Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Loan Officer interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Loan Officer so you can tailor your answers to impress potential employers.

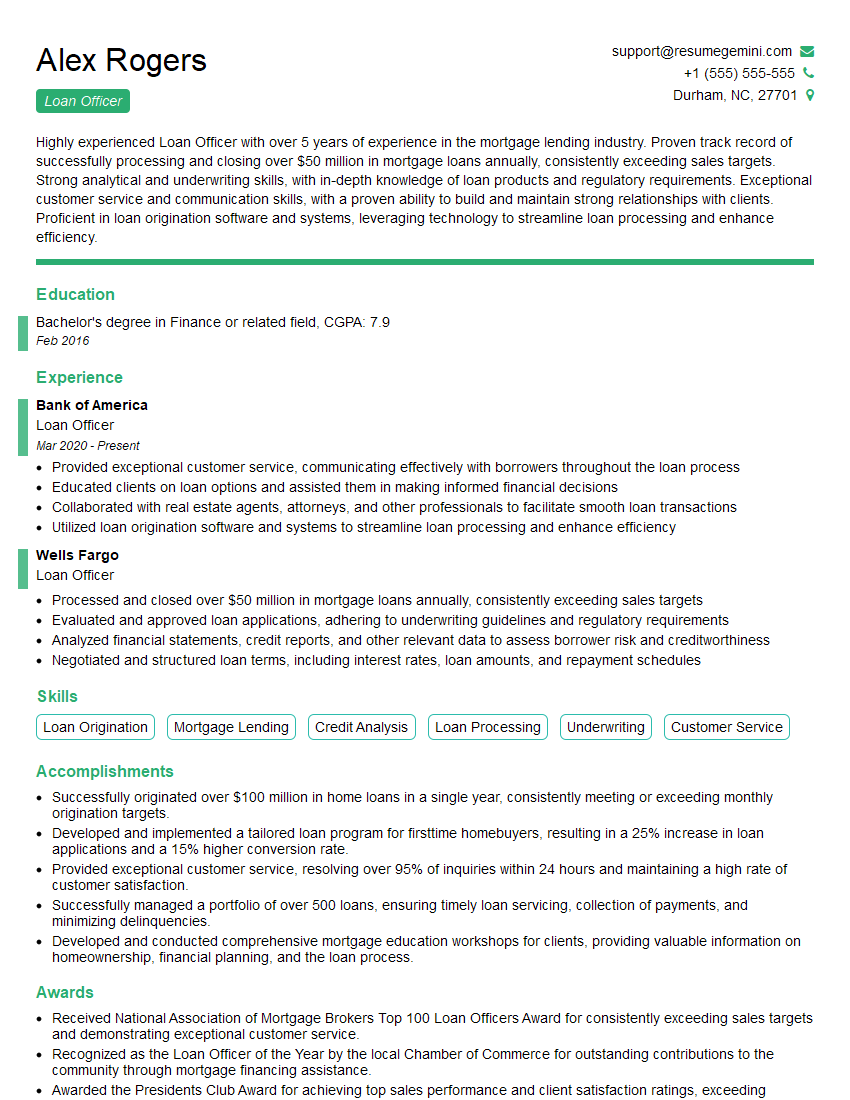

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Officer

1. How do you determine the eligibility of a borrower for a loan?

I assess borrower eligibility based on several key factors:

- Credit history: I examine the borrower’s credit report and score to evaluate their past borrowing behavior and creditworthiness.

- Debt-to-income ratio: I calculate the percentage of the borrower’s monthly income that is used to service existing debts. A low debt-to-income ratio indicates better financial stability.

- Employment history: I verify the borrower’s employment stability and income potential through employment verification and income documentation.

- Assets and liabilities: I analyze the borrower’s assets and liabilities to assess their overall financial health and capacity to repay the loan.

2. What types of loan products are you familiar with?

Mortgage Loans:

- Conventional loans

- FHA loans

- VA loans

Consumer Loans:

- Personal loans

- Auto loans

- Credit card financing

Business Loans:

- Small business loans

- Commercial real estate loans

- Lines of credit

3. Explain the process of underwriting a loan application.

Loan underwriting involves a thorough assessment of the borrower’s credit profile and financial history to evaluate their ability to repay the loan. I follow the following steps in the underwriting process:

- Loan application review: I carefully review the loan application to ensure all required information is provided.

- Credit report analysis: I obtain the borrower’s credit report and analyze their credit history, payment history, and outstanding debts.

- Income and asset verification: I verify the borrower’s income through pay stubs, bank statements, and tax returns. I also review their asset statements for collateral or liquidity.

- Debt-to-income ratio calculation: I calculate the borrower’s debt-to-income ratio to assess their financial stability and capacity to repay the loan.

- Approval or denial decision: Based on the aforementioned factors, I determine whether to approve or deny the loan application and establish the loan terms if approved.

4. How do you handle borrowers with complex financial situations?

When dealing with borrowers who have complex financial situations, I take a holistic approach that involves:

- Detailed financial analysis: I meticulously examine their credit history, income sources, assets, and liabilities to understand their overall financial position.

- Alternative documentation: In cases where traditional income verification is not feasible, I consider alternative documentation such as bank statements or tax returns to assess their financial stability.

- Customized loan solutions: I collaborate with the borrower to explore alternative loan products or programs that may better suit their needs and circumstances.

- Risk assessment: I carefully weigh the risks associated with complex financial situations and determine whether mitigating factors are present to support the loan application.

5. Describe your experience in managing a loan portfolio.

Throughout my career, I have effectively managed loan portfolios by:

- Loan monitoring: I regularly reviewed loan performance, monitored payments, and identified potential issues or risks.

- Portfolio analysis: I analyzed loan portfolios to assess overall performance, identify trends, and make strategic decisions to optimize yield and minimize risk.

- Loan servicing: I assisted borrowers with account servicing, provided guidance on loan repayment, and resolved queries or concerns.

- Risk management: I implemented risk management strategies, including loan-level risk assessments and portfolio stress testing, to mitigate potential losses.

6. How do you stay up-to-date with changes in lending regulations?

I continuously stay abreast of regulatory changes affecting the lending industry by:

- Regulatory agency updates: I monitor updates from regulatory agencies, such as the Consumer Financial Protection Bureau (CFPB) and the Federal Reserve, to stay informed about new policies and regulations.

- Industry publications and conferences: I subscribe to industry publications and attend conferences to gain insights into emerging trends and regulatory changes.

- Networking and peer exchange: I connect with professionals in the lending industry to share knowledge and stay updated on best practices.

- Continuing education: I participate in continuing education programs to enhance my knowledge and skills in compliance and regulatory matters.

7. How do you build and maintain strong relationships with clients?

Building and maintaining strong relationships with clients is crucial in my role as a Loan Officer. I follow these strategies:

- Active listening and communication: I actively listen to client needs, ask clarifying questions, and provide clear and timely communication throughout the loan process.

- Personalized service: I tailor my approach to each client’s unique circumstances and provide customized solutions that meet their financial goals.

- Follow-up and support: I regularly follow up with clients after loan closing to ensure satisfaction and address any ongoing concerns.

- Referrals and networking: I maintain a strong referral network and actively participate in community events to build relationships with potential clients.

8. Describe a challenging loan application you have handled and how you resolved it.

In my previous role, I encountered a loan application from a small business owner with a complex financial history and limited documentation. Despite the challenges, I was able to resolve the situation by:

- Thorough analysis: I carefully reviewed the borrower’s business plan, financial projections, and alternative income verification sources.

- Working with the borrower: I collaborated closely with the borrower to gather necessary documentation and provide guidance on improving their financial standing.

- Risk mitigation: I identified potential risks and implemented mitigating measures, such as a higher down payment and personal guarantee from the borrower.

- Approval and monitoring: Based on my comprehensive analysis and risk assessment, I approved the loan and closely monitored its performance after closing.

9. How do you ensure accuracy and compliance in your loan processing?

Accuracy and compliance are paramount in my loan processing practices. I adhere to the following measures:

- Detailed documentation: I meticulously document all steps of the loan process, including loan applications, credit reports, and underwriting analysis.

- Regulatory adherence: I am thoroughly familiar with lending regulations and ensure compliance with applicable laws and guidelines.

- Quality checks: I regularly conduct internal quality checks to identify and rectify any potential errors or omissions.

- Continuous improvement: I actively seek feedback and participate in training to enhance my knowledge and ensure best practices in loan processing.

10. What sets you apart from other Loan Officers?

My unique combination of skills and experience sets me apart from other Loan Officers in the industry:

- In-depth technical knowledge: I possess a deep understanding of lending principles, underwriting criteria, and loan products.

- Exceptional communication and interpersonal skills: I can effectively communicate with borrowers, lenders, and colleagues to build strong relationships and facilitate successful loan transactions.

- Problem-solving ability: I am adept at identifying and resolving challenges, finding creative solutions, and ensuring a smooth loan process for all parties involved.

- Market expertise: I stay abreast of industry trends and local market conditions to provide valuable insights and tailored advice to my clients.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan Officers play a crucial role in the financial industry by providing loans and mortgages to individuals and businesses. Their key responsibilities include:

1. Client Interaction and Consultation

Initiate and maintain relationships with prospective and existing clients.

- Conduct consultations to assess financial needs and risk profiles.

- Explain loan products, terms, and interest rates clearly.

2. Loan Processing and Underwriting

Process loan applications thoroughly and efficiently.

- Collect and verify financial documentation, such as income statements and tax returns.

- Underwrite loans by evaluating creditworthiness and mitigating risks.

3. Loan Closing and Post-Closing Support

Facilitate the smooth closing of approved loans.

- Prepare and present loan closing documents, ensuring proper execution.

- Provide post-closing support by answering questions and resolving issues.

4. Regulatory Compliance and Ethical Standards

Adhere to all applicable regulations and industry best practices.

- Maintain knowledge of Fair Lending Laws and Equal Credit Opportunity Act.

- Maintain confidentiality and protect sensitive client information.

Interview Tips

Preparing thoroughly for a loan officer interview can significantly increase your chances of success:

1. Research the Company and Position

Familiarize yourself with the company’s culture, values, and loan products.

- Review the job description and identify key responsibilities and qualifications.

- Prepare specific examples of your skills and experience that align with the job requirements.

2. Practice Your Communication Skills

Loan officers must be able to communicate effectively with clients and colleagues.

- Practice answering common interview questions clearly and concisely.

- Use examples to demonstrate your ability to explain complex financial concepts.

3. Highlight Your Sales and Analytical Abilities

Loan officers often have sales targets and must be able to analyze financial data.

- Quantify your sales achievements and provide specific examples of success.

- Show your ability to interpret financial statements and identify potential risks.

4. Prepare for Technical and Regulatory Questions

Loan officers must have a strong understanding of loan products and regulations.

- Review different loan types, interest rates, and fees.

- Familiarize yourself with relevant laws and regulatory guidelines.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Loan Officer interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.