Are you gearing up for a career in Foreign Banknote Teller Trader? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Foreign Banknote Teller Trader and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

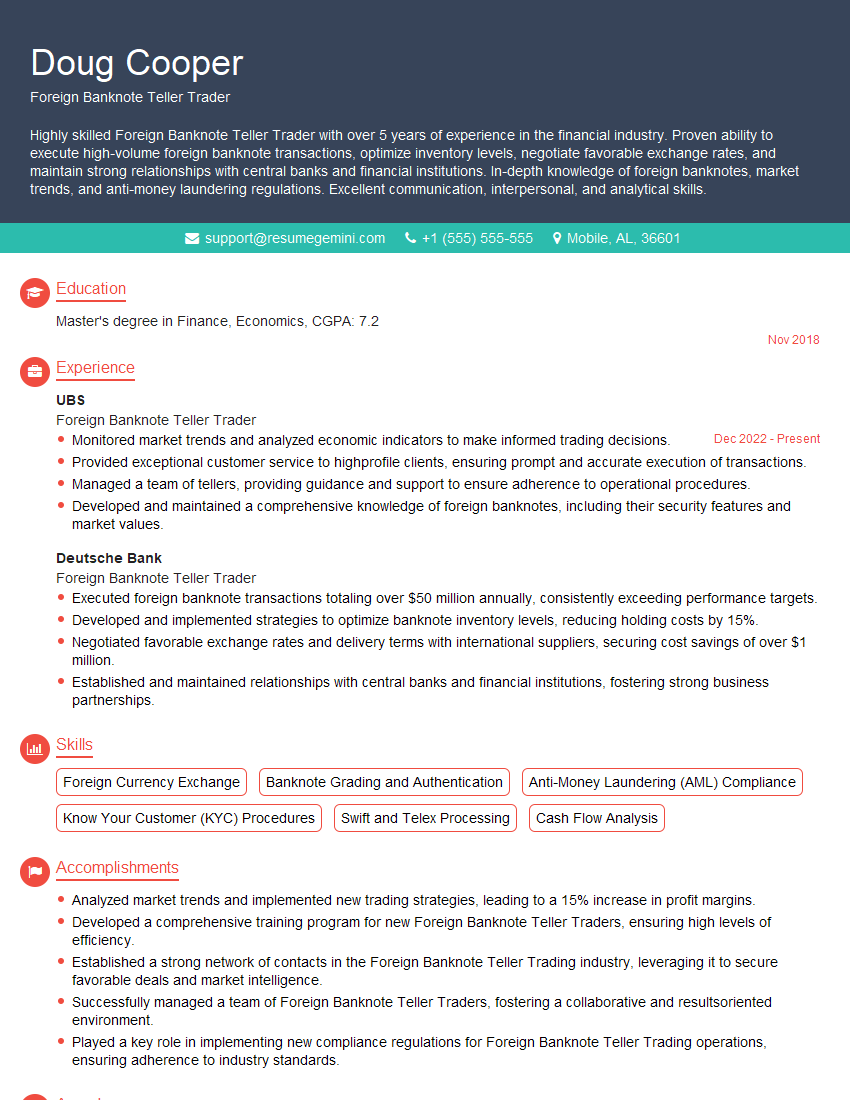

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Foreign Banknote Teller Trader

1. What are the key responsibilities of a Foreign Banknote Teller Trader?

- Buying and selling foreign banknotes in the interbank market.

- Monitoring the foreign exchange market and providing currency forecasts.

- Executing foreign exchange transactions for clients.

- Managing the bank’s foreign banknote inventory.

- Maintaining relationships with other banks and financial institutions.

2. What are the different types of foreign banknote transactions?

Spot Transactions

- Immediate delivery and settlement.

- Typically used for smaller amounts.

Forward Transactions

- Delivery and settlement at a future date.

- Used to manage currency risk.

Swap Transactions

- Simultaneous buying and selling of different currencies.

- Used to hedge against currency fluctuations.

3. What are the key factors that affect the value of foreign banknotes?

- Economic conditions

- Political stability

- Interest rates

- Inflation

- Supply and demand

4. What are the risks associated with foreign banknote trading?

- Currency risk

- Interest rate risk

- Settlement risk

- Operational risk

5. How do you manage the risks associated with foreign banknote trading?

- Hedging

- Diversification

- Risk limits

- Stress testing

6. What are the key regulations that govern foreign banknote trading?

- Bank Secrecy Act

- Anti-Money Laundering Act

- Foreign Corrupt Practices Act

- Banker’s Banknotes Act

7. What are the ethical considerations that must be taken into account when trading foreign banknotes?

- Transparency

- Fair play

- Market integrity

- Client confidentiality

8. What are the key skills and qualities required to be a successful Foreign Banknote Teller Trader?

- Strong understanding of foreign exchange markets

- Excellent communication and negotiation skills

- Ability to work independently and as part of a team

- Detail-oriented and analytical

- Strong ethical values

9. What are the career prospects for a Foreign Banknote Teller Trader?

- Assistant Trader

- Trader

- Senior Trader

- Head Trader

10. Why are you interested in this role and what makes you a good fit for our bank?

I have always been fascinated by the foreign exchange market and the role of banknotes in the global economy. I am confident that I have the skills and experience necessary to be successful in this role, and I am eager to contribute to the success of your bank. I am a highly motivated and results-oriented individual with a strong work ethic and I am confident that I can be a valuable asset to your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Foreign Banknote Teller Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Foreign Banknote Teller Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Foreign Banknote Teller Trader is responsible for a wide range of duties related to the exchange and trading of foreign currency. These responsibilities include:

1. Foreign Currency Exchange

This is the main task of the Foreign Banknote Teller Trader. The trader exchanges foreign currency for customers, ensures that the exchange rates are correct, and verifies the authenticity of the currency.

2. Foreign Currency Trading

The trader may also trade foreign currency on behalf of the bank. This involves buying and selling foreign currency in order to make a profit.

3. Maintaining Inventory

The trader is responsible for maintaining an inventory of foreign currency. This includes keeping track of the amount of currency on hand, as well as the exchange rates.

4. Customer Service

The trader provides customer service to clients who are exchanging or trading foreign currency. This includes answering questions, providing information, and resolving any issues.

Interview Tips

To ace the interview for a Foreign Banknote Teller Trader position, it is important to prepare thoroughly. Here are some tips:

1. Research the company and the position

Take some time to learn about the company you are interviewing with, as well as the specific position you are applying for. This will help you understand the company’s culture and the requirements of the job.

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. Practice your answers to these questions ahead of time so that you can deliver them confidently and concisely.

3. Be prepared to talk about your experience

The interviewer will want to know about your experience in foreign currency exchange and trading. Be prepared to talk about your previous experience, as well as your skills and knowledge.

4. Be enthusiastic and professional

Make sure to be enthusiastic and professional during your interview. This will show the interviewer that you are interested in the position and that you are a good fit for the company.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Foreign Banknote Teller Trader interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!