Feeling lost in a sea of interview questions? Landed that dream interview for Head of Payroll but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Head of Payroll interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

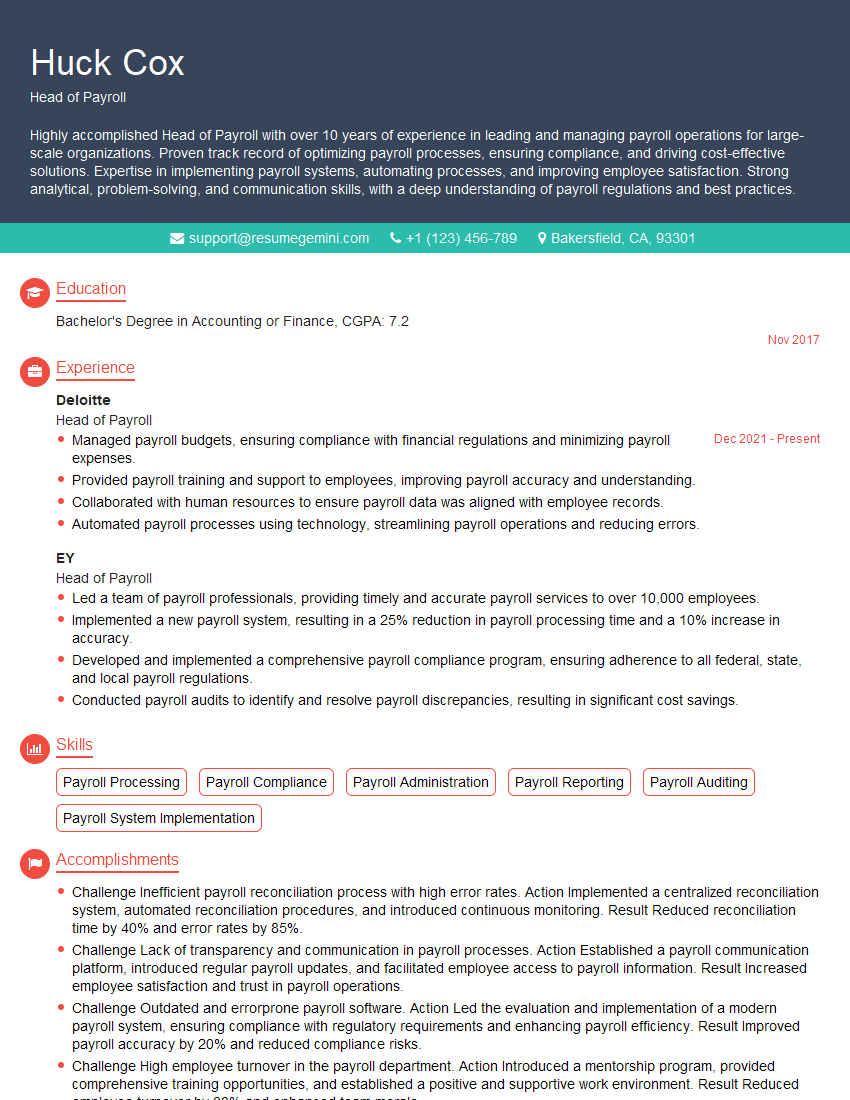

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Head of Payroll

1. What are the key responsibilities of a Head of Payroll?

- Leading and managing the payroll department

- Developing and implementing payroll policies and procedures

- Ensuring compliance with all relevant payroll legislation

- Processing payroll and ensuring timely payment of employees

- Managing payroll budgets and forecasting

- Providing support and guidance to employees on payroll matters

- Collaborating with other departments, such as HR and Finance

- Keeping up to date with changes in payroll legislation and best practices

2. What are the key challenges facing Head of Payrolls today?

subheading of the answer

- Keeping up with the increasing complexity of payroll legislation

- Managing the payroll process in a cost-effective manner

- Ensuring the accuracy and timeliness of payroll processing

- Meeting the needs of a diverse workforce

- Dealing with employee queries and concerns

subheading of the answer

- Staying abreast of new technologies that can improve the payroll process

- Managing the risks associated with payroll processing

- Developing and maintaining a strong team of payroll professionals

3. What are the key qualities and skills required to be a successful Head of Payroll?

- Strong knowledge of payroll legislation and best practices

- Excellent communication and interpersonal skills

- Ability to manage a team and delegate effectively

- Strong analytical and problem-solving skills

- Ability to work independently and as part of a team

- Attention to detail and accuracy

- Excellent time management skills

- Ability to stay up to date with changes in payroll legislation and best practices

4. What are the different types of payroll systems available?

- Manual payroll systems

- Semi-automated payroll systems

- Fully automated payroll systems

- Cloud-based payroll systems

- On-premise payroll systems

5. What are the advantages and disadvantages of each type of payroll system?

-

Manual payroll systems

- Advantages: Low cost, easy to implement, no need for specialized software

- Disadvantages: Time-consuming, prone to errors, difficult to scale Semi-automated payroll systems

- Advantages: More efficient than manual systems, less prone to errors, can be integrated with other HR systems

- Disadvantages: More expensive than manual systems, require some level of technical expertise Fully automated payroll systems

- Advantages: Most efficient and accurate, can be integrated with other HR and financial systems, can be used for large organizations

- Disadvantages: Most expensive, require a high level of technical expertise Cloud-based payroll systems

- Advantages: Accessible from anywhere with an internet connection, no need to install software, can be scaled easily

- Disadvantages: Can be more expensive than on-premise systems, may have security concerns On-premise payroll systems

- Advantages: More secure than cloud-based systems, can be customized to meet specific needs

- Disadvantages: More expensive than cloud-based systems, require IT support

6. What are the key steps involved in implementing a new payroll system?

- Planning and preparation

- System selection

- Implementation

- Testing

- Go-live

- Post-implementation support

7. What are the key risks associated with payroll processing?

- Errors in payroll calculations

- Fraud

- Non-compliance with payroll legislation

- Data breaches

- System failures

8. How can the risks associated with payroll processing be mitigated?

- Implementing robust payroll processes and procedures

- Regularly reviewing and updating payroll policies and procedures

- Training payroll staff on the latest payroll legislation and best practices

- Implementing a system of checks and balances

- Regularly reviewing payroll data for errors and inconsistencies

- Investing in payroll software that includes security features

- Having a disaster recovery plan in place

9. What are the key trends in payroll processing?

- The increasing use of cloud-based payroll systems

- The adoption of artificial intelligence (AI) and machine learning (ML) in payroll processing

- The growing importance of data security

- The need for payroll professionals to be more strategic

10. What are your thoughts on the future of payroll processing?

- I believe that payroll processing will become increasingly automated in the future

- I think that AI and ML will play a major role in payroll processing

- I believe that payroll professionals will need to be more strategic in the future

- I think that data security will become increasingly important in the future

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Head of Payroll.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Head of Payroll‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Head of Payroll is responsible for all aspects of payroll management within the organization. This includes:

Payroll Processing

Ensuring accurate and timely payroll processing for all employees.

- Calculating and issuing paychecks

- Withholding and remitting taxes and other deductions

- Preparing and distributing payroll reports

Payroll Administration

Managing all aspects of payroll administration, including:

- Maintaining employee payroll records

- Processing payroll changes, such as new hires, terminations, and pay rate changes

- Responding to employee inquiries about payroll

Payroll Compliance

Ensuring compliance with all applicable payroll laws and regulations.

- Staying up-to-date on payroll legislation

- Conducting payroll audits

- Implementing and maintaining payroll controls

Payroll Reporting

Preparing and submitting payroll reports to management and external stakeholders.

- Providing payroll data for financial reporting

- Submitting payroll tax returns

- Preparing payroll-related reports for employees

Interview Tips

Preparing for an interview for a Head of Payroll position can be daunting, but with the right preparation, you can increase your chances of success. Here are some tips to help you ace your interview:

Research the company and the position

Before your interview, take some time to research the company and the specific Head of Payroll position you are applying for. This will help you understand the company’s culture, values, and the specific responsibilities of the role.

- Visit the company’s website

- Read the job description carefully

- Talk to your recruiter or a current employee of the company

Practice answering common interview questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” or “Why are you interested in this position?”. It is helpful to practice answering these questions in advance so that you can deliver your answers confidently and concisely.

- Use the STAR method to answer behavioral questions

- Be prepared to talk about your experience and skills

- Highlight your knowledge of payroll laws and regulations

Be prepared to ask questions

Asking questions at the end of the interview shows that you are interested in the position and that you have taken the time to prepare. It is also a good opportunity to get more information about the company and the role.

- Ask about the company’s payroll software

- Inquire about the company’s payroll compliance history

- Ask about the company’s plans for future payroll initiatives

Next Step:

Now that you’re armed with the knowledge of Head of Payroll interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Head of Payroll positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini