Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Loan Documentation Specialist position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

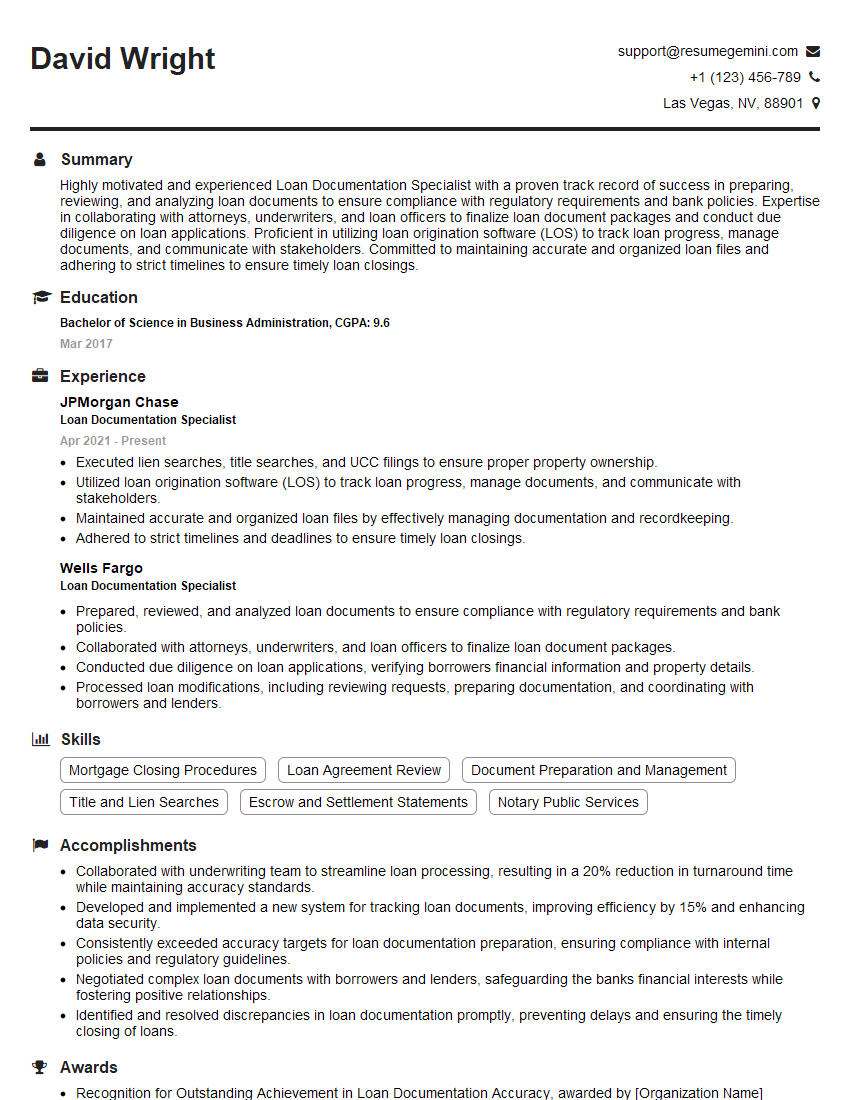

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Documentation Specialist

1. What are the key responsibilities of a Loan Documentation Specialist?

As a Loan Documentation Specialist, my primary responsibilities would include:

- Drafting, reviewing, and negotiating loan documents

- Ensuring accuracy and compliance with legal and regulatory requirements

- Coordinating with lenders, borrowers, and other stakeholders

- Analyzing loan applications and performing due diligence

- Maintaining and managing loan documentation throughout the loan lifecycle

2. Describe the different types of loan documents you have experience with.

Throughout my career, I have gained extensive experience drafting and reviewing various loan documents, including:

Types of Loan Documents

- Loan agreements

- Security agreements

- Promissory notes

- Disclosure statements

- Closing documents

Specialized Loan Documents

- Commercial real estate loans

- Residential mortgages

- Asset-based loans

- Letters of credit

- Syndicated loans

3. What are the key elements to consider when drafting a loan agreement?

When drafting a loan agreement, it is crucial to consider the following key elements:

- Purpose and amount of the loan

- Repayment terms, including principal and interest

- Collateral or security for the loan

- Covenants and representations of the borrower

- Events of default and remedies

- Governing law and jurisdiction

4. How do you ensure the accuracy and compliance of loan documents?

To ensure the accuracy and compliance of loan documents, I follow a rigorous process that includes:

- Thoroughly reviewing all relevant loan application materials

- Consulting with legal counsel as needed

- Comparing documents to industry standards and precedents

- Utilizing checklists and templates to minimize errors

- Obtaining necessary signatures and notarizations

5. Describe your experience with managing loan documentation throughout the loan lifecycle.

Throughout the loan lifecycle, I am responsible for:

- Creating and maintaining a central repository for all loan documentation

- Tracking the status of each loan and ensuring timely completion of tasks

- Monitoring loan performance and providing periodic updates to stakeholders

- Preparing and filing necessary regulatory reports

- Assisting with loan modifications and workouts as needed

6. How do you stay up-to-date on the latest laws and regulations related to loan documentation?

To stay up-to-date on the latest laws and regulations related to loan documentation, I:

- Attend industry conferences and webinars

- Subscribe to legal publications and newsletters

- Seek guidance from legal counsel as needed

- Participate in professional development courses

- Monitor regulatory agency websites

7. Describe a challenging loan documentation project you have worked on. How did you overcome the challenges?

One challenging loan documentation project I worked on involved a complex commercial real estate loan with multiple parties and security interests. The challenges included:

Challenge 1: Conflicting Legal Interests

- Successfully negotiated and drafted language that addressed the competing interests of the lender, borrower, and investors

Challenge 2: Time Constraints

- Worked diligently and efficiently to meet tight deadlines without compromising accuracy or quality

Challenge 3: Limited Resources

- Collaborated with other team members to leverage resources and expertise

8. What is your understanding of best practices for loan documentation?

Best practices for loan documentation include:

- Clarity and precision in drafting

- Adherence to legal requirements

- Thorough due diligence and risk assessment

- Transparency and fairness to all parties

- Use of plain language and clear formatting

- Involvement of legal counsel when necessary

9. How do you handle conflicts of interest that may arise during loan documentation?

To handle conflicts of interest, I:

- Disclose any potential conflicts to all parties involved

- Recuse myself from any decision-making processes where a conflict may exist

- Seek guidance from senior management or legal counsel as needed

- Maintain the confidentiality of all sensitive information

10. What is your approach to collaborating with cross-functional teams on loan documentation projects?

When collaborating with cross-functional teams, I:

- Establish clear communication channels and set expectations

- Actively participate in meetings and contribute my expertise

- Share information and documents promptly

- Seek feedback and input from other team members

- Respect the roles and responsibilities of others

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Documentation Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Documentation Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Loan Documentation Specialist plays a crucial role in the lending process, ensuring accuracy and completeness of loan documentation. Here are their key responsibilities:

1. Document Preparation and Review

Draft, prepare, and review loan documentation, including loan agreements, security agreements, and other supporting documents.

- Review loan applications, credit reports, and other financial information to assess loan eligibility and prepare loan documents accordingly.

- Obtain necessary signatures from borrowers and other relevant parties on loan documents.

2. Compliance and Regulatory Adherence

Ensure all loan documentation is in compliance with applicable laws, regulations, and industry best practices.

- Keep abreast of regulatory changes and ensure loan documentation meets legal requirements.

- Maintain records of all loan documents and transactions for audit purposes.

3. Customer Service and Communication

Provide excellent customer service to borrowers and other stakeholders throughout the loan documentation process.

- Answer questions and provide guidance to borrowers regarding loan documentation and the lending process.

- Communicate effectively with internal teams, including loan officers, underwriters, and legal counsel.

4. Process Management and Efficiency

Streamline and optimize the loan documentation process to ensure efficiency and timely loan approvals.

- Develop and implement procedures to improve document turnaround time.

- Utilize technology and automation to enhance productivity and minimize errors.

Interview Tips

To ace your interview for a Loan Documentation Specialist position, here are some tips and preparation hacks:

1. Research the Company and Role

Thoroughly research the financial institution or organization you’re applying to, including their loan products, industry reputation, and company culture. Understand the specific responsibilities of the Loan Documentation Specialist role within the organization.

- Visit the company website, read industry news, and connect with current or former employees on LinkedIn for insights.

- Prepare questions that demonstrate your knowledge of the company and the role, showing that you’ve invested time in learning about the opportunity.

2. Highlight Your Skills and Experience

Emphasize your relevant skills and experience in loan documentation, including any knowledge of specific loan products or regulatory requirements. Quantify your accomplishments whenever possible to showcase your impact.

- Review the job description carefully and tailor your resume and answers to highlight the skills and experience they are seeking.

- Use the STAR method (Situation, Task, Action, Result) when answering behavioral interview questions to provide concrete examples of your work.

3. Demonstrate Attention to Detail

Loan Documentation Specialists must be highly detail-oriented and meticulous in their work. During the interview, provide examples that showcase your precision and accuracy.

- Explain how you use checklists or quality control measures to ensure the accuracy of your documentation.

- Share an experience where you identified and corrected a critical error in loan documentation, preventing potential issues down the road.

4. Practice Answering Commonly Asked Questions

Prepare for common interview questions related to loan documentation, such as:

- “Describe your experience in preparing and reviewing loan agreements and security documents.”

- “How do you stay up-to-date on regulatory changes affecting loan documentation?”

- “How do you handle complex loan transactions involving multiple parties and jurisdictions?”

5. Ask Insightful Questions

At the end of the interview, take the opportunity to ask thoughtful questions that demonstrate your interest and engagement.

- Inquire about the company’s loan portfolio and any recent or upcoming changes in their lending practices.

- Ask about opportunities for professional development and career growth within the organization.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Loan Documentation Specialist role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.