Are you gearing up for an interview for a Credit Operations Processor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Credit Operations Processor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

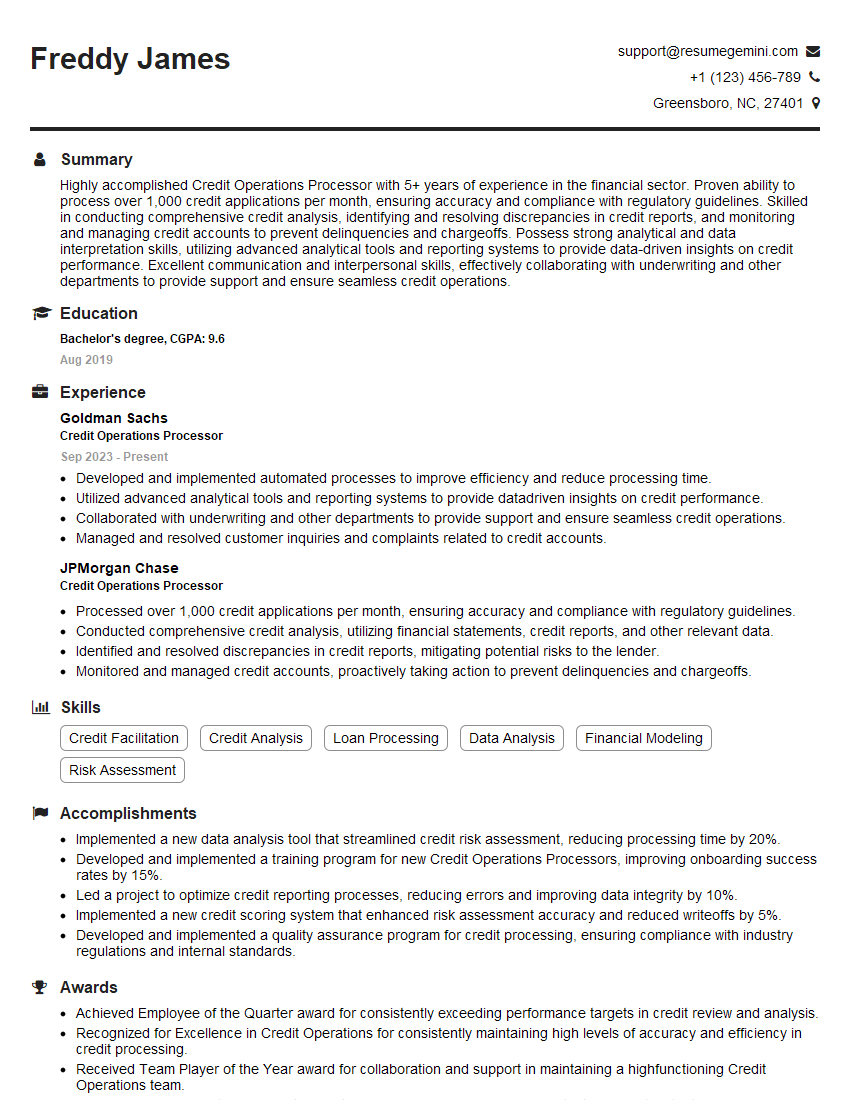

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Operations Processor

1. Explain your understanding of the role of a Credit Operations Processor?

- Performing daily operational tasks related to credit management and processing.

- Handling credit applications, reviewing credit reports, and analyzing financial statements.

- Assessing credit risks, making credit decisions, and managing accounts receivable.

- Maintaining accurate credit files, tracking credit limits, and monitoring payment performance.

- Communicating with customers, collecting past-due payments, and resolving disputes.

2. Describe the various credit assessment techniques you are familiar with?

Financial Analysis

- Ratio analysis to evaluate financial performance and stability.

- Cash flow analysis to assess liquidity and solvency.

- Trend analysis to identify patterns and predict future performance.

Credit Scoring

- Using credit scoring models to assign numerical scores to applicants based on their credit history.

- Interpreting credit scores to make informed credit decisions.

Industry-Specific Analysis

- Considering industry-specific factors and risks when evaluating credit applications.

- Researching industry trends, competition, and regulatory requirements.

3. What steps do you take to ensure accurate and timely processing of credit applications?

- Establishing clear processing standards and procedures.

- Utilizing automated systems to streamline and expedite processing.

- Conducting thorough credit reviews to verify information and assess risk.

- Communicating effectively with applicants and external parties to gather necessary documents.

- Providing regular updates to management on application status and processing timelines.

4. How do you handle exceptions and disputes related to credit decisions?

- Following established exception handling procedures to resolve issues promptly.

- Investigating the underlying cause of disputes and gathering additional information.

- Communicating with customers to explain decisions and resolve concerns.

- Escalating unresolved disputes to supervisors or management for further review.

- Documenting all interactions and resolutions to maintain accurate records.

5. Describe your experience with using credit management software and tools

- Expertise in using industry-standard credit management platforms.

- Experience with credit scoring systems, decision engines, and reporting tools.

- Understanding of data management, security, and compliance requirements.

- Ability to extract and analyze data to generate insights and improve processes.

- Proficiency in using Microsoft Office Suite and other relevant software.

6. How do you stay abreast of industry regulations and best practices in credit operations?

- Regularly attending industry webinars, conferences, and training programs.

- Reading industry publications, whitepapers, and online resources.

- Participating in professional organizations and networking with peers.

- Monitoring regulatory updates and changes to ensure compliance.

- Seeking feedback from supervisors, colleagues, and customers to improve practices.

7. How do you manage a high volume of credit applications and ensure efficient processing?

- Developing and implementing workflow management systems to prioritize and track applications.

- Automating repetitive tasks to expedite processing and minimize errors.

- Delegating responsibilities effectively to team members based on their skills and experience.

- Establishing clear deadlines and performance targets to maintain efficiency.

- Identifying bottlenecks and implementing process improvements to enhance productivity.

8. Describe your experience with managing accounts receivable and collecting past-due payments.

- Following established collection procedures to recover overdue payments effectively.

- Negotiating payment arrangements and restructuring repayment plans with customers.

- Using a variety of collection methods, including phone calls, emails, and letters.

- Maintaining clear records of all collection activities and customer interactions.

- Collaborating with legal counsel when necessary to resolve non-performing accounts.

9. How do you prioritize multiple responsibilities and manage your time effectively?

- Using time management techniques such as prioritizing tasks, setting deadlines, and delegating.

- Breaking down complex tasks into smaller, manageable steps.

- Creating and adhering to a structured work schedule.

- Communicating effectively with supervisors and colleagues to coordinate workloads.

- Seeking support from team members when necessary to ensure timely completion of tasks.

10. How would you contribute to the continuous improvement of credit operations processes and procedures?

- Identifying areas for improvement through data analysis and process reviews.

- Suggesting and implementing innovative solutions to streamline operations and enhance efficiency.

- Collaborating with stakeholders to gather feedback and drive process enhancements.

- Documenting and sharing best practices to promote knowledge transfer and maintain consistency.

- Monitoring industry trends and emerging technologies to implement new and improved practices.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Operations Processor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Operations Processor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Credit Operations Processors are responsible for maintaining the accuracy and integrity of credit data, ensuring compliance with regulations, and providing support to customers.

1. Data Entry and Processing

Key responsibilities include:

- Entering and processing credit applications

- Updating and maintaining customer credit files

- Processing payments and resolving disputes

2. Credit Analysis

Key responsibilities include:

- Analyzing credit applications and making recommendations

- Monitoring customer credit activity and identifying potential risks

- Investigating and resolving credit-related issues

3. Compliance and Reporting

Key responsibilities include:

- Ensuring compliance with all applicable laws and regulations

- Preparing and submitting reports to management and regulatory agencies

- Maintaining documentation and records of all credit-related activities

4. Customer Service

Key responsibilities include:

- Answering customer inquiries and resolving issues

- Providing information about credit products and services

- Building and maintaining relationships with customers

Interview Tips

Preparing for an interview for a Credit Operations Processor position requires researching the company, practicing answering common interview questions, and presenting yourself professionally. Here are some tips and tricks to help you ace your interview:

1. Research the Company

Before your interview, take the time to research the company’s website, social media pages, and news articles. This will give you a good understanding of the company’s culture, values, and goals. You can also use this information to tailor your answers to the interviewer’s questions.

2. Practice Answering Common Interview Questions

There are a number of common interview questions that you’re likely to be asked in an interview for a Credit Operations Processor position. Some of the most common questions include:

- Tell me about your experience in credit operations.

- What are your strengths and weaknesses as a Credit Operations Processor?

- Why are you interested in working for this company?

- What are your salary expectations?

Take some time to practice answering these questions in a clear and concise way. You can also prepare some questions of your own to ask the interviewer.

3. Dress Professionally

First impressions matter, so dress professionally for your interview. This means wearing a suit or business casual attire. You should also make sure that your clothes are clean and pressed.

4. Be Punctual

Punctuality is important for any interview, but it’s especially important for interviews in the financial industry. Aim to arrive at your interview location at least 15 minutes early. This will give you time to relax and prepare yourself for the interview.

5. Be Confident

Confidence is key in any interview situation. Believe in yourself and your abilities, and let the interviewer know that you’re the right person for the job.

6. Follow Up

After your interview, send a thank-you note to the interviewer. This is a great way to show your appreciation for the opportunity to interview and to reiterate your interest in the position.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Credit Operations Processor role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.