Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Exchange Operator position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

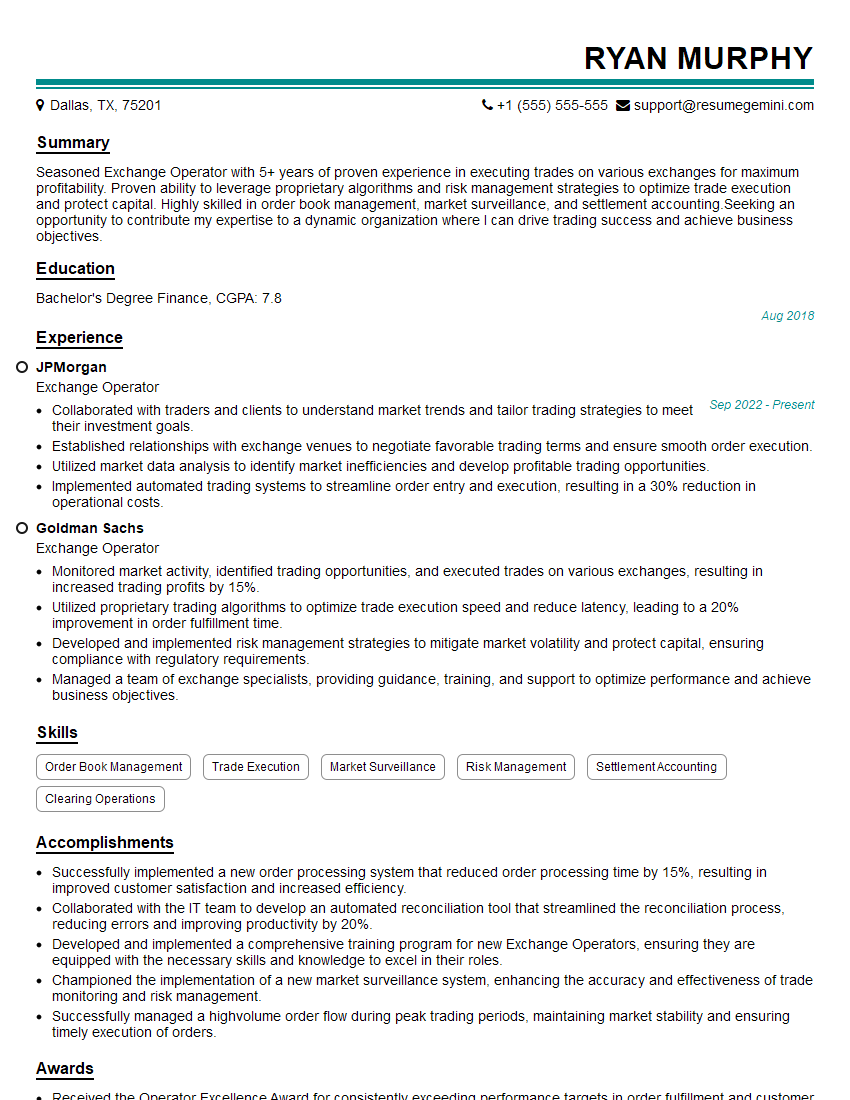

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Exchange Operator

1. Explain the key responsibilities of an Exchange Operator.

– Monitor and manage the trading activities on the exchange – Facilitate the trading process and ensure a fair and orderly market – Maintain accurate records and reports of all trading activity – Respond to inquiries from traders and other market participants – Enforce exchange rules and regulations

2. Describe the different types of trading orders and how they are processed.

Market Order

- Executed immediately at the best available price

- No guarantee of execution at a specific price

Limit Order

- Executed only at or better than a specified price

- Remains in the order book until executed or cancelled

Stop Order

- Triggered when the market price reaches a specified stop price

- Converted to a market order once triggered

3. What are the different types of financial instruments traded on your exchange?

– Stocks – Bonds – Options – Futures – Commodities

4. How do you ensure the security and integrity of the trading system?

– Utilize robust technology and infrastructure – Implement strict security protocols – Regularly monitor and test the system for vulnerabilities – Train staff on security best practices – Comply with all applicable laws and regulations

5. What are the key challenges facing the exchange industry today?

– Increasing competition from new exchanges – Regulatory changes – Technological advancements – Cybersecurity threats

6. How do you stay up-to-date on the latest industry trends and developments?

– Attend industry conferences and webinars – Read industry publications – Network with other professionals – Participate in online forums and discussions

7. What is the most important skill for an Exchange Operator to have?

– Excellent communication and interpersonal skills – Strong understanding of financial markets – Ability to work independently and as part of a team – Attention to detail and accuracy

8. What are your strengths and weaknesses as an Exchange Operator?

Strengths:

– Strong understanding of financial markets

– Excellent communication and interpersonal skills

– Ability to work independently and as part of a team

– Attention to detail and accuracy

Weaknesses:

– Limited experience in a production environment

– Not yet familiar with all of the exchange’s systems and procedures

9. Why are you interested in this role at our exchange?

– I am passionate about the financial markets and have a strong desire to contribute to the success of an exchange. – I believe that my skills and experience would make me a valuable asset to your team. – I am excited about the opportunity to learn from experienced professionals and contribute to the growth of the exchange.

10. What are your career goals?

– I aspire to become a senior Exchange Operator and eventually a manager. – I am confident that my skills and experience will enable me to achieve my goals and make significant contributions to the exchange.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Exchange Operator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Exchange Operator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Exchange Operators play a pivotal role in ensuring the smooth and efficient functioning of financial markets. They are responsible for executing orders on trading floors, monitoring market conditions, and maintaining the integrity of the exchange’s trading systems.

1. Order Execution

Exchange Operators receive orders from market participants via various channels, such as brokers, dealers, and individual traders. They are responsible for accurately and timely executing these orders on the appropriate market.

- Verify and validate order details, including quantity, price, and ticker symbol

- Route orders to the appropriate trading venue, such as the stock exchange or futures market

- Execute orders according to the market’s auction process or matching engine

2. Market Monitoring

Exchange Operators continuously monitor market conditions to identify any unusual or volatile activity. They track market indices, news events, and trading volumes to assess the health and stability of the market.

- Observe market depth, bid-ask spreads, and order imbalances

- Identify and report trading irregularities or potential market disruptions

- Coordinate with market surveillance teams to investigate and resolve any market anomalies

3. System Management

Exchange Operators maintain and manage the exchange’s trading systems, ensuring their reliability, accuracy, and efficiency. They monitor system performance, troubleshoot issues, and implement system upgrades.

- Conduct routine system checks and maintenance

- Identify and resolve system outages or delays

- Implement system upgrades and enhancements

4. Regulatory Compliance

Exchange Operators are obligated to comply with industry regulations and policies that govern the conduct of financial markets. They ensure that trading activities adhere to ethical and legal standards.

- Enforce market rules and regulations

- Assist with regulatory audits and investigations

- Maintain accurate records of all trading activities

Interview Tips

To prepare for an Exchange Operator interview, it’s essential to possess a deep understanding of financial markets, trading systems, and regulatory frameworks. Here are some tips to help you ace the interview:

1. Research the Exchange

Thoroughly research the exchange you are applying to. Understand its market offerings, trading platforms, and regulatory compliance history. This will demonstrate your interest and knowledge of the specific organization.

- Review the exchange’s website, annual reports, and press releases

- Attend industry events or webinars featuring the exchange

2. Practice Technical Skills

Exchange Operators require strong technical skills in trading systems and software. Familiarize yourself with the specific trading platforms and systems used by the exchange. Practice executing orders and monitoring market activity.

- Obtain hands-on experience through trading simulations or online courses

- Learn about market data feeds, order types, and trading protocols

3. Emphasize Regulatory Awareness

Regulatory compliance is a crucial aspect of an Exchange Operator’s role. Highlight your understanding of the regulatory environment governing financial markets.

- Study relevant regulations, such as the Securities and Exchange Commission (SEC) rules

- Familiarize yourself with anti-money laundering and market abuse prevention measures

4. Prepare for Behavioral Questions

Interviewers will assess your behavioral traits and suitability for the role. Prepare for questions that explore your teamwork skills, attention to detail, and ability to handle pressure.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers

- Emphasize your ability to work independently and as part of a team

5. Ask Thoughtful Questions

At the end of the interview, prepare thoughtful questions to ask the interviewers. This shows your engagement and interest in the role. Ask about the exchange’s strategic direction, growth opportunities, or industry trends.

- Avoid generic or superficial questions

- Tailor your questions to the specific exchange and industry

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Exchange Operator interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.