Feeling lost in a sea of interview questions? Landed that dream interview for Financial Institution President but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Financial Institution President interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

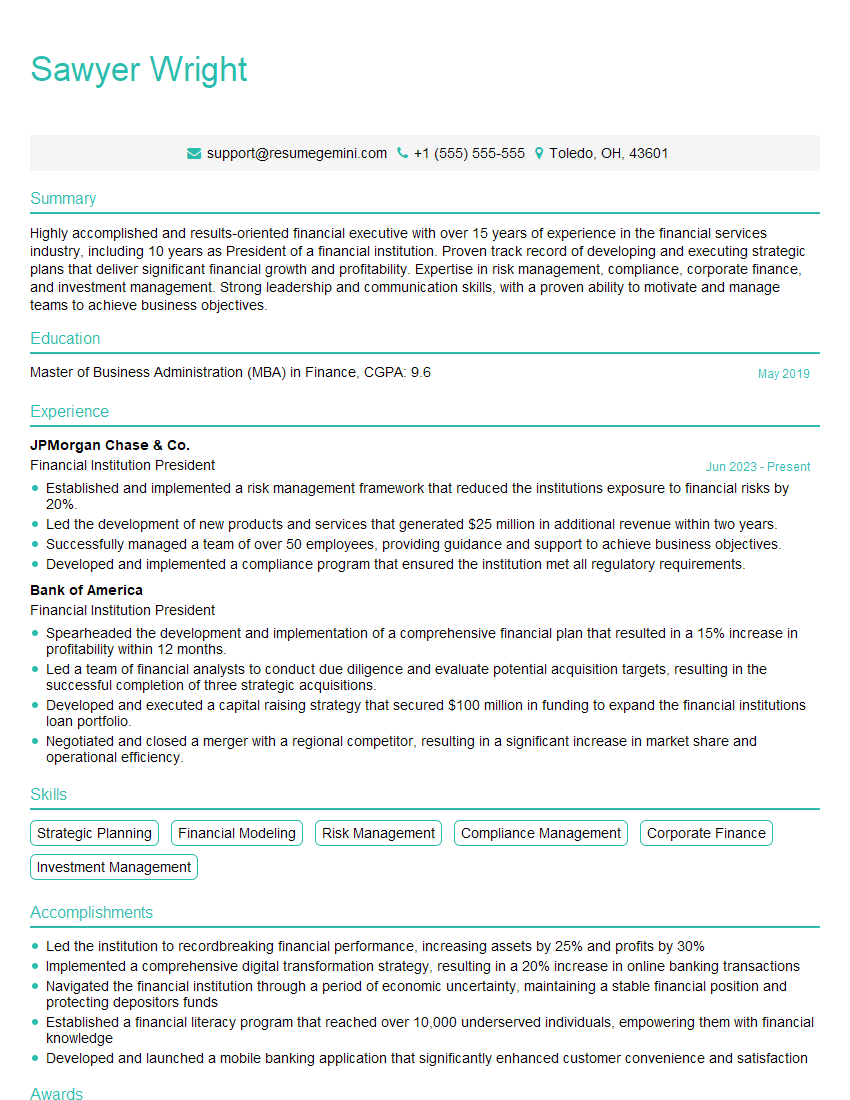

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Institution President

1. What are the key challenges facing the financial services industry today?

Some of the key challenges facing the financial services industry today include:

- Increased competition: The financial services industry is becoming increasingly competitive, with new entrants and innovative technologies disrupting the market.

- Changing customer expectations: Customers are becoming more demanding and expect a higher level of service and convenience from their financial institutions.

- Regulatory changes: The financial services industry is heavily regulated, and new regulations are constantly being introduced. This can be a challenge for institutions to comply with.

- Cybersecurity threats: Financial institutions are increasingly targeted by cyberattacks, which can lead to data breaches and financial losses.

- Economic uncertainty: The global economy is facing a number of challenges, such as the COVID-19 pandemic and the war in Ukraine. This uncertainty can impact the financial performance of financial institutions.

2. What are your thoughts on the role of technology in the future of financial services?

Leveraging AI and Machine Learning

- AI and machine learning can be used to automate tasks, improve risk management, and provide personalized customer service.

- This can help financial institutions to reduce costs, increase efficiency, and improve the customer experience.

Blockchain Technology

- Blockchain technology can be used to create secure and transparent financial transactions.

- This can help to reduce fraud, improve settlement times, and lower costs.

Cloud Computing

- Cloud computing can help financial institutions to access data and applications from anywhere, at any time.

- This can increase flexibility, scalability, and cost-effectiveness.

3. What are your key priorities as President of this financial institution?

My key priorities as President of this financial institution would be to:

- Develop a strategic plan to guide the institution’s growth and success.

- Improve the customer experience by providing excellent service and innovative products.

- Increase profitability by growing revenue and reducing costs.

- Manage risk by identifying and mitigating potential threats.

- Foster a culture of innovation by encouraging employees to think creatively and take risks.

4. How do you plan to achieve these priorities?

I plan to achieve these priorities by:

- Working with the board of directors to develop a strategic plan that is aligned with the institution’s mission, vision, and values.

- Empowering employees to deliver excellent customer service and develop innovative products.

- Investing in technology to improve efficiency and reduce costs.

- Implementing a robust risk management framework to identify and mitigate potential threats.

- Creating a culture of innovation by encouraging employees to share ideas and take risks.

5. What are your strengths and weaknesses as a leader?

Strengths:

- Strategic thinking: I am able to think strategically and develop long-term plans.

- Communication: I am an effective communicator and can clearly articulate my vision and goals.

- Teamwork: I am a team player and can work effectively with others to achieve common goals.

- Decision-making: I am able to make sound decisions under pressure.

- Resilience: I am resilient and able to overcome challenges.

Weaknesses:

- Delegation: I sometimes have difficulty delegating tasks and can be a bit of a perfectionist.

- Impatience: I can sometimes be impatient and want to see results quickly.

6. What is your management style?

My management style is collaborative and empowering. I believe that the best results are achieved when everyone on the team is involved in the decision-making process.

I am also a firm believer in giving employees the freedom to make mistakes and learn from them. I believe that this is the best way to foster a culture of innovation and creativity.

7. How do you stay up-to-date on the latest trends in the financial services industry?

I stay up-to-date on the latest trends in the financial services industry by:

- Reading industry publications

- Attending conferences and webinars

- Networking with other professionals

- Taking online courses

- Experimenting with new technologies

8. What is your experience with mergers and acquisitions?

I have experience with mergers and acquisitions in a number of roles, including:

- As an investment banker, I advised clients on mergers and acquisitions.

- As a corporate development executive, I led the acquisition of several companies.

- As a financial consultant, I helped companies integrate after a merger.

9. What are your thoughts on the future of the community banking industry?

I believe that the community banking industry has a bright future. Community banks play a vital role in the local economy, providing financial services to businesses and consumers.

However, community banks must adapt to the changing landscape of the financial services industry. This includes investing in technology and developing new products and services.

10. How do you manage risk?

I manage risk by:

- Identifying potential risks

- Assessing the likelihood and impact of these risks

- Developing strategies to mitigate these risks

- Monitoring these risks on an ongoing basis

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Institution President.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Institution President‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Institution Presidents hold the utmost responsibility within their organizations. They are tasked with overseeing the entirety of the institution’s operations, ensuring its financial health, and driving its strategic direction. Their key responsibilities include:

1. Strategic Planning and Vision

Presidents establish and execute long-term strategies for their institutions, aligning them with market trends, regulatory requirements, and stakeholder expectations.

2. Financial Management

They oversee the institution’s financial performance, including budgeting, revenue generation, and risk management. They ensure the institution meets its financial goals and maintains a sound financial position.

3. Regulatory Compliance

Presidents ensure their institutions comply with all applicable laws and regulations, including those governing banking, securities, and consumer protection.

4. Risk Management

They identify, assess, and mitigate financial, operational, and reputational risks that may impact the institution.

5. Relationship Management

Presidents build and maintain strong relationships with key stakeholders, including customers, investors, regulators, and the community.

6. Innovation and Technology

They promote innovation and technology adoption to enhance efficiency, improve customer experiences, and drive growth.

7. Corporate Governance

Presidents ensure the institution has a strong corporate governance structure and that its operations are conducted ethically and transparently.

8. Talent Management

They lead the development and management of talent, ensuring the institution has a skilled and motivated workforce.

Interview Tips

To ace the interview for a Financial Institution President position, candidates should:

1. Research the Institution

Thoroughly research the institution’s history, financial performance, strategic direction, and regulatory environment.

2. Practice Common Interview Questions

Prepare answers to common interview questions, including those about your experience, skills, and leadership style.

3. Highlight Your Accomplishments

Quantify your achievements and provide specific examples of how you have contributed to the success of your previous organizations.

4. Be Confident and Enthusiastic

Project confidence and enthusiasm during the interview. Demonstrate your passion for the financial industry and your commitment to the institution.

5. Ask Thoughtful Questions

Prepare thoughtful questions to ask the interviewer. This shows your engagement and interest in the position and the institution.

6. Dress Professionally

Make a positive first impression by dressing professionally and arriving on time for the interview.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Financial Institution President role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.