Feeling lost in a sea of interview questions? Landed that dream interview for Deputy Insurance Commissioner but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Deputy Insurance Commissioner interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

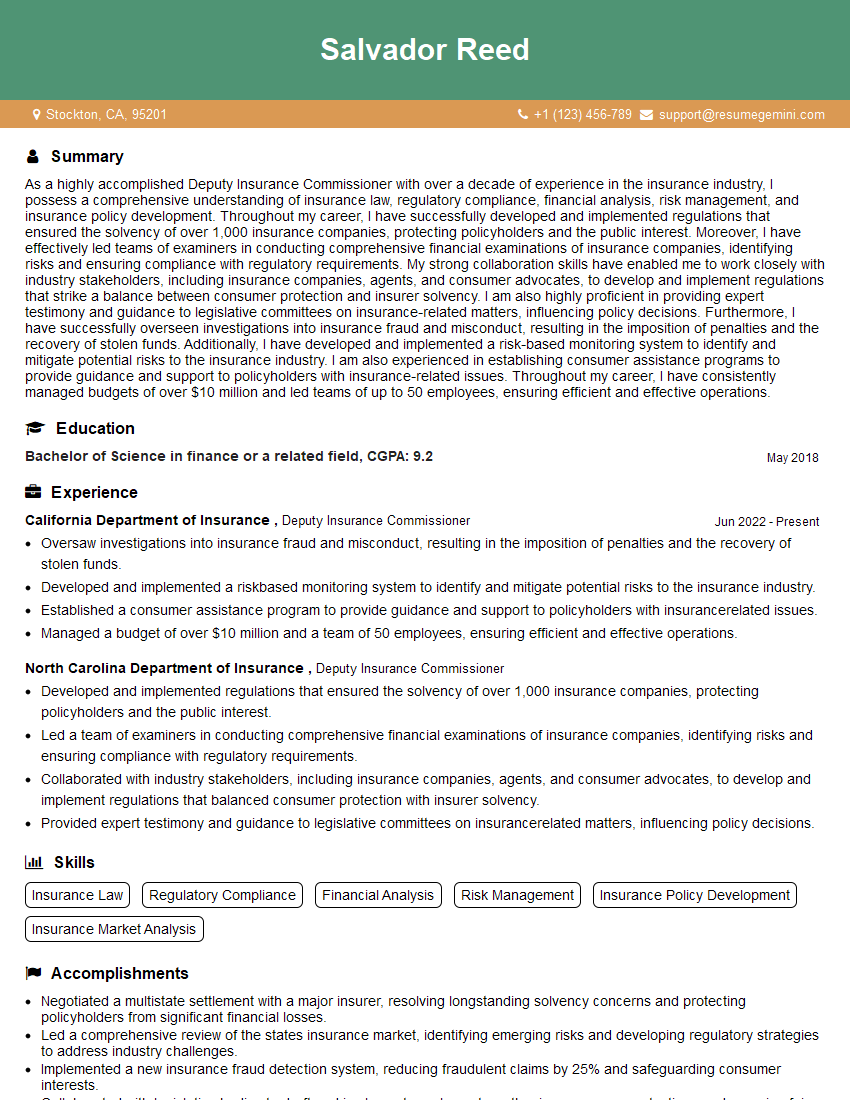

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Deputy Insurance Commissioner

1. How would you approach the task of reviewing an insurance company’s financial statements to assess its solvency?

Example Answer:

- Review the company’s balance sheet to understand its assets, liabilities, and equity.

- Analyse the company’s income statement to assess its revenue, expenses, and profitability.

- Review the company’s cash flow statement to assess its liquidity and cash flow.

- Calculate the company’s key financial ratios, such as its debt-to-equity ratio and current ratio.

- Compare the company’s financial ratios to industry benchmarks to assess its solvency.

2. What are the key risk factors that you would consider when evaluating an insurance company’s underwriting process?

Example Answer:

- Inadequate underwriting standards

- Lack of diversification in the insurance portfolio

- Catastrophic events

- Fraudulent claims

- Changes in the regulatory environment

3. How would you go about investigating a complaint against an insurance company?

Example Answer:

- Review the complaint to understand the nature of the issue.

- Contact the insurance company to get its perspective on the issue.

- Request documents from the insurance company to support its position.

- Interview the complainant to get their account of the issue.

- Make a determination based on the evidence and apply relevant laws and regulations.

4. What are the key elements of an effective insurance regulation program?

Example Answer:

- Strong regulatory authority with adequate resources and expertise.

- Clear and concise regulations that are based on sound actuarial principles.

- Effective enforcement of regulations.

- Close cooperation between regulators and insurance companies.

- Regular review of the regulatory program to ensure its effectiveness.

5. How would you approach the task of developing and implementing a new insurance regulation?

Example Answer:

- Identify the need for the new regulation.

- Develop a draft regulation based on sound actuarial principles.

- Seek input from stakeholders, including industry representatives, consumer advocates, and other regulators.

- Finalise the regulation and publish it for public comment.

- Implement the regulation and monitor its effectiveness.

6. What are the key challenges facing the insurance industry today?

Example Answer:

- Climate change

- Cyber risk

- Rising healthcare costs

- Economic uncertainty

- Technological disruption

7. How would you approach the task of modernizing the insurance industry?

Example Answer:

- Leverage technology to improve efficiency and customer service.

- Develop new products and services to meet the changing needs of consumers.

- Encourage innovation and experimentation.

- Collaborate with other stakeholders in the insurance ecosystem.

- Promote financial literacy among consumers.

8. What is your understanding of the role of the Deputy Insurance Commissioner?

Example Answer:

Responsibilities:

- Assist the Insurance Commissioner in regulating the insurance industry.

- Review and approve insurance company filings.

- Investigate complaints against insurance companies.

- Develop and implement new insurance regulations.

- Represent the department at industry events and conferences.

Qualifications:

- Strong understanding of insurance law and regulations.

- Experience in insurance regulation or a related field.

- Excellent communication and interpersonal skills.

- Ability to work independently and as part of a team.

- Commitment to public service.

9. What are your strengths and weaknesses as they relate to this position?

Example Answer:

Strengths:

- Strong understanding of insurance law and regulations.

- Extensive experience in insurance regulation.

- Excellent communication and interpersonal skills.

- Ability to work independently and as part of a team.

- Commitment to public service.

Weaknesses:

- Lack of experience in some areas of insurance regulation, such as reinsurance.

- Tendency to be detail-oriented, which can sometimes lead to delays in decision-making.

10. What are your salary expectations for this position?

Example Answer:

- My salary expectations are in line with the market rate for similar positions.

- I am open to negotiating a salary that is fair and commensurate with my experience and qualifications.

- I am more interested in the opportunity to work for a reputable organization and make a meaningful contribution to the insurance industry.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Deputy Insurance Commissioner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Deputy Insurance Commissioner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Deputy Insurance Commissioner is responsible for assisting the Insurance Commissioner in regulating the insurance industry within the jurisdiction.

1. Regulation and Enforcement

Develop and implement regulations, policies, and procedures for the insurance industry.

- Enforce insurance laws and regulations to ensure compliance.

- Conduct investigations and examinations of insurers to assess their financial health and compliance.

2. Policy Development

Analyze industry trends and data to identify areas for policy development.

- Develop and recommend legislation and regulations to address regulatory gaps and protect consumers.

- Provide guidance and support to insurance companies on regulatory compliance.

3. Consumer Protection

Protect the interests of insurance policyholders.

- Respond to consumer complaints and inquiries regarding insurance matters.

- Educate consumers about insurance products and their rights.

4. Collaboration and Outreach

Represent the insurance department at industry events and conferences.

- Work with other state and federal agencies on insurance-related matters.

- Provide training and support to insurance professionals.

Interview Tips

Preparing thoroughly for the interview is crucial to making a positive impression. Here are some tips to help you ace the interview for the Deputy Insurance Commissioner position:

1. Research the Role and Organization

Thoroughly review the job description and research the insurance department where you are applying. Understanding the specific responsibilities and expectations of the role will help you demonstrate your qualifications and interest.

- Identify the key areas of responsibility and how your experience aligns with them.

- Research the department’s recent initiatives and regulatory actions to show your knowledge of the industry.

2. Quantify Your Accomplishments

When describing your past experiences, focus on quantifying your accomplishments using specific metrics or results. This will provide tangible evidence of your contributions and impact.

- Example: Instead of saying “I managed a team of insurance examiners,” say “I led a team of examiners to conduct over 50 insurance company examinations, resulting in the identification of significant financial and compliance risks.”

3. Highlight Your Regulatory Expertise

The Deputy Insurance Commissioner is a key regulatory role. Emphasize your expertise in insurance regulation, including your knowledge of insurance laws, regulations, and industry best practices.

- Discuss your experience in developing or implementing insurance regulations.

- Share examples of how you have successfully resolved complex regulatory issues.

4. Demonstrate Your Leadership and Communication Skills

The Deputy Insurance Commissioner is a leadership position that requires strong communication and interpersonal skills. Highlight experiences where you have effectively led teams, managed stakeholders, and communicated complex technical information to non-technical audiences.

- Example: Describe a time when you successfully negotiated a settlement with an insurance company that resulted in a favorable outcome for consumers.

5. Be Prepared to Discuss Industry Trends

The insurance industry is constantly evolving. Show that you are up-to-date on industry trends and have a forward-looking perspective.

- Discuss your thoughts on emerging insurance technologies and their potential impact on regulation.

- Identify areas where you see a need for regulatory reform or innovation.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Deputy Insurance Commissioner, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Deputy Insurance Commissioner positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.