Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Loan Expediter interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Loan Expediter so you can tailor your answers to impress potential employers.

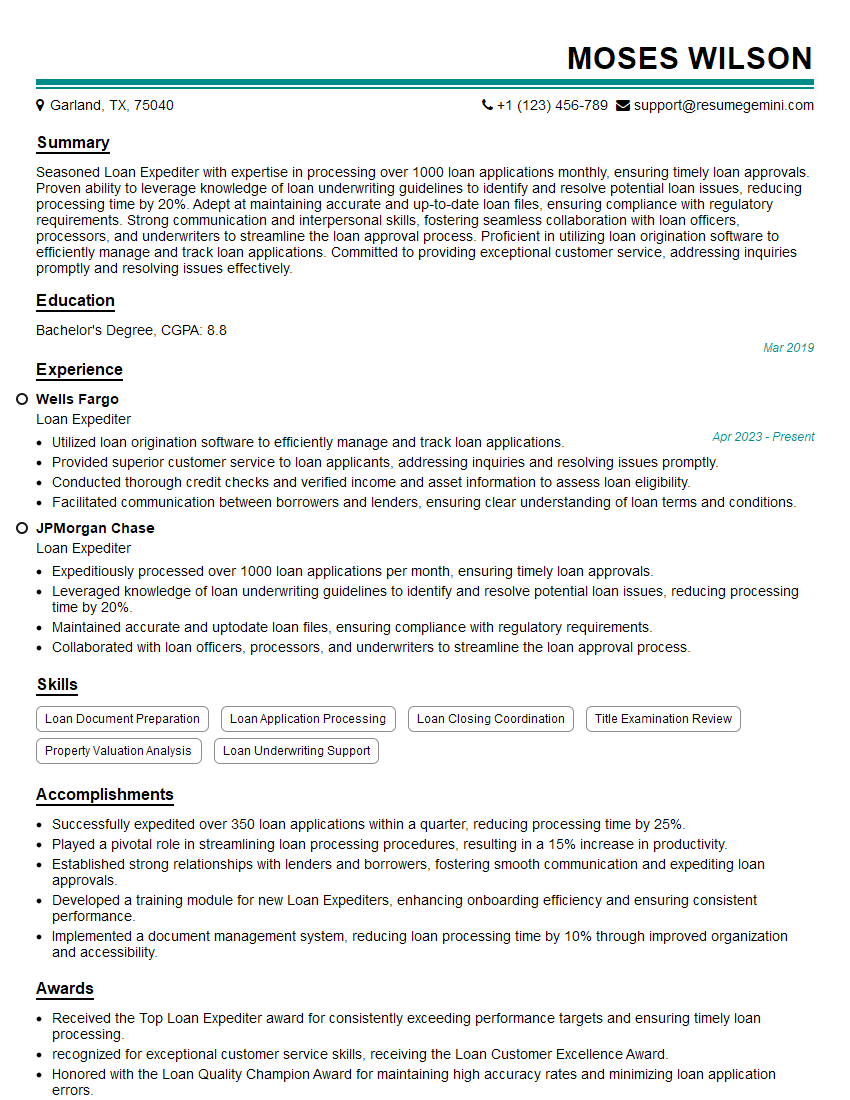

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Expediter

1. How many types of mortgage products have you processed in the past?

I’ve worked with a wide range of mortgage products, including:

- Conventional loans

- FHA loans

- VA loans

- USDA loans

- Jumbo loans

2. Explain your process for handling complex or unusual loan applications?

Verifying Applicant Information

- Confirming the borrower’s identity

- Verifying income and assets

- Checking credit history

Assessing the Property

- Ordering an appraisal

- Reviewing the title report

- Conducting a property inspection

3. How do you prioritize multiple loan applications and ensure timely processing?

I use a combination of:

- Establishing clear deadlines

- Communicating regularly with borrowers and lenders

- Automating tasks to improve efficiency

- Prioritizing applications based on urgency and risk factors

4. What are the common challenges you face as a Loan Expediter and how do you overcome them?

Some common challenges include:

- Missing or incomplete documentation

- Issues with the property’s title

- Delays with third-party vendors

- Changes in loan terms or requirements

To overcome these challenges, I:

- Communicate proactively with all parties involved

- Use strong problem-solving skills to find solutions

- Stay up to date on industry regulations and best practices

5. Describe your experience with using loan processing software and technology.

I’m proficient in using a variety of loan processing software, including:

- Encompass

- LoanPro

- Mortgage Cadence

- Ellie Mae Encompass

- Fannie Mae Desktop Underwriter

I’m also familiar with using technology to automate tasks, improve communication, and enhance the loan processing experience.

6. How important is attention to detail in your role? Share an example of how it impacted your work.

Attention to detail is critical in my role as a Loan Expediter. Even a small mistake can delay the loan process or lead to costly errors.

One example of how attention to detail impacted my work was when I was processing a loan application for a borrower with a complex financial history. I carefully reviewed all of the documentation and noticed a discrepancy in the borrower’s income statement.

I contacted the borrower to verify the discrepancy, and it turned out that there was a typographical error in the statement. I corrected the error and resubmitted the application to the lender, which prevented any delays in the loan process.

7. Can you explain the process of underwriting a loan?

Loan underwriting is the process of assessing the risk of a loan application and determining whether to approve the loan.

An underwriter will typically review the borrower’s credit history, income, assets, and debts to determine their ability to repay the loan.

The underwriter will also review the property being financed to ensure that it meets the lender’s requirements.

Once the underwriter has completed their review, they will make a decision on whether to approve the loan.

8. What are some of the most important qualities of a successful Loan Expediter?

Some of the most important qualities of a successful Loan Expediter include:

- Strong attention to detail

- Excellent communication skills

- Ability to work independently

- Ability to meet deadlines

- Knowledge of the mortgage industry

- Proficiency in loan processing software

9. How do you stay up-to-date on changes in the mortgage industry?

I stay up-to-date on changes in the mortgage industry by:

- Reading industry publications

- Attending industry conferences

- Taking continuing education courses

- Networking with other mortgage professionals

- Following industry news and updates online

10. What are your career goals?

My career goal is to become a Loan Officer. I believe that my skills and experience as a Loan Expediter will give me a strong foundation for success in this role.

I am confident that I have the drive, determination, and commitment to succeed as a Loan Officer. I am eager to learn and grow in this industry and to make a positive contribution to my company and my clients.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Expediter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Expediter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan Expediters are responsible for ensuring that loan applications are processed efficiently and accurately. Their key responsibilities include:

1. Processing Loan Applications

Loan Expediters review loan applications, verify information, and gather any additional documents that may be required. They also ensure that all required signatures and disclosures are obtained.

- Reviewing loan applications for completeness

- Verifying applicant information

- Gathering additional documentation

- Obtaining required signatures and disclosures

2. Communicating with Borrowers and Lenders

Loan Expediters communicate with borrowers and lenders throughout the loan process. They answer questions, provide updates, and resolve any issues that may arise.

- Answering questions from borrowers and lenders

- Providing updates on loan status

- Resolving issues that may arise

3. Tracking Loan Progress

Loan Expediters track the progress of loan applications through the underwriting and approval process. They identify any potential delays and take steps to resolve them.

- Tracking loan progress

- Identifying potential delays

- Taking steps to resolve delays

4. Maintaining Loan Files

Loan Expediters maintain loan files throughout the loan process. They ensure that all documents are organized and easily accessible.

- Maintaining loan files

- Organizing documents

- Ensuring easy accessibility of documents

Interview Tips

Preparing for a loan expediter interview can be challenging, but there are several key tips that can help you ace the interview.

1. Research the Company and Position

Before you go on an interview, it is important to research the company and the position you are applying for. This will help you understand the company’s culture, goals, and expectations for the role.

- Visit the company’s website

- Read about the company’s products or services

- Look for news articles or press releases about the company

- Research the specific position you are applying for

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” or “Why are you interested in this position?” It is important to practice your answers to these questions in advance so that you can deliver them confidently and effectively.

- Prepare answers to common interview questions

- Practice your answers out loud

- Time yourself to make sure you can answer each question within the allotted time

3. Be Prepared to Talk About Your Experience

In your interview, you will be asked about your experience and qualifications. Be prepared to talk about your relevant skills and experience, and how they relate to the position you are applying for.

- Highlight your relevant skills and experience

- Explain how your skills and experience relate to the position

- Provide specific examples of your work

4. Be Professional and Enthusiastic

First impressions matter, so it is important to be professional and enthusiastic during your interview. Dress appropriately, arrive on time, and be polite to everyone you meet.

- Dress professionally

- Arrive on time

- Be polite and respectful to everyone you meet

- Show enthusiasm for the position

Next Step:

Now that you’re armed with the knowledge of Loan Expediter interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Loan Expediter positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini