Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Fiscal Technician position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

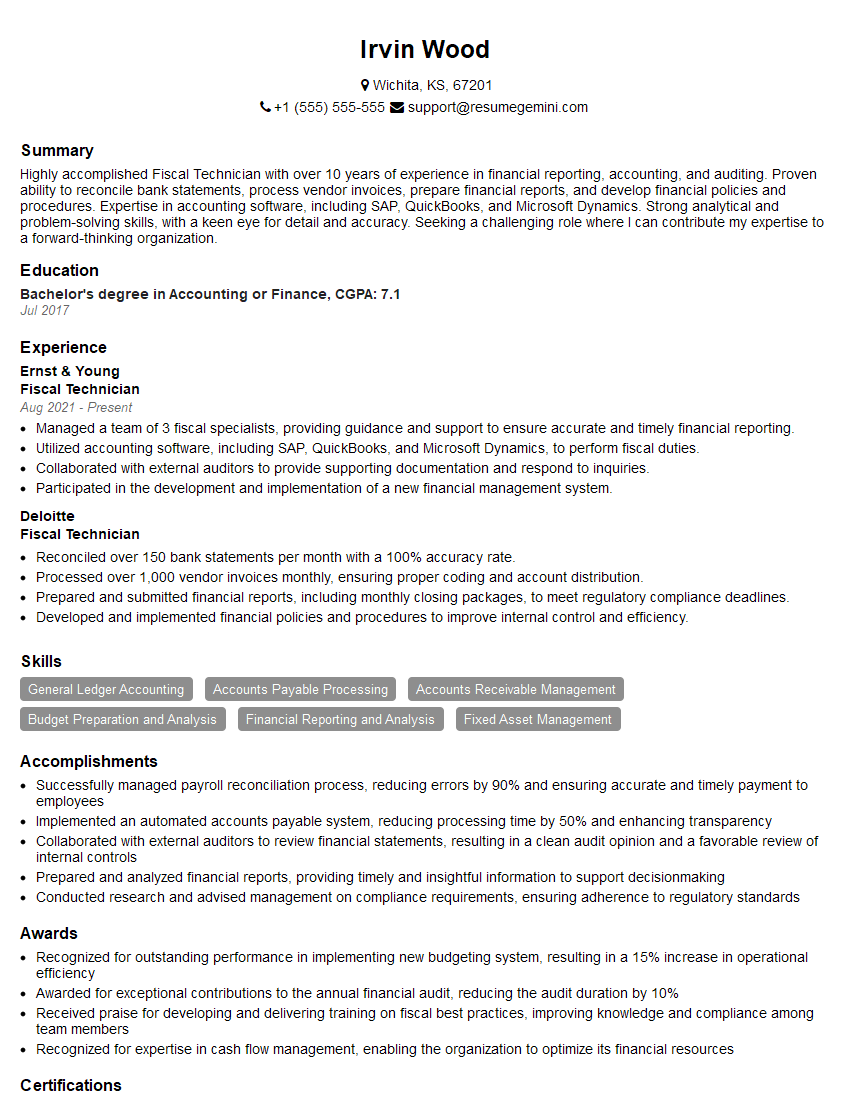

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Fiscal Technician

1. What is the difference between an appropriation and a budget?

An appropriation is a legal authorization to spend money for a specific purpose, while a budget is a plan for how money will be spent.

2. What are the different types of funds that a government can use?

General funds

- Can be used for any purpose

- Are the most flexible type of fund

Special revenue funds

- Can only be used for a specific purpose

- Are less flexible than general funds

Capital projects funds

- Can only be used for capital projects

- Are the least flexible type of fund

3. What is the accounting cycle?

- Recording transactions

- Posting transactions to the general ledger

- Preparing financial statements

- Closing the books

4. What are the different types of financial statements?

- Balance sheet

- Income statement

- Statement of cash flows

- Statement of changes in equity

5. What are the key elements of internal control?

- Control environment

- Risk assessment

- Control activities

- Information and communication

- Monitoring

6. What are the different types of audits?

- Financial audit

- Performance audit

- Compliance audit

- Operational audit

7. What are the key differences between a financial audit and a performance audit?

- Financial audits focus on the accuracy and reliability of financial information, while performance audits focus on the efficiency and effectiveness of operations.

- Financial audits are typically conducted by independent auditors, while performance audits can be conducted by internal or external auditors.

8. What are the benefits of internal auditing?

- Improved financial reporting

- Reduced risk of fraud

- Enhanced operational efficiency

- Increased stakeholder confidence

9. What are the challenges of internal auditing?

- Gaining access to information

- Getting buy-in from management

- Maintaining independence

- Keeping up with changing regulations

10. What are the qualities of a good fiscal technician?

- Strong accounting skills

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- Attention to detail

- Problem-solving skills

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Fiscal Technician.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Fiscal Technician‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Fiscal Technician is responsible for performing a variety of accounting and fiscal tasks in support of the organization’s financial operations.

1. Accounts Payable

Process and record accounts payable transactions, including invoices, check requests, and payments.

2. Accounts Receivable

Process and record accounts receivable transactions, including invoices, receipts, and cash applications.

3. Bank Reconciliation

Reconcile bank statements on a regular basis and resolve any discrepancies.

4. Payroll

Assist with payroll processing, including calculating pay, withholding taxes, and issuing paychecks.

5. Financial Reporting

Assist with the preparation of financial reports, including balance sheets, income statements, and cash flow statements.

Interview Tips

By following these interview tips, you can increase your chances of landing your dream job as a Fiscal Technician. A well prepared candidate always stands out in interview.

1. Research the Company and Position

Take the time to learn about the company’s culture, values, and financial performance. Also, review the job description carefully and make sure you understand the specific responsibilities of the position.

2. Practice Your Answers to Common Interview Questions

There are certain questions that are commonly asked in Fiscal Technician interviews. Prepare your answers to these questions in advance so that you can deliver them confidently and concisely. Some common interview questions are:

- Tell me about your experience in accounts payable and accounts receivable.

- How do you handle reconciling bank statements?

- What is your experience with payroll processing?

- What are your strengths and weaknesses as a Fiscal Technician?

3. Showcase Your Skills and Experience

In your interview, be sure to highlight your skills and experience that are relevant to the position. Use specific examples to demonstrate your abilities.

For example, you could highlight your experience in implementing a new accounts payable system that streamlined the process and reduced errors. Or, you could mention your role in developing and implementing a new payroll system that improved efficiency and compliance.

4. Be Professional and Enthusiastic

First impression matters a lot in interview.

Dress professionally and arrive on time for your interview. Be polite and respectful to everyone you meet, including the receptionist and other employees. Maintain a positive attitude and enthusiasm throughout the interview.

5. Follow Up

After your interview, send a thank-you note to the interviewer. In your note, reiterate your interest in the position and thank the interviewer for their time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Fiscal Technician interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!