Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Funding Specialist interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Funding Specialist so you can tailor your answers to impress potential employers.

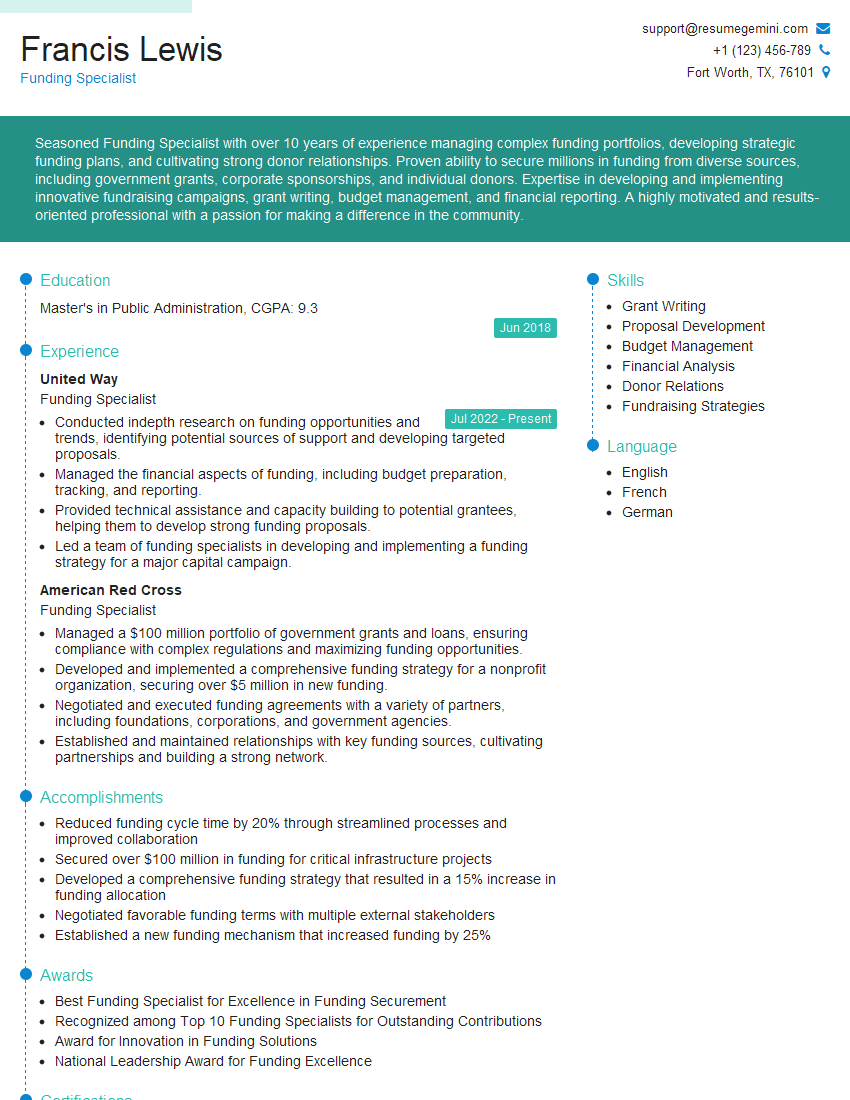

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Funding Specialist

1. Describe the key steps involved in obtaining project funding from external sources.

The key steps involved in obtaining project funding from external sources include:

- Identifying potential funding sources

- Developing a compelling project proposal

- Submitting the proposal to the funding source

- Managing the grant or loan process

- Reporting on project progress and outcomes

2. How do you assess the financial viability and sustainability of a project?

Analysis of Financial Statements

- Review income statements, balance sheets, and cash flow statements

- Examine key financial ratios (e.g., profitability, liquidity, solvency)

Projection and Sensitivity Analysis

- Develop financial projections (e.g., revenue, expenses, cash flow)

- Conduct sensitivity analysis to assess the impact of changes in assumptions

Market Assessment

- Analyze industry trends and competition

- Identify potential revenue streams and growth opportunities

3. What strategies can you employ to increase the likelihood of securing funding for a project?

Strategies to increase the likelihood of securing funding for a project include:

- Developing a clear and concise project proposal

- Tailoring the proposal to the specific requirements of the funding source

- Building relationships with potential funders

- Demonstrating the project’s impact and sustainability

- Securing matching funds or in-kind contributions

4. What are the most common types of funding sources available for projects?

The most common types of funding sources available for projects include:

- Government grants

- Foundation grants

- Corporate donations

- Loans

- Crowdfunding

5. How do you manage the relationship with funders after receiving funding?

After receiving funding, it is important to manage the relationship with funders by:

- Providing regular updates on project progress

- Responding promptly to funder inquiries

- Meeting all reporting requirements

- Acknowledging the funder’s support

- Building a mutually beneficial relationship

6. What are the ethical considerations you must keep in mind when applying for and managing external funding?

Ethical considerations to keep in mind when applying for and managing external funding include:

- Truthfulness and accuracy in funding applications

- Proper use of funding for the intended purpose

- Avoiding conflicts of interest

- Transparency and accountability in financial management

- Compliance with all applicable laws and regulations

7. How do you stay up-to-date on the latest funding opportunities?

To stay up-to-date on the latest funding opportunities, you can:

- Subscribe to funding newsletters and alerts

- Attend industry conferences and workshops

- Network with other funding professionals

- Use online funding search engines

- Monitor government and foundation websites

8. What are the challenges you have faced in the past when seeking external funding, and how did you overcome them?

Challenges I have faced in the past when seeking external funding include:

- Finding funding sources that align with the project’s goals

- Developing a competitive proposal

- Managing multiple funding applications simultaneously

- Negotiating funding terms with funders

- Ensuring compliance with funding requirements

To overcome these challenges, I have:

- Thoroughly researched potential funding sources

- Tailored my proposals to each funder’s specific requirements

- Prioritized and planned my time effectively

- Consulted with experts and sought feedback on my proposals

- Established strong relationships with funders

9. What is your experience in using financial modeling to evaluate funding options?

I have experience using financial modeling to evaluate funding options through:

- Developing financial projections to assess the viability of different funding scenarios

- Conducting sensitivity analysis to identify the impact of changes in key assumptions

- Evaluating the cost-benefit ratio of different funding sources

- Making recommendations on the optimal funding mix

- Using financial modeling tools such as Excel, Google Sheets, and specialized software

10. How do you ensure that funding is used in an efficient and responsible manner?

To ensure that funding is used in an efficient and responsible manner, I:

- Develop a detailed budget and track expenses carefully

- Seek approval for any major expenditures

- Implement internal controls to prevent fraud and misuse

- Conduct regular audits and reviews

- Provide regular financial reports to stakeholders

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Funding Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Funding Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Funding Specialist plays a crucial role in securing financial resources for organizations, primarily through grants, contracts, and donations. Their key responsibilities include:

1. Research and Identify Funding Opportunities

Thoroughly research potential funding sources, including government agencies, foundations, corporations, and individual donors, to identify opportunities that align with the organization’s mission and goals.

2. Develop and Submit Proposals

Craft compelling grant proposals, contracts, and fundraising materials that effectively convey the organization’s needs, impact, and ability to deliver on the proposed project.

3. Manage Funding Relationships

Build and maintain strong relationships with funding agencies, donors, and other stakeholders, fostering communication and ensuring the organization meets reporting and compliance requirements.

4. Track Funding Progress and Report Results

Monitor the status of funding applications, track expenses, and report on the progress and impact of funded projects to donors and stakeholders.

Interview Tips

To ace the Funding Specialist interview, candidates should prepare thoroughly and showcase their skills and experience. Here are some tips:

1. Research the Organization and Position

Thoroughly research the organization’s mission, programs, and financial situation. Understand the specific role and responsibilities of the Funding Specialist position.

2. Highlight Relevant Skills and Experience

Emphasize your skills in grant writing, research, relationship building, and financial management. Provide specific examples of successful funding applications or fundraising campaigns you have led.

3. Prepare for Common Interview Questions

Practice answering common interview questions, such as: “Why are you interested in this position?” or “What is your approach to developing and submitting funding proposals?”

4. Bring Examples of Your Work

If possible, bring samples of your grant proposals, contracts, or other materials that demonstrate your writing and analytical skills. This will provide tangible evidence of your capabilities.

5. Ask Insightful Questions

Prepare insightful questions to ask the interviewer about the organization’s funding strategy, partnership opportunities, or any current challenges they are facing. This shows your engagement and interest in the position.

Next Step:

Now that you’re armed with the knowledge of Funding Specialist interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Funding Specialist positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini