Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Factorer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

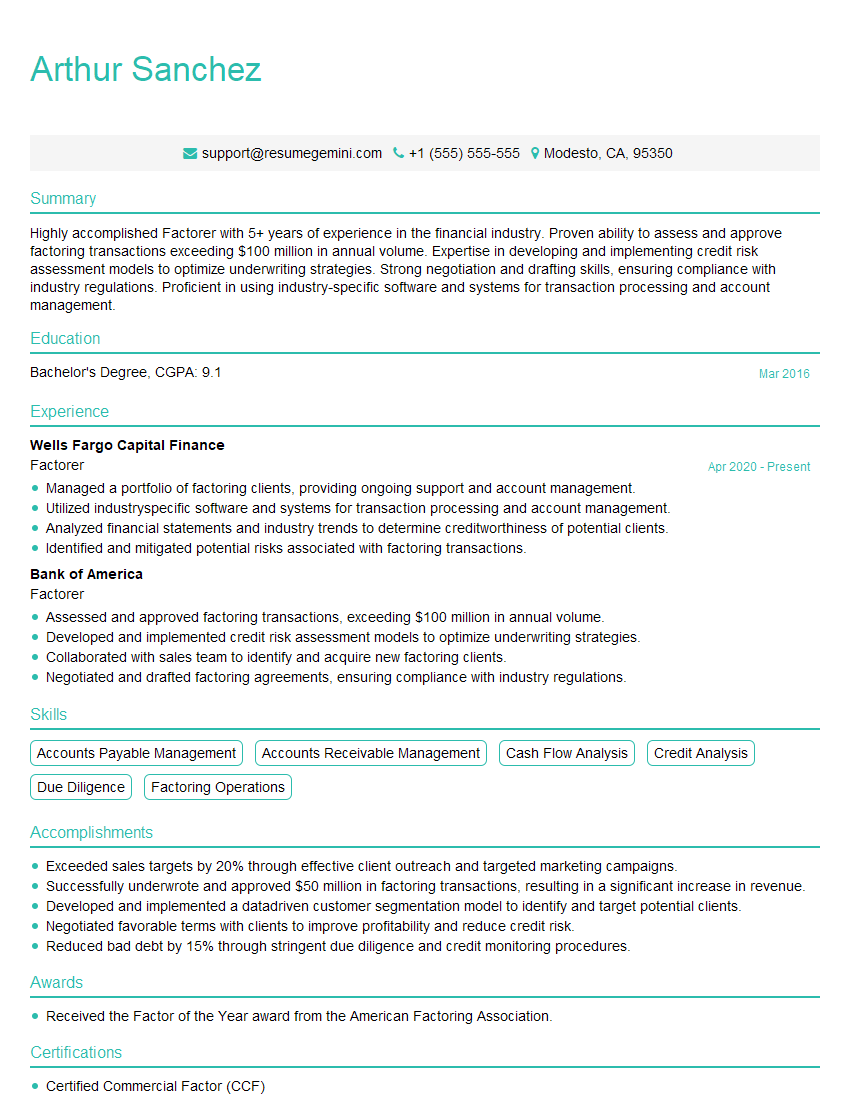

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Factorer

1. What are the key considerations when evaluating a factoring transaction?

When evaluating a factoring transaction, I consider the following key factors:

- The creditworthiness of the account debtor: I assess the financial health and payment history of the account debtor to determine the likelihood of payment.

- The terms of the factoring agreement: I review the fees, interest rates, and other terms to ensure they are acceptable to both parties.

- The value of the receivables: I evaluate the amount and quality of the receivables being factored to determine the potential return on investment.

- The impact on the company’s cash flow: I assess how factoring will affect the company’s cash flow and overall financial position.

- The potential risks involved: I identify and evaluate any potential risks associated with the factoring transaction, such as the risk of non-payment by the account debtor.

2. How do you determine the appropriate factoring rate for a client?

To determine the appropriate factoring rate for a client, I consider the following factors:

Market Conditions

- Current market interest rates

- Demand for factoring services

- Competition in the factoring industry

Client-Specific Factors

- Creditworthiness of the client

- Volume and quality of receivables

- Payment history

- Size and industry of the client

Factor’s Operating Costs

- Cost of funds

- Administrative expenses

- Risk assessment and management

3. What strategies do you use to mitigate the risk of bad debts in factoring?

- Credit analysis and due diligence: I thoroughly evaluate the creditworthiness of potential account debtors before approving a factoring transaction.

- Diversification: I spread my factoring portfolio across a range of clients and industries to reduce the risk of losses from any one source.

- Credit insurance: I may purchase credit insurance to protect against the risk of non-payment by account debtors.

- Ongoing monitoring: I regularly monitor the financial health and payment patterns of my clients to identify potential problems early on.

- Collections: I have a team of experienced collectors who work to recover outstanding receivables as efficiently as possible.

4. How do you structure a factoring agreement that is beneficial for both the client and the factor?

To structure a factoring agreement that is beneficial for both parties, I consider the following principles:

- Clear and concise language: The agreement should be easy to understand and avoid any ambiguity.

- Fair pricing: The factoring rate should be competitive and reasonable for both parties.

- Flexibility: The agreement should be flexible enough to accommodate the changing needs of the client and the factor.

- Protections for both parties: The agreement should include provisions to protect the interests of both the client and the factor, such as recourse and non-recourse options.

5. What are the different types of factoring services?

- Recourse factoring: The client remains responsible for the credit risk of the account debtor.

- Non-recourse factoring: The factor assumes the credit risk of the account debtor.

- Spot factoring: The factor purchases individual invoices on an ad hoc basis.

- Bulk factoring: The factor purchases a large volume of receivables at a discounted rate.

- Invoice discounting: The factor provides a loan against the value of the client’s receivables.

6. What industries are best suited for factoring?

- Manufacturing: Companies that sell goods to other businesses

- Distribution: Companies that buy and sell goods

- Transportation: Companies that provide transportation services

- Professional services: Companies that provide professional services, such as accounting, legal, and consulting

- Healthcare: Companies that provide healthcare services

7. What are the advantages and disadvantages of factoring?

Advantages

- Improved cash flow

- Reduced risk of bad debts

- Access to additional capital

- Administrative support

Disadvantages

- Cost

- Loss of control over receivables

- Potential for recourse

8. What are the key trends in the factoring industry?

- Increased use of technology: Factoring companies are increasingly using technology to streamline their processes and improve efficiency.

- Growth of non-recourse factoring: Non-recourse factoring is becoming more popular as clients seek to reduce their credit risk.

- Expansion into new markets: Factoring companies are expanding into new markets, such as emerging economies and specialized industries.

- Increased regulation: The factoring industry is increasingly regulated, which is driving up compliance costs for factors.

9. How do you stay up-to-date on the latest developments in the factoring industry?

- Attend industry events and conferences: I attend industry events and conferences to network with other professionals and learn about the latest trends.

- Read industry publications: I read industry publications, such as trade magazines and newsletters, to stay informed about the latest news and developments.

- Take continuing education courses: I take continuing education courses to enhance my knowledge and skills.

- Network with other professionals: I network with other professionals in the factoring industry to exchange ideas and insights.

10. What do you consider to be the most important skills for a successful factor?

- Strong financial analysis skills: Factors must be able to assess the creditworthiness of potential clients and the value of their receivables.

- Excellent communication skills: Factors must be able to communicate effectively with clients, account debtors, and other stakeholders.

- Negotiation skills: Factors must be able to negotiate favorable terms for factoring agreements.

- Risk management skills: Factors must be able to identify and manage risks associated with factoring transactions.

- Customer service skills: Factors must be able to provide excellent customer service to their clients.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Factorer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Factorer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Factorer plays a vital role in the financial operations of a company by managing the sale and factoring of accounts receivable.

1. Factoring Accounts Receivable

A Factorer is primarily responsible for evaluating, purchasing, and managing accounts receivable from a company’s customers.

- Conduct credit checks and due diligence on customers to assess their creditworthiness.

- Analyze and evaluate accounts receivable to determine their eligibility for factoring.

- Negotiate and establish factoring agreements with clients, outlining terms and conditions.

- Monitor the performance of accounts receivable and follow up with customers to ensure timely payments.

2. Managing Cash Flow

By purchasing accounts receivable, a Factorer provides companies with immediate access to cash, improving their cash flow.

- Advance a percentage of the value of accounts receivable to clients, typically between 70-90%.

- Track and manage collections from customers on behalf of the client.

- Provide ongoing cash flow analysis and reporting to clients.

- Monitor the client’s financial performance and provide advice on cash flow management.

3. Mitigating Credit Risk

Factoring helps reduce credit risk for companies by assuming the responsibility of collecting from customers.

- Conduct thorough credit checks on customers before approving factoring agreements.

- Monitor customer payment history and identify potential credit issues.

- Establish recourse or non-recourse factoring options, depending on the client’s risk tolerance.

- Provide credit insurance or other mechanisms to protect against customer defaults.

4. Enhancing Customer Relationships

A Factorer can act as a liaison between a company and its customers, fostering strong relationships.

- Communicate with customers about factoring arrangements and answer any questions.

- Provide customer support and resolve any issues related to payments or account queries.

- Monitor customer satisfaction and provide feedback to the client company.

Interview Tips

Preparing thoroughly for a Factorer interview can increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Company and Role

Before the interview, take the time to research the company you’re applying to and the specific Factorer role.

- Review the company’s website, financial reports, and industry news.

- Identify the specific responsibilities and requirements of the Factorer position.

2. Quantify Your Experience and Skills

When describing your experience and skills, be sure to quantify your accomplishments whenever possible.

- Use specific numbers and metrics to demonstrate the impact of your work.

- Highlight instances where you improved cash flow, reduced credit risk, or enhanced customer relationships.

3. Emphasize Your Analytical and Communication Skills

Factoring requires strong analytical and communication skills.

- Demonstrate your ability to analyze financial data and make sound decisions.

- Highlight your experience in communicating effectively with clients and internal stakeholders.

4. Prepare for Industry-Specific Questions

Be prepared to answer questions related to the factoring industry and current trends.

- Research industry publications and attend industry events to stay up-to-date.

- Develop opinions on key industry issues and be able to articulate them clearly.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Factorer interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.