Are you gearing up for a career in Insurance Sales Supervisor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Insurance Sales Supervisor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

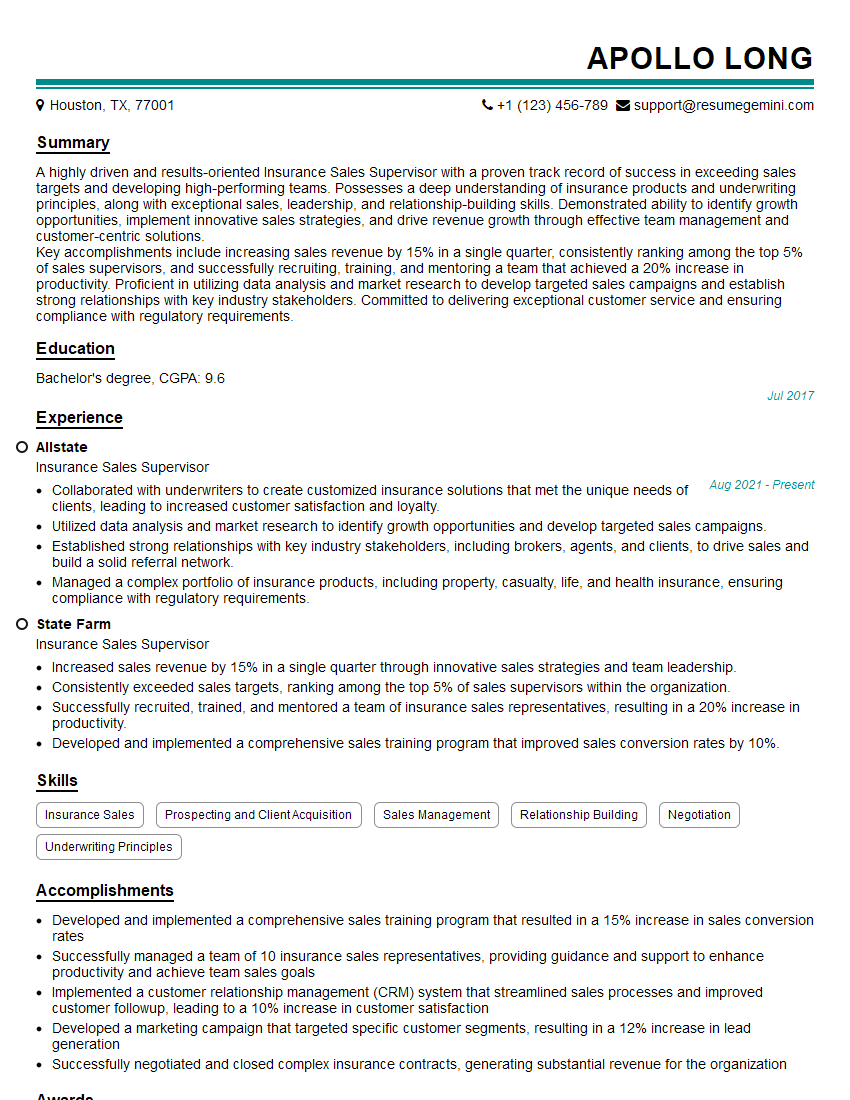

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Sales Supervisor

1. How do you plan and execute sales strategies to achieve targets in a competitive insurance market?

- Conduct thorough market research to understand the competitive landscape, identify customer needs, and assess market trends.

- Develop tailored sales strategies that align with market demands, target specific customer segments, and address their unique insurance requirements.

- Implement effective marketing campaigns, utilize digital channels, and leverage technology to reach and engage potential clients.

- Monitor sales performance metrics, analyze data, and make data-driven adjustments to optimize strategies and improve results.

- Collaborate with product development teams to ensure that insurance offerings meet market needs and support sales efforts.

2. Describe your approach to managing and motivating a sales team to exceed performance expectations.

Empowering the team:

- Provide clear goals, objectives, and expectations to the sales team.

- Delegate responsibilities and empower team members to make decisions.

- Provide ongoing training and development opportunities to enhance skills and knowledge.

Motivating the team:

- Recognize and reward individual and team accomplishments.

- Create a positive and supportive work environment.

- Foster a culture of collaboration and teamwork.

3. How do you stay updated on the latest insurance industry trends and regulations to ensure compliance and maintain a competitive edge?

- Regularly attend industry conferences, seminars, and webinars.

- Subscribe to industry publications and online resources.

- Network with other insurance professionals.

- Monitor regulatory updates and participate in industry consultations.

- Seek professional development opportunities, such as certifications and continuing education courses.

4. How do you handle and resolve customer complaints or concerns in a professional and effective manner?

- Listen attentively to the customer’s concerns and acknowledge their perspective.

- Thoroughly investigate the issue and gather relevant information.

- Explain the situation and resolution options in a clear and empathetic manner.

- Work with the customer to find a mutually acceptable solution.

- Document the complaint and resolution process for future reference and improvement.

5. How do you build and maintain strong relationships with clients to ensure customer satisfaction and loyalty?

- Provide excellent customer service by being responsive, proactive, and attentive.

- Understand the client’s needs, risk profile, and financial situation.

- Tailor insurance solutions to meet the specific requirements of each client.

- Regularly communicate with clients to provide updates, review coverage, and address any concerns.

- Go the extra mile to build personal connections and establish trust.

6. How do you handle ethical dilemmas or conflicts of interest that may arise in the sales process?

- Prioritize the client’s best interests and act in good faith.

- Disclose any potential conflicts of interest to the client.

- Seek guidance from senior management or compliance officers when necessary.

- Adhere to industry regulations and ethical guidelines.

- Maintain transparency and honesty in all interactions.

7. How do you utilize technology to enhance sales productivity and improve customer experiences?

- Use customer relationship management (CRM) systems to manage client data, track interactions, and automate workflows.

- Leverage data analytics to identify sales opportunities, personalize marketing campaigns, and improve decision-making.

- Incorporate artificial intelligence (AI) and chatbots to enhance customer service and provide instant support.

- Utilize video conferencing and online tools for virtual meetings and presentations.

- Stay updated on emerging technologies and explore their potential application in the insurance industry.

8. Describe your experience in developing and implementing sales training programs for insurance agents.

Needs assessment:

- Identify the specific training needs of the sales team based on performance gaps and market trends.

Program design:

- Develop tailored training modules that address the identified needs.

- Incorporate a mix of interactive learning methods, such as role-playing, case studies, and simulations.

Delivery and evaluation:

- Deliver training sessions in an engaging and effective manner.

- Evaluate the effectiveness of the training program through performance metrics, feedback, and follow-up assessments.

9. How do you measure and track the effectiveness of your sales strategies and make adjustments as needed?

- Establish clear sales metrics and key performance indicators (KPIs).

- Regularly monitor and analyze sales data using dashboards and reporting tools.

- Identify areas for improvement and develop strategies to address them.

- Make data-driven decisions to adjust sales strategies, marketing campaigns, and product offerings.

- Seek feedback from the sales team and customers to optimize the effectiveness of sales efforts.

10. How do you handle objections from potential clients and overcome resistance to purchasing insurance products?

- Listen attentively to the client’s objections and acknowledge their concerns.

- Address the objections with empathy and provide clear and concise explanations.

- Provide evidence to support the value and benefits of the insurance product.

- Tailor the sales pitch to the client’s specific needs and risk profile.

- Foster a sense of trust and build rapport with the client.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Sales Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Sales Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Insurance Sales Supervisor is a crucial role responsible for guiding and overseeing a team of insurance sales professionals. Their key responsibilities encompass:

1. Team Management

Leading, motivating, and supporting a team of insurance sales representatives to achieve sales targets.

- Assigning sales territories, providing guidance, and offering coaching to enhance team performance.

- Conducting regular performance evaluations and providing feedback to facilitate professional development.

2. Sales Strategy and Implementation

Developing and implementing effective sales strategies to maximize sales revenue and achieve organizational goals.

- Analyzing market trends, identifying potential clients, and implementing targeted sales strategies.

- Monitoring sales performance, adjusting strategies as necessary, and optimizing sales processes.

3. Customer Relationship Management

Building and maintaining strong customer relationships to drive sales and ensure customer satisfaction.

- Understanding customer needs, providing tailored solutions, and resolving any issues promptly.

- Fostering ongoing relationships with existing clients to drive repeat business and generate referrals.

4. Training and Development

Providing ongoing training and development opportunities to enhance the knowledge and skills of sales representatives.

- Conducting training sessions on insurance products, sales techniques, and customer service best practices.

- Identifying training needs and developing customized training programs to address gaps in knowledge.

Interview Tips

To ace an interview for an Insurance Sales Supervisor role, it’s essential to prepare thoroughly and showcase your relevant skills and experience.

1. Research the Company and Position

Familiarize yourself with the company’s background, products/services, and industry. Understand the specific responsibilities and expectations of the Insurance Sales Supervisor role.

- Visit the company’s website, read industry-related articles, and check social media platforms for updates.

- Prepare questions to ask during the interview that demonstrate your interest and understanding of the role.

2. Highlight Your Sales Leadership Abilities

Emphasize your experience and success in leading and developing sales teams. Provide specific examples of how you have achieved sales goals, motivated teams, and implemented effective sales strategies.

- Quantify your accomplishments using metrics such as revenue growth, market share gained, or sales pipeline generated.

- Be prepared to discuss your approach to sales coaching, talent development, and performance management.

3. Demonstrate Your Knowledge of Insurance Products and Industry

Show your understanding of insurance products, industry regulations, and market dynamics. Explain how you stay up-to-date with industry trends and incorporate them into your sales strategies.

- Discuss your experience in selling different types of insurance products, such as life, health, property, or casualty.

- Mention recent industry changes or best practices that you have implemented to enhance your sales performance.

4. Articulate Your Customer-Centric Approach

Explain your passion for providing exceptional customer service and building long-term relationships with clients. Describe how you resolve customer issues effectively and maintain customer satisfaction.

- Share examples of how you have gone the extra mile to meet customer needs and exceed their expectations.

- Discuss your strategies for building trust, handling objections, and closing deals.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Insurance Sales Supervisor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!