Feeling lost in a sea of interview questions? Landed that dream interview for Foreign Exchange Clerk but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Foreign Exchange Clerk interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

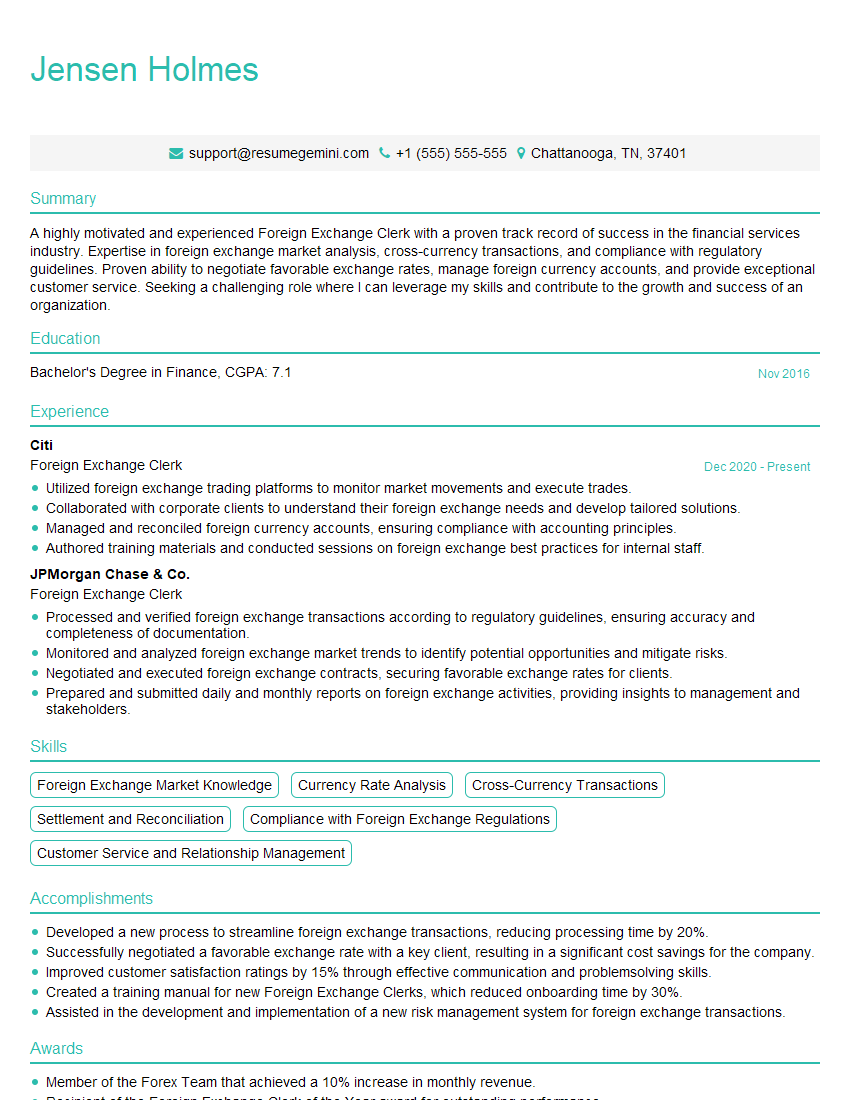

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Foreign Exchange Clerk

1. What are the key responsibilities of a Foreign Exchange Clerk?

As a Foreign Exchange Clerk, I would be responsible for handling a range of tasks related to foreign currency transactions, including:

- Processing foreign exchange orders for clients

- Monitoring foreign exchange rates and market trends

- Providing foreign exchange quotes and advice to clients

- Reconciling foreign exchange accounts and transactions

- Maintaining compliance with regulatory requirements

2. How do you stay up-to-date on foreign exchange market trends and developments?

: Monitoring Market News and Data

- Regularly read industry publications and news sources

- Attend industry conferences and webinars

- Subscribe to market data providers

Subheading: Networking and Collaboration

- Network with other foreign exchange professionals

- Join professional organizations

- Attend industry events

3. What is the importance of risk management in foreign exchange transactions?

Risk management is crucial in foreign exchange transactions to mitigate the potential losses that can arise from fluctuating currency rates. I understand the importance of implementing strategies such as:

- Hedging positions

- Setting stop-loss orders

- Monitoring market conditions

- Understanding the risk appetite of clients

4. What are the different types of foreign exchange transactions?

Foreign exchange transactions can be classified into various types, including:

- Spot transactions: Immediate exchange of currencies at the current market rate

- Forward transactions: Contracts to exchange currencies at a predetermined rate on a future date

- Swap transactions: Exchange of one currency for another and then back again at a later date

- Options transactions: Contracts that give the buyer the right but not the obligation to buy or sell a currency at a specified price on a certain date

5. What are the key factors that affect foreign exchange rates?

Foreign exchange rates are influenced by various factors, including:

- Economic conditions

- Interest rate differentials

- Political stability

- Supply and demand

- Speculation

6. What is the role of the central bank in the foreign exchange market?

The central bank plays a significant role in the foreign exchange market by:

- Managing the country’s foreign exchange reserves

- Setting interest rates

- Intervening in the market to influence the exchange rate

7. What are the ethical considerations in foreign exchange transactions?

Ethical considerations are critical in foreign exchange transactions, including:

- Maintaining confidentiality of client information

- Avoiding conflicts of interest

- Acting with integrity and professionalism

- Complying with regulatory requirements

8. What software or tools are you proficient in for foreign exchange transactions?

I am proficient in using various software and tools for foreign exchange transactions, such as:

- Foreign exchange trading platforms

- Risk management tools

- Market data providers

9. How do you handle discrepancies in foreign exchange transactions?

When discrepancies occur in foreign exchange transactions, I follow a systematic process to resolve them efficiently:

- Identify the discrepancy and its source

- Communicate with relevant parties to gather information

- Reconcile the discrepancy and ensure accuracy

- Document the investigation and resolution process

10. How do you stay motivated and engaged in your work as a Foreign Exchange Clerk?

I remain motivated and engaged in my role as a Foreign Exchange Clerk through:

- The dynamic nature of the foreign exchange market

- The opportunity to contribute to the success of my clients

- The continuous learning and development required to stay up-to-date in the field

- The rewarding feeling of helping clients navigate the complexities of foreign exchange transactions

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Foreign Exchange Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Foreign Exchange Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Foreign Exchange Clerk plays a crucial role in the financial sector by assisting with international currency exchange transactions. Their primary responsibilities encompass various aspects of foreign exchange, as detailed below:

1. Currency Exchange Processing

Execute foreign currency exchange transactions based on customer requests, ensuring accurate conversion rates and timely processing.

- Convert currencies between different countries, considering exchange rates and market fluctuations.

- Adhere to compliance regulations and internal policies while processing transactions.

2. Account Management

Maintain and update customer accounts, ensuring accurate records and timely reconciliation of transactions.

- Track customer account balances and transaction history.

- Reconcile accounts regularly to identify and resolve discrepancies.

3. Customer Service and Support

Provide exceptional customer service, promptly addressing inquiries and resolving issues related to foreign exchange transactions.

- Respond to customer inquiries via phone, email, or in person.

- Resolve customer issues related to currency exchange, account balances, and transaction fees.

4. Compliance and Regulatory Adherence

Ensure compliance with all applicable laws, regulations, and internal policies governing foreign exchange transactions.

- Stay updated on regulatory changes and implement necessary updates to processes.

- Monitor transactions for suspicious activities and report any irregularities.

Interview Tips

To ace your interview for a Foreign Exchange Clerk position, it’s crucial to prepare thoroughly. Here are some tips and hacks to help you succeed:

1. Research the Company and Industry

Familiarize yourself with the company’s history, culture, and specific focus within the foreign exchange market. Research industry trends and recent developments to demonstrate your knowledge and enthusiasm.

2. Highlight Relevant Experience and Skills

Emphasize your experience in currency exchange, account management, or customer service. Quantify your accomplishments whenever possible to showcase your impact on previous roles.

3. Demonstrate Professionalism and Attention to Detail

Dress professionally and arrive on time for your interview. Throughout the conversation, maintain eye contact, speak clearly, and demonstrate your ability to handle confidential information discreetly.

4. Prepare Answers to Common Interview Questions

Anticipate standard interview questions and prepare thoughtful responses. Practice answering questions about your experience, skills, motivation, and how you would handle specific foreign exchange scenarios.

5. Example Outline

When answering interview questions, consider using the following outline:

- Situation: Briefly describe the situation or task you faced.

- Action: Explain the specific actions you took to address the situation.

- Result: Quantify the positive outcomes or impact of your actions.

6. End with a Strong Closing

Conclude the interview by reiterating your interest in the position and how your skills and experience align with the company’s needs. Thank the interviewer for their time and express your enthusiasm for the opportunity.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Foreign Exchange Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!