Feeling lost in a sea of interview questions? Landed that dream interview for Loan Processing Supervisor but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Loan Processing Supervisor interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

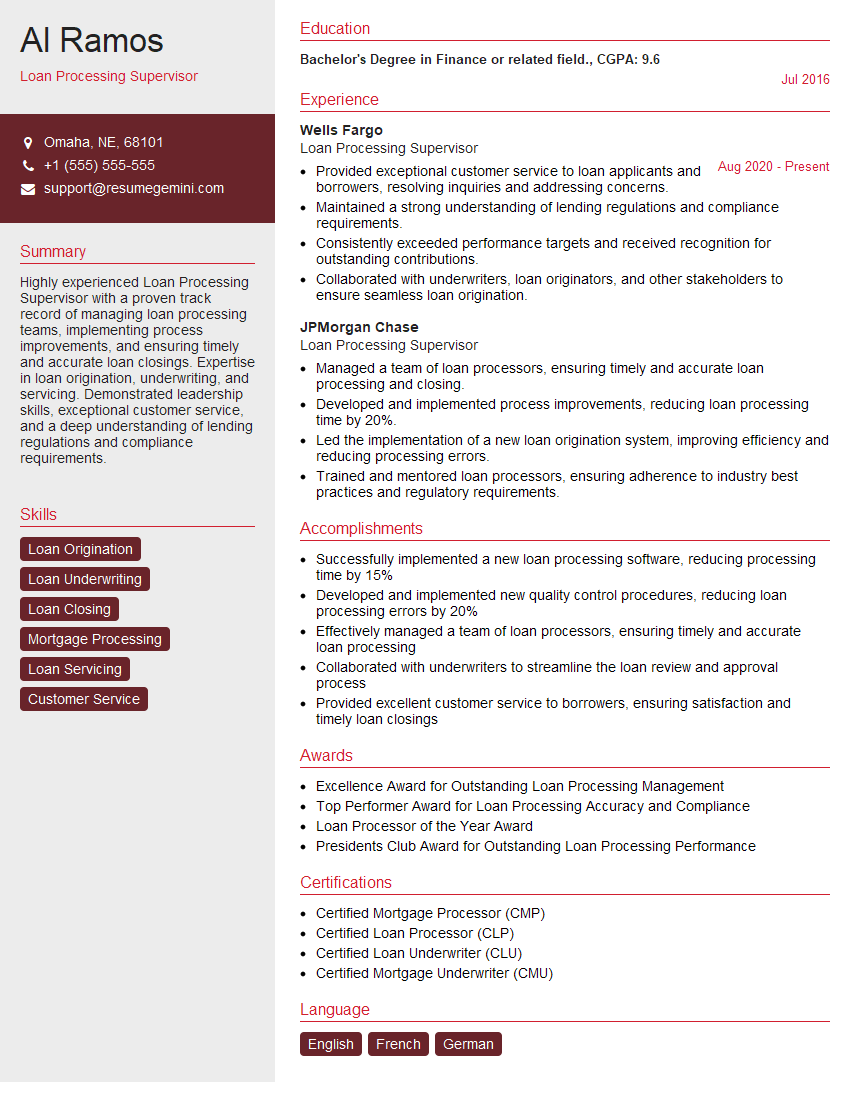

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Processing Supervisor

1. Can you explain the different types of loan products that you have experience processing?

In my previous role, I gained extensive experience processing various loan products, including residential mortgages, commercial loans, personal loans, and auto loans. I am well-versed in the specific requirements and documentation needed for each type of loan, ensuring that all applications are complete and meet underwriting guidelines.

2. What are the key steps involved in the loan processing workflow?

Pre-Processing

- Receiving and reviewing loan applications

- Verifying applicant information

- Ordering credit reports and appraisals

Processing

- Analyzing financial statements and income documentation

- Determining loan eligibility and risk assessment

- Preparing loan documentation and disclosures

Post-Processing

- Submitting loan packages for approval

- Coordinating with underwriters and closing agents

- Ensuring timely closing and funding

3. How do you handle complex or high-risk loan applications?

When dealing with complex or high-risk loan applications, I approach them with extra diligence and caution. I carefully review all documentation and seek additional information to fully understand the applicant’s financial situation and risk profile. I also consult with senior underwriters to obtain their insights and guidance. By taking a comprehensive and collaborative approach, I ensure that these applications are processed accurately and efficiently.

4. What is your approach to managing a high volume of loan applications?

Effective time management is crucial when handling a high volume of loan applications. I prioritize tasks based on urgency and importance, utilizing a work management system to track progress and meet deadlines. I also delegate responsibilities to my team members, ensuring that workload is evenly distributed. By optimizing my workflow and leveraging technology, I maintain efficiency and accuracy in processing a large number of applications.

5. How do you ensure the accuracy and completeness of loan applications?

Accuracy and completeness are paramount in loan processing. I meticulously review all submitted documentation, verifying applicant information against multiple sources. I utilize checklists and automated tools to ensure that all required documents are present and complete. I also maintain open communication with applicants and external parties to obtain any missing or incomplete information promptly. By adhering to strict quality control measures, I minimize errors and ensure that loan applications are submitted error-free.

6. Can you describe your experience with loan processing software and technology?

I am proficient in various loan processing software, including [Software Name 1], [Software Name 2], and [Software Name 3]. I leverage these tools to automate tasks, streamline processes, and enhance efficiency. I am also familiar with industry-specific technology, such as [Technology Name 1] and [Technology Name 2], which enables me to access and analyze loan data effectively. By embracing technology, I stay up-to-date with industry trends and optimize my loan processing capabilities.

7. What are your strategies for maintaining a high level of productivity without compromising quality?

Maintaining high productivity without compromising quality requires a strategic approach. I employ effective time management techniques, prioritizing tasks and allocating time efficiently. I also utilize technology to streamline processes and minimize manual tasks. Furthermore, I have developed a quality assurance framework to review my work and identify areas for improvement. By adopting lean principles and seeking feedback from colleagues, I continuously refine my processes, ensuring that I deliver high-quality results while maximizing productivity.

8. How do you handle and resolve loan processing errors or discrepancies?

Loan processing errors or discrepancies require prompt attention to minimize delays and maintain accuracy. When an error is identified, I immediately notify the relevant parties and initiate corrective action. I conduct thorough root cause analysis to determine the cause of the error and implement measures to prevent recurrence. I also maintain clear and concise documentation of all errors and their resolutions. By addressing errors proactively and effectively, I ensure that loan applications are processed seamlessly and meet underwriting requirements.

9. Can you share an example of a complex or challenging loan application that you successfully processed?

During my tenure as a Loan Processing Supervisor at [Company Name], I encountered a complex loan application involving a self-employed applicant with multiple income streams. The applicant’s financial documentation was extensive and required meticulous analysis to accurately assess their income and debt-to-income ratio. By collaborating with the underwriter and utilizing my expertise in non-traditional income verification, I successfully processed the application, ensuring that the applicant’s unique financial situation was accurately represented.

10. What are your key strengths and weaknesses as a Loan Processing Supervisor?

Strengths

- Exceptional attention to detail and accuracy

- Strong understanding of lending guidelines and regulations

- Excellent communication and interpersonal skills

- Proven ability to manage high-volume workloads efficiently

- Proficient in loan processing software and technology

Weaknesses

- I can be overly meticulous at times, leading to slightly slower processing speeds.

- I am still developing my skills in managing a large team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Processing Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Processing Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Loan Processing Supervisor is responsible for overseeing the loan processing function within a financial institution. They play a crucial role in ensuring the accuracy and timely processing of loan applications.

1. Loan Processing Management

Supervises and manages a team of loan processors, ensuring adherence to established policies and procedures.

- Assigns and tracks loan applications, monitoring progress and providing guidance.

- Reviews and approves completed loan applications before submitting them to underwriters.

2. Quality Control and Assurance

Maintains high standards of loan processing accuracy and completeness.

- Conducts regular audits to identify and address any errors or deviations from established guidelines.

- Develops and implements quality control measures to ensure consistent and efficient loan processing.

3. Compliance and Risk Management

Ensures compliance with all applicable laws, regulations, and industry best practices.

- Monitors changes in regulatory requirements and updates loan processing procedures accordingly.

- Identifies and mitigates risks associated with loan processing, including fraud and creditworthiness.

4. Customer Service

Provides exceptional customer service to loan applicants and other stakeholders.

- Responds promptly to inquiries and resolves issues related to loan processing.

- Maintains positive relationships with customers and business partners.

Interview Tips

To ace an interview for a Loan Processing Supervisor position, it’s essential to prepare thoroughly. Here are some tips to help you make a strong impression:

1. Research the Company and Position

Before the interview, take the time to learn about the financial institution and the specific role you’re applying for. Understand their loan products, industry reputation, and any recent news or developments.

- Tailor your answers to the company’s values and the requirements of the position.

- Highlight your knowledge of the loan processing industry and any relevant experience or qualifications.

2. Quantify Your Accomplishments

When describing your past experiences, use specific and quantifiable metrics to demonstrate your impact. This could include:

- Number of loans processed or approved per period.

- Percentage improvement in loan processing accuracy or efficiency.

- Time saved or costs reduced through process optimization.

3. Prepare for Technical Questions

Expect to be asked technical questions about loan processing, including:

- The different types of loan products and their underwriting criteria.

- The steps involved in loan processing, from application to closing.

- Common challenges in loan processing and how to mitigate them.

4. Demonstrate Leadership and Management Skills

As a Loan Processing Supervisor, you will be responsible for leading and managing a team. Highlight your experience in supervising others, including:

- Setting goals, providing feedback, and motivating team members.

- Resolving conflicts, managing performance, and developing talent.

- Creating a positive and collaborative work environment.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Loan Processing Supervisor, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Loan Processing Supervisor positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.