with different sectors

3. How do you determine appropriate credit limits for customers?

Determining credit limits involves a balanced approach:

- Customer’s Creditworthiness: Assessing financial strength, credit history, and business outlook.

- Company’s Credit Policy: Establishing guidelines for credit limits based on industry standards, risk appetite, and cash flow requirements.

- Customer’s Needs and Potential: Considering the customer’s projected sales, growth plans, and overall business strategy.

- Market Conditions: Evaluating industry trends, economic indicators, and competition to adjust credit limits accordingly.

4. What are the key metrics you track to measure the performance of your credit department?

I monitor several key metrics to evaluate our performance:

- Days Sales Outstanding (DSO): Measures the average time it takes customers to pay their invoices.

- Bad Debt Expense: Tracks the amount of uncollectible accounts write-offs.

- Credit Loss Ratio: Calculates the percentage of total sales lost due to bad debts.

- Customer Satisfaction: Surveys and feedback mechanisms to assess customer experience with our credit policies and processes.

5. Can you describe your approach to managing customer disputes effectively?

My approach to dispute management involves several steps:

- Acknowledge and Investigate: Promptly acknowledge the dispute, gather relevant information, and investigate the issue thoroughly.

- Communicate and Collaborate: Engage in open and proactive communication with the customer to understand their concerns and explore possible solutions.

- Negotiate and Resolve: Work collaboratively with the customer to find a mutually acceptable resolution that preserves the business relationship.

- Document and Follow Up: Record all agreements and actions taken to avoid future misunderstandings and ensure follow-up to verify resolution.

6. How do you stay abreast of industry best practices and regulatory changes in credit management?

I prioritize continuous professional development through:

- Attending conferences and webinars: Staying informed about industry trends and advancements.

- Subscribing to industry publications and online resources: Accessing up-to-date information and insights.

- Networking with peers: Exchanging knowledge and experiences with other credit professionals.

- Completing relevant certifications: Demonstrating commitment to professional growth and regulatory compliance.

7. Can you share a challenging situation you faced in credit management and how you overcame it?

During a period of economic downturn, we faced a surge in customer defaults. To mitigate the impact, we:

- Strengthened Credit Policies: Revised our credit assessment criteria to identify and mitigate risks.

- Enhanced Collection Strategies: Implemented a proactive collection process to minimize overdue payments.

- Renegotiated Credit Terms: Worked with customers to adjust payment terms and provide support during the challenging times.

- Improved Communication: Openly communicated with customers and stakeholders to foster understanding and collaboration.

8. How do you balance the need for risk management with the company’s growth objectives?

I believe in a balanced approach that aligns with the company’s overall business strategy:

- Establishing Clear Risk Appetite: Defining the level of risk the company is willing to take to achieve its growth goals.

- Implementing Effective Risk Controls: Implementing policies, procedures, and technologies to mitigate risks and ensure compliance.

- Monitoring and Adjusting Strategies: Regularly reviewing credit performance, market conditions, and adjusting strategies as needed.

- Collaborating with Business Units: Partnering with sales, marketing, and operations to ensure growth initiatives align with credit risk management.

9. What is your experience in using credit scoring models and how do you ensure their accuracy and reliability?

I have extensive experience in using credit scoring models to assess customer creditworthiness:

- Model Selection and Validation: Evaluating and selecting models based on their predictive power and risk assessment capabilities.

- Data Quality Management: Ensuring the accuracy and integrity of data used to train and validate models.

- Monitoring and Calibration: Regularly monitoring model performance and recalibrating as needed to maintain accuracy.

- Audit and Compliance: Adhering to regulatory requirements and ensuring model transparency and fairness.

10. How do you manage a team of credit analysts and foster a successful work environment?

Effective team management is crucial for credit department success:

- Clear Expectations and Communication: Setting clear performance goals, providing regular feedback, and maintaining open communication channels.

- Training and Development: Investing in ongoing training and development to enhance team skills and knowledge.

- Empowerment and Accountability: Providing analysts with autonomy while holding them accountable for their decisions.

- Collaboration and Teamwork: Encouraging collaboration among team members to share knowledge and support each other.

- Recognition and Appreciation: Acknowledging and rewarding team members’ contributions to maintain motivation and a positive work environment.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Credit Manager is responsible for overseeing and managing the credit operations of a company. They play a crucial role in assessing the creditworthiness of customers, setting credit limits, and collecting overdue payments. Their primary goal is to minimize the risk of bad debt while maintaining positive customer relationships and maximizing revenue.

1. Credit Analysis and Risk Assessment

The Credit Manager evaluates the financial health and creditworthiness of potential and existing customers. They analyze financial statements, credit reports, and other relevant data to determine the risk associated with extending credit. Based on their assessment, they make recommendations on credit limits, payment terms, and other credit-related decisions.

- Conduct thorough credit investigations to determine the creditworthiness of customers.

- Analyze financial statements, credit reports, and other relevant information to assess the risk of extending credit.

- Establish credit limits and payment terms based on the risk assessment.

2. Credit Policy Development and Implementation

The Credit Manager develops and implements credit policies and procedures to ensure consistent and effective credit management practices. They establish guidelines for credit approval, collection strategies, and customer dispute resolution.

- Develop and implement credit policies and procedures to guide credit operations.

- Establish credit approval criteria and processes to ensure compliance with established policies.

- Train and supervise staff on credit policies and procedures.

3. Credit Collection and Management

The Credit Manager is responsible for collecting overdue payments and managing delinquent accounts. They work closely with customers to negotiate payment arrangements, implement collection strategies, and resolve disputes.

- Monitor customer accounts for overdue payments.

- Develop and implement collection strategies to recover overdue payments.

- Negotiate payment arrangements and resolve customer disputes.

4. Risk Management and Reporting

The Credit Manager regularly monitors and reviews credit risk and reports on the overall health of the credit portfolio. They identify areas of concern, develop mitigation strategies, and provide insights to senior management on credit-related matters.

- Monitor credit risk and identify potential problem areas.

- Develop and implement risk mitigation strategies.

- Report on the overall health of the credit portfolio to senior management.

Interview Tips

To ace an interview for a Credit Manager position, it is important to demonstrate your knowledge of credit management principles, analytical skills, and ability to effectively manage relationships with customers and colleagues.

1. Research the Company and Industry

Familiarize yourself with the company’s business, credit policies, and industry trends. This knowledge will help you understand the company’s specific needs and tailor your answers accordingly.

- Visit the company’s website and read their annual reports to learn about their business strategy and financial performance.

- Research the credit management industry and identify any recent trends or best practices.

2. Highlight Your Skills and Experience

Emphasize your relevant skills and experience in credit analysis, risk assessment, credit policy development, and collection management. Quantify your accomplishments whenever possible to demonstrate your impact.

- Provide specific examples of how you have successfully analyzed financial data and made sound credit decisions.

- Showcase your ability to develop and implement effective credit policies and procedures.

3. Demonstrate Problem-Solving Abilities

Credit Managers often encounter challenging situations. In the interview, be prepared to discuss how you have handled difficult customers or resolved complex credit issues.

- Provide examples of how you have successfully negotiated payment arrangements with delinquent customers.

- Describe how you have resolved customer disputes and maintained positive relationships.

4. Show Your Passion for Credit Management

Express your enthusiasm for credit management and explain why you are passionate about this field. Highlight your commitment to ethical and responsible lending practices.

- Discuss your understanding of the importance of credit in the business world.

- Explain how you stay updated on industry best practices and regulatory changes.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Credit Manager role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.