Are you gearing up for a career in Foreign Exchange Position Clerk? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Foreign Exchange Position Clerk and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

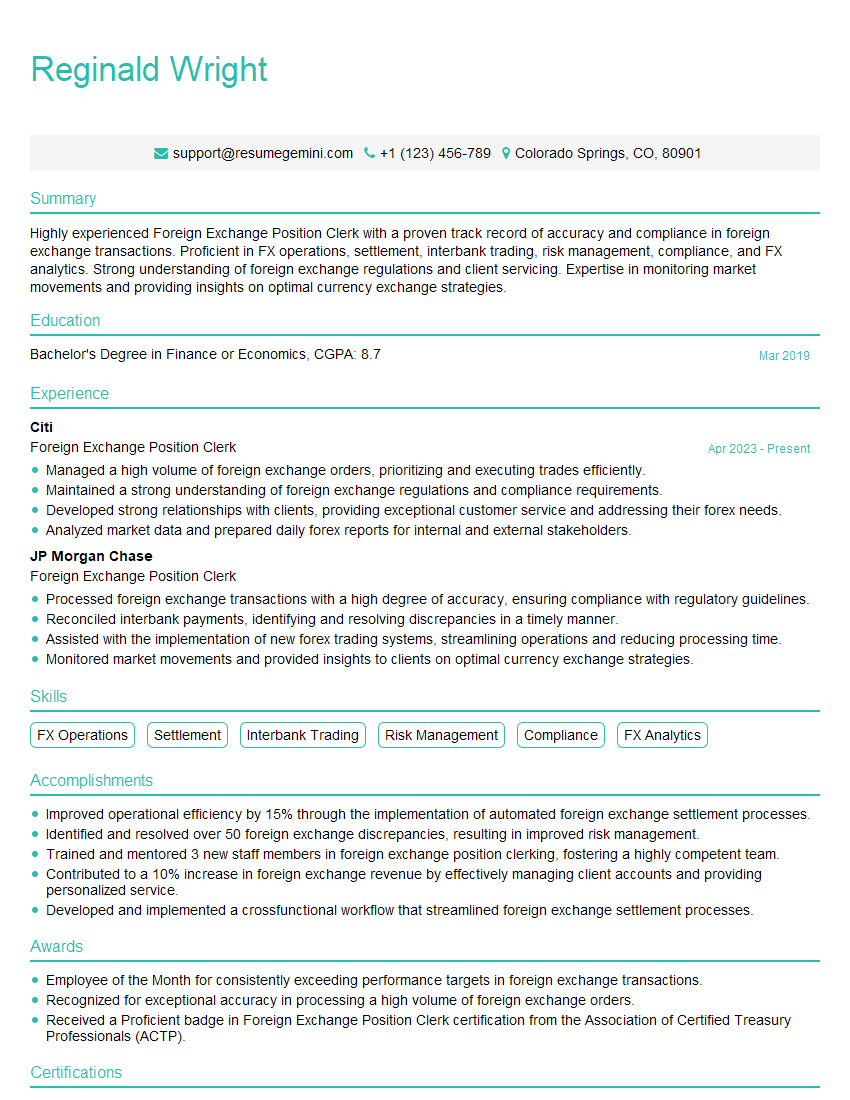

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Foreign Exchange Position Clerk

1. Describe the key responsibilities and duties of a Foreign Exchange Position Clerk?

As a Foreign Exchange Position Clerk, my primary responsibilities include:

- Monitoring foreign exchange transactions and ensuring compliance with regulations.

- Reconciling accounts and verifying the accuracy of transactions.

2. What are the essential skills and qualifications required for this role?

Technical Skills

- Proficient in FX trading platforms and systems

- Knowledge of foreign exchange terminology

- Understanding of market fundamentals and economic indicators

Soft Skills

- Excellent communication and interpersonal skills

- Strong attention to detail and accuracy

- Ability to work independently and as part of a team

3. How do you stay updated with the latest trends and developments in the foreign exchange market?

I make it a point to continuously stay up-to-date with the foreign exchange market trends and developments through various channels such as:

- Reading industry publications and market reports

- Attending conferences, workshops, and online webinars

4. Can you explain the process of reconciling foreign exchange transactions?

The process of reconciling foreign exchange transactions typically involves the following steps:

- Gathering all relevant transaction records

- Matching transactions and identifying discrepancies

- Investigating and resolving any discrepancies

- Preparing a reconciliation report

5. What are the common challenges faced by Foreign Exchange Position Clerks?

- Market volatility and fluctuations

- Regulatory compliance and reporting requirements

- Accuracy and timeliness of transactions

6. How do you ensure the accuracy and confidentiality of foreign exchange transactions?

To ensure accuracy and confidentiality, I adhere to the following best practices:

- Double-checking all transactions and documentation

- Utilizing secure systems and protocols

- Maintaining confidentiality of client information

7. What is your understanding of spot and forward foreign exchange contracts?

Spot Contracts

- Traded immediately at the current market exchange rate

- Settled within 2 business days

Forward Contracts

- Agreed upon exchange rate for a future date

- Used for managing currency risk

8. How do you prioritize tasks and manage your workload as a Foreign Exchange Position Clerk?

- Prioritize tasks based on urgency and importance

- Use a task management system or tool

- Delegate tasks when necessary

9. Can you describe your experience in using a Foreign Exchange trading platform?

I have extensive experience using the Bloomberg FX trading platform. I am proficient in:

- Executing trades and monitoring positions

- Managing orders and analyzing market data

- Customizing the platform for efficient workflow

10. Tell me about a time when you faced a challenging foreign exchange transaction. How did you resolve it?

In a recent transaction, there was a discrepancy in the settlement date for a forward contract. I promptly alerted the relevant parties, clarified the correct settlement date, and ensured a smooth and timely settlement.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Foreign Exchange Position Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Foreign Exchange Position Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Foreign Exchange Position Clerks are responsible for facilitating foreign exchange transactions and maintaining the accuracy of foreign exchange trading positions within financial institutions.

1. Process Foreign Exchange Transactions

Process and verify foreign exchange buy and sell orders.

- Review transactions for completeness and accuracy.

- Execute transactions on trading platforms and settlement systems.

2. Manage Foreign Exchange Position

Monitor and maintain the bank’s foreign exchange position within established limits.

- Monitor open positions and calculate potential risks.

- Hedge against currency fluctuations to minimize losses.

3. Prepare Reports and Analysis

Prepare and distribute foreign exchange reports and analysis.

- Track and analyze market trends and currency valuations.

- Provide insights and recommendations to traders and management.

4. Comply with Regulations

Ensure compliance with all relevant foreign exchange regulations.

- Adhere to anti-money laundering laws and sanctions guidelines.

- Maintain accurate and up-to-date records of transactions.

Interview Tips

Preparing for an interview for a Foreign Exchange Position Clerk role requires a combination of technical knowledge, industry awareness, and interview skills.

1. Understand the Role

Thoroughly review the job description and research the organization to gain a deep understanding of the responsibilities and expectations of the role.

- Familiarize yourself with the different types of foreign exchange transactions and trading platforms.

- Research industry regulations and best practices.

2. Practice Common Interview Questions

Prepare for typical interview questions related to foreign exchange and trading, such as:

- Explain the concept of a foreign exchange swap.

- How would you calculate the potential profit or loss on a currency trade?

3. Highlight Relevant Skills and Experience

Emphasize your technical skills, such as proficiency in trading platforms and data analysis. Also, highlight any experience in foreign exchange or related financial fields.

- Quantify your accomplishments using metrics and specific examples.

- Showcase your ability to work independently and as part of a team.

4. Research the Company and Industry

Demonstrate your interest in the company and the foreign exchange industry by researching their business operations, recent news, and market trends.

- Show that you are informed about current events and industry developments.

- Ask thoughtful questions during the interview to demonstrate your engagement.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Foreign Exchange Position Clerk, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Foreign Exchange Position Clerk positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.