Are you gearing up for an interview for a Financial Recording Clerk position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Financial Recording Clerk and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

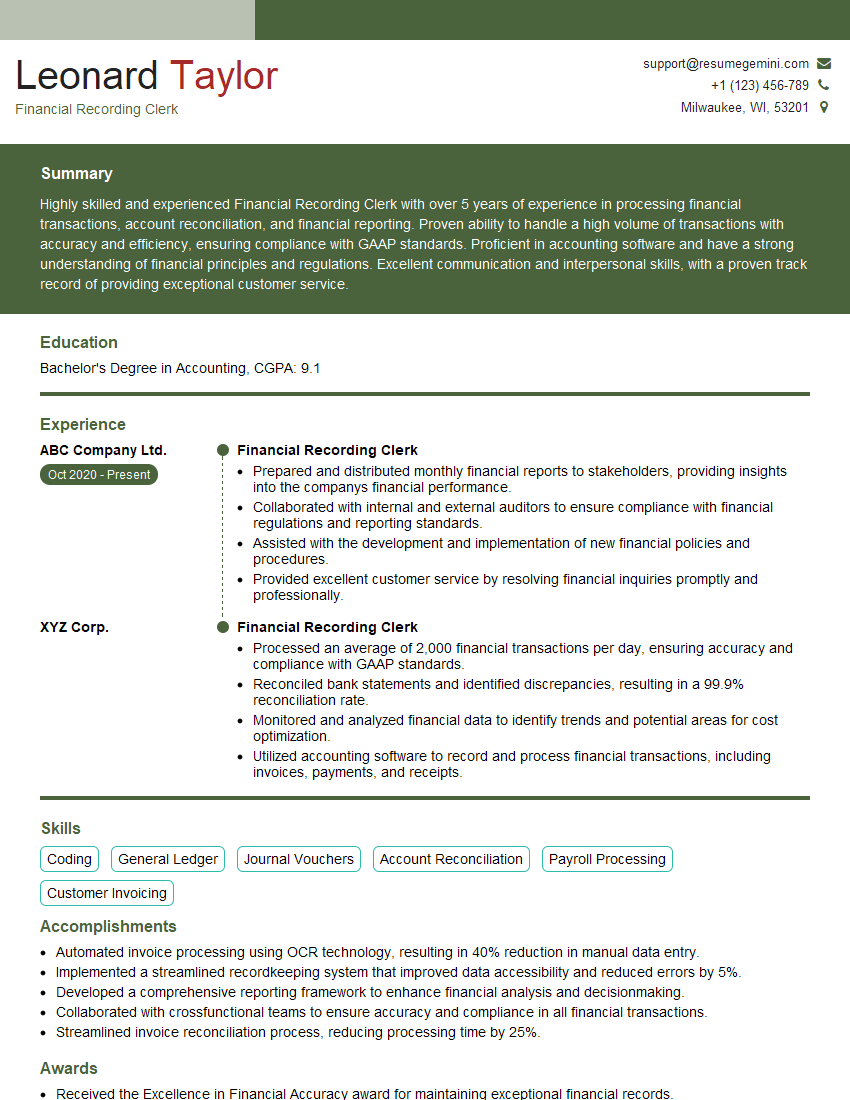

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Recording Clerk

1. How would you ensure the accuracy of your financial recordings?

As a detail-oriented and meticulous individual, I take several measures to ensure the accuracy of my financial recordings:

- Double-checking and cross-referencing: I carefully review all transactions and supporting documentation multiple times to minimize errors.

- Utilizing technology: I leverage accounting software and spreadsheets to automate calculations and reduce manual entry errors.

- Regular reconciliations: I perform regular reconciliations to identify and correct any discrepancies between recorded transactions and bank statements.

2. Describe your experience with various accounting software and systems.

Accounting Software Expertise:

- Proficient in QuickBooks Online and Desktop

- Experience with NetSuite and SAP Business One

- Knowledge of Microsoft Excel and Google Sheets for financial analysis and reporting

Accounting Systems Understanding:

- Familiar with GAAP and IFRS accounting principles

- Understanding of financial statement preparation

- Experience with inventory management systems

3. How do you handle confidential financial information?

Treating confidential financial information with the utmost integrity is paramount to me:

- Secure Storage: I store all sensitive documents in a locked cabinet or access-controlled electronic system.

- Limited Access: I only share information with authorized personnel on a need-to-know basis.

- Compliance with Regulations: I adhere to all applicable privacy and data protection laws and regulations.

4. Explain your understanding of bank reconciliations.

Bank reconciliations are crucial for ensuring the accuracy of financial records:

- Matching Transactions: I compare bank statements with recorded transactions to identify any unmatched items.

- Investigating Differences: I analyze discrepancies to determine their nature, such as errors, outstanding checks, or deposits in transit.

- Adjusting Accounts: If necessary, I make appropriate adjustments to the cash balance and other accounts to reconcile the differences.

5. Describe how you stay up-to-date with changes in accounting rules and regulations.

Staying informed about accounting updates is essential for maintaining accuracy:

- Continuing Education: I participate in seminars, workshops, and online courses to enhance my knowledge.

- Professional Reading: I subscribe to accounting publications and regularly review industry news.

- Networking: I connect with other accounting professionals to exchange information and stay abreast of best practices.

6. How do you manage your time and prioritize tasks effectively?

Time management is crucial to ensure timely and accurate financial recordings:

- Prioritization: I prioritize tasks based on importance and urgency, using tools like to-do lists and project management software.

- Planning and Scheduling: I plan my workday and allocate specific time slots for different tasks.

- Delegation: When appropriate, I delegate tasks to colleagues to ensure efficient workload distribution.

7. How do you handle errors or discrepancies in financial records?

Handling errors and discrepancies is an important aspect of financial recording:

- Identify and Investigate: I promptly identify errors and investigate their root causes to prevent recurrence.

- Corrective Action: I take appropriate corrective action to correct errors and ensure data integrity.

- Documentation: I document all errors and the steps taken to resolve them for audit purposes.

8. Explain your experience with handling high volumes of financial transactions.

Managing high transaction volumes requires efficiency and accuracy:

- Efficient Processing: I have experience in processing a large number of transactions quickly and accurately.

- Data Entry Automation: I utilize technology to automate data entry and minimize errors.

- Batch Processing: I use batch processing techniques to improve efficiency and reduce manual errors.

9. Describe your strengths and weaknesses as a Financial Recording Clerk.

Strengths:

- Exceptional attention to detail and accuracy

- Proficient in accounting principles and software

- Strong time management and prioritization skills

Weaknesses:

- I am still developing my knowledge of IFRS accounting standards.

- I am working on improving my speed in processing high volumes of transactions.

10. Why are you interested in this Financial Recording Clerk position?

I am eager to join your organization because:

- Alignment with Skills: My skills and experience in financial recording align perfectly with the requirements of this position.

- Growth Opportunities: I am confident that this role will provide me with valuable opportunities to enhance my knowledge and contribute to the company’s success.

- Company Reputation: I am impressed by the company’s reputation for excellence and its commitment to ethical accounting practices.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Recording Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Recording Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Financial Recording Clerk, you’ll perform a range of essential tasks to maintain accurate financial records for an organization.

1. Data Entry and Processing

Meticulously enter and process financial data, ensuring its accuracy and completeness.

- Handle transactions, invoices, receipts, and payments.

- Update financial systems and databases.

2. Posting and Reconciling Transactions

Post financial transactions to appropriate accounts and reconcile them for accuracy.

- Review bank statements and compare them to internal records.

- Identify and resolve discrepancies.

3. Maintaining Financial Records

Maintain up-to-date financial records in compliance with accounting principles.

- File and organize financial documents.

- Prepare reports and summaries as required.

4. Assisting in Financial Reporting

Assist in preparing financial reports and disclosures for internal and external stakeholders.

- Provide data and information for financial analysis.

- Contribute to the development of financial policies and procedures.

Interview Tips

To ace your interview for a Financial Recording Clerk position, consider the following preparation tips:

1. Research the Company and Role

Thoroughly research the organization and the specific Financial Recording Clerk role to gain a deep understanding of their business, culture, and requirements.

- Visit the company website and social media pages.

- Read industry news and articles related to the company and the finance sector.

2. Practice Your Skills

Review your proficiency in financial data entry, posting, and reconciliation techniques. Refresh your knowledge of accounting concepts and principles.

- Set up a mock financial system and practice entering and processing transactions.

- Solve reconciliation problems to demonstrate your accuracy and attention to detail.

3. Quantify Your Accomplishments

Highlight your past accomplishments and contributions in financial recording tasks. Use specific metrics and examples to demonstrate your impact.

- Quantify the number of transactions processed or reconciled in a given period.

- Describe how you improved accuracy or reduced errors in financial reporting.

4. Prepare for Common Interview Questions

Anticipate common interview questions for the Financial Recording Clerk role and prepare thoughtful answers that showcase your skills and experience.

- Describe your experience in maintaining financial records.

- Explain how you ensure the accuracy and integrity of financial data.

5. Practice Your Communication Skills

Financial Recording Clerks interact with various stakeholders, including accountants, auditors, and managers. Practice communicating clearly and confidently.

- Role-play scenarios where you need to explain technical information to non-finance professionals.

- Ask a friend or family member to provide feedback on your communication style.

6. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally and arrive on time for your interview. Punctuality and appropriate attire demonstrate respect for the interviewer and the organization.

- Wear a suit or business casual attire.

- Be well-groomed and avoid excessive jewelry or fragrances.

7. Follow Up

After the interview, send a thank-you note to the interviewer expressing your appreciation for their time and consideration. Reiterate your interest in the position and highlight any additional qualifications you may have.

- Send an email within 24 hours of the interview.

- Keep your follow-up note brief and professional.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Financial Recording Clerk role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.